Executive Summary:

Apollo Global Management is a leading American alternative asset management firm specializing in investments across various sectors, including credit, private equity, real estate, and infrastructure. Apollo invests on behalf of institutional and individual investors, seeking to generate attractive returns through a variety of strategies. Its investment philosophy emphasizes disciplined risk management and a focus on long-term value creation.

Apollo Global Management, Inc. reported adjusted net income of $1.85 per share, exceeding the consensus analyst estimate of $1.79 per share. Revenue for the quarter came in at $1.1 billion.

Stock Overview:

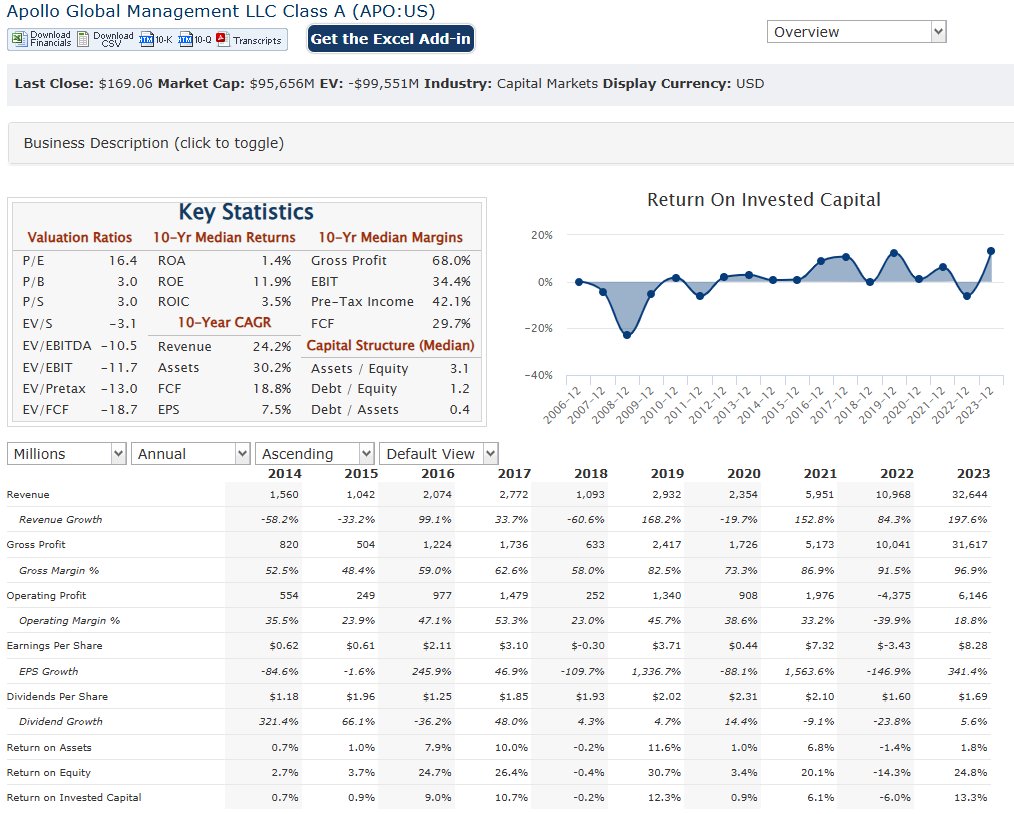

| Ticker | $APO | Price | $169.06 | Market Cap | $95.66B |

| 52 Week High | $189.49 | 52 Week Low | $94.19 | Shares outstanding | 565.82M |

Company background:

Apollo Global Management, Inc. is a leading American alternative asset management firm founded in 1990 by Leon Black, Josh Harris, and Marc Rowan. Headquartered in New York City, managing over $548 billion in assets across various investment strategies. The firm invests on behalf of a diverse range of institutional and individual investors, seeking to generate attractive returns through a combination of active management, deep industry expertise, and a disciplined investment approach.

Apollo’s investment strategies encompass a wide spectrum of opportunities. In credit, the firm invests in a variety of debt instruments, including corporate bonds, high-yield debt, distressed debt, and structured credit. The private equity segment focuses on acquiring and managing controlling stakes in companies across various industries, seeking to enhance their value through operational improvements and strategic initiatives. The infrastructure segment invests in critical infrastructure assets such as energy, transportation, and communications.

Apollo faces competition from a number of other large alternative asset managers, including Blackstone, Carlyle Group, KKR, and TPG. These firms compete with Apollo for investment opportunities, talent, and investor capital. Apollo’s competitive advantages include its long track record of success.

Apollo has also expanded into other areas, such as insurance and asset management for high-net-worth individuals. The firm has a significant presence in the insurance market through its Athene Holding subsidiary, which provides retirement services and life insurance products. Apollo also offers a range of investment products and services to high-net-worth individuals and family offices.

Recent Earnings:

Apollo Global Management, Inc. reported adjusted net income of $1.85 per share, surpassing the consensus analyst estimate of $1.79 per share. Revenue for the quarter reached $1.1 billion, slightly exceeding analyst expectations. The slight outperformance of analyst estimates suggests positive revenue growth compared to the prior year’s corresponding quarter.

- Assets Under Management (AUM): AUM figures provide insight into the scale of Apollo’s investment operations and its ability to attract investor capital.

- Fee-Related Earnings (FRE): This metric reflects the profitability of Apollo’s asset management business and is a crucial indicator of its ongoing revenue generation.

- Investment Performance: Key performance metrics for Apollo’s various investment strategies, such as internal rates of return (IRRs) and net asset values (NAVs), would have been discussed.

Apollo likely provided an outlook for future earnings and operational performance. This guidance would have considered factors such as the macroeconomic environment, competitive pressures, and the anticipated performance of its investment portfolios.

The Market, Industry, and Competitors:

Apollo Global Management Inc. operates in the alternative investment management sector, focusing on three primary segments: Asset Management, Retirement Services, and Principal Investing. The firm is known for its diversified investment strategies, which include credit, private equity, and real assets. Apollo manages a wide array of assets, such as convertible securities, distressed debt, and real estate across various industries including natural resources, consumer services, and technology. Apollo had approximately $548 billion in assets under management (AUM), with significant investments in credit ($392 billion), private equity ($99 billion), and real assets ($46.2 billion).

Apollo Global Management is strategically positioning itself for growth by enhancing its focus on sectors such as technology and ESG (Environmental, Social, and Governance) investments. The company aims to capitalize on the increasing demand for retirement planning and asset management services due to an aging population. Apollo likely achieving a compound annual growth rate (CAGR) of around 7-10% through 2030 as it leverages its extensive expertise and diversified portfolio to navigate market fluctuations and capitalize on emerging opportunities.

Unique differentiation:

- Blackstone: A leading global investment firm with a strong presence across private equity, real estate, credit, and infrastructure. Known for its large-scale deals and significant AUM.

- KKR: A prominent private equity firm with a long history of successful investments. KKR also has a growing presence in credit and other alternative asset classes.

- Carlyle Group: A diversified investment firm with a global reach, focusing on private equity, real estate, and global credit. Carlyle has a strong track record in various sectors.

- TPG: A global investment firm with a focus on private equity, growth equity, and credit. TPG is known for its sector-specific expertise and long-term investment approach.

These firms compete with Apollo for investment opportunities, investor capital, and top talent. The competitive landscape is dynamic and constantly evolving, with new players entering the market and existing firms expanding their investment offerings.

Integrated Platform: Apollo leverages its integrated platform, including its insurance subsidiary Athene, to generate synergies and offer unique investment solutions. This integrated approach can provide a competitive edge in certain markets.

Focus on Credit: Apollo has a strong historical focus on credit investments, building a deep expertise in this area. This specialized knowledge can be a significant advantage in navigating complex credit markets.

Management & Employees:

Marc Rowan: Co-Founder, Chief Executive Officer, and President

Scott Kleinman: Co-President, Apollo Asset Management

Martin Kelly: Partner, Chief Financial Officer, Apollo Global Management

Johannes Wørsoe: Partner, Chief Financial Officer, Apollo Asset Management

Financials:

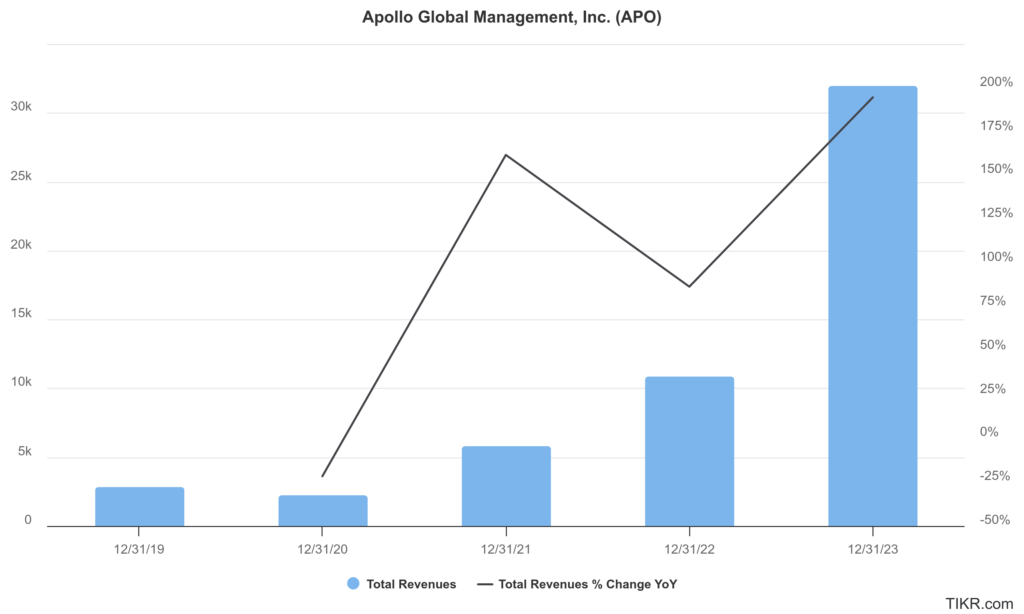

Apollo Global Management Inc. has reported a net income and revenue growth. In 2023, Apollo reported a net income of $5.001 billion, a stark contrast to a loss of $1.961 billion in 2022, highlighting a remarkable recovery following a challenging period. The company’s revenue has shown a compound annual growth rate (CAGR) of approximately 15% over this period, reflecting strong demand for its investment strategies and services.

With net income increasing dramatically from $120 million in 2020 to $5.001 billion in 2023. This translates to an impressive CAGR of around 180% for net income over the five years. The substantial increase in earnings can be attributed to Apollo’s strategic focus on diversifying its investments and enhancing its operational efficiencies. The company’s fee-related earnings (FRE) and spread-related earnings (SRE) have consistently contributed to this growth, with FRE reaching record levels due to strong performance across its asset management operations.

It has a solid financial position, with total assets under management (AUM) reaching approximately $733 billion as of the third quarter of 2024. The firm’s leverage ratios remain manageable, allowing it to pursue further growth opportunities while maintaining financial stability.

Technical Analysis:

The stock is in a stage 2 markup (bullish) on the monthly chart, but in a stage 3 consolidation (neutral) on the weekly chart and bearish stage 4 markdown on the daily chart. The near term gap which it should fill is in the $157 to $146 range, where we could expect a reversal.

Bull Case:

Diversified Business Model: Apollo’s diversified investment platform across credit, private equity, real estate, and infrastructure provides resilience in different market cycles. This diversification can help mitigate risks and ensure consistent revenue streams.

Growth in Alternative Assets: The alternative asset management industry is expected to experience significant growth in the coming years, driven by factors such as increasing institutional investor demand and the search for higher returns. This industry tailwind can benefit Apollo’s growth trajectory.

Bear Case:

Rising Interest Rates: Rising interest rates can increase borrowing costs for Apollo and its portfolio companies, potentially impacting profitability and investment returns.

Regulatory Scrutiny: The financial services industry is subject to significant regulatory oversight. Increased regulatory scrutiny or changes in regulations could impact Apollo’s operations and profitability.

Performance Fluctuations: Apollo’s investment performance can fluctuate significantly depending on market conditions and the success of its investment strategies. Underperformance across key investment areas could negatively impact investor sentiment and stock price.