Executive Summary:

Sprout Social Inc. is a leading social media management software company founded in 2010 and headquartered in Chicago. Their platform offers businesses a centralized location to manage all their social media accounts, schedule posts, track conversations, analyze data, and monitor brand mentions. The firm also offers solutions for enterprises, agencies, small businesses, customer service, social media marketing, and employee advocacy sectors.

Sprout Social Q4 total revenue between $97.2 million and $97.3 million, represented 29% growth year-over-year.

Stock Overview:

| Ticker | $SPT | Price | $56.01 | Market Cap | $3.15B |

| 52 Week High | $68.41 | 52 Week Low | $37.00 | Shares outstanding | 49.41M |

Company background:

Sprout Social Inc. offers a cloud-based platform that allows businesses to manage all their social media accounts in one place. This includes scheduling posts, tracking conversations, analyzing data, and monitoring brand mentions. Their user-friendly interface and powerful features, including advanced AI and machine learning for social listening and analytics, have made them a popular choice for businesses of all sizes.

Sprout Social has received funding from a number of investors, including Goldman Sachs, Benchmark Capital, and Lead Edge Capital. The company’s total funding is reported to be over $100 million. Sprout Social’s main competitors include Spinklr, Hootsuite, Buffer, and Sendible.

Recent Earnings:

The company reported Q4 revenue of $93.6 million, reflecting a significant 34% year-over-year growth compared to the fourth quarter of 2022. This positive trend indicates strong performance in attracting new customers and potentially increasing existing customer spending.

Sprout Social reported a GAAP net loss of $20.1 million, compared to a loss of $11.9 million in the same quarter of the previous year. This might raise concerns about the company’s short-term profitability.

Sprout Social managed to achieve a non-GAAP net income of $1.0 million, exceeding the $1.8 million reported in Q4 2022. Translating to a non-GAAP earnings per share (EPS) between $0.00 and $0.01.

The Market, Industry, and Competitors:

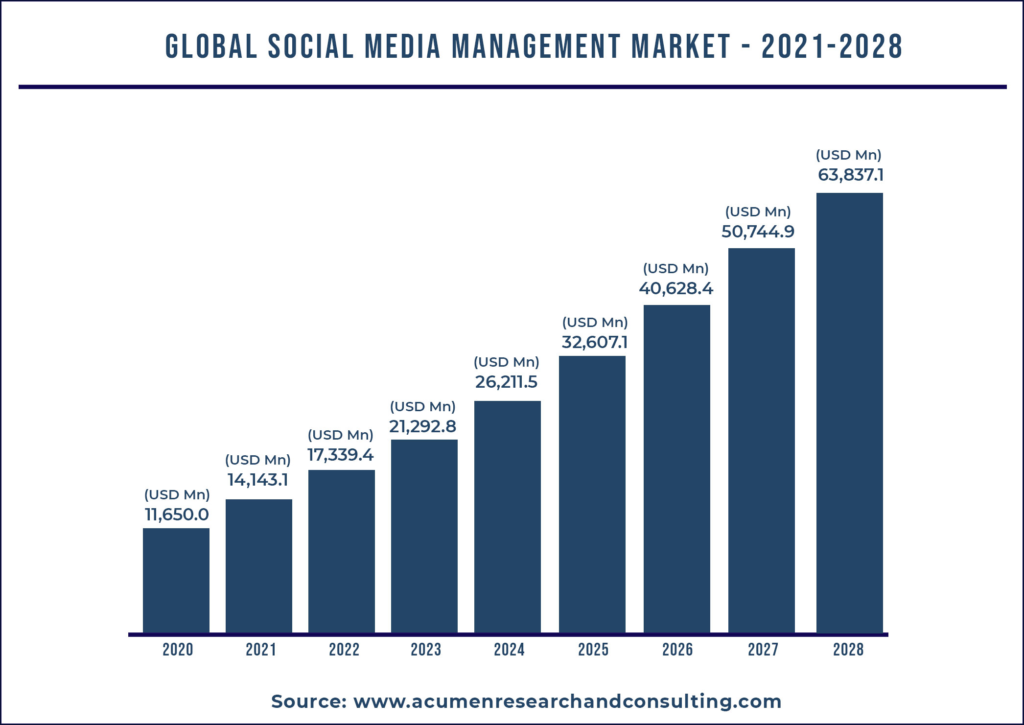

Sprout Social operates is a rapidly growing field fueled by the ever-increasing importance of social media for businesses. The rise of e-commerce and the constant need for customer engagement make effective social media management crucial. This market is expected to continue its strong trajectory, with projections suggesting a Compound Annual Growth Rate (CAGR) in the double digits until 2030. Factors like the increasing adoption of social commerce and the growing need for data-driven social media strategies will contribute to this expansion.

Sprout Social is well-positioned to benefit from this market growth. Their focus on enterprise-level features caters to the evolving needs of businesses, while their recent acquisition of Tagger for influencer marketing opens doors to a lucrative new market segment. By continuing to innovate and expand their platform, Sprout Social has the potential to capture a significant share of the growing social media management software market by 2030.

Unique differentiation:

Sprout Social faces competition from a range of social media management software companies, each catering to slightly different needs:

- Established giants: Hootsuite and Buffer are major competitors, offering similar core functionalities like scheduling posts and social listening. Hootsuite boasts a larger user base and a focus on affordability, while Buffer excels in user-friendliness and caters well to smaller businesses and individuals.

- Enterprise-focused contenders: Companies like Sendible and Khoros compete directly with Sprout Social in the enterprise space. They offer advanced features like social media compliance management and robust analytics, making them strong choices for large organizations with complex social media needs.

- Emerging specialists: Newer platforms like Loomly and Agora Pulse are carving a niche by focusing on specific aspects of social media management. Loomly excels in visual content creation and scheduling, while Agora Pulse prioritizes social media inbox management and customer service through social channels.

- Strong Customer Support: Sprout Social is known for its exceptional customer support, offering dedicated account managers and comprehensive resources to ensure clients get the most out of the platform. This focus on user success sets them apart from competitors who might offer a wider user base but less personalized support.

- Unified Platform with AI Integration: Unlike some competitors who offer separate tools for scheduling and analytics, Sprout Social provides a unified platform encompassing all aspects of social media management. This streamlined approach is further enhanced by their integration of AI for tasks like social listening and content optimization, offering valuable data-driven insights.

- Recent Acquisition for Growth: Sprout Social’s acquisition of Tagger, a leading influencer marketing platform, demonstrates their proactive approach to growth. This move allows them to tap into a lucrative market segment and offer a more comprehensive solution to their clients, potentially setting them apart from competitors focused solely on core social media management.

Management & Employees:

- Justyn Howard (CEO, Co-Founder, Chairman): A Sprout Social co-founder, Howard has been the driving force behind the company’s vision and strategy since its inception.

- Gil Lara (Chief Creative Officer, Co-Founder): Lara brings his design expertise to the table, shaping the user experience and overall brand identity of Sprout Social.

- Aaron Rankin (Former CTO, Co-Founder): Although Rankin stepped down as CTO in December 2023, he remains a co-founder and board member, contributing his technical knowledge and strategic vision.

Financials:

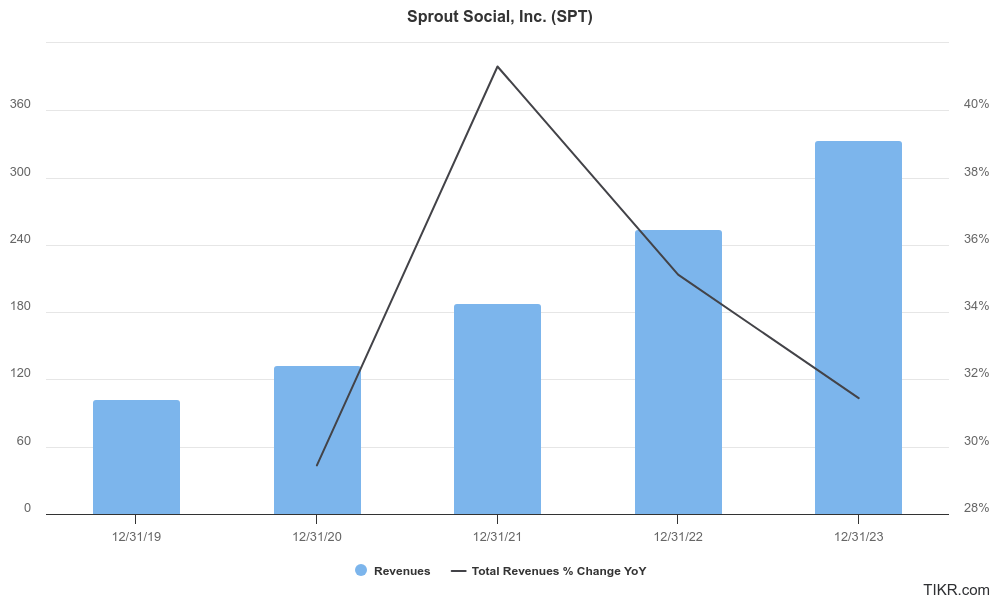

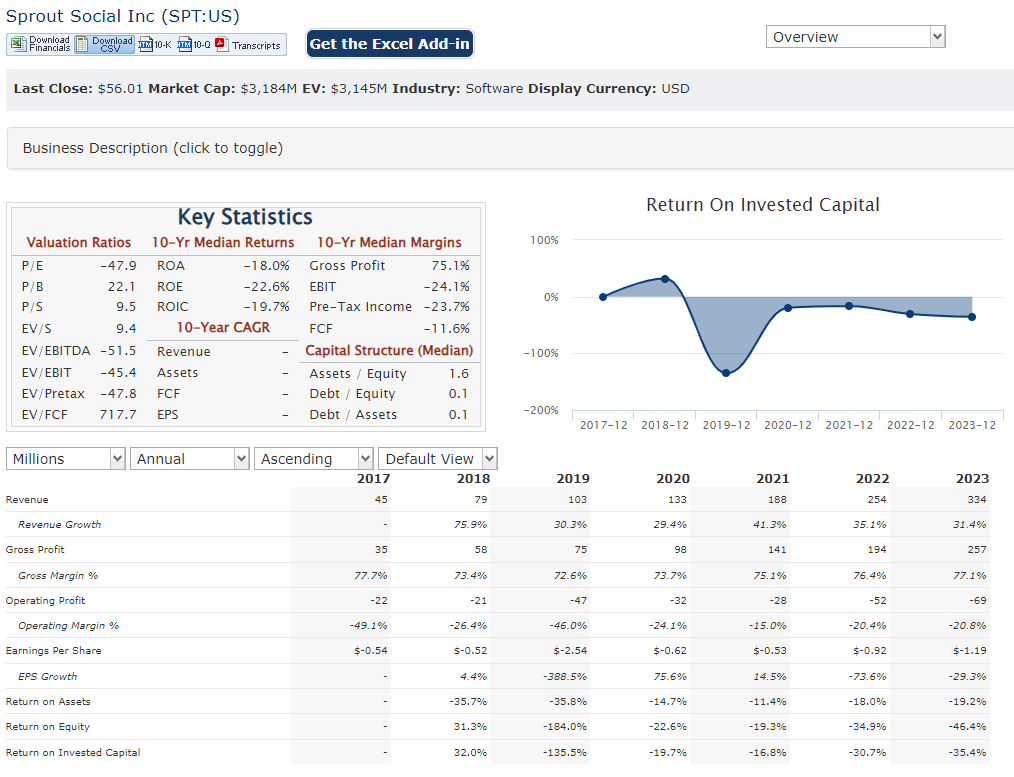

Revenue has consistently climbed year-over-year, with a Compound Annual Growth Rate (CAGR) estimated to be in the double digits. This upward trend reflects the increasing demand for effective social media management solutions across various industries.

The company’s earnings performance has been less consistent. While some years saw positive net income, others resulted in net losses. This might be due to factors like increased investments in product development, marketing initiatives, and potential acquisitions.

While profitability might be a short-term concern, the company’s revenue growth and progress towards adjusted profitability indicate a promising future.

Technical Analysis:

$SPT is range bound on the monthly and weekly chart, indicating a stage 1 /3 (consolidation) phase. On the daily chart, the consolidation lead to a breakdown (bearish) and is still finding its bottom, which could be in the $53 to $55 zone. Since the RSI and MACD are negative, we expect shares to move down lower to the 200 Day Moving Average close to $53.

Bull Case:

- Strong Market Tailwinds: The social media management software market is booming, driven by the ever-increasing importance of social media for businesses. This rising tide lifts all boats, and Sprout Social is well-positioned to capture a significant share of this growing market.

- Non-GAAP Earnings Growth: Though GAAP net income might fluctuate, Sprout Social has shown progress towards profitability on an adjusted basis, with non-GAAP earnings exhibiting a positive CAGR over the past five years. This trend suggests potential for future sustained profitability.

Bear Case:

- Profitability Concerns: While revenue is growing, Sprout Social has yet to achieve consistent profitability based on GAAP net income. This might raise concerns about the company’s ability to generate sustainable long-term profits.

- Market Saturation: The social media management software market might become saturated as more players enter the space. This could lead to increased price competition and pressure on Sprout Social’s margins.

- Reliance on Acquisitions: While the Tagger acquisition might be positive, Sprout Social’s future growth strategy relying heavily on acquisitions could be risky. Integration challenges and potential overpayment for targets could negatively impact the company’s finances.