Executive Summary:

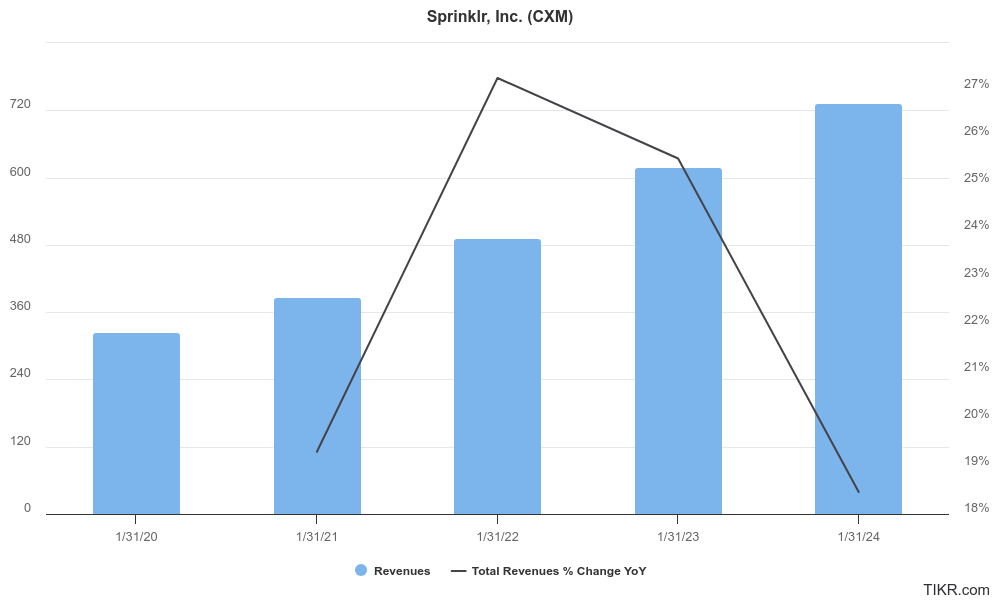

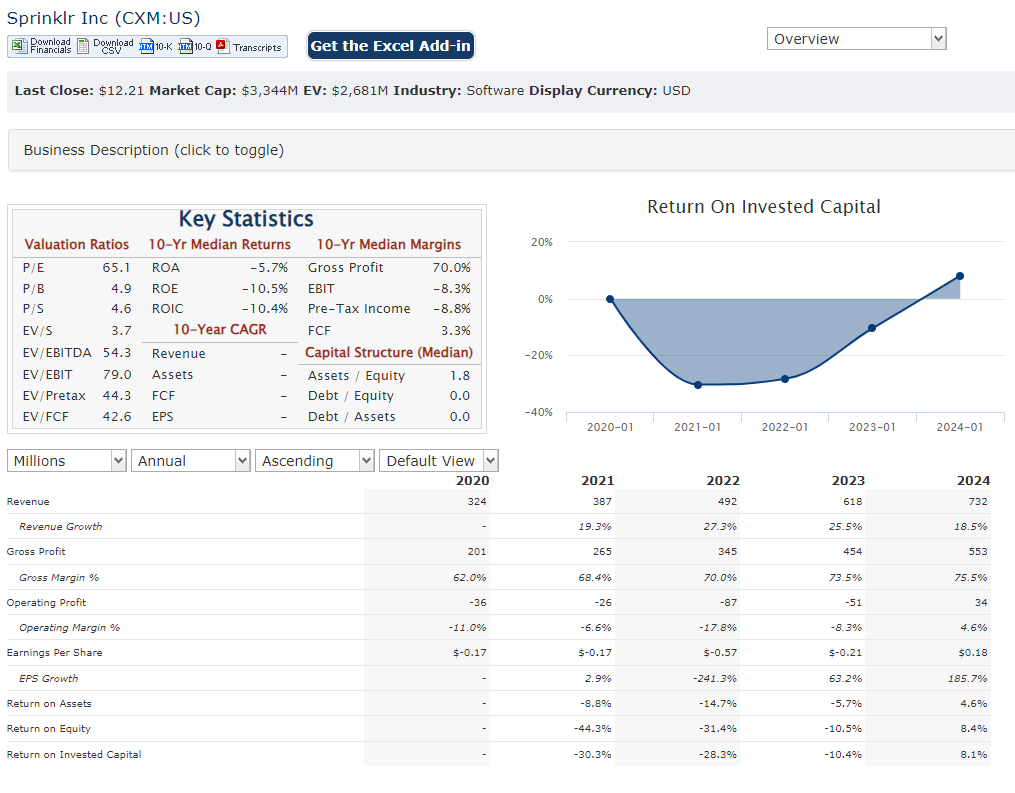

Sprinklr is a New York-based software company that offers a cloud-based platform (SaaS) designed to help businesses manage their customer experience. Their platform combines tools for social media marketing, advertising, content management, and customer service. Founded in 2009, the company went public in 2021 and is used by many large brands. The total revenue of $732.4 million, which is an 18% increase year-over-year.

Stock Overview:

| Ticker | $CXM | Price | $12.21 | Market Cap | $3.34B |

| 52 Week High | $17.14 | 52 Week Low | $10.93 | Shares outstanding | 151.61M |

Company background:

Sprinklr was founded by Ragy Thomas, Sprinklr started by focusing on social media marketing but has grown into a comprehensive platform.

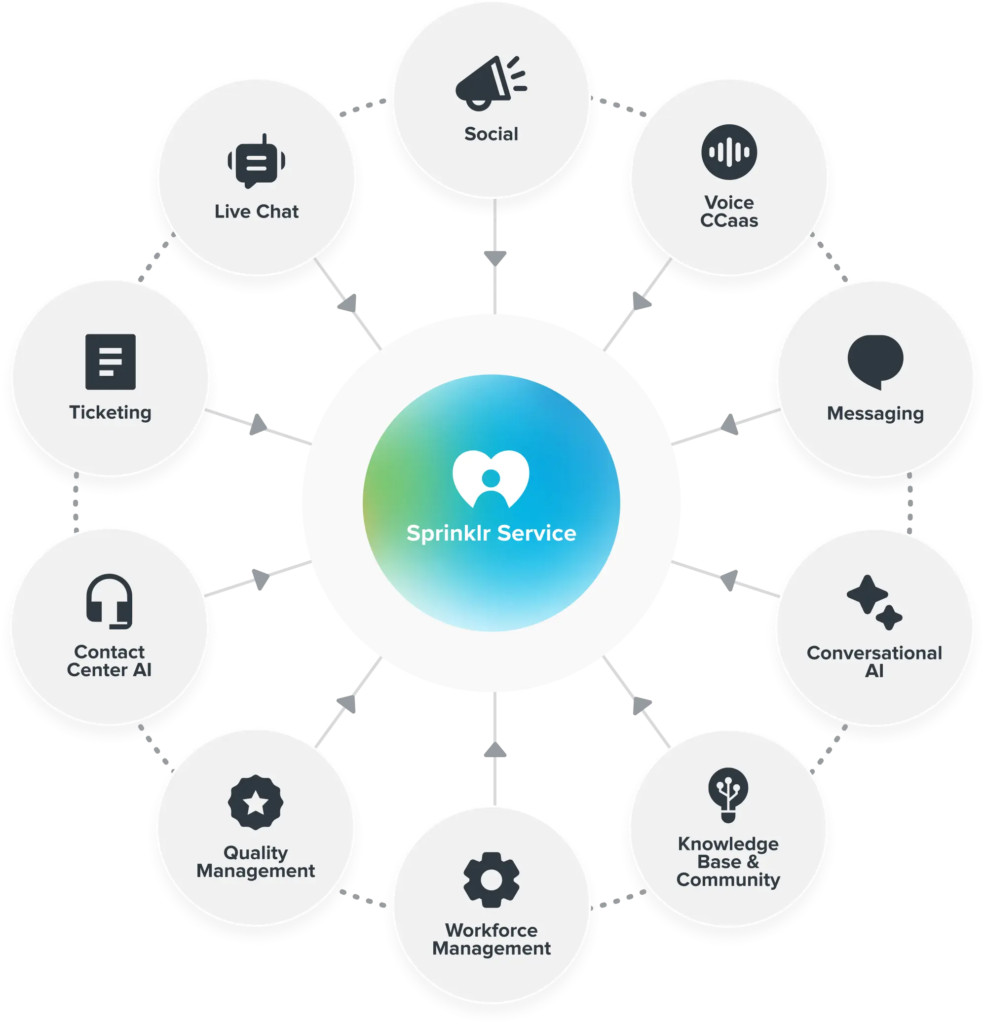

Sprinklr’s allows businesses to manage all their customer interactions across various digital channels in one place. Sprinklr competes with several established software companies. Some of their main competitors include Qualtrics, Salesforce, Adobe, Oracle, and Hootsuite.

Recent Earnings:

Revenue for the full year 2023 reached $732.4 million, reflecting an 18% increase year-over-year. This indicates healthy growth in their core business of providing customer experience management software. EPS of $0.13 for Q1 2024. This suggests significant growth compared to previous quarters.

The Market, Industry, and Competitors:

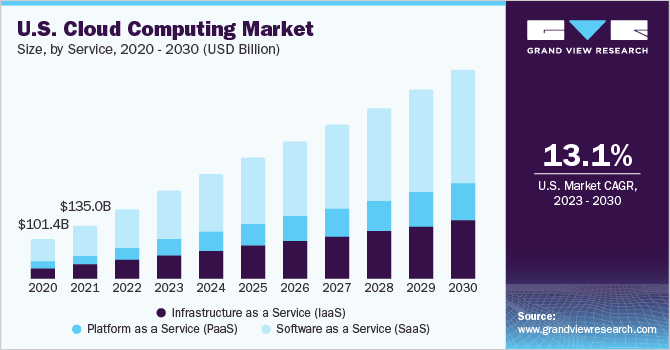

Sprinklr the comapany has some of the factors like rising social media usage, the proliferation of e-commerce, and the growing adoption of cloud-based solutions are fueling this market’s expansion. Analysts predict the CXM software market to reach a compound annual growth rate (CAGR) of over 14% by 2030.

Sprinklr is well-positioned to benefit from this market growth. Their comprehensive CXM platform caters to the evolving needs of businesses and their customers. By continually innovating and expanding their product offerings, Sprinklr can solidify its position as a leader in this high-growth market. It’s important to note that this is a competitive space with established players. Sprinklr’s success will depend on their ability to outpace competitors in features, functionality, and ease of use.

Unique differentiation:

Sprinklr faces competition from a variety of companies offering customer experience management (CXM) solutions:

- Established giants: Salesforce, Adobe, and Oracle all offer comprehensive CXM suites that include functionalities like social media management, marketing automation, and customer service. These companies have a strong brand presence and vast resources for ongoing development.

- Social media specialists: Qualtrics, Hootsuite, Sprout Social, and Buffer are strong contenders in social media management. They offer user-friendly interfaces and features specifically designed for social media scheduling, content creation, and engagement. While Sprinklr offers a broader range of CXM tools, it might need to stay competitive on core social media functionalities to retain its user base in this area.

- Emerging players: Konnect Insights, Meltwater, and Brandwatch are innovative companies that focus on specific aspects of CXM like social listening and media monitoring. They can pose a threat by offering specialized solutions at competitive prices. Sprinklr needs to continuously enhance its platform’s capabilities in these areas to stay ahead of the curve.

- Unified Customer Experience Platform: Unlike some competitors that offer siloed solutions for social media management, marketing automation, or customer service, Sprinklr provides a unified platform. This allows businesses to manage all their customer interactions across various digital channels in one place.

- AI-powered Social Listening & Brand Reputation Management: Sprinklr goes beyond basic social media management by incorporating robust social listening and brand reputation management capabilities powered by Artificial Intelligence (AI). This allows businesses to gain deeper insights into customer sentiment, identify brand mentions across the web, and proactively address potential issues.

Management & Employees:

- Ragy Thomas (Founder & CEO): The driving force behind Sprinklr, Ragy Thomas holds the CEO and Chairman positions. He brings extensive experience in the marketing technology industry and is responsible for the company’s overall vision and strategy.

- Manish Sarin (Chief Financial Officer): Manish oversees Sprinklr’s financial operations, bringing over 20 years of experience in scaling high-growth tech companies. His expertise is crucial for the company’s financial health and future planning.

- Amitabh Misra (Chief Technology Officer): Leading the team that crafts Sprinklr’s innovative technology, Amitabh holds the CTO position. His technical expertise is essential for developing and maintaining the company’s robust CXM platform.

Financials:

- Revenue Growth: Sprinklr upward trend suggests a healthy market demand for their CXM platform.

- Earnings Growth: While revenue growth is a positive sign, profitability is also crucial for long-term sustainability. Sprinklr hasn’t always been profitable. EPS growth not yet available

- Balance Sheet: Sprinklr’s balance sheet provides insights into their financial health, including assets, liabilities, and shareholder equity.

Technical Analysis: The weekly and daily chart show a bearish bear flag, which indicates a move down to $10s, is likely but the stock is bouncing off the $11.85 mark, so we would expect the shares to move lower to the $11.04 to $11.4 mark.

Bull Case:

- Market Growth Tailwinds: The CXM software market is booming, driven by factors like the increasing importance of customer experience, rising social media usage, and e-commerce growth. Analysts predict a CAGR exceeding 14% by 2030, creating a massive opportunity for Sprinklr.

- Growth Through Innovation: Continued innovation is crucial for Sprinklr to stay ahead in this competitive space. They’ll need to enhance their platform’s capabilities in social listening, AI features, and potentially expand into new areas of CXM to solidify their market position.

- Potential Acquisitions: The CXM landscape is constantly evolving, and Sprinklr might consider strategic acquisitions of smaller players with complementary technology or expertise.

Bear Case:

- Pressure on Margins: While Sprinklr is experiencing revenue growth, their path to consistent profitability remains uncertain. Intense competition can lead to price wars, potentially squeezing their margins and making it difficult to achieve sustained profitability.

- Keeping Pace with Innovation: The technology landscape is constantly evolving. Sprinklr must invest heavily in research and development to stay ahead of the curve with cutting-edge features and functionalities in AI, social listening, and other areas.

- Valuation Concerns: Sprinklr’s recent stock price drop suggests potential investor concerns about their valuation. While the CXM market holds promise, the company needs to demonstrate a clear path to profitability to justify its current valuation.