Executive Summary:

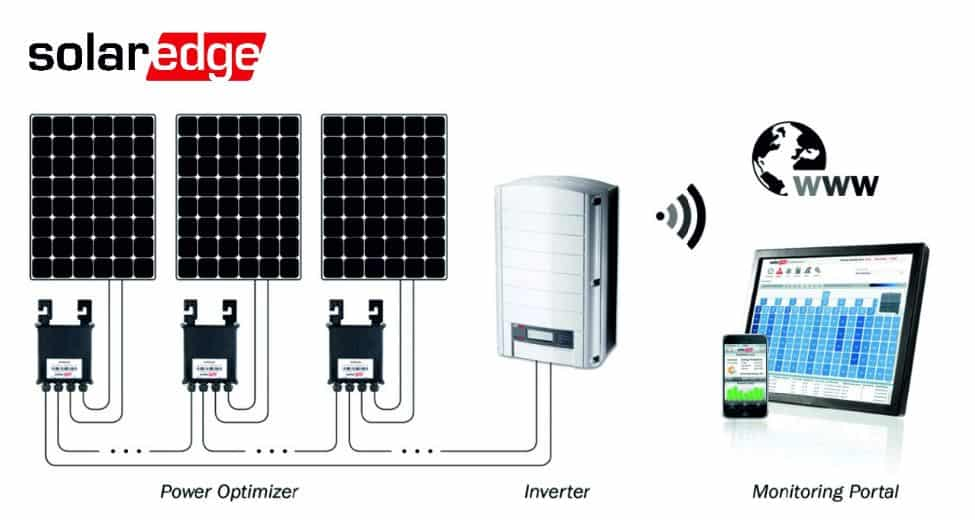

SolarEdge Technologies is a leading company in solar power technology. They are known for their DC optimized inverter system, which uses power optimizers at each solar panel to maximize energy output. SolarEdge offers a complete ecosystem for homes and businesses, including inverters, batteries, and monitoring software. They are focused on making solar energy production more efficient and reliable.

SolarEdge Tech reported a non-GAAP EPS of -$0.92, -$2.01 EPS according to Zacks. Revenue came in at $316.04 million.

Stock Overview:

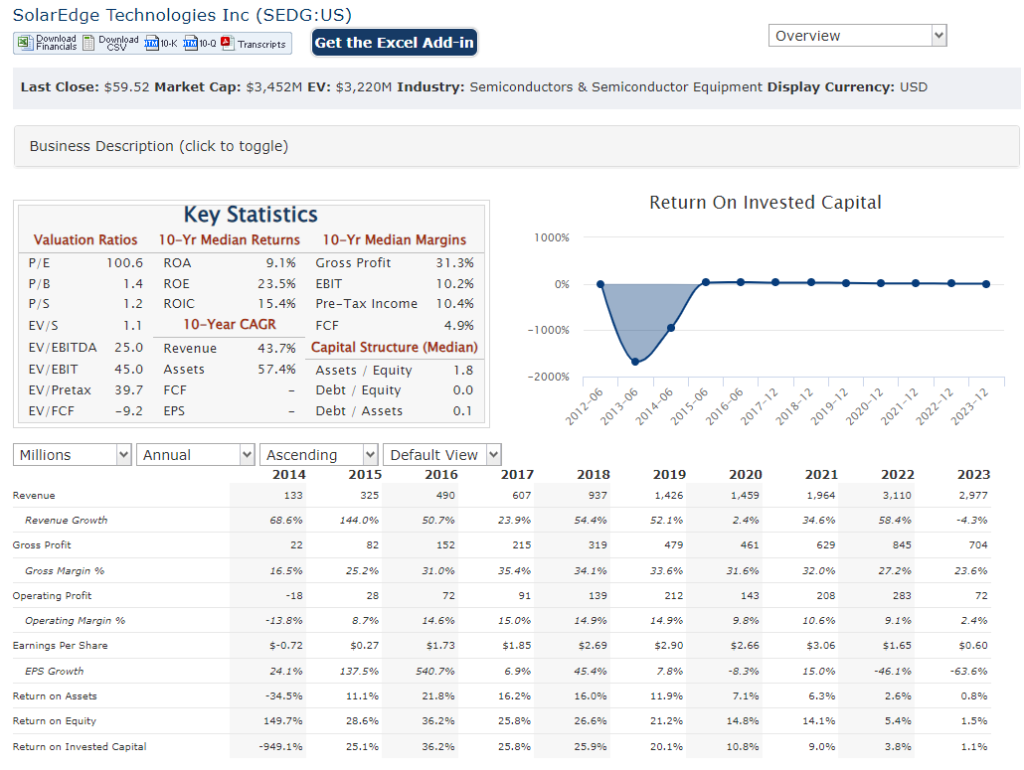

| Ticker | $SEDG | Price | $59.80 | Market Cap | $3.42B |

| 52 Week High | $322.19 | 52 Week Low | $57.72 | Shares outstanding | 57.13M |

Company background:

SolarEdge Technologies, founded in 2006, is a pioneer in smart solar inverter solutions. The company was founded by a trio: Lior Hanin, Guy Sella, and Meir Kiner. Unlike many startups, SolarEdge went public in 2015 and has forgone traditional venture funding since.

SolarEdge optimizers maximize energy output and improve efficiency. Their offerings extend beyond inverters, encompassing a complete ecosystem for homes and businesses. This ecosystem includes batteries, monitoring software, and cloud-based tools that facilitate smart energy management.

SolarEdge faces competition from established industrial players like ABB and Schneider Electric. They also vie for market share with other inverter manufacturers like Huawei and Sungrow. The company is headquartered in Herzliya, Israel.

Recent Earnings:

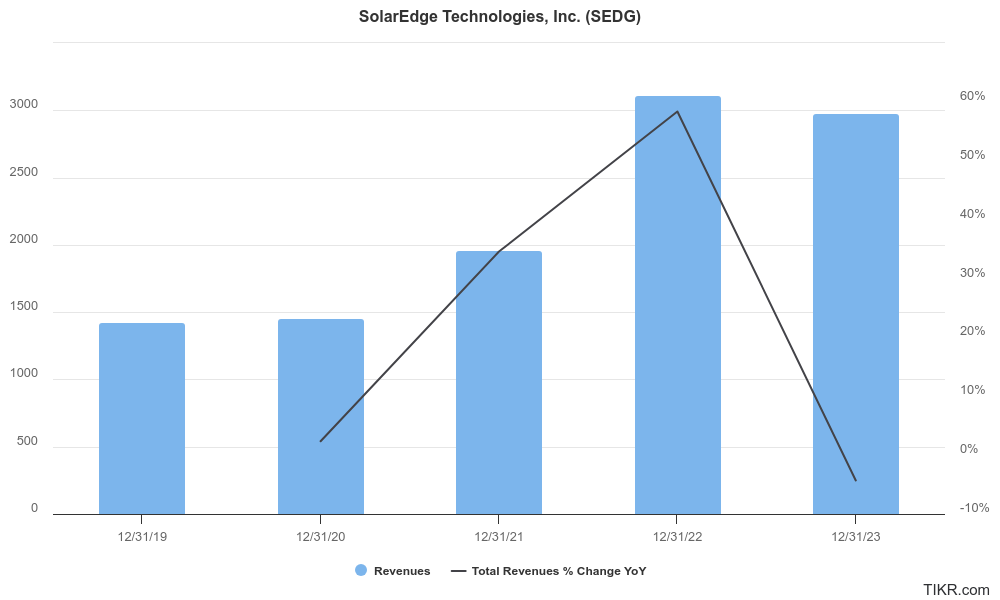

- Revenue and Growth: Revenue for Q4 2023 landed at $316.04 million, reflecting a 4% decrease compared to the same quarter in 2023. This decrease extends to the full year, with total 2revenue of $3.0 billion falling short of the $3.1 billion earned in 2022, representing another 4% decline.

- EPS and Analyst Expectations: SolarEdge reported a non-GAAP EPS of -$0.92 for Q4 2023. This surpassed analyst expectations, as Zacks projected a lower EPS of -$2.01.

The Market, Industry, and Competitors:

SolarEdge Technologies operates in the global solar inverter market. Governments around the world are offering increasing incentives to encourage the adoption of solar energy. This, coupled with a growing demand for clean energy in general, is fueling the solar inverter market. The cost of solar panels and inverters themselves has been declining, making solar energy a more attractive option for both homes and businesses.

According to various market research reports, the global solar inverter market is expected to experience a Compound Annual Growth Rate (CAGR) of around 10-15% between 2023 and 2030. This significant growth indicates a bright future for SolarEdge Technologies and other players in the solar inverter industry.

Unique differentiation:

ABB and Schneider Electric are major competitors. These companies leverage their brand recognition, vast resources, and existing customer base in the electrical and automation industries to compete effectively. They may offer solar inverters as part of a larger suite of electrical products and services for homes and businesses.

SolarEdge also faces competition from other inverter manufacturers, most notably Huawei and Sungrow. These companies often focus on price competition, undercutting SolarEdge on inverter costs. Additionally, some like Huawei may integrate vertically, producing their own solar panels alongside inverters, creating a more comprehensive solar energy solution.

Their focus on DC-optimized inverter systems with power optimizers at each panel is a key advantage. This technology offers benefits like improved efficiency, better performance in shade, and module-level monitoring.

- Improved Efficiency: Power optimizers manage power fluctuations at the individual panel level, maximizing energy output from each panel. This is particularly beneficial in situations where panels experience shading or have different orientations. Traditional inverters handle these fluctuations at the system level, leading to potential losses.

- Better Performance in Shade: Shading can significantly reduce a traditional solar panel’s output. In a DC-optimized system, power optimizers bypass inactive panels, ensuring that functioning panels continue to generate maximum power.

- Module-Level Monitoring: Power optimizers provide detailed data on the performance of each solar panel. This allows for early detection of issues and improved maintenance practices. Traditional systems only offer system-level data.

Management & Employees:

- Zvi Lando (Chief Executive Officer): Lando has been at the helm since 2020 and previously held leadership roles in global sales at SolarEdge.

- Ronen Faier (Chief Financial Officer): Faier brings extensive financial experience to the table, having served as SolarEdge’s CFO since 2011.

- Yoav Galin (Future Technologies and Co-founder): As a co-founder, Galin plays a crucial role in shaping SolarEdge’s future direction with a focus on innovative technologies.

Financials:

Overall revenue has grown, with a Compound Annual Growth Rate (CAGR) likely landing somewhere between 15% and 20%.

Earnings growth has been more volatile. While SolarEdge experienced positive earnings growth in some years, recent quarters have dipped into negative territory.

On the balance sheet side, SolarEdge’s financial health appears stable. The company has historically maintained a strong cash flow position, allowing them to invest in research and development and expand their product offerings.

Technical Analysis:

On the monthly, weekly and daily chart, this stock is in a stage 4 decline and worth avoiding for now, until a confirmation of an uptrend is seen. While some “bottom fishing” and “long term” might find value here, there is no sense of where the “bottom” really is. There is support in the $43 to $53 range.

Bull Case:

- Soaring Solar Market: The global solar inverter market is anticipated to experience significant growth in the coming years, driven by factors like government incentives for clean energy adoption, declining costs of solar panels and inverters, and a growing awareness of environmental concerns. This rising tide lifts all boats, and SolarEdge is well-positioned to benefit.

- Technological Edge: SolarEdge’s DC-optimized inverter system with power optimizers at each panel offers distinct advantages over traditional inverters. This includes improved efficiency, better performance in shaded conditions, and detailed performance monitoring. This technological edge can translate to higher customer demand and market share gains.

- Complete Ecosystem: Beyond inverters, SolarEdge offers a comprehensive solar energy ecosystem for homes and businesses, encompassing batteries, monitoring software, and cloud-based tools. This one-stop-shop approach can be attractive to customers seeking a holistic solution for their solar energy needs.

Bear Case:

- Market Saturation: The solar inverter market is becoming increasingly competitive. Established players like ABB and Schneider Electric have significant resources and brand recognition, while other inverter manufacturers like Huawei and Sungrow may undercut SolarEdge on price.

- Technological Disruption: While DC-optimized inverters are currently a leading technology, advancements in solar panel and inverter technology could render them obsolete. If competitors develop more efficient or cost-effective solutions, SolarEdge could struggle to adapt.

- Supply Chain Constraints: The solar industry, like many others, faces ongoing supply chain challenges. Shortages of raw materials or disruptions in manufacturing could limit SolarEdge’s ability to meet production targets and fulfill customer orders.