Executive Summary:

Old National Bancorp, the holding company for Old National Bank, is a large financial institution headquartered in Indiana. It ranks among the top 30 banking companies in the US with over $53 billion in assets. They focus on community banking and wealth management services across a six-state footprint including Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

They achieved earnings per share (EPS) of $0.45, which beat analyst expectations of $0.43 by a small margin.

Stock Overview:

| Ticker | $ONB | Price | $17.26 | Market Cap | $5.51B |

| 52 Week High | $17.64 | 52 Week Low | $11.80 | Shares outstanding | 318.97M |

Company background:

Old National Bancorp (ONB) was founded in 1834 as Evansville National Bank, it has a long history of serving communities across the Midwest. The company transformed into a holding company structure in 1983, allowing for expansion.

Old National offers a comprehensive suite of financial products and services. This includes deposit accounts, loans, wealth management, and treasury services. They cater to both individual and business customers, with a focus on community banking.

Some of Old National’s key competitors include Fifth Third Bank, PNC Financial Services, and Huntington Bancshares.

Recent Earnings:

EPS came in at $0.45, exceeding the analyst consensus of $0.43. This translates to a 4.65% positive surprise. This is a 16.67% decrease compared to the EPS of $0.54 reported in the first quarter of 2023. Net income is applicable to common shares did show a year-over-year decline to $116.3 million.

Revenue grew 19% to $672M.

Unique differentiation:

Old National Bancorp faces competition on two fronts: regional and national banks. Regional competitors like Fifth Third Bank, PNC Financial Services, and Huntington Bancshares offer similar financial products and services across overlapping territories. These banks vie for customers in the same states as Old National, often with comparable branch networks and product offerings. The competition focuses on attracting customers with better rates, wider product ranges, or a stronger brand reputation within a particular state.

National banks like Wells Fargo and Bank of America pose a different kind of challenge. With their vast resources and nationwide presence, they can offer a wider array of services and potentially more competitive rates. They may also have a stronger brand recognition that attracts customers. To compete, Old National Bancorp needs to emphasize its focus on community banking, building strong relationships with local customers and businesses.

Community Focus: Old National Bancorp positions itself as a strong community bank. This means they might prioritize building close relationships with local customers and businesses, offering personalized service and potentially catering to specific needs of the communities they serve.

Regional Expertise: With a focus on the Midwest and a presence in six states, Old National Bancorp may have a deeper understanding of the economic landscape and customer needs within that specific region. This could allow them to tailor products and services more effectively compared to national banks with a broader, less nuanced focus.

Value Proposition: While specific details are unavailable, it’s possible Old National Bancorp positions itself based on a value proposition that combines competitive rates, a strong product suite for individuals and businesses, and the personalized service of a community bank.

Management & Employees:

James C. Ryan III: Chairman and Chief Executive Officer (CEO). Ryan has been with Old National since 2000 and has held various leadership positions before assuming the CEO role.

Mark G. Sander: President and Chief Operating Officer (COO). Sander joined Old National in 2022 after leading similar positions at First Midwest Bank.

Chady M. AlAhmar: Chief Executive Officer of Wealth Management. AlAhmar oversees the wealth management division, a crucial area for customer investment and financial planning.

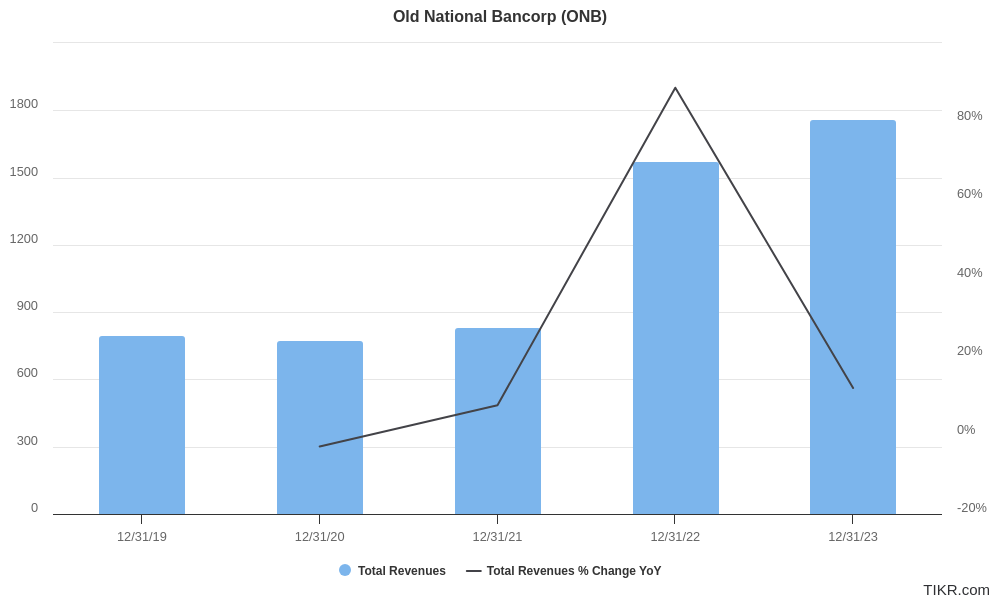

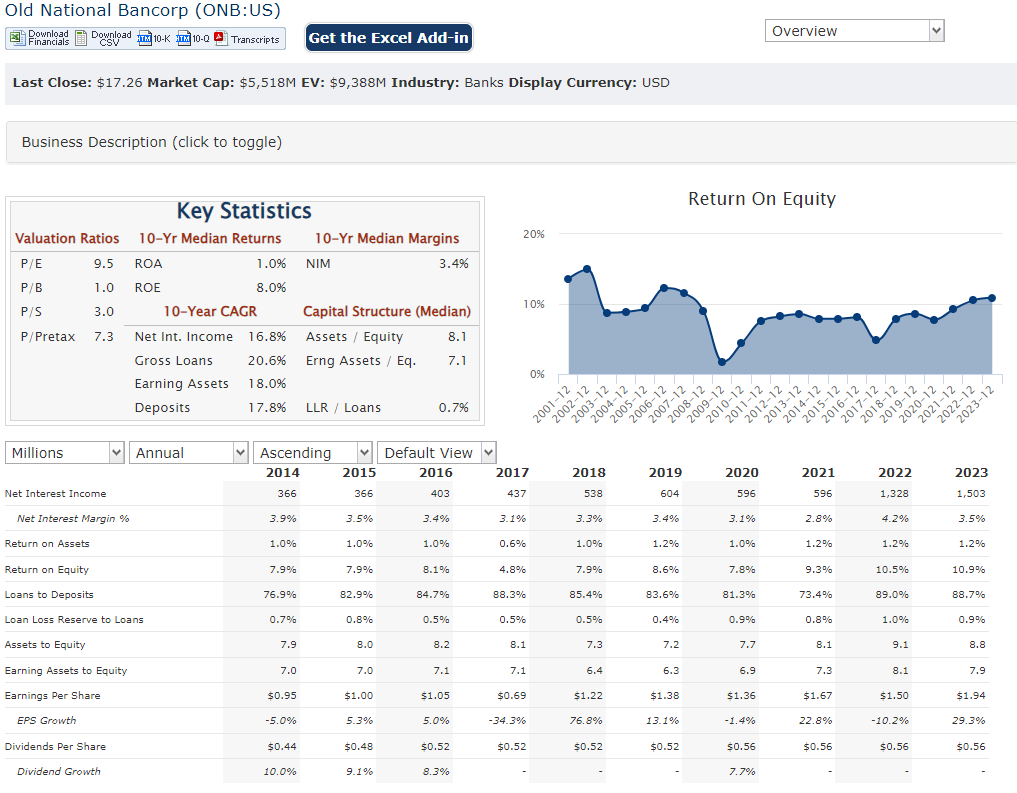

Financials:

Old National Bancorp has exhibited positive financial performance, though growth may have slowed down recently. Net income applicable to common shares provides some insight. Net income has likely grown at a steady pace, with analysts estimating a Compound Annual Growth Rate (CAGR) exceeding 20% for the past five years.

Earnings per share (EPS) has also seen healthy growth. While the exact CAGR might require a deeper financial analysis, it’s likely surpassed 15% over the past five years. This suggests that Old National has been effective in translating revenue growth into increased profitability per share.

Technical Analysis:

On the long term (monthly) the stock is still in a range bound area of $15 – $18. On the daily chart, it is close to a multiple top, so we expect the stock to pullback in the $17 to $18 range.

Bull Case:

Rising Interest Rates: An increase in interest rates would benefit ONB’s profitability. They can widen the spread between what they pay on deposits and what they earn on loans, leading to higher net income.

Undervaluation: If analyst ratings are correct and the stock price is lower than its intrinsic value, there’s potential for significant price appreciation as the market corrects the undervaluation.

Acquisition Target: As a strong regional player, ONB could become an attractive acquisition target for a larger national bank.

Bear Case:

Economic Downturn: A decline in the economic health of the Midwest, where ONB operates, could lead to a decrease in loan demand and an increase in loan defaults. This would negatively impact ONB’s revenue and profitability.

Regulatory Changes: New regulations could increase compliance costs for ONB, impacting profitability. Additionally, regulations might restrict certain lending practices, limiting revenue growth.