Executive Summary:

Kyndryl Holdings is a major player in the world of information technology, specifically infrastructure services. Founded in 2021 through a spin-off from IBM, they design, build, manage and develop large-scale IT systems. Currently headquartered in New York City, Kyndryl boasts a global presence with a customer base that includes 75% of Fortune 100 companies. With nearly 88,000 employees worldwide, they are the world’s largest IT infrastructure services provider and the fifth-largest consulting provider.

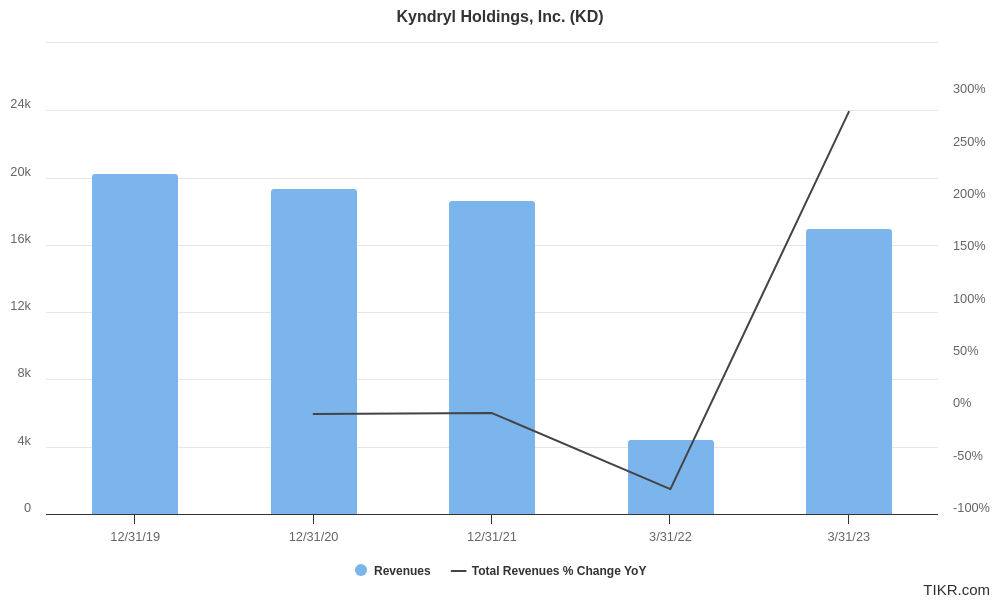

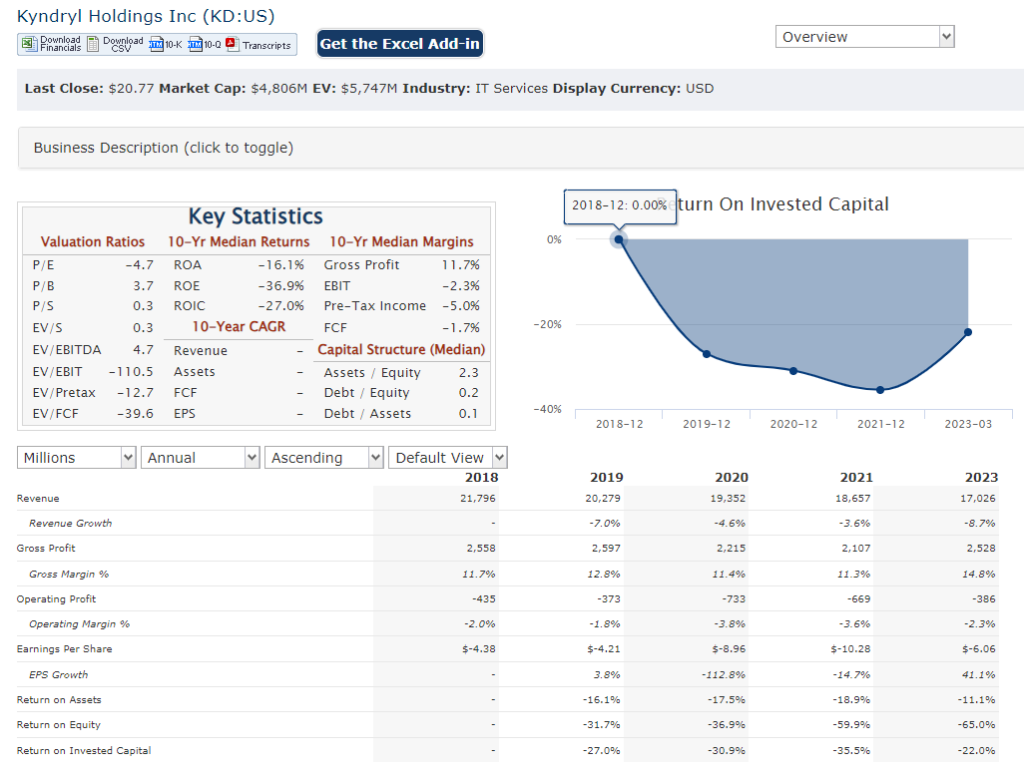

They experienced a net loss of $340 million, revenue reached $16.1 billion, a 6% decline year-over-year. Kyndryl outperformed analyst expectations, and their adjusted pretax income of $165 million exceeded projections.

Stock Overview:

| Ticker | $KD | Price | $20.77 | Market Cap | $4.78B |

| 52 Week High | $22.90 | 52 Week Low | $11.36 | Shares outstanding | 230.10M |

Company background:

Kyndryl Holdings wasn’t founded by a single person or small group, but rather spun off from the established tech giant IBM. Unlike most startups that seek funding, Kyndryl benefitted from IBM’s resources and didn’t require traditional funding methods.

Kyndryl focuses on designing, building, managing, and developing large-scale information systems that are critical for businesses around the world. They essentially act as the backbone for many companies’ IT operations. Kyndryl boasts an impressive client list, including a staggering 75% of Fortune 100 companies.

Kyndryl faces competition from industry giants like Accenture, Atos, NTT DATA, and Tata Consultancy Services. However, Kyndryl holds its own as the world’s largest IT infrastructure services provider and the fifth-largest consulting provider globally. Nearly 88,000 employees worldwide, Kyndryl is a major force to be reckoned with in the IT infrastructure services industry.

Recent Earnings:

- Revenue and Growth: Kyndryl reported revenue of $16.1 billion, which reflects a 6% decline year-over-year. This decrease held steady even after adjusting for currency fluctuations. It’s worth noting that this decline is partly due to a strategic move by Kyndryl to remove low-margin business from their contracts.

- EPS and Growth: Kyndryl did not deliver positive earnings per share (EPS) as they reported a net loss of $340 million.

- Analyst Expectations: Despite the revenue dip, Kyndryl actually outperformed analyst expectations. This positive surprise came from their adjusted pretax income of $165 million, which exceeded analyst projections.

- Forward Guidance: They projected a return to positive constant-currency revenue growth, indicating they expect their revenue to start increasing again. They forecast at least $435 million in adjusted pretax income for fiscal year 2025.

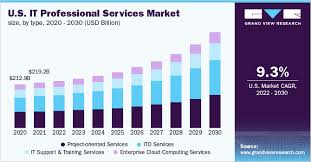

The Market, Industry, and Competitors:

Kyndryl Holdings operates in the global IT infrastructure services market, a massive and growing field. This strong growth is fueled by businesses’ increasing reliance on complex IT systems and their need for expert management and maintenance.

Kyndryl itself isn’t offering specific growth expectations for 2030. Their recent earnings report showing a strategic shift away from low-margin business and their guidance for positive revenue growth in fiscal 2025 suggests optimism about their future. Analysts covering the company are cautiously optimistic as well, with a mix of short-term revenue decline predictions and long-term growth expectations reflected in their price targets. The market Kyndryl operates in is primed for significant growth, and while Kyndryl’s own future trajectory remains to be seen, they are positioned to benefit from the overall industry trends.

Unique differentiation:

- Established giants: Accenture, Atos, NTT DATA, and Tata Consultancy Services are all major forces in the industry. These companies boast extensive experience, global reach, and a wide range of IT services beyond just infrastructure. They can potentially offer clients a one-stop shop for all their IT needs, which could be a competitive advantage.

- Consulting firms with strong IT practices: Companies like Deloitte Consulting, IBM Consulting, and KPMG Consulting may also be competitors for Kyndryl, particularly for complex IT transformation projects that require deep industry expertise alongside infrastructure management.

- Cloud-focused players: Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are increasingly offering infrastructure services as part of their cloud computing packages. While their core offerings might differ from Kyndryl’s traditional data center focus, they could be attractive options for businesses looking for a more cloud-centric approach.

- Heritage and Specialization: Being spun off from IBM gives Kyndryl a unique advantage. They inherit decades of experience and expertise specifically in IT infrastructure, unlike some competitors who might be more broadly focused on consulting or cloud services.

- Focus on Legacy Systems: Many businesses still rely on complex legacy IT systems. Kyndryl’s deep understanding of these systems, along with their expertise in managing them, can be valuable for companies hesitant to migrate entirely to the cloud.

- Incorporating Cloud Expertise: While Kyndryl has a strong legacy system focus, strategically integrating cloud solutions could be crucial to stay relevant as businesses increasingly adopt hybrid cloud models.

- Focus on Automation and AI: Embracing automation and AI tools for infrastructure management can improve efficiency and potentially offer cost advantages to clients.

- Specialization within Infrastructure: Kyndryl might benefit from further specialization within the IT infrastructure domain, focusing on areas like security, edge computing, or data center modernization.

Management & Employees:

Martin Schroeter: Chairman and Chief Executive Officer. He brings extensive experience in the IT services industry to the role.

Elly Keinan: Group President. Leads a specific regional or industry group within Kyndryl.

Edward Sebold: General Counsel. Provides legal counsel and guidance to Kyndryl.

Financials:

Kyndryl Holdings: Financial Performance Overview (2019-2024)

Revenue: While specific year-over-year figures aren’t publicly available for the pre-spin-off period, Kyndryl reported full-year revenue of $16.1 billion for fiscal year 2024. This reflects a 6% decline compared to the previous year.

Earnings: Kyndryl hasn’t yet achieved profitability. They reported a net loss of $340 million for fiscal year 2024. CAGR (Compound Annual Growth Rate) for earnings isn’t relevant in this scenario due to the negative figures.

Looking Forward: Kyndryl projects a return to positive constant-currency revenue growth for fiscal year 2025. Their guidance of at least $435 million in adjusted pretax income suggests a path towards future profitability.

Technical Analysis:

After a long 18-month base being built post the IPO the stock finally made a strong move to the upside which could be the beginning of a stage 2 markup after reporting good earnings beat on poor revenue growth. The losses are narrowing even though revenue is lower for the 1st quarter of 2024.

We would give the stock a few days to see the pattern that emerges and get in at the $24 level for a move to the $30s.

Bull Case:

Market Growth Potential: The IT infrastructure services market is expected to experience significant growth in the coming years, fueled by businesses’ increasing reliance on complex IT systems. Kyndryl, as a major player in this space, is well-positioned to benefit from this market tailwind.

Unique Differentiation: Kyndryl boasts a heritage of expertise in IT infrastructure management, a deep understanding of legacy systems, and strong client relationships, especially with large enterprises. These factors can set them apart from competitors with broader service offerings.

Spin-off Momentum: As a recent spin-off from IBM, Kyndryl might benefit from the initial excitement and potential for faster growth often associated with newly independent companies.

Bear Case:

Legacy Focus as a Liability: While Kyndryl’s expertise in legacy systems can be an advantage, it could also become a burden. Over-reliance on traditional infrastructure management might limit their ability to adapt to the evolving IT landscape, where cloud computing and digital transformation are increasingly dominant.

Uncertain Impact of Strategic Shift: Kyndryl’s move away from low-margin business has a short-term impact on revenue. While it might improve profitability in the long run, the success of this strategy remains to be seen.

Limited Track Record: Given its short existence as an independent company, Kyndryl has a limited track record to assess its future performance. Investors might be wary of the unknown compared to established players with a long history.