Executive Summary:

Joby Aviation is a California-based company developing electric vertical takeoff and landing aircrafts (eVTOLs) for commercial air taxi services. Their eVTOL aircraft, designed to carry a pilot and four passengers at speeds of up to 200 mph, aims to reduce urban traffic congestion and provide a sustainable transportation option. Founded in 2009, Joby Aviation has spent over a decade developing and testing their electric aircraft with the goal of launching operations from 2024.

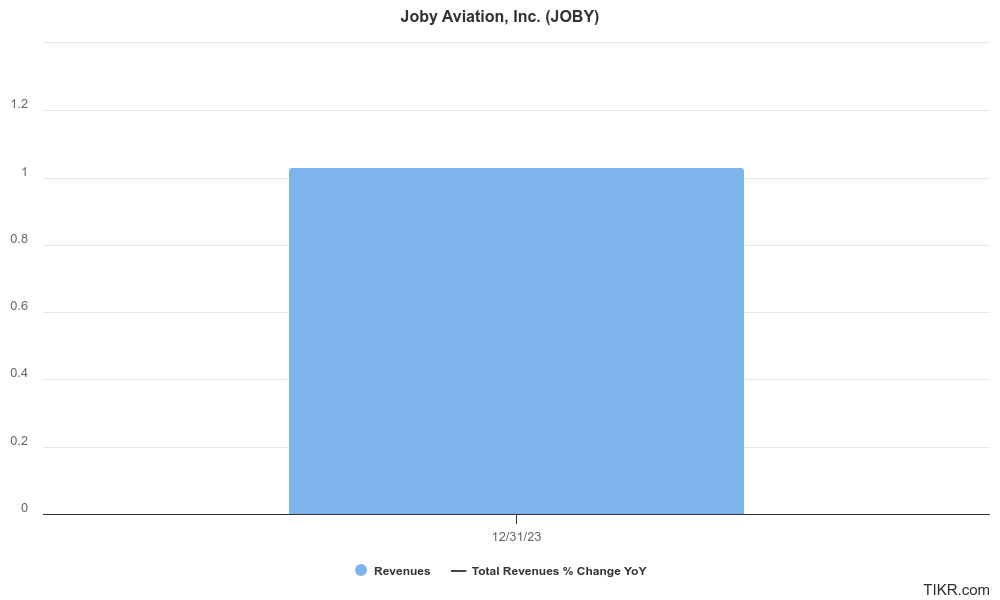

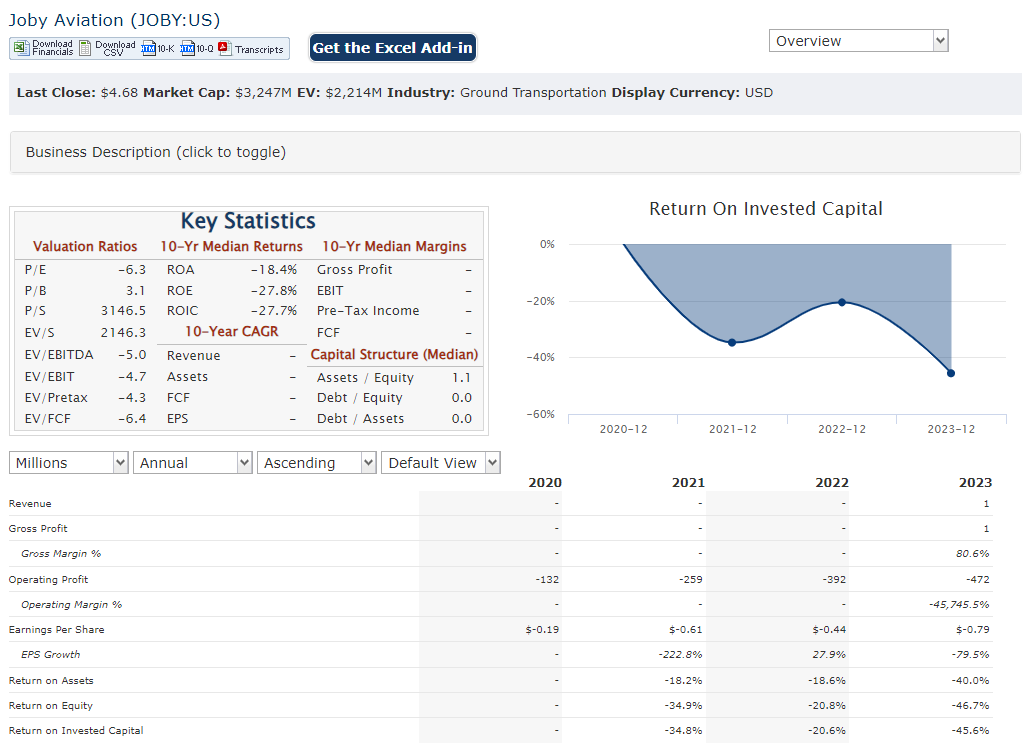

They reported a net loss of -$115.1 million. Revenue was $1.03 million.

Stock Overview:

| Ticker | $JOBY | Price | $4.68 | Market Cap | $3.28B |

| 52 Week High | $11.98 | 52 Week Low | $3.72 | Shares outstanding | 702.8M |

Company background:

Joby Aviation was founded by Joe Gebbia, co-founder of Airbnb, and Neil Ferguson. All-electric aircraft are designed to carry a pilot and four passengers up to 150 miles on a single charge, aiming to revolutionize transportation within and between cities by reducing traffic congestion.

Joby has received over $1 billion in funding and is backed by major players like Toyota, Delta, and Uber. With a team of over 1400 engineers and experts, Joby is focused on obtaining certification from the Federal Aviation Administration (FAA) and ramping up production of their eVTOL aircraft. The company faces competition from other eVTOL developers such as Archer Aviation, Volocopter, and EHang, all vying to be at the forefront of this emerging.

Recent Earnings:

For Q4 2023, Joby reported a net loss of -$115.1 million, a substantial decrease compared to the previous year. It’s important to consider that Joby is a pre-revenue company, so their current revenue stream is minimal. They did report $1.03 million in Q4 2023.

Analyst expectations for Q1 2024 EPS are around -$0.17. This aligns with Joby’s focus on certification and manufacturing for their eVTOL aircraft in 2024, prioritizing these milestones over generating immediate revenue.

They plan to launch commercial air taxi services in 2025, so future earnings reports will likely include operational metrics like the number of vehicles produced and routes launched.

The Market, Industry, and Competitors:

- Urban traffic congestion: Traffic congestion in major cities is a growing problem, and eVTOLs offer a potential solution by providing point-to-point transportation that bypasses congested roads.

- Increasing demand for sustainable transportation options: As environmental concerns rise, there’s a growing demand for cleaner transportation options. Electric-powered eVTOLs produce zero operational emissions, making them attractive in this regard.

- Technological advancements in electric battery and autonomous flight systems: Advancements in battery technology are increasing the range and efficiency of eVTOLs. Additionally, developments in autonomous flight systems could lead to the creation of self-flying eVTOLs in the future, further revolutionizing urban transportation.

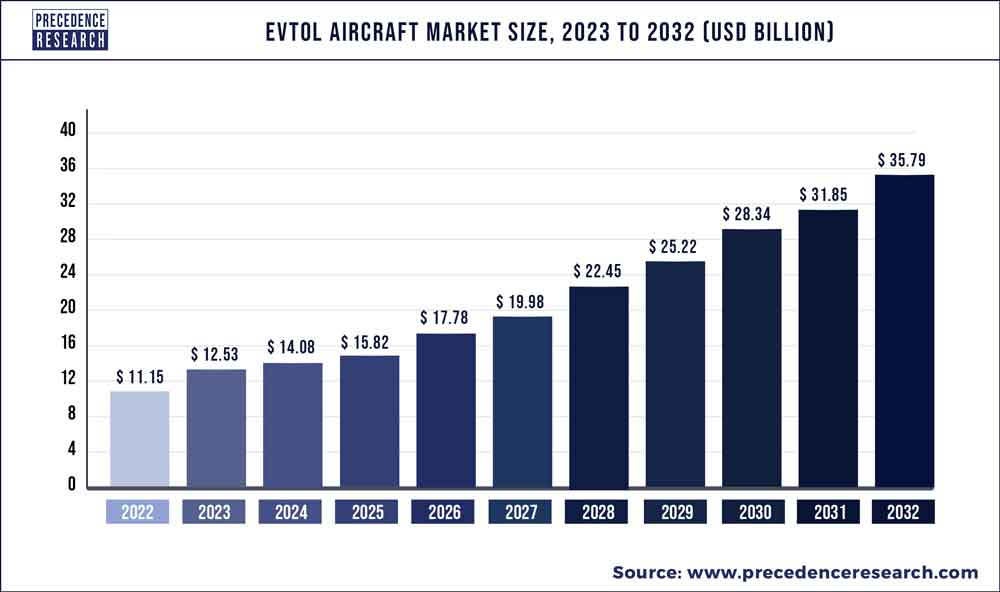

Market size and CAGR estimates vary, but analysts like Morgan Stanley predict the global eVTOL market to reach $1.5 trillion by 2030, with a Compound Annual Growth Rate (CAGR) of 28%.

Unique differentiation:

- Archer Aviation: A leading competitor based in California, Archer is developing a four-passenger eVTOL known as Maker. Similar to Joby, Archer is targeting a range of 100 miles and a launch in 2024. They recently merged with special purpose acquisition company (SPAC) Atlas Crest Investments to go public.

- Volocopter: This German company is a pioneer in the eVTOL space, known for its multi-copter design. Volocopter focuses on developing urban air mobility solutions and has conducted public test flights in Dubai. They are aiming for commercial launch in the mid-2020s.

- EHang: A Chinese company, EHang is another major player with a two-seater autonomous eVTOL called the EHang 216. EHang has already received conditional certification for passenger flights in China and has conducted demonstration flights.

- Focus on Quiet Operations: Joby emphasizes the quiet operation of their eVTOL aircraft, aiming to address noise concerns often associated with vertical takeoff and landing vehicles. This could be a significant advantage in urban environments with stricter noise regulations.

- Proven Technology & Experienced Team: Founded in 2009, Joby has a longer track record in eVTOL development compared to some competitors. Their team of over 1400 engineers brings expertise in aeronautical engineering, electric propulsion, and composite materials. This experience could translate to a more refined and reliable aircraft design.

- Strategic Partnerships: Joby has secured partnerships with major players like Toyota, Delta Airlines, and Uber. These partnerships could provide Joby with advantages in manufacturing, infrastructure access, and potential future ride-sharing integrations.

Management & Employees:

- JoeBen Bevirt (Founder & CEO): Bevirt has been at the helm of Joby since its inception, guiding the company’s vision and strategy for eVTOL development.

- Bonny Simi (President of Operations): Simi leverages her extensive experience in aviation operations, including piloting experience, to oversee Joby’s operational efficiency.

- Eric Allison (Chief Product Officer): Allison focuses on the design and development of Joby’s eVTOL aircraft, ensuring it meets performance and user experience goals.

Financials:

Joby reported a net loss of $115.1 million, which reflects their focus on research, development, and manufacturing rather than generating revenue at this stage.

Joby is still in the pre-revenue phase, so traditional financial metrics like revenue growth and CAGR for earnings aren’t applicable at the moment. Their financial performance will be more accurately measured once they begin commercial operations and report on factors like quarterly or annual revenue and profitability.

Looking at their balance sheet, Joby has secured over $1 billion in funding from investors like Toyota, Delta Airlines, and Uber. These funds have primarily been used for research and development efforts to bring their eVTOL aircraft to market. Their cash flow is currently focused on operational expenses and ramping up production capabilities.

Technical Analysis:

Shares are in a stage 4 decline on the monthly, weekly and daily charts, so we are not going to advocate any position in the company yet, even for the long term. The support exists at the $3.3 to $4.3 range.

Bull Case:

- Large, Growing Market: The eVTOL market is anticipated to experience significant growth in the coming years, driven by factors like urban traffic congestion, demand for sustainable transportation, and advancements in battery and autonomous flight technology.

- First-Mover Advantage: Joby is a pioneer in the eVTOL space, with a longer track record in development compared to some competitors. Their focus on achieving key milestones like FAA certification and production ramp-up could position them for early market entry and leadership.

- Potential for High Margins: If Joby successfully establishes itself in the market, eVTOL air taxi services could offer high margins due to the premium nature of the service.

Bear Case:

- Technological Uncertainties: eVTOL technology is still evolving, and unforeseen technical challenges could arise during development or commercial operations. Delays or setbacks in battery range, noise reduction, or autonomous flight systems could impact Joby’s timeline and cost projections.

- Regulatory Hurdles: Obtaining FAA certification for commercial eVTOL operations is a complex and lengthy process. Regulatory delays or unexpected changes in regulations could hinder Joby’s launch plans and impact their bottom line.

- Public Acceptance: Public perception of eVTOL safety and noise levels is a major unknown. If widespread concerns arise, it could dampen demand for air taxi services and slow market adoption.