Executive Summary:

PowerSchool Holdings is a leading provider of cloud-based software for K-12 education in North America. Their mission is to empower educators and students through technology. They offer a unified platform that helps schools manage various administrative tasks, including attendance, grading, and finances. The company recently surpassed $700 million in annual recurring revenue.

PowerSchool Holdings revenue reached $185 million, reflecting a 16% increase year-over-year. Subscription and support revenue, a key metric, grew even faster at 18% to $167 million.

Stock Overview:

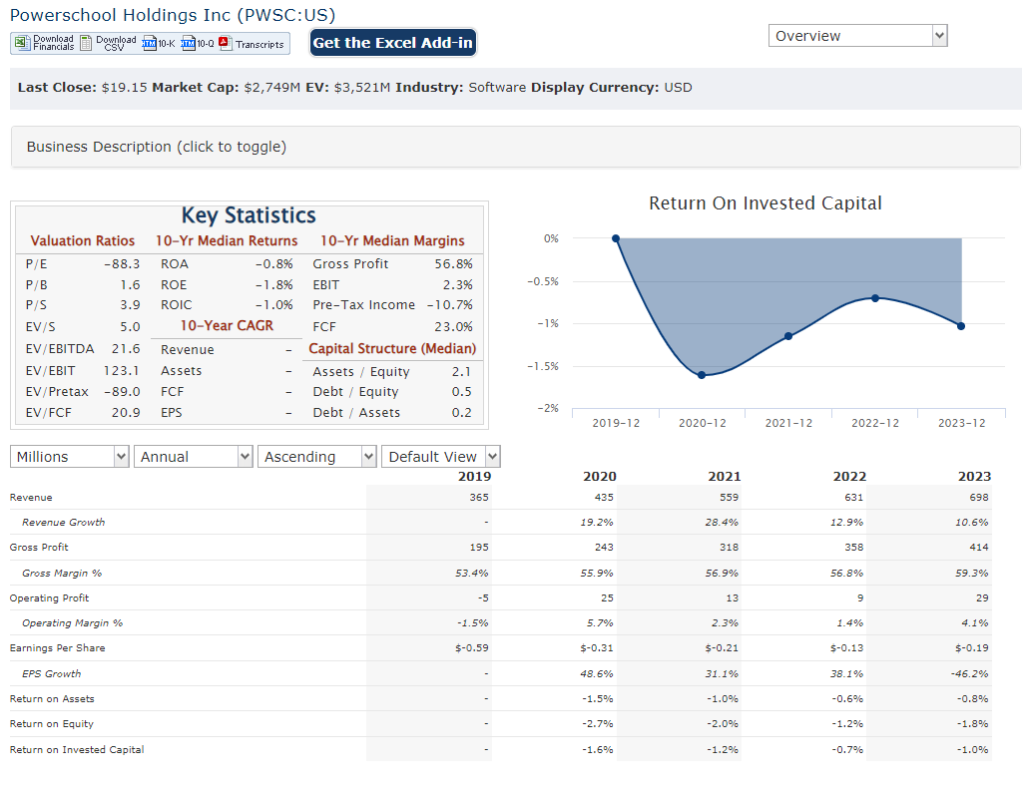

| Ticker | $PWSC | Price | $19.15 | Market Cap | $3.88B |

| 52 Week High | $25.16 | 52 Week Low | $16.15 | Shares outstanding | 164.9M |

Company background:

Founded in 2020 and headquartered in Folsom, California. Their mission is to empower all these stakeholders with technology that personalizes education and improves student outcomes.

PowerSchool Holdings offers a unified platform that streamlines various administrative tasks in schools. This includes managing attendance, grading, finances, state reporting, and special education resources. Their cloud-based solutions are designed to be user-friendly and accessible from anywhere, fostering communication between teachers, students, parents, and administrators.

The company went public in 2020 and trades under the ticker symbol PWSC on the New York Stock Exchange. In the competitive K-12 software market, PowerSchool faces competition from companies like Blackboard, Instructure, and Renaissance Learning.

Recent Earnings:

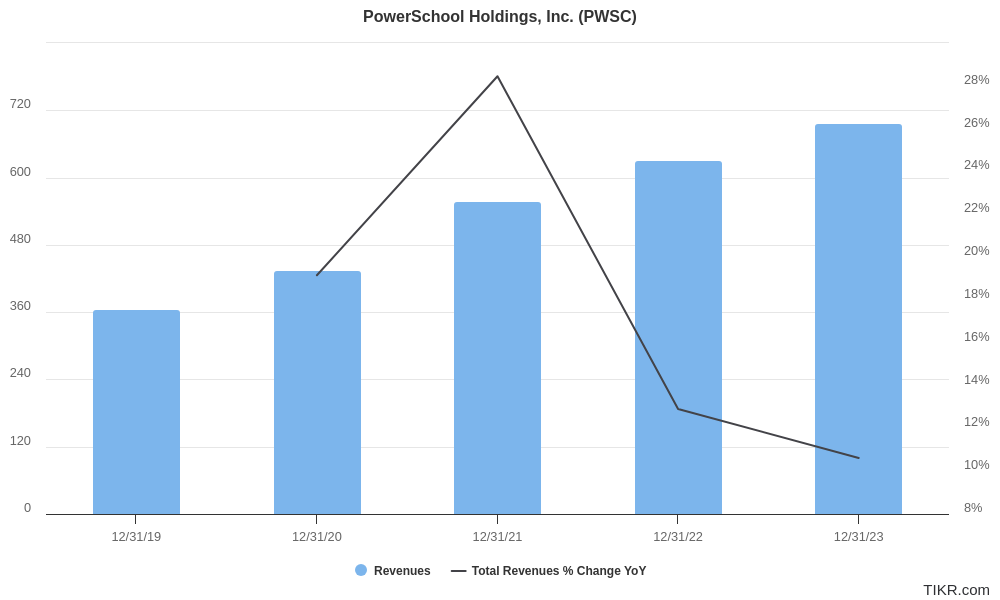

Revenue and Growth: Total revenue reached $185 million, reflecting a healthy 16% increase year-over-year. Subscription revenue grew by an impressive 18% year-over-year to $167 million, making up a significant portion of total revenue (90%).

EPS and Analyst Expectations: Analysts’ consensus forecast anticipated EPS of $0.13.

The Market, Industry, and Competitors:

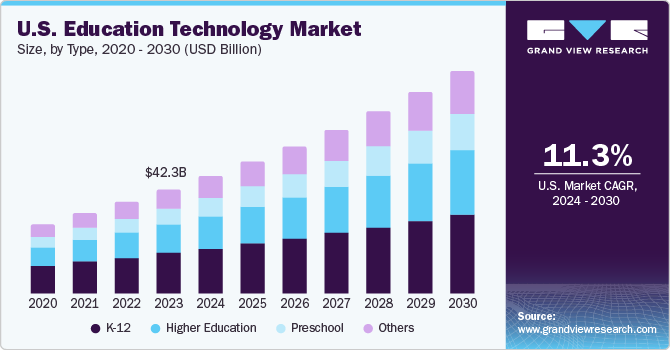

- Increasing adoption of technology in classrooms: Schools are embracing technology to enhance learning experiences and personalize education.

- Growing demand for personalized learning solutions: As educators strive to cater to individual student needs, software that facilitates personalized learning experiences is increasingly sought after.

Market research suggests this K-12 education software market is expected to expand at a Compound Annual Growth Rate (CAGR) of 9.1% by 2030. This translates to a projected market size of approximately $16.86 billion by 2030, up from an estimated $10 billion in 2024.

Unique differentiation:

Large, Incumbent Players: Blackboard, a leading provider of learning management systems (LMS), competes with PowerSchool’s Schoology product. Instructure, another established player, offers Canvas, a comprehensive LMS platform that rivals PowerSchool’s suite of solutions. These companies have a strong brand presence and significant resources, making them formidable competitors.

Focused Point-Solution Providers: Renaissance Learning caters to specific needs like reading and math interventions, while McGraw-Hill focuses on curriculum and assessment tools. These companies might not offer a unified platform like PowerSchool, but they excel in their specialized areas, requiring PowerSchool to continually innovate and demonstrate the value proposition of its comprehensive suite.

Emerging EdTech Startups: The K-12 education space is constantly evolving, with new startups offering innovative solutions like adaptive learning platforms or gamified educational experiences. PowerSchool needs to stay agile and adapt its product offerings to address emerging trends and cater to the evolving needs of educators and students.

Unified Platform: Unlike some competitors offering point solutions for specific needs, PowerSchool boasts a comprehensive, unified platform (PowerSchool Unified Classroom) that integrates various functionalities. This streamlines workflows for schools by offering a one-stop shop for tasks like attendance, grading, communication, and special education resources.

Focus on User Experience: PowerSchool prioritizes user-friendly interfaces for all stakeholders – teachers, students, parents, and administrators. This focus on accessibility allows for easier adoption and fosters better communication and collaboration within the school community.

Focus on Data & Analytics: PowerSchool’s solutions go beyond basic functionalities. They offer data analytics tools that empower educators to make data-driven decisions and personalize learning experiences for students.

Management & Employees:

Hardeep Gulati, Chief Executive Officer (CEO): Hardeep brings over two decades of experience leading software businesses. His passion for education and proven track record in growth are credited with driving PowerSchool’s success.

Eric Shander, President and Chief Financial Officer (CFO): Eric oversees both the business and financial aspects of PowerSchool.

Financials:

PowerSchool Holdings: Financial Performance Overview (2019-2024)

- Revenue Growth: PowerSchool has demonstrated steady revenue growth year-over-year. Their most recent earnings release in May 2024 showcased a strong 11% increase in total revenue for the fiscal year ending December 31, 2023, reaching $697.7 million.

- Earnings Growth: While PowerSchool hasn’t always reported net income, they have shown progress towards profitability. Their most recent quarter (ending March 2024) exceeded analyst expectations, but specific EPS figures haven’t been officially released yet.

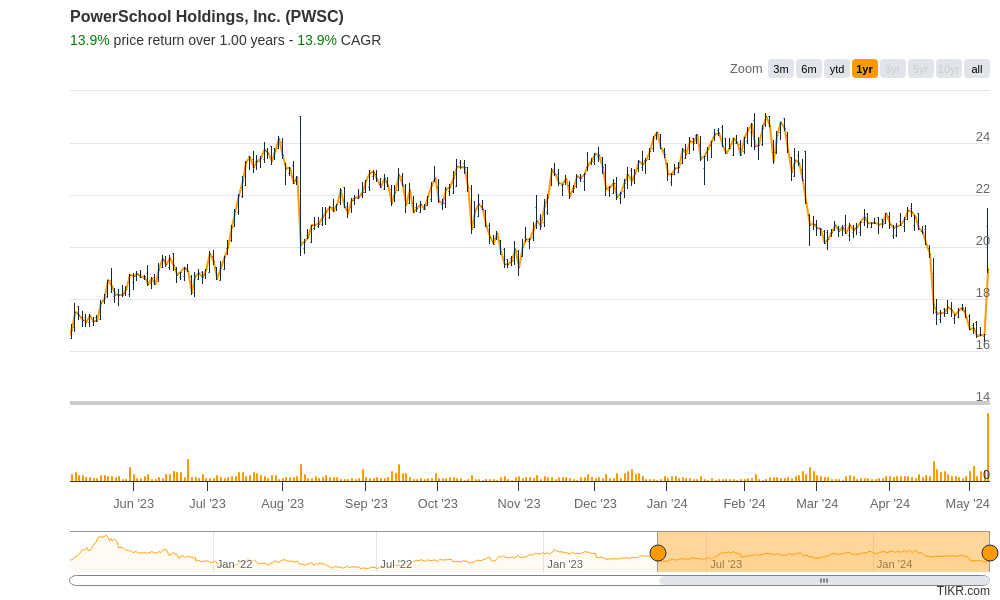

Technical Analysis:

On the monthly chart the stock is consolidating (range bound, stage 1 or 3) between $16 and $24. While it has attempted several reversals, it has failed most of the times. On the weekly chart, the stock is still finding a base in the $18 zone, but could be a good point to attempt a reversal again. If it does not hold the current levels, the next stop is multi-year lows at $15s.

Bull Case:

Expanding Market: The K-12 education software market is expected to experience significant growth in the coming years, driven by factors like increasing technology adoption in classrooms and the demand for personalized learning solutions. PowerSchool, as a leading provider, is well-positioned to benefit from this market expansion.

Data & Analytics Focus: PowerSchool’s solutions go beyond basic functionalities. Their data analytics tools empower educators to personalize learning experiences, potentially leading to improved student outcomes. This focus on data-driven decision making can be a significant selling point for schools.

Growth Through Acquisitions: PowerSchool has a history of acquiring complementary businesses, allowing them to expand their product offerings and enter new markets. This inorganic growth strategy can further solidify their market position.

Bear Case:

Price-to-Sales Ratio (P/S Ratio): While PowerSchool’s recent revenue growth has been impressive, their P/S ratio might be considered high by some investors. This could indicate that the stock price is inflated compared to their current revenue stream.

Focus on K-12 Market: PowerSchool’s primary focus on the K-12 market limits their diversification. If this market experiences a slowdown or unexpected changes in educational technology adoption, it could significantly impact their business.

Integration Challenges with Acquisitions: PowerSchool has a history of acquisitions. While this can be a growth strategy, integrating new businesses and technologies can be complex and lead to unforeseen challenges.