Executive Summary:

Dell Technologies Inc. is a multinational information technology company that provides a wide range of products and services, including personal computers, servers, data storage, networking, and cloud solutions. The company has grown into a global leader in the IT industry, serving customers across various sectors such as business, government, and education. Dell Technologies is known for its innovative products and solutions, strong customer focus, and commitment to sustainability.

Dell Technologies reported an EPS of $2.15, exceeding the consensus estimate of $1.83 by $0.32. Quarterly revenue rose 9.5% year-over-year to $24.37 billion, slightly below analyst estimates of $24.67 billion.

Stock Overview:

| Ticker | $DELL | Price | $116.53 | Market Cap | $81.62B |

| 52 Week High | $179.70 | 52 Week Low | $75.33 | Shares outstanding | 357.34M |

Company background:

Dell Technologies was founded by Michael Dell in 1984 while still a student at the University of Texas at Austin, the company initially focused on selling IBM-compatible personal computers directly to customers. This direct-to-customer model, which bypassed traditional retail channels, proved highly successful and helped Dell quickly gain market share. Dell has expanded its product offerings to include servers, data storage systems, networking equipment, and other IT infrastructure solutions. The company has also made several strategic acquisitions, such as the purchase of EMC in 2016, which significantly expanded its portfolio and market reach.

Dell Technologies offers a comprehensive range of products and services to meet the diverse needs of its customers. Its product portfolio includes personal computers, laptops, tablets, workstations, servers, storage systems, networking equipment, and a variety of software and services. The company also provides a range of IT services, including consulting, implementation, support, and managed services. Dell’s products and services are used by businesses, governments, and educational institutions around the world.

Dell Technologies faces competition from some of other major IT companies, including Hewlett Packard Enterprise (HPE), Lenovo, Cisco, IBM, and Microsoft. These companies compete with Dell in various markets, including personal computers, servers, storage, networking, and cloud computing. The company also invests heavily in research and development to maintain its technological leadership and develop innovative new products and services.

Dell Technologies is headquartered in Round Rock, Texas, and has operations in over 180 countries. The company employs over 150,000 people worldwide and generates annual revenue of over $90 billion.

Recent Earnings:

Dell Technologies reported an EPS of $2.15, exceeding the consensus estimate of $1.83 by $0.32. Quarterly revenue rose 9.5% year-over-year to $24.37 billion, slightly below analyst estimates of $24.67 billion.

Revenue for the quarter increased 9.5% year-over-year to $24.37 billion, driven by strong growth in the Infrastructure Solutions Group (ISG), which saw revenue increase 34% year-over-year. Dell’s EPS for the quarter was $2.15, up 14% year-over-year. This exceeded the consensus estimate of $1.83 by $0.32.

Dell’s operating margin for the quarter was 8.8%, up from 7.7% in the same quarter last year. The company also generated $1.7 billion in operating cash flow during the quarter.

The company’s backlog increased 17% year-over-year to $44 billion. This indicates strong demand for Dell’s products and services. Dell expects revenue to be in the range of $24.5 billion to $25.5 billion. This would represent year-over-year growth of 3% to 8%. Dell expects EPS to be in the range of $1.80 to $2.00. This would represent year-over-year growth of 6% to 17%.

The Market, Industry, and Competitors:

Dell Technologies operates in the highly competitive and dynamic information technology (IT) market. This market encompasses a wide range of segments, including personal computers, servers, data storage, networking, and cloud computing. The IT market is characterized by rapid technological advancements, evolving customer demands, and intense competition from a number of major players.

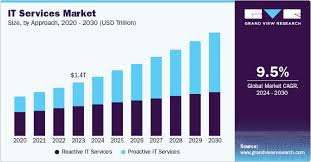

Growth expectations for the IT market are generally positive, driven by factors such as the increasing adoption of cloud computing, the growth of artificial intelligence (AI), and the rise of the Internet of Things (IoT). The global IT market is expected to grow at a compound annual growth rate (CAGR) of around 7-10% over the next several years. However, the actual growth rate will vary depending on the specific segment of the market.

Dell Technologies is well-positioned to capitalize on the growth of the IT market. The company has a strong presence in many of the fastest-growing segments of the market, including servers, storage, and networking. Dell is leveraging its strong customer relationships and its global reach to expand its market share and drive revenue growth.

Unique differentiation:

Dell Technologies faces competition, In the personal computer market, major rivals include Lenovo, which has consistently held the top spot in global PC shipments, and HP Inc., a long-standing competitor with a strong presence in both consumer and enterprise segments. Apple also poses a significant threat with its highly integrated ecosystem of hardware and software.

In the server market, Hewlett Packard Enterprise (HPE) is a key competitor, known for its broad portfolio of servers and enterprise solutions. IBM remains a major player with its strong presence in enterprise computing and cloud services. Cisco also competes in this space with its networking and data center infrastructure offerings.

Data storage is another fiercely competitive arena, with players like NetApp, Pure Storage, and EMC (now owned by Dell) vying for market share. Cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud also offer storage services as part of their broader cloud platforms, further intensifying competition.

Direct Sales Model & Customization: Historically, Dell pioneered a direct-to-customer model, allowing for high levels of customization. This enabled customers to tailor their systems to specific needs, fostering a strong customer relationship.

End-to-End Solutions: Dell offers a comprehensive portfolio spanning PCs, servers, storage, networking, and cloud solutions. This “end-to-end” approach provides customers with a single vendor for many of their IT needs, simplifying procurement and support.

Global Reach and Scale: With a global presence and a vast network of partners, Dell can effectively serve customers worldwide, offering consistent service and support across different regions.

Management & Employees:

Michael Dell: Chairman and CEO

Jeff Clarke: Vice Chairman, Products & Operations

Chuck Whitten: Co-COO

Financials:

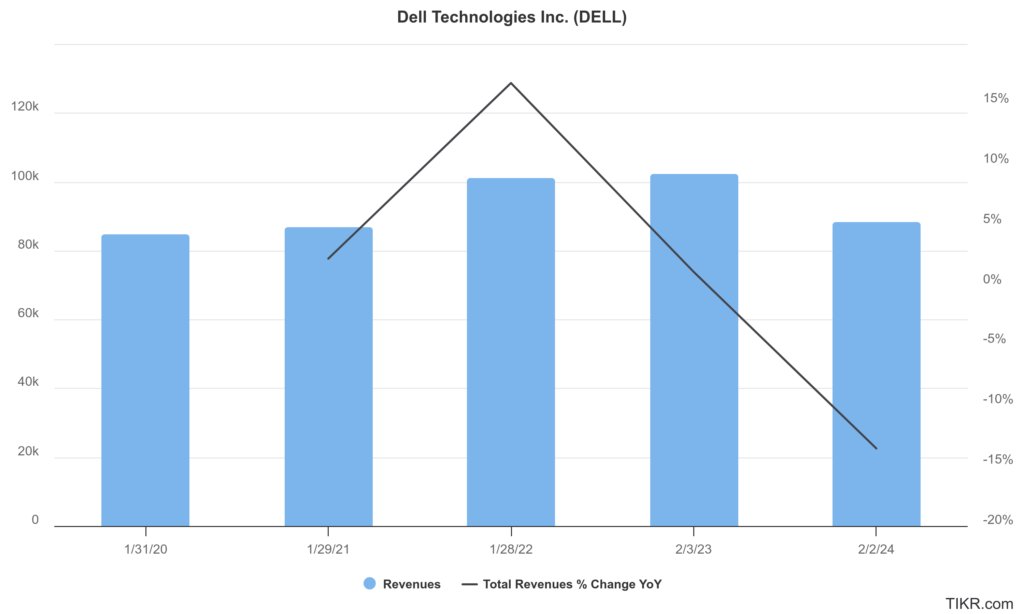

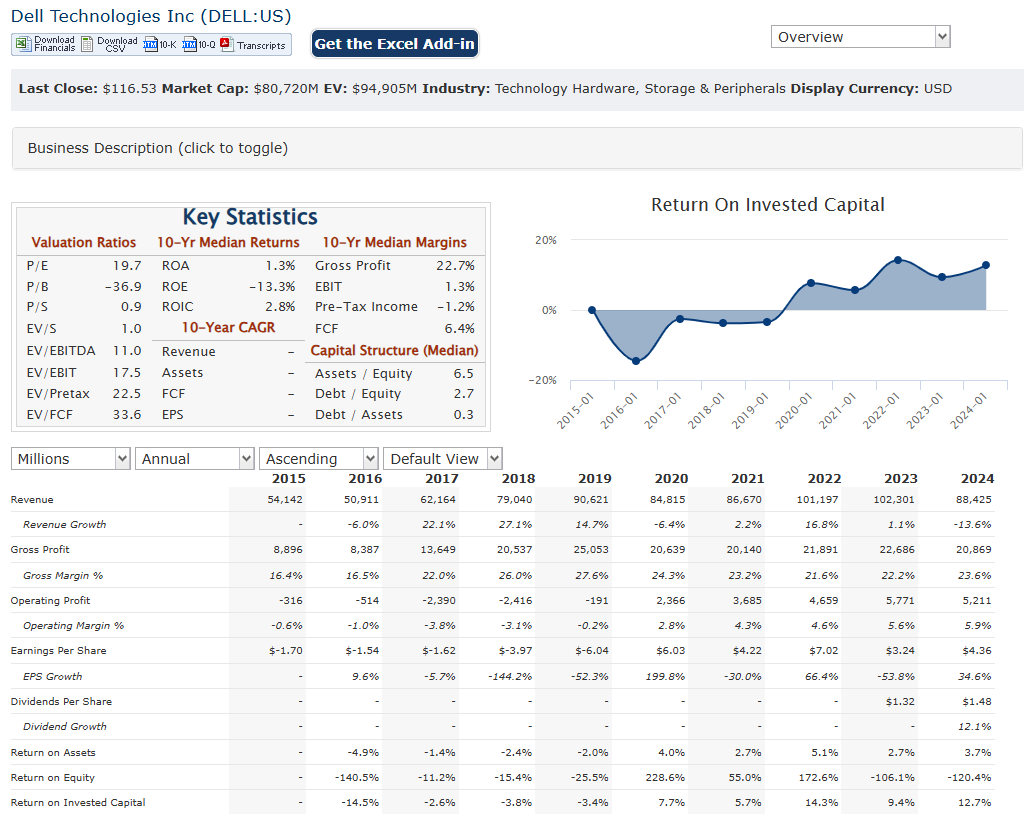

Dell Technologies Inc. has reported revenues of approximately $84.8 billion, which increased to $102.3 billion in fiscal year 2023, reflecting a compound annual growth rate (CAGR) of about 6.5% during this period. Where revenues fell to $88.4 billion, representing a decline of 14% from the previous year. Dell faced a competitive and changing market landscape, particularly as demand for personal computers and related services fluctuated post-pandemic.

Dell’s diluted earnings per share (EPS) stood at $3.61, which grew to $4.36 in fiscal year 2024, indicating a CAGR of approximately 9.5% over these five years. Dell managed to increase its diluted EPS by 35% compared to fiscal year 2023, driven by improved operational efficiencies and cost management strategies. Non-GAAP diluted EPS also showed resilience, increasing from $5.79 in fiscal year 2020 to $7.13 in fiscal year 2024.

The company achieved its core leverage target of 1.5x debt-to-EBITDA, reflecting prudent financial management amidst fluctuating revenue streams. The cash flow from operations was robust at $8.7 billion for fiscal year 2024, allowing Dell to return capital to shareholders through dividends and share repurchases, which underscores its commitment to shareholder value even during periods of revenue contraction. The recent decline in revenue signals potential challenges ahead as the company navigates an evolving technology landscape and seeks to capitalize on emerging opportunities such as AI and cloud computing.

Technical Analysis:

The stock is in a consolidation stage 3 on the monthly chart, and the weekly chart is similar. The daily chart shows a likely move higher to the $130 range where there is a lot of resistance. The stock should head lower post that stage to the $109 range again.

Bull Case:

AI-Driven Growth: The burgeoning artificial intelligence market presents a significant opportunity for Dell. As AI applications proliferate, demand for high-performance computing infrastructure, including servers and storage, is expected to surge. Dell’s comprehensive portfolio positions it well to capitalize on this trend.

Strong Execution and Cost Control: Dell has demonstrated a track record of strong execution, particularly in managing costs and improving profitability. This focus on efficiency can drive earnings growth and enhance shareholder value.

Competitive Advantages: Dell’s direct sales model, strong customer relationships, and comprehensive product portfolio provide a competitive edge in the market.

Bear Case:

Supply Chain Disruptions: Global supply chain issues could disrupt Dell’s operations, impacting production, delivery times, and ultimately, revenue.

Cybersecurity Threats: Increasing cybersecurity threats pose a risk to Dell’s business and could damage its reputation if its products or services are compromised.

Execution Risks: Successfully navigating the evolving IT landscape, integrating acquisitions, and executing on strategic initiatives all carry inherent execution risks.