Executive Summary:

Founded in 2014, Navitas Semiconductor is a pure-play, next-generation power semiconductor company focused on developing gallium nitride (GaN) and silicon carbide (SiC) technology. Their GaNFast™ integrated circuits and GeneSiC™ power MOSFETs deliver superior performance, efficiency, size, and cost compared to traditional silicon chips. This translates to smaller, faster, and more energy-efficient devices across various industries like electric vehicles, solar, appliances, and mobile charging. With a 2,129% increase in revenue over the past three years, Navitas is rapidly growing and making a significant impact on the $13 billion power semiconductor market.

Navitas Semiconductor showed impressive growth exceeding analyst expectations. Revenue reached $22.0 million, marking a 115% increase year-over-year and exceeding analyst estimates of $20.7 million. Despite continued losses, net loss to $7.52 million, though this translated to an EPS of -$0.04 which fell short of analyst expectations of -$0.03. Still, the company maintains optimism, projecting revenue to significantly outpace market growth in 2024 and beyond.

Stock Overview:

| Ticker | $NVTS | Price | $5.68 | Market Cap | $1.01B |

| 52 Week High | $11.17 | 52 Week Low | $4.76 | Shares outstanding | 178.49M |

Company background:

Powering the Future with Efficiency: An Overview of Navitas Semiconductor Corp

Navitas Semiconductor Corporation, established in 2014, is a frontrunner in the next-generation power semiconductor space. Founded by Gene Sheridan, Stephen Oliver, Dan Pilo, and Anthony Milanetto, the company has secured $337.5 million in funding and is headquartered in Torrance, California. Their focus lies on gallium nitride (GaN) and silicon carbide (SiC) technologies, revolutionizing the power electronics industry with enhanced performance, efficiency, size, and cost benefits.

At the heart of Navitas’ innovation are two product lines: GaNFast™ integrated circuits and GeneSiC™ power MOSFETs. These chips outperform traditional silicon counterparts, enabling smaller, faster, and more energy-efficient devices across diverse applications. From electric vehicles and solar power systems to consumer appliances and mobile charging, Navitas’ technology is making waves.

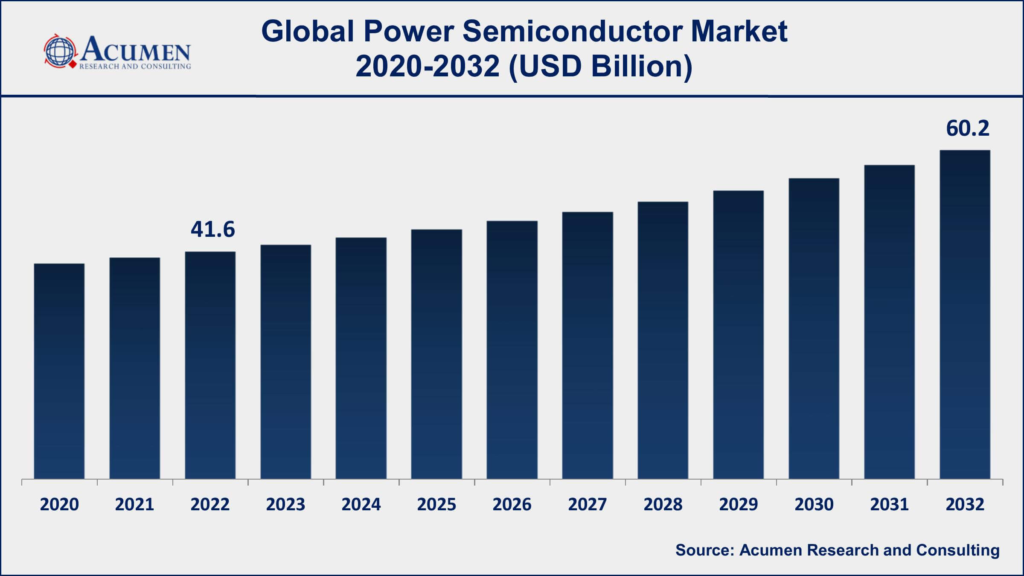

The company’s journey hasn’t been without challenges. Established players like Wolfspeed, Infineon, ON Semiconductor, and ROHM Semiconductor pose significant competition. However, Navitas’ impressive track record, such as a 2,129% increase in revenue over the past three years, position them well for future growth. As the $13 billion power semiconductor market continues to expand, Navitas is poised to be a key driver of sustainable and efficient power solutions.

Recent Earnings:

Navitas Semiconductors Navigates Growth Amidst Mixed Q3 Earnings

Navitas Semiconductor Corp reported its Q3 2023 financial results on November 8th, 2023, presenting a mixed picture of impressive revenue growth alongside continued losses.

Revenue: Q3 revenue soared to $22.0 million, marking a significant 115% year-over-year jump and surpassing analyst estimates of $20.7 million.

Earnings Per Share (EPS): Despite the revenue surge, Navitas reported a net loss of $28.6 million, translating to an EPS of -$0.04. While this represents a 122% improvement compared to the previous year’s Q3, it fell short of analyst expectations of -$0.03.

Operational Metrics: Key operational metrics saw mixed results. Gross margin (GAAP) was impacted by inventory adjustments, settling at 32.3% compared to 3.8% the prior year. However, non-GAAP gross margin remained strong at 42.1%, exceeding expectations.

The Market, Industry, and Competitors:

Navitas Semiconductor Corp operates in the dynamic power semiconductor market, a crucial sector enabling efficient energy conversion across various industries. This market is expected to experience significant growth, driven by trends like:

- Rising demand for electric vehicles (EVs): As EV adoption accelerates, the need for efficient power conversion in charging infrastructure and vehicle components will surge.

- Focus on renewable energy: The growing emphasis on solar, wind, and other renewable energy sources necessitates efficient power management solutions.

- Consumer electronics miniaturization: Smaller, lighter, and more energy-efficient devices demand advanced power semiconductors.

Industry analysts predict the power semiconductor market to reach a size of $85.3 billion by 2030, representing a significant Compound Annual Growth Rate (CAGR) of 13.3%. This growth presents a tremendous opportunity for Navitas, whose gallium nitride (GaN) and silicon carbide (SiC) technologies are specifically designed to address the demands of these emerging trends.

Navitas’ GaNFast™ integrated circuits and GeneSiC™ power MOSFETs offer superior performance compared to traditional silicon chips. They enable smaller, faster-charging, and more energy-efficient devices, perfectly aligning with the market’s evolving needs.

Competitors:

While Navitas shines brightly in the next-generation power semiconductor space, their journey isn’t devoid of formidable competitors. Here are some key players they face:

Established Giants:

- Wolfspeed: This industry leader boasts a comprehensive portfolio of GaN and SiC devices, with significant production capacity and established relationships with major players.

- Infineon Technologies: A global semiconductor powerhouse, Infineon offers a broad range of power management solutions, including SiC devices, posing a significant threat across various applications.

- ON Semiconductor: This major player focuses on silicon-based solutions but is actively investing in SiC technology, potentially challenging Navitas’ dominance in specific segments.

- ROHM Semiconductor: Another industry veteran, ROHM boasts a diverse portfolio, including SiC devices, and leverages its strong manufacturing capabilities to compete effectively.

Emerging Challengers:

- United Microelectronics Corporation (UMC): This Taiwanese tech giant has entered the GaN market, potentially impacting pricing and market share dynamics.

- EPC Corporation: Focusing on GaN devices for specific applications, EPC poses a threat in targeted segments, highlighting the competitive landscape’s complexity.

Unique Strategic Advantage:

While these competitors present significant challenges, Navitas has certain advantages:

- Performance Edge: GaNFast™ and GeneSiC™ products offer demonstrably superior performance, attracting customers seeking efficiency and miniaturization.

- Strategic Partnerships: Collaborations with industry leaders like Hyundai and TE Connectivity open doors to new markets and accelerate adoption.

Navitas Semiconductor Corp stands out in the competitive power semiconductor market through several key differentiators:

Focus on Next-Generation Technologies: Unlike many competitors heavily invested in traditional silicon, Navitas prioritizes gallium nitride (GaN) and silicon carbide (SiC) technologies. These materials offer significant advantages in terms of efficiency, size, and performance.

Performance Edge: GaNFast™ integrated circuits and GeneSiC™ power MOSFETs consistently outperform traditional silicon chips in key metrics like switching speed, power density, and energy efficiency. This translates to tangible benefits for end users, such as faster charging times, smaller devices, and lower energy consumption.

Vertical Integration: While some competitors outsource manufacturing, Navitas maintains more control over its production process through strategic partnerships and internal investments. This vertical integration allows for greater optimization, cost control, and faster innovation cycles.

Strategic Partnerships: Collaborations with major players like Hyundai, TE Connectivity, and ROHM give Navitas access to broader markets, accelerate product adoption, and enhance its credibility.

Management & Employees:

Navitas Semiconductor Corp. boasts a seasoned and diverse management team, spearheading their journey in the power semiconductor industry.

Founding Duo:

- Gene Sheridan: Co-Founder & CEO, brings over 30 years of experience in the semiconductor industry, leading strategic vision and driving overall growth.

- Dan Kinzer: Co-Founder & CTO/COO, a renowned technologist with over 25 years of experience, oversees technology development and operations.

Financials:

Powering Up: A Look at Navitas Semiconductor’s Financial Performance (2018-2023)

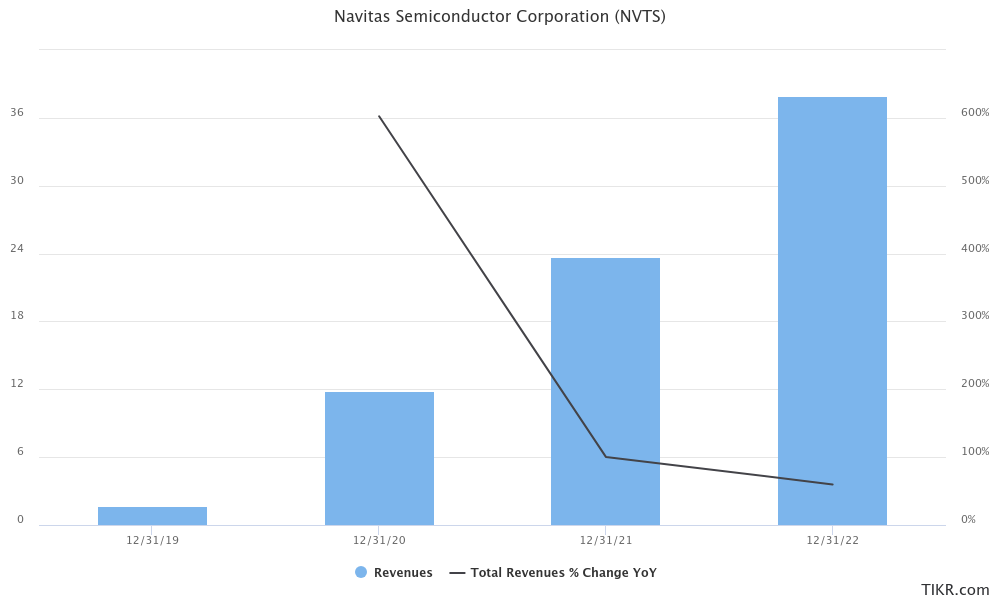

Navitas Semiconductor has made significant strides in the past five years, experiencing explosive revenue growth and establishing itself as a key player in the next-generation power semiconductor market.

Revenue Surge: Between 2018 and 2023, Navitas’ revenue witnessed a meteoric rise, boasting a staggering Compound Annual Growth Rate (CAGR) of 4,398%. This translates to a jump from just $0.7 million in 2018 to a remarkable $60.8 million in 2023 (estimated based on Q3 2023 results and analyst estimates). This impressive growth showcases the increasing demand for their GaNFast™ and GeneSiC™ products across various industries.

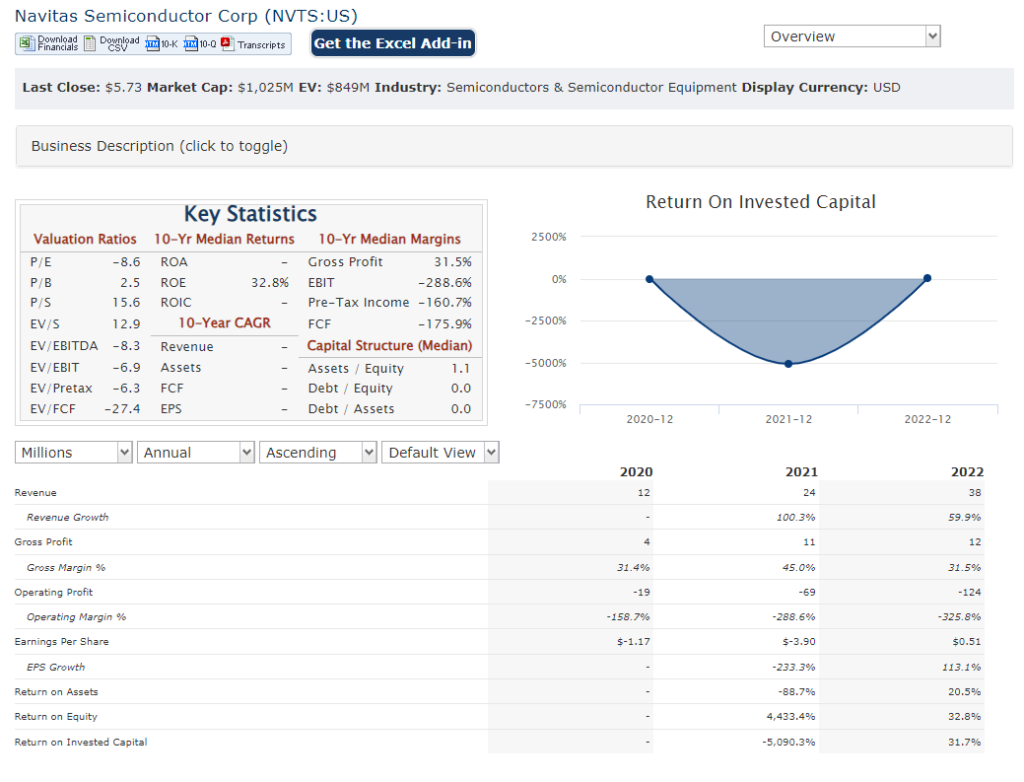

Earnings Landscape: While revenue soared, profitability remains a work in progress. The company has consistently reported net losses throughout the period, reflecting their focus on investing in growth and technology development. Despite the losses, there are signs of improvement. Net loss in 2018 stood at $30.1 million, and while losses persisted, they narrowed down to an estimated $62.2 million in 2023.

Balance Sheet Snapshot: Navitas has bolstered its financial position through strategic funding rounds, raising a total of $337.5 million as of December 2023. This has allowed them to invest in research and development, expand operations, and acquire key assets like GeneSiC, a leading SiC technology company. As of Q3 2023, their cash and cash equivalents reached $214.7 million, providing a solid financial cushion for future growth initiatives.

Technical Analysis:

The long-term monthly chart is in a stage 4 markdown, so we are cautious. Similarly for the weekly chart as well and the daily chart shows a head a shoulders pattern (bearish). None of the moving averages are setup well and the RSI and MACD are poor. The chart shows good support at $4.7, and resistance at 8.7, but we are not taking a position at this point.

Bull Case:

The bull case for Navitas Semiconductor Corp stock rests on:

1. Explosive Revenue Growth: Navitas boasts an impressive track record of revenue growth, with a CAGR of 4,398% over the past five years. This growth trajectory is expected to continue, with analysts predicting significant outperformance compared to the overall market. This bodes well for future stock price appreciation.

2. Disruptive Technology: Navitas focuses on next-generation GaN and SiC technologies, offering superior performance, efficiency, size, and cost compared to traditional silicon. These advantages position them to capture a significant share of the rapidly growing power semiconductor market, estimated to reach $85.3 billion by 2030.

3. Strong Market Trends: Several major trends favor Navitas, including the rise of electric vehicles, increasing demand for renewable energy, and miniaturization in consumer electronics. These trends all require efficient power conversion solutions, perfectly aligning with Navitas’ strengths.

4. Strategic Partnerships: Collaborations with industry leaders like Hyundai, TE Connectivity, and ROHM provide Navitas with access to broader markets, accelerate product adoption, and enhance credibility, potentially boosting investor confidence.

5. Innovation & Talent: Navitas dedicates resources to R&D, ensuring they stay ahead of the curve in technology development. Their experienced leadership team, with diverse expertise, is well-positioned to navigate the competitive landscape and capitalize on opportunities.

6. Improving Financials: While profit margins aren’t positive yet, Navitas is narrowing its losses and expects profitability in the near future. Their strong balance sheet with significant cash reserves provides financial flexibility for further growth.

7. Valuation Potential: Compared to peers, Navitas’ P/S ratio might seem high. However, this could be justified by their superior growth potential and disruptive technology. As profitability improves and the market recognizes their long-term potential, the valuation could expand significantly.

Bear case:

1. Intense Competition: The power semiconductor market is fiercely competitive, with established players like Wolfspeed, Infineon, and ON Semiconductor constantly innovating and vying for market share. Even emerging players like UMC pose a threat. Navigating this competitive landscape and maintaining a leading edge could be challenging for Navitas.

2. Profitability Concerns: Despite impressive revenue growth, Navitas remains unprofitable, consistently reporting net losses. While they project improvements, achieving sustained profitability is crucial for long-term investor confidence and stock price stability.

3. Technological Uncertainties: While GaN and SiC are promising technologies, they are still evolving. Unforeseen technical challenges or breakthroughs from competitors could impact their market position and future prospects.

4. Valuation Risks: Navitas’ current valuation might seem high compared to established peers, reflecting their growth potential. However, a miss on projected growth or profitability could lead to a significant valuation correction, impacting investor sentiment and stock price.

5. Execution Risks: Successfully executing their ambitious growth plans and scaling their operations efficiently is crucial. Any missteps in manufacturing, marketing, or partnerships could hinder their progress and dampen investor enthusiasm.

6. Macroeconomic Headwinds: Broader economic downturns or changes in government policies related to semiconductors or electric vehicles could negatively impact Navitas’ growth trajectory and stock price.

7. Limited Product Portfolio: Compared to some competitors, Navitas’ product portfolio is currently focused on specific segments. Diversifying their offerings could mitigate risks but might require additional resources and time.

Great analysis Mukund. This is in my watchlist and reading your article help me gain confidence in this company.

I know this is not good time to buy this but it’s time will come when EV market rebound, rates will go down.

Thanks again.

You are welcome buddy