Executive Summary:

Wolfspeed Inc. makes special semiconductors. They focus on materials like silicon carbide and gallium nitride, used in components for power and wireless systems. Their products contribute to more efficient electric vehicles, renewable energy systems, and faster communication networks.

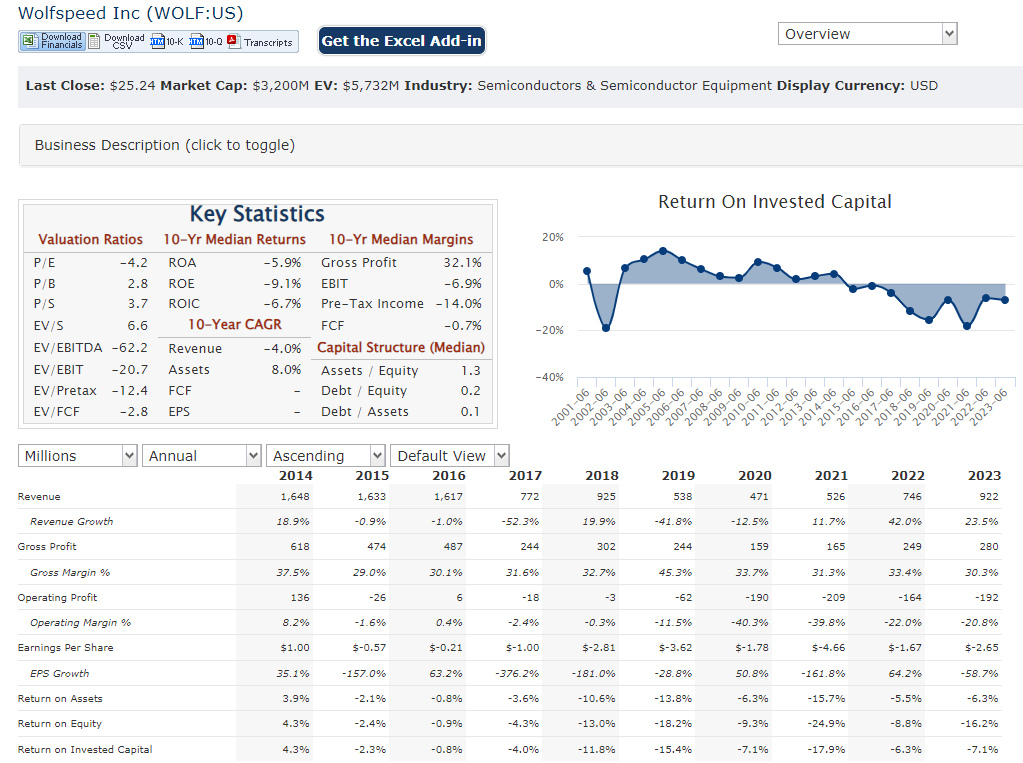

Revenue reached $208.4 million, a 5.57% increase compared to the previous quarter but a 3.56% decrease year-over-year. Earnings per share (EPS) were negative at -$0.55.

Stock Overview:

| Ticker | $WOLF | Price | $25.24 | Market Cap | $3.17B |

| 52 Week High | $70.42 | 52 Week Low | $23.54 | Shares outstanding | 125.8M |

Company background:

Wolfspeed Inc. was founded in 2017 as a spin-off from Cree. The company’s headquarters are located in Durham, North Carolina, USA. Their materials hold the key to components in power and radio frequency (RF) systems that are more efficient. The company is experiencing significant growth, recently opening the world’s largest silicon carbide fabrication facility.

Wolfspeed’s core products are silicon carbide and gallium nitride-based devices used for power and radio frequency applications. They include silicon carbide metal-oxide-semiconductor field-effect transistors (SiC MOSFETs), Schottky diodes, and power modules. These devices enable features like faster charging in electric vehicles and improved efficiency in solar power inverters.

Wolfspeed faces competition from established industry players like ON Semiconductor, Infineon Technologies, STMicroelectronics, and ROHM Semiconductor. These companies have a broader range of products and a longer history in the semiconductor market. Wolfspeed’s focus on silicon carbide and gallium nitride technology positions it well for the growing demand for efficient power electronics.

Recent Earnings:

Wolfspeed brought in $208.4 million in revenue. This represents a 5.57% increase year-over-year but a 3.56% decrease compared to the prior quarter. Earnings per share (EPS) were negative at -$0.55.

This is evident in their operational metrics. For instance, they recently completed the sale of their RF business to focus on silicon carbide technology. They are also significantly expanding their manufacturing capacity, with the opening of the world’s largest silicon carbide fabrication facility. They project revenue between $185 million and $215 million, with a targeted net loss.

The Market, Industry, and Competitors:

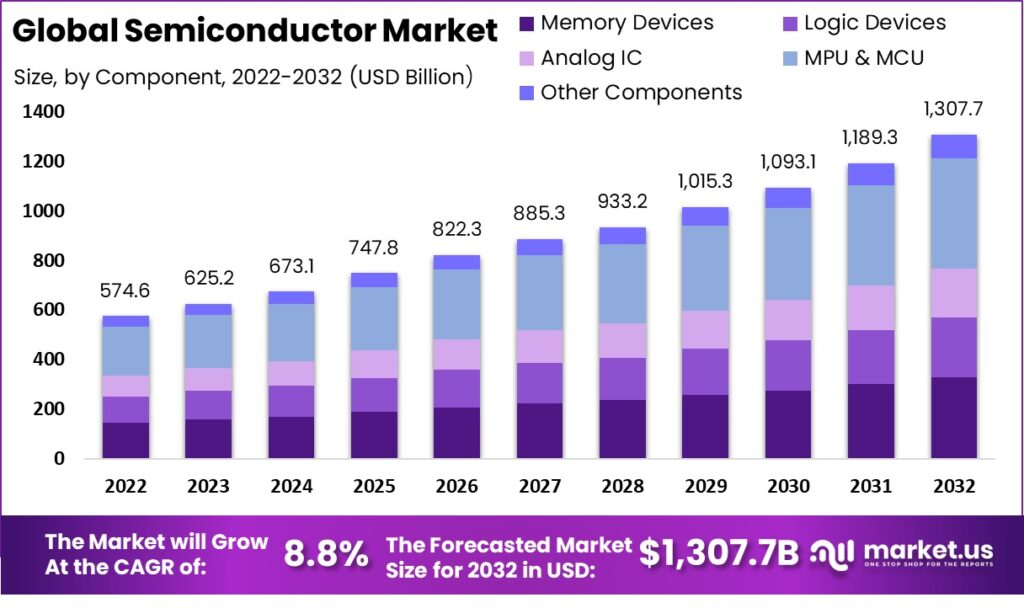

Wolfspeed operates in the power electronics market, a sector anticipated to reach a staggering $756.8 billion by 2030. This significant growth is fueled by the increasing demand for electric vehicles, renewable energy sources, and data centers, all of which rely heavily on efficient power electronics.

Wolfspeed focuses on a specific niche – silicon carbide and gallium nitride semiconductors. These advanced materials are expected to experience a surge in demand, with a projected Compound Annual Growth Rate (CAGR) exceeding 30% by 2030. The exceptional efficiency and power handling capabilities of these semiconductors make them ideal for the aforementioned growth sectors, solidifying a positive outlook for Wolfspeed’s core products.

Unique differentiation:

The well-recognized names in the semiconductor market, such as ON Semiconductor, Infineon Technologies, STMicroelectronics, and ROHM Semiconductor. These companies boast a broader product portfolio and a longer track record in the industry. They can leverage their existing infrastructure and customer base to compete with Wolfspeed.

Wolfspeed has a strategic advantage in its focus on silicon carbide and gallium nitride technology. These next-generation materials are specifically designed for efficiency in power and radio frequency applications, which aligns perfectly with the growing demand for electric vehicles, renewable energy, and advanced communication networks.

Another set of competitors includes companies like Odyssey Semiconductor Technologies, Intematix, and AVX. These firms are also developing advanced materials and devices in the semiconductor space. They may target similar applications or explore alternative technologies that could compete with Wolfspeed’s offerings. By staying at the forefront of innovation and efficiently scaling its production, Wolfspeed can solidify its position in this dynamic and rapidly growing market.

- Material Expertise: Unlike many competitors offering a broader range of semiconductors, Wolfspeed specializes in silicon carbide and gallium nitride. These advanced materials offer superior efficiency and power handling capabilities compared to traditional silicon.

- Market Alignment: Wolfspeed’s core technology aligns perfectly with the growing demand for electric vehicles, renewable energy systems, and advanced communication networks. These sectors prioritize efficiency, making silicon carbide and gallium nitride ideal choices.

Management & Employees:

- Gregg Lowe (President & CEO): Lowe leads the company’s overall strategy and growth initiatives.

- Priya Almelkar (Chief Information Officer & SVP): Almelkar spearheads digital transformation efforts and leverages technology to enhance efficiency and scalability.

- Cengiz Balkas (SVP & GM, Materials): Balkas brings over 20 years of experience in silicon carbide development and commercialization, leading Wolfspeed’s materials division.

Financials:

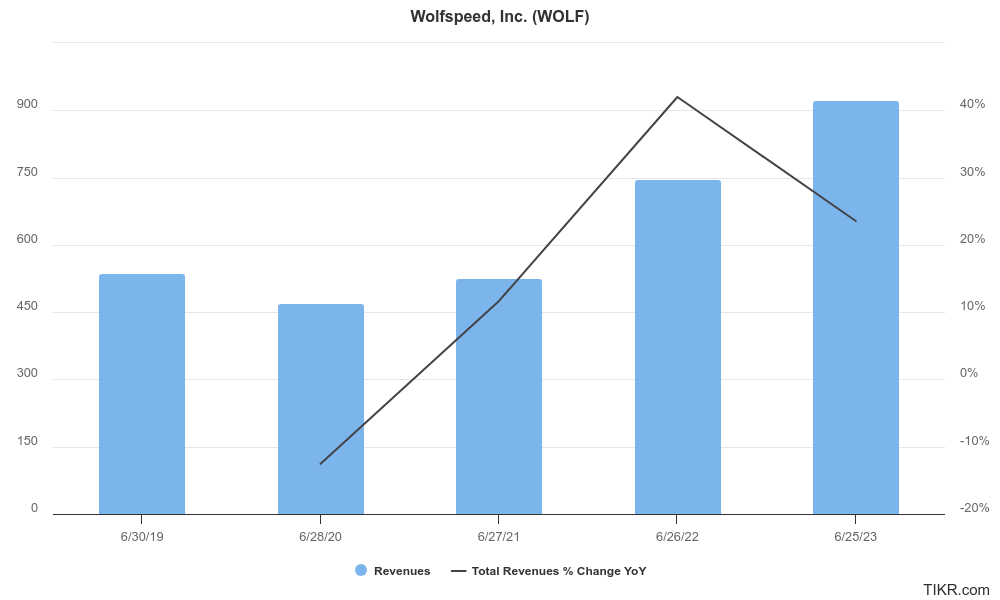

Wolfspeed has been experiencing significant revenue growth. Since its inception, the company has seen year-over-year revenue increases, with a focus on market expansion over immediate profits. This prioritization is reflected in their Earnings Per Share (EPS), which have remained negative in recent quarters.

It’s important to note that calculating a Compound Annual Growth Rate (CAGR) for such a short timeframe wouldn’t be particularly meaningful.

On the balance sheet side, Wolfspeed has been securing funding to support its growth strategy. The company has garnered over $463 million through multiple rounds. This capital is being used to invest in research and development, expand manufacturing capacity, and build their market presence.

Wolfspeed’s focus on a rapidly growing market with superior technology positions them well for future success.

Technical Analysis:

The monthly, weekly and daily chart are all in stage 4 (bearish) markdown phase. We would avoid the stock.

Bull Case:

- Market Leader in Silicon Carbide (SiC): Wolfspeed is considered a frontrunner in SiC technology, a next-generation semiconductor material with superior efficiency and power handling compared to traditional silicon.

- Pick-and-Shovel Play: Wolfspeed doesn’t manufacture finished products like electric vehicles, but rather the essential building blocks (SiC chips) needed by these industries. This “pick-and-shovel” approach allows them to benefit from the overall growth of these sectors without the complexities of building and selling end products.

- Expanding Manufacturing Capacity: Wolfspeed is actively expanding its manufacturing capacity, including the opening of the world’s largest silicon carbide fabrication facility.

Bear Case:

- Execution Risk: Successfully scaling production and maintaining quality control for a new technology like SiC is challenging.

- Macroeconomic Downturn: A broader economic slowdown could dampen demand for electric vehicles, renewable energy, and data centers, all key markets for Wolfspeed. This could negatively impact their revenue and profitability.

- Dependence on Limited Markets: Wolfspeed is heavily reliant on the success of a few specific markets. If these markets don’t experience the anticipated growth, it could significantly impact their business.