Executive Summary:

Autodesk Inc. is a multinational software corporation that develops and sells computer-aided design (CAD), engineering, and entertainment software. The company’s flagship product is AutoCAD, a widely used 2D and 3D drafting software. Autodesk serves a diverse range of industries, including architecture, engineering, construction, manufacturing, media, and entertainment. The company offers a subscription-based model for most of its software, providing access to the latest versions and updates.

Autodesk Inc. reported total revenue increased 11% to $1.57 billion. GAAP diluted EPS was $1.27, while non-GAAP diluted EPS reached $2.17. Recurring revenue remained strong, representing 97% of total revenue.

Stock Overview:

| Ticker | $ADSK | Price | $295.57 | Market Cap | $63.55B |

| 52 Week High | $326.62 | 52 Week Low | $195.32 | Shares outstanding | 215M |

Company background:

Autodesk, Inc. is a multinational software corporation that develops and sells computer-aided design (CAD), engineering, and entertainment software. Founded in 1982 by John Walker, a co-author of the first versions of AutoCAD, the company’s flagship product, AutoCAD, is widely used in various industries for 2D and 3D drafting. Autodesk has expanded its product portfolio to include software for architecture, engineering, construction, manufacturing, media, and entertainment. The company’s headquarters is located in San Francisco, California.

Autodesk’s software has been instrumental in the design and development of numerous iconic projects, including the One World Trade Center, Tesla electric cars, and many more. The company has a strong focus on innovation and has been a pioneer in the development of 3D modeling, simulation, and visualization technologies.

Autodesk’s key competitors include Bentley Systems, Dassault Systèmes, PTC, and Siemens PLM Software. These companies also offer a wide range of CAD, engineering, and manufacturing software, and compete with Autodesk in various market segments.

The company continues to invest heavily in research and development and is committed to providing its customers with the most advanced and effective software solutions. Autodesk’s products are used by professionals in a wide range of industries, and the company plays a vital role in the design and development of many of the products and infrastructure.

Recent Earnings:

Autodesk Inc. reported total revenue for the quarter reached $1.57 billion, marking an 11% increase year-over-year. GAAP diluted earnings per share (EPS) for the quarter was $1.27, while non-GAAP diluted EPS reached $2.17. Both figures surpassed analyst forecasts, indicating strong profitability. Recurring revenue remained a significant driver, representing 97% of total revenue, highlighting the stability and predictability of Autodesk’s subscription-based business model.

Key operational metrics also showed positive trends. Subscription plan revenue continued to grow, demonstrating high customer satisfaction and retention rates. Autodesk maintained a strong balance sheet and generated solid cash flow, providing financial flexibility for future investments and strategic initiatives.

Autodesk reaffirmed its guidance for revenue growth in the range of 10-11%. The company also reiterated its commitment to driving innovation and expanding its product portfolio to address evolving customer needs across various industries.

The Market, Industry, and Competitors:

Autodesk operates in the Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software market, which encompasses a broad range of tools used in various industries like architecture, engineering, construction, manufacturing, media, and entertainment. This market is characterized by a high demand for innovative and efficient software solutions that can help companies streamline their design and production processes, improve collaboration, and accelerate time-to-market.

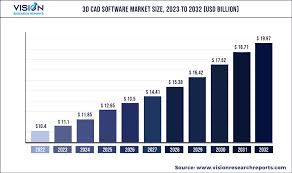

The CAD/CAM software market is expected to exhibit significant growth in the coming years, driven by several factors, including the increasing adoption of Building Information Modeling (BIM) in the construction industry, the growing demand for Industry 4.0 technologies such as the Industrial Internet of Things (IIoT) and artificial intelligence (AI), and the rising need for sustainable and efficient design practices.

The global CAD software market is projected to reach USD 17.34 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 6.7% from 2023 to 2030. This growth is expected to be fueled by the increasing adoption of cloud-based CAD solutions, which offer enhanced accessibility, collaboration, and scalability.

Unique differentiation:

- Dassault Systèmes: A major player with a comprehensive portfolio of 3D design, simulation, and product lifecycle management software, including the popular SOLIDWORKS platform.

- Siemens PLM Software: Another significant competitor offering a wide range of software solutions for product development and lifecycle management, including NX CAD/CAM software.

- PTC: Known for its Creo CAD/CAM software and Windchill PLM platform, PTC competes with Autodesk across various industries.

- Bentley Systems: A leading provider of software solutions for the infrastructure industry, including civil engineering, geospatial, and building design.

- Trimble: A global technology company that offers a range of positioning, modeling, connectivity, and data analytics solutions, including SketchUp 3D modeling software.

These competitors offer a variety of software solutions that compete directly with Autodesk’s products in specific market segments. The competitive landscape is dynamic, with companies continuously developing new technologies and expanding their product offerings to meet evolving customer needs.

Industry-Leading Portfolio: Autodesk boasts a comprehensive and diverse product portfolio spanning various industries, including architecture, engineering, construction, manufacturing, media, and entertainment. This breadth allows them to offer integrated solutions across the entire design and production lifecycle.

Focus on Innovation: Autodesk consistently invests heavily in research and development, pushing the boundaries of 3D modeling, simulation, and visualization technologies. They are known for incorporating cutting-edge technologies like AI and machine learning into their software.

Subscription Model: Autodesk’s transition to a subscription-based model has provided them with recurring revenue streams and enhanced customer relationships. This model also allows them to deliver regular updates, new features, and cloud-based services to their customers.

Management & Employees:

Andrew Anagnost: President and CEO

Steve Blum: Executive Vice President and COO

Ruth Ann Keene: Executive Vice President and General Counsel

Prakash Kota: Chief Information Officer

Financials:

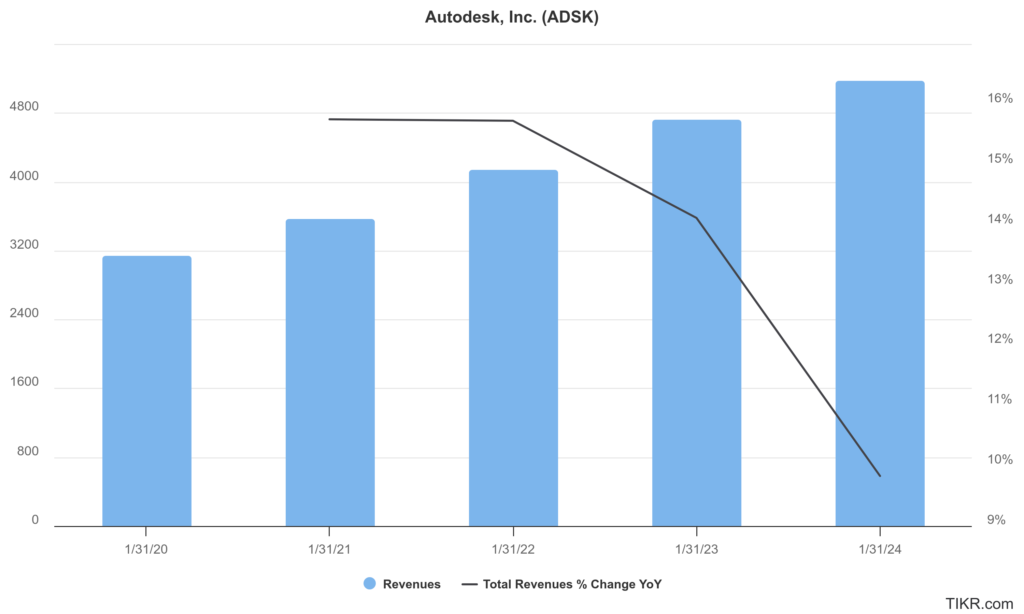

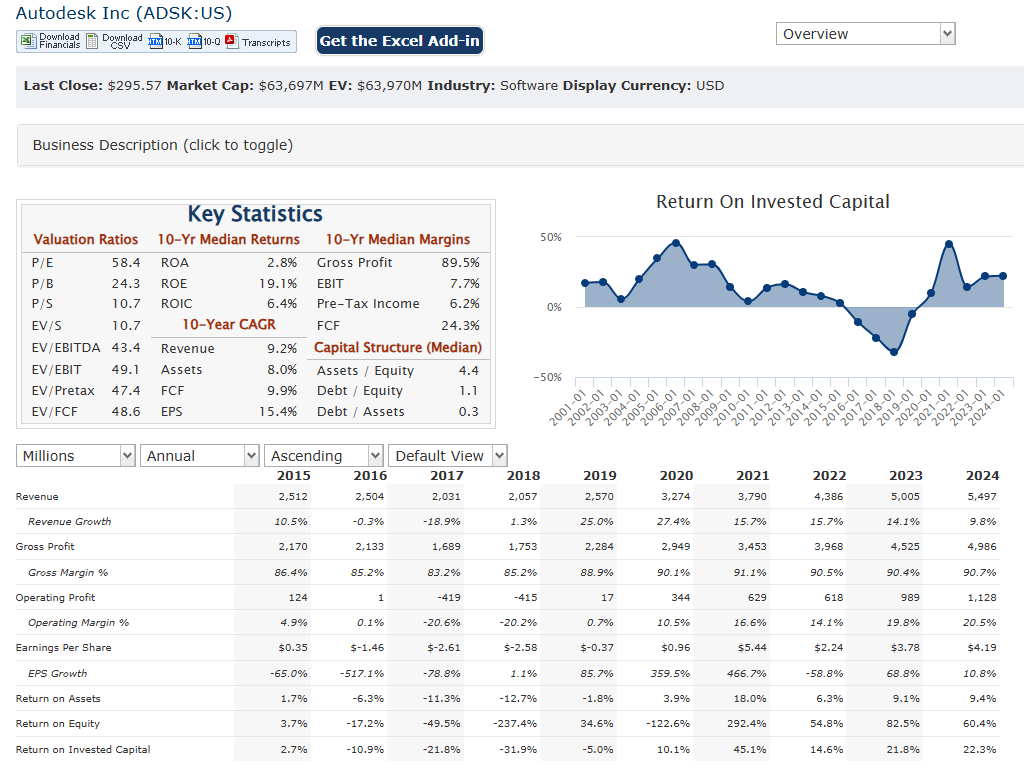

Autodesk Inc. has reported revenues of approximately $3.27 billion, which grew to $5.50 billion by fiscal year 2024, reflecting a compound annual growth rate (CAGR) of about 11.41% during this period. The revenue growth has been consistent, with year-over-year increases ranging from 9.83% to 15.76% across the fiscal years, indicating a solid demand for Autodesk’s software solutions in the design and engineering sectors.

The net income for Autodesk rose from $214.5 million in fiscal year 2020 to approximately $906 million in fiscal year 2024, resulting in a CAGR of around 20.12%. This volatility highlights both the resilience and challenges faced by Autodesk as it navigates market dynamics.

Autodesk reported net debt of approximately $38 million, a significant decrease from $864 million in fiscal year 2022. Free cash flow has remained strong, reaching approximately $1.28 billion in fiscal year 2024, which allows for continued investment in product development and shareholder returns.

Overall, Autodesk reflects a successful transition to a subscription-based model that has driven recurring revenue to account for nearly all of its total revenue 97% by fiscal year 2025.

Technical Analysis:

The stock is in a stage 2 markup (bullish) on the monthly chart, and weekly chart is in stage 3 consolidation. The daily chart has a bottom forming in the $283 – $290 zone, which indicates a reversal might be in the cards and a move higher is likely only after near term move lower.

Bull Case:

Recurring Revenue Model: The company’s transition to a subscription-based model has significantly increased revenue predictability and reduced customer churn. This recurring revenue stream provides a stable base for future growth and profitability.

Growth in Key Markets: The company operates in several high-growth markets, including construction, manufacturing, and media and entertainment. These markets are expected to experience significant growth in the coming years, driven by factors such as urbanization, industrial automation, and the increasing demand for digital content.

Bear Case:

Disruption from Emerging Technologies: The rapid evolution of technologies like artificial intelligence (AI), cloud computing, and the Internet of Things (IoT) could disrupt the CAD/CAM software market. Autodesk needs to adapt quickly to these emerging technologies to remain competitive.

Dependence on Subscription Revenue: While the subscription model provides recurring revenue, it also increases customer churn risk. If Autodesk fails to deliver continuous value and innovation through its subscription offerings, customers may be more likely to switch to competitors.