Executive Summary:

Oscar Health is a health insurance company founded in 2012 that focuses on making health insurance easier to navigate. They use technology, design, and data to create a more user-friendly experience for members. Their approach includes features like telemedicine, a healthcare-focused app, and transparent pricing. Oscar Health is publicly traded and has over 1 million members. They recently underwent some leadership changes with Mark Bertolini taking over as CEO in April 2023.

Bertolini, a healthcare veteran with a notable tenure as the former Chairman and CEO of Aetna Inc., is recognized for his leadership expertise and his track record of pushing the healthcare industry towards more consumer-oriented, value-based care, and increased digitization

Stock Overview:

| Ticker | $OSCR | Price | $13.85 | Market Cap | $2.69B |

| 52 Week High | $18.55 | 52 Week Low | $3.23 | Shares outstanding | 194.21M |

Company background:

Oscar Health, founded by Mario Schlosser, Josh Kushner, and Kevin Nazemi, is an health insurance company aiming to revolutionize health insurance with technology.

Leveraging technology, design, and data. Oscar is still growing, Oscar Health hasn’t reached profitability yet.

Oscar Health’s headquarters are in New York City, New York. Their main competitors include established insurance giants like Aetna, UnitedHealthcare, and Humana. While Oscar Health focuses on a more tech-driven approach, these competitors offer traditional insurance plans with wider provider networks.

Recent Earnings:

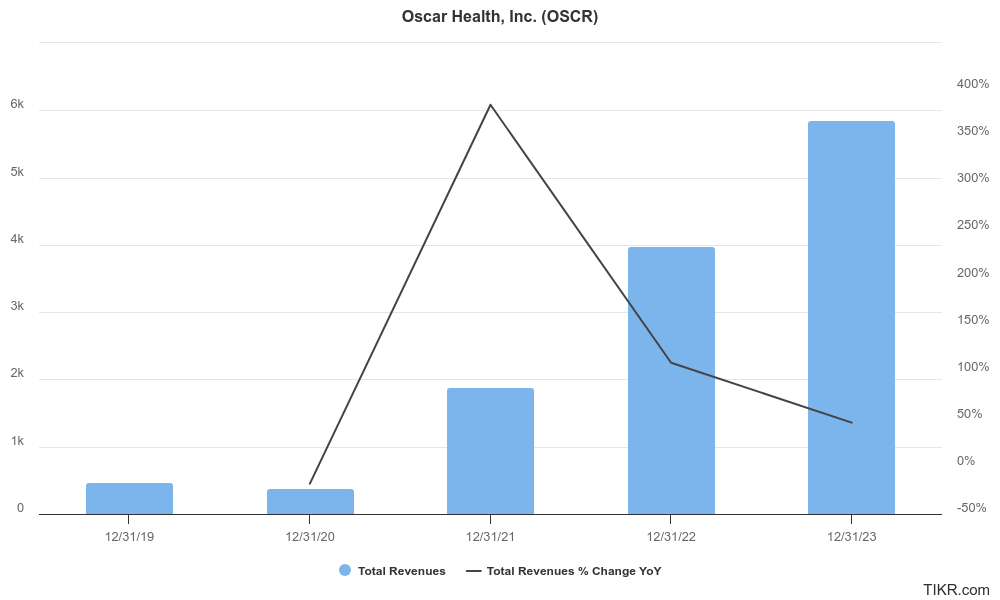

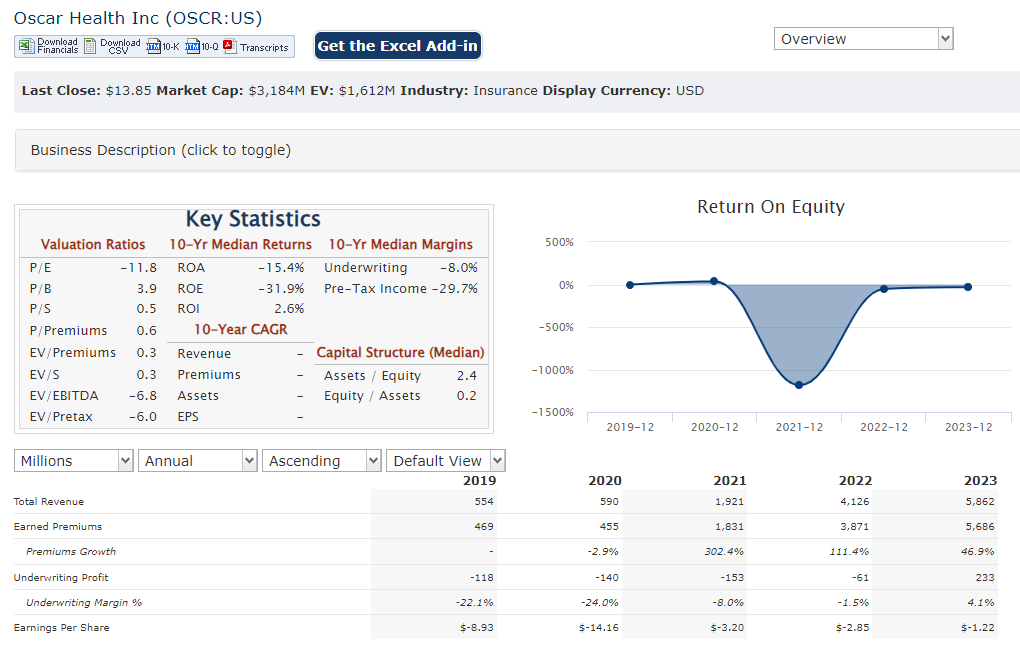

The net loss of $271 million for the full year 2023. This represents a significant improvement of $339 million year-over-year, indicating progress in narrowing the gap between revenue and expenses.

Oscar Health did report Direct and Assumed Policy Premiums of $6.6 billion. This figure shows a 3% decrease compared to 2022. A brighter light is shed by Premiums Earned, which reflect the actual revenue generated from policy premiums. Premiums Earned saw a substantial increase of 47% year-over-year, reaching $5.7 billion.

The Market, Industry, and Competitors:

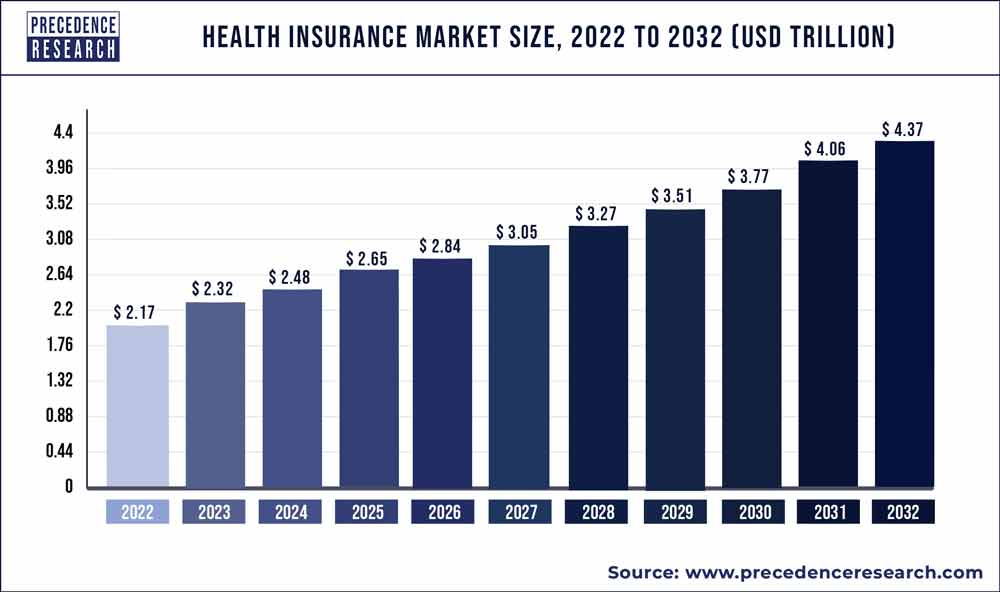

Oscar Health operates in the vast and ever-expanding U.S. health insurance market, projected to reach a staggering $6.8 trillion by 2030. This growth is fueled by several factors, including an aging population requiring more healthcare services and rising medical costs. Analysts predict a Compound Annual Growth Rate (CAGR) of around 5.3% for this market between 2023 and 2030.

This growth stems from trends like increasing government healthcare spending, a growing focus on preventive care, and the adoption of new technologies within the healthcare industry. Oscar Health, with its emphasis on technology and user-friendly experiences, is well-positioned to capitalize on this expanding market. Their focus on efficiency and cost-effectiveness could also be attractive to cost-conscious consumers looking for new and innovative health insurance options.

Unique differentiation:

Traditional players like Aetna, UnitedHealthcare, and Humana are entrenched in the market, boasting vast provider networks and a wider customer base. These giants offer a more familiar insurance experience, but may lack the tech-forward approach and focus on user-friendliness that Oscar Health prioritizes.

On the other hand, Oscar Health faces competition from innovative health insurance startups that share its focus on technology. Companies like Clover Health and Bright Health utilize data analytics and telemedicine to deliver a more streamlined and potentially more affordable insurance experience. However, these startups may have limited footprints compared to the established giants, and may still be working on building brand recognition.

For Oscar Health, navigating this competitive landscape hinges on its ability to leverage its technological strengths to stand out. By continuously improving its user experience, offering competitive plans, and potentially expanding its network, Oscar Health can carve out a niche in the evolving health insurance market.

- Technology-driven User Experience: Unlike traditional insurance companies with complex plans and paperwork, Oscar Health prioritizes a user-friendly experience.

- Mobile App: Members can easily manage their plans, access ID cards, and file claims through a user-friendly mobile app.

- Telemedicine: Oscar Health offers convenient access to doctors virtually, reducing the need for in-person appointments for non-emergency situations.

- Transparent Pricing: They aim to simplify healthcare costs by providing clear explanations of what procedures and treatments cost.

- Focus on Efficiency and Cost-effectiveness: Oscar Health leverages technology and data to manage healthcare costs effectively.

- Lower Administrative Costs: By streamlining processes through technology, Oscar Health potentially reduces operational expenses compared to traditional insurers.

- Data-driven Care Management: They might utilize data analytics to identify high-cost cases and recommend preventive care measures, aiming to improve member health and potentially lower overall healthcare spending.

Management & Employees:

- Mario Schlosser (Co-Founder & President, Technology): Schlosser plays a vital role in leveraging technology to create Oscar’s user-friendly platform and efficient operations.

- Mark Bertolini (CEO): Bertolini, who joined in April 2023, brings extensive experience in healthcare leadership to guide Oscar’s overall strategy and growth.

- Alessa Quane (Chief Insurance Officer): Quane oversees Oscar’s insurance operations, ensuring they meet regulatory requirements and deliver value to members.

Financials:

Oscar Health did report Premiums Earned reaching $5.8 billion in 2023, reflecting a significant year-over-year increase. This suggests they’re successfully enrolling new members and generating revenue. However, Direct and Assumed Policy Premiums, a broader revenue metric, did show a 3% decrease year-over-year in 2023. Calculating a Compound Annual Growth Rate (CAGR) for revenue would require more historical data, but the overall trend points towards Oscar Health establishing a growing member base.

Oscar Health remains unprofitable, and hasn’t reported positive Earnings Per Share (EPS). However, they have shown progress in narrowing the gap between revenue and expenses. Their net loss for full year 2023 was $271 million, a significant improvement of $339 million year-over-year. This indicates an upward trend in earnings growth, although calculating a CAGR for earnings would again require a longer timeframe.

Oscar Health’s balance sheet likely reflects a company in its growth phase. They’re likely investing heavily in technology, member acquisition, and potentially expanding their network.

Technical Analysis:

The strong results from 2 quarters has moved the stock price nearly 9X in 15 months from $2.X to $18.X

The bull flag on the daily chart along with the strong base on the monthly chart with a retrace to the 50 day moving average on the daily is a good move. The should should bounce in the $12.5 range, but could also retest the $11.4 (100 day MA) or $8.9 range at the 200 day moving average if the market sells off overall. We would be long term buyers in the $9 – $12 range.

Bull Case:

- Large and Growing Market: The U.S. health insurance market is massive and projected to reach $6.8 trillion by 2030, fueled by an aging population and rising medical costs. Oscar Health is well-positioned to capture a slice of this expanding market.

- Growth Potential: Oscar Health’s member base is growing, and their Premiums Earned have shown significant year-over-year increases. This indicates the potential for substantial revenue growth in the coming years.

- Undervalued Potential: Some analysts believe Oscar Health might be undervalued compared to its future potential.

Bear Case:

- Profitability Concerns: Despite revenue growth, Oscar Health remains unprofitable. Their net losses, while improving, could continue to strain investor confidence, especially if the path to profitability seems unclear.

- Intense Competition: Established insurance giants boast vast networks and brand recognition. Meanwhile, other tech-driven startups are vying for the same market share. Oscar Health needs to effectively compete on price, features, and network breadth.

- High Customer Acquisition Costs: Attracting new members in a crowded market can be expensive. Oscar Health might need to spend heavily on marketing and promotions, impacting their bottom line.

I love this analysis! I will buy 1000 shares tomorrow because I want it at a good price. Thank you I will be seeing more of your articles