Executive Summary:

Asana Inc. is a software company based in San Francisco that offers a project management platform to help teams collaborate and organize their work. Founded in 2008, the company’s Asana service is a web and mobile application that allows users to create projects, assign tasks, set deadlines, and track progress. With features like file attachments, calendars, and goal tracking, Asana is used by millions of teams and over 100,000 organizations worldwide, including many Fortune 100 companies.

Revenue of $171.1 million, a 14% increase year-over-year. Earnings per share (EPS) were negative $0.04.

Stock Overview:

| Ticker | $ASAN | Price | $13.67 | Market Cap | $3.07B |

| 52 Week High | $26.27 | 52 Week Low | $13.43 | Shares outstanding | 139.32M |

Company background:

Asana Inc. is a software company based in San Francisco, California that specializes in work management tools, by Dustin Moskovitz and Justin Rosenstein, both former Facebook employees. The core product of Asana is their namesake web and mobile application which allows teams to collaborate on projects.

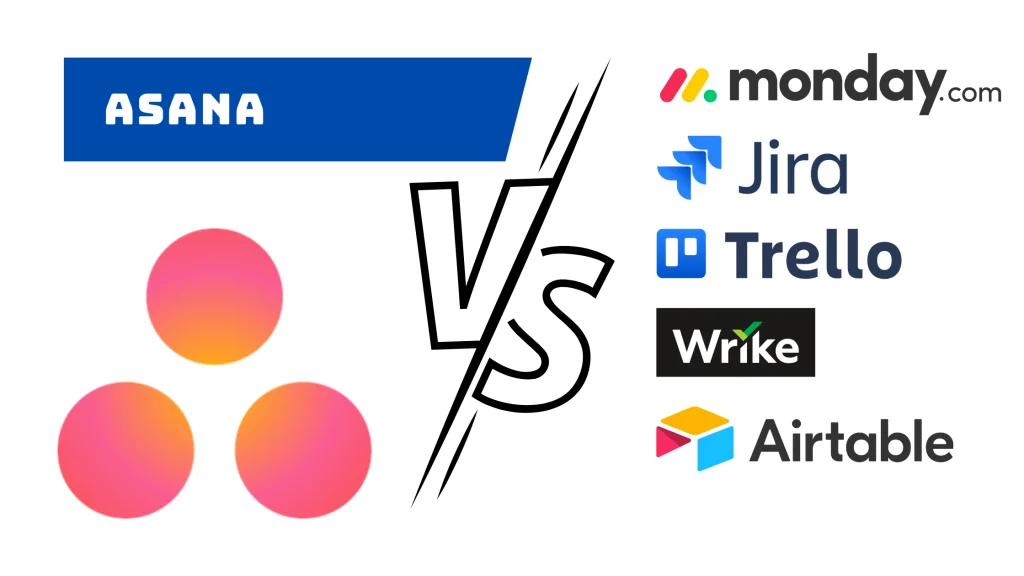

Asana competes in a crowded project management software market with key competitors including monday.com, Trello (owned by Atlassian), and Microsoft Project. Despite the competition, Asana has carved out a niche for itself with a focus on ease of use and a clean interface.

Recent Earnings:

- Revenue: Asana’s revenue for Q4 2024 was $171.1 million, reflecting a 14% year-over-year increase.

- EPS: Earnings per share (EPS) were negative $0.04.

- Operational Metrics: Revenue from customers spending over $100,000 annually increasing by 29% year-over-year. Additionally, dollar-based net retention rate (DBNRR) from these large customers remained high at 115%.

The Market, Industry, and Competitors:

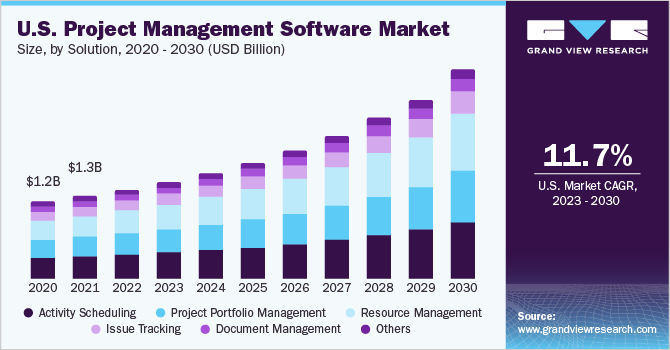

Asana operates in the work management software market, which is a large and growing market. Analysts expect this work management software market to continue growing at a healthy clip in the coming years. Some estimates suggest a Compound Annual Growth Rate (CAGR) of over 14% between 2023 and 2030.

Asana is well-positioned to benefit from this growth. The company is focused on expanding its product offerings and attracting new customers, particularly large enterprises. With its focus on ease of use and a clean interface, Asana can carve out a significant share of the growing work management software market.

Unique differentiation:

- Microsoft Project: A mature and feature-rich solution from Microsoft, particularly popular with large enterprises that are already invested in the Microsoft ecosystem.

- Trello (owned by Atlassian): A free, user-friendly tool with a Kanban board interface, ideal for small teams and individual users who prefer a more visual approach to task management.

- ClickUp: A feature-rich platform with a wide range of functionalities beyond just project management, including task management, wikis, and even whiteboards. It appeals to users seeking a comprehensive solution.

- Monday.com: Another popular platform known for its high degree of customization and visual interface. It caters to teams that need a solution that can adapt to their specific workflows.

- Focus on User Experience: Asana prioritizes a clean and intuitive interface, making it easy for users to learn and navigate the platform. This is particularly appealing for teams who need a user-friendly tool to streamline their workflow without a complex learning curve.

- Collaboration Features: Asana goes beyond simple task management. It offers robust features that facilitate seamless communication and teamwork within projects. This can be through built-in chat functionality, task comments, and clear assignment and delegation tools.

- Balance of Power and Flexibility: Compared to some competitors with a vast array of functionalities, Asana strikes a balance. It offers enough power for effective project management but avoids overwhelming users with excessive features.

Management & Employees:

- Dustin Moskovitz (Co-Founder & CEO): Previously co-founded Facebook and served as its CTO and VP of Engineering. He leads Asana’s overall direction and vision, emphasizing a user-friendly product and strong company culture.

- Anna Binder (Head of People Operations): Oversees Asana’s human resources department, focusing on employee recruitment, development, and fostering a positive work environment.

- Tim Wan (Head of Finance): Manages Asana’s financial operations, including budgeting, financial reporting, and strategic financial planning.

Financials:

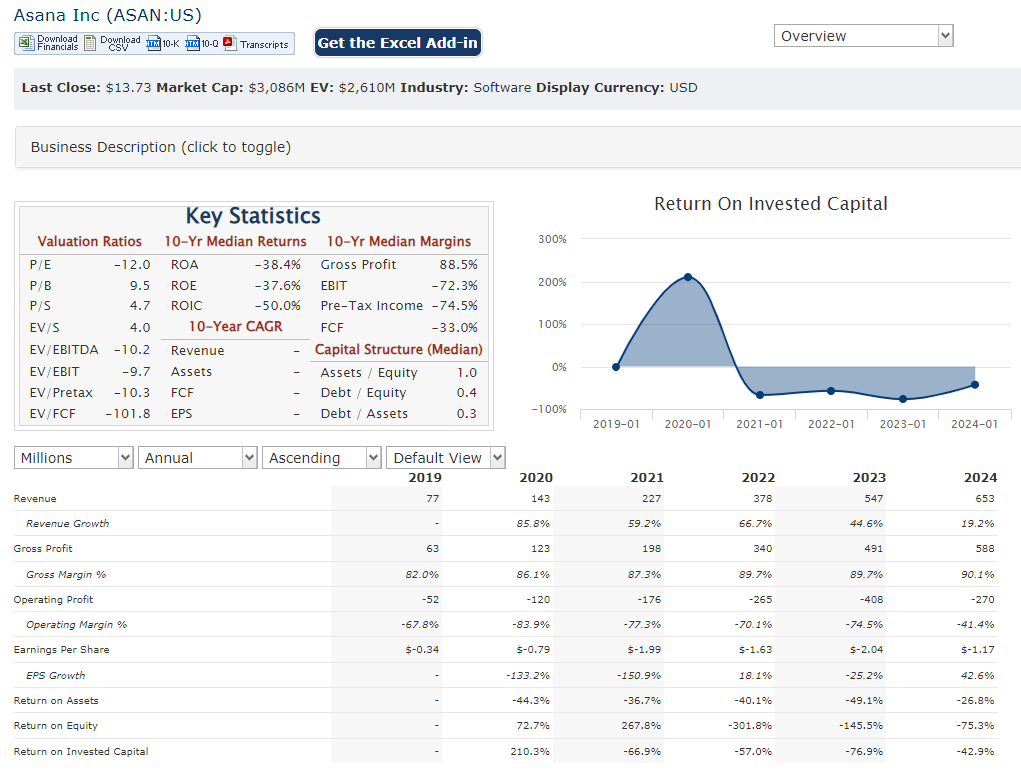

Revenue has seen a steady increase, with a Compound Annual Growth Rate (CAGR) likely exceeding 30% based on reported year-over-year growth figures. Most recent earnings report in March 2024 showed a 14% year-over-year increase in revenue for fiscal year 2024.

Earnings per share (EPS) haven’t yet reached positive territory, which is common for companies in the growth stage. While a CAGR for EPS can’t be accurately calculated , it’s safe to say their losses have likely increased year-over-year as they invest in product development, marketing, and customer acquisition to fuel revenue growth.

Technical Analysis:

The stock is building a base in the $11 to $15 range on the monthly and weekly chart. On the daily chart, the stock is in a stage 4, bearish markdown phase, with a possible support at $13.2 range, but realistically support only exists in the $11.4 range. We would avoid this stock for now. $MNDY is a better medium to long-term option.

Bull Case:

- Future Profitability: While Asana isn’t currently profitable, bulls believe the company can eventually achieve profitability as it scales and leverages its high gross margins. As they focus less on customer acquisition and more on operational efficiency, their EPS could turn positive and significantly impact the stock price.

- Product Differentiation: Bulls are confident that Asana’s focus on user experience, clean design, and robust collaboration features will continue to differentiate it from competitors with a more complex or feature-heavy approach.

Bear Case:

- Declining Dollar-Based Net Retention Rate (DBNRR): A recent decline in DBNRR, a metric indicating existing customer spending, suggests potential issues with churn or customers downgrading plans.

- Valuation Concerns: While growth is exciting, Asana’s stock price might be inflated based on future expectations, not current financials.

- Macroeconomic Factors: A broader economic downturn could lead to decreased IT budgets and reduced demand for Asana’s software, impacting their sales and growth trajectory.