Executive Summary:

Lucid Group Inc. is an American company that designs and manufactures luxury electric vehicles. Their mission is to promote sustainable energy through advanced technology and user-centered design. Their first car, the Air, is a luxury sedan known for its long range. The company is headquartered in California and builds its vehicles in Arizona founded in 2007.

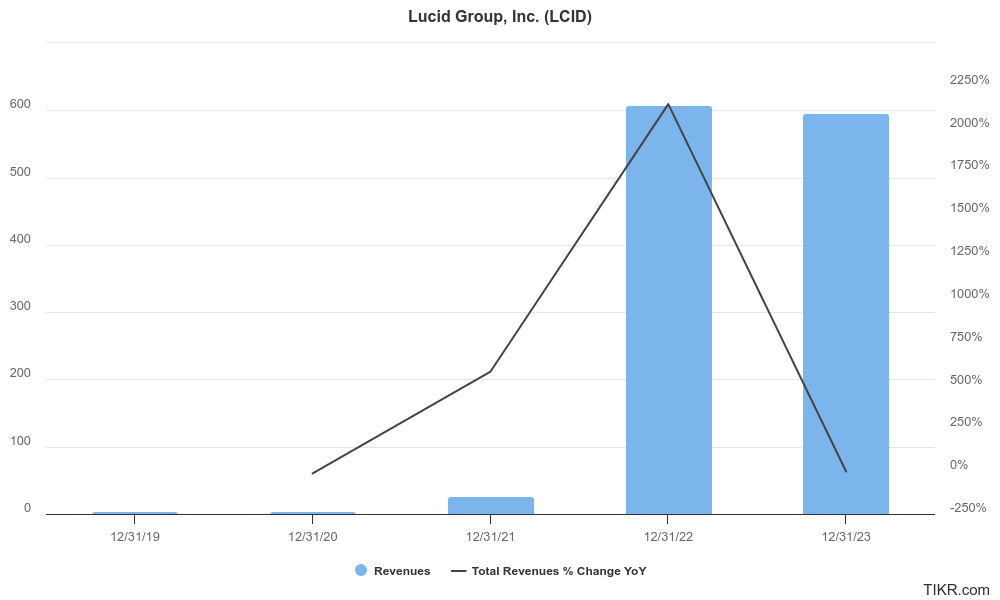

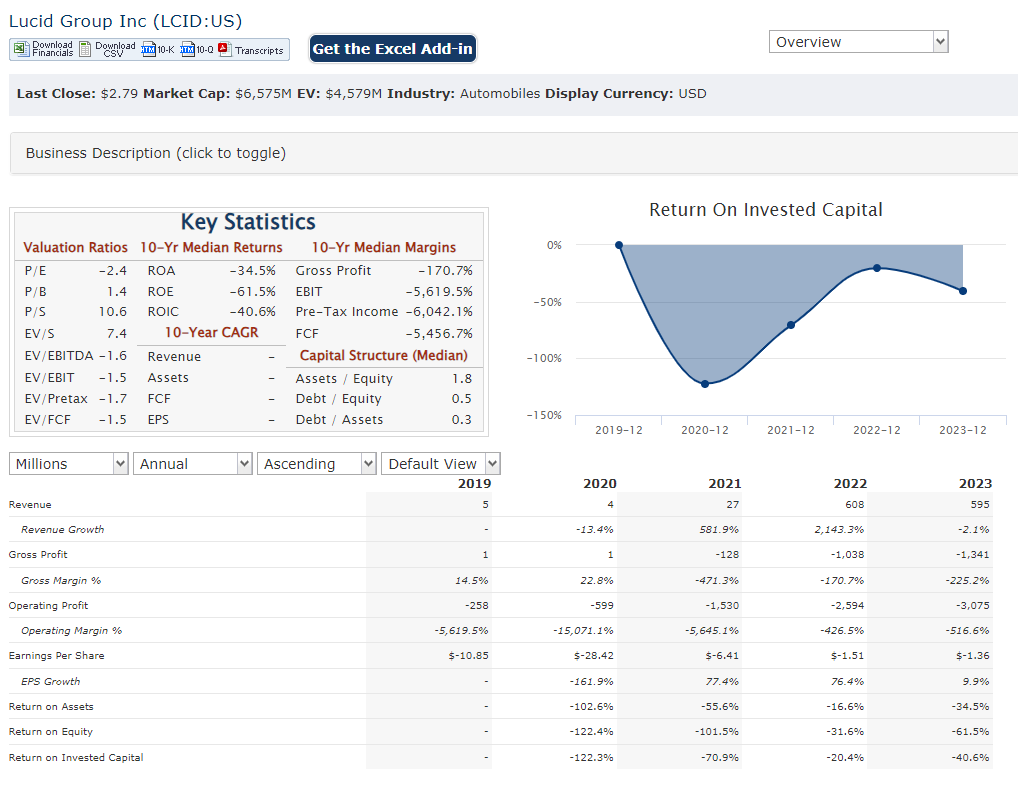

Lucid Group Inc. reported a revenue of $172.7 million, which is a 15.6% increase year-over-year. Their net loss was $680.86 million, translating to an EPS of -$0.30.

Stock Overview:

| Ticker | $LCID | Price | $2.80 | Market Cap | $6.46B |

| 52 Week High | $8.37 | 52 Week Low | $2.29 | Shares outstanding | 2.31B |

Company background:

Lucid Group Inc. is an American manufacturer of luxury electric vehicles, founded in 2007 by Bernard Tse, Sam Weng, and Sheaupyng Lin. Originally named Atieva, the company initially focused on developing electric vehicle batteries and powertrains for other carmakers. In 2019, it received a majority stake investment from the Public Investment Fund of Saudi Arabia, which enabled them to shift focus towards designing and manufacturing their own electric cars under the Lucid brand.

Lucid’s current lineup consists solely of the Air, a luxury electric sedan known for its exceptional range and spacious interior. The Lucid Air Grand Touring boasts an EPA-estimated range of 516 miles, putting it among the leaders in electric vehicle range.

Lucid competes in the growing market for luxury electric vehicles. Their key competitors include established automakers like Tesla and Mercedes-Benz, as well as other EV startups like Rivian. As the electric vehicle market continues to evolve, Lucid Group Inc. is positioned as a major player with its focus on luxury, technology, and extended range.

Recent Earnings:

Lucid reported revenue of $172.7 million, reflecting a 15.6% year-over-year increase. This indicates some positive growth for the company. Lucid remains unprofitable, with a net loss of $680.86 million, translating to an EPS of -$0.30. While this represents a 12.66% increase in net loss, analysts’ expectations were for an EPS of -$0.26.

Lucid delivered 1,967 vehicles in Q1, a significant 39.9% jump compared to Q1 2023. They produced 1,728 vehicles, putting them on track to achieve their 2024 production target of approximately 9,000 vehicles.

Lucid secured $1.0 billion in funding via a private placement with an affiliate of the Public Investment Fund (PIF) during Q1. This demonstrates continued support from their major investor and strengthens their financial runway.

The Market, Industry, and Competitors:

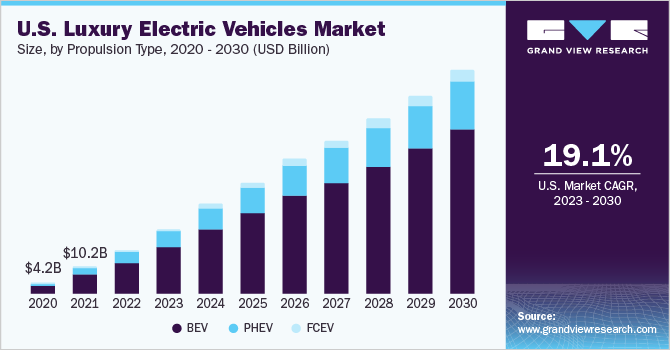

Lucid Group Inc. finds itself in the booming electric vehicle (EV) market. This sector is experiencing rapid growth fueled by rising consumer demand for sustainable transportation, government incentives, and technological advancements. Analysts predict the global EV market to reach a staggering $8.0 trillion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of over 23% from 2024.

Lucid, as a new entrant in this space, aims to capitalize on this growth by carving out a niche in the luxury EV segment. Their focus on extended range, technology, and premium design positions them to attract a specific customer base. With successful production ramp-up and potential new models, Lucid could see significant revenue growth in the coming years, mirroring the overall EV market’s upward trajectory. However, competition is fierce, and established players like Tesla and Mercedes-Benz pose a significant challenge. Lucid’s success will hinge on their ability to maintain a competitive edge through innovation and brand differentiation.

Unique differentiation:

Established Automakers: Traditional car giants like Tesla, Mercedes-Benz, and Audi are all aggressively pushing into the EV space. These companies leverage their existing brand recognition, extensive dealership networks, and vast resources for research and development. Tesla, in particular, holds a dominant market share and is known for its innovative technology and long-range vehicles. Competing with these established players requires Lucid to showcase a compelling value proposition that emphasizes its unique features and brand identity.

EV Startups: Lucid isn’t alone in the race for the electric future. Up-and-comers like Rivian and Fisker pose a significant threat. These startups share a similar focus on luxury and cutting-edge technology, potentially attracting the same customer base as Lucid. Additionally, Rivian has garnered attention for its electric trucks, a segment Lucid doesn’t currently compete in. To outmaneuver these rivals, Lucid needs to focus on efficient production, timely delivery, and establishing a strong brand reputation for quality and performance.

Focus on Efficiency: Lucid prioritizes powertrain efficiency, achieving longer ranges on a single charge compared to some competitors. This translates to fewer charging stops and potentially lower long-term ownership costs for customers who value range anxiety mitigation.

Luxury Experience: Lucid targets the luxury car segment, offering spacious interiors with premium materials and high-tech features. This focus on comfort and a refined driving experience sets it apart from competitors who might prioritize affordability or a more minimalist aesthetic.

Tech-Forward Approach: Lucid integrates advanced technology throughout its vehicles. This could include features like sophisticated driver-assistance systems, a user-friendly infotainment interface, and innovative charging solutions. By prioritizing cutting-edge tech, Lucid positions itself as an attractive option for tech-savvy luxury car buyers.

Management & Employees:

Peter Rawlinson (CEO & CTO): Prior to joining Lucid, Rawlinson played a key role in developing Tesla’s Model S. He brings expertise in electric vehicle engineering and technology leadership to the table.

Marc Winterhoff (COO): Winterhoff oversees Lucid’s day-to-day operations, leveraging his experience in manufacturing and supply chain management.

Eric Bach (Senior VP of Product & Chief Engineer): Bach leads product development and engineering, ensuring Lucid’s vehicles meet performance and technological benchmarks.

Financials:

Lucid Group Inc. they reported a revenue of $172.7 million. This suggests some year-over-year growth, but calculating a CAGR for such a short timeframe wouldn’t be particularly meaningful.

Lucid remains in the net loss territory, with a reported EPS of -$0.30 for Q1 2024. While tracking earnings growth over a longer period would be ideal, their focus is currently on scaling production and establishing a market presence.

Lucid has been actively securing funding to support their growth initiatives. In Q1 2024, they secured an additional $1.0 billion through a private placement with an affiliate of the Public Investment Fund (PIF).

Technical Analysis:

The stock is on a stage 4 decline on all 3 time frames – monthly, weekly and daily. The RSI and MACD point to a move back to $2.29 range which is the 52 Week low.

Bull Case:

Rapidly Growing EV Market: The electric vehicle market is booming, with analysts predicting a Compound Annual Growth Rate (CAGR) exceeding 23% to reach $8.0 trillion by 2030. Lucid, as a new player, is positioned to capitalize on this surge in demand.

Unique Differentiation: Lucid offers a distinct value proposition by focusing on extended range, a luxurious driving experience, and cutting-edge technology. This strategy could attract a specific customer base willing to pay a premium for these features.

Potential for New Models: Expanding their product portfolio beyond the Air sedan with additional SUVs or high-performance vehicles could broaden their customer base and further increase revenue streams.

Bear Case:

Production Risks: Lucid is a relatively new company with limited production experience. Scaling up production to meet ambitious targets could be challenging and lead to delays or quality issues. Any hiccups in production could damage investor confidence and negatively impact the stock price.

Dependence on External Funding: Lucid relies heavily on external funding from investors like PIF to support its operations. If they struggle to secure additional funding in the future, it could hinder their growth plans and development.