Executive Summary:

Sportradar Group is a leading sports technology company that sits at the junction of sports, media, and betting. Founded in 2001 and headquartered in Switzerland, the company uses its expertise in data collection and analysis to provide B2B solutions to the sports betting industry. They also offer services to sports federations and media companies. Sportradar boasts partnerships with major organizations like NBA, MLB, NASCAR, and FIFA.

Revenue reached €252.6 million, a 22% increase year-over-year, exceeding analyst expectations by 1.73%. The total profit from continuing operations for the quarter was €23.2 million, a significant improvement compared to the loss of €33.3 million.

Stock Overview:

| Ticker | $SRAD | Price | $11.27 | Market Cap | $3.35B |

| 52 Week High | $15.56 | 52 Week Low | $8.08 | Shares outstanding | 206.62M |

Company background:

Sportradar Group, was launched by Carsten Koerl and Roger Haller in Vienna, Austria, the company has grown organically by reinvesting its profits.

Sportradar Group with a global presence, Sportradar sits at the intersection of sports, media, and betting. They offer real-time sports data, streaming services, and integrity services to ensure fair play for betting operators and sports federations alike. Sportradar also provides sports fan engagement solutions and even sports betting content and marketing services.

Sportradar boasts an impressive list of partners, including major sports leagues and federations around the world. Facing competition from companies like Genius Sports, Stats Perform, and Deltatre, Sportradar continues to be a leader in the sports data and technology realm.

Recent Earnings:

Revenue and Growth: Revenue for the fourth quarter reached €252.6 million, the full-year revenue hit €877.6 million, up from €730.19 million in 2022, marking a 20% growth.

Forward Guidance: Sportradar provided they are targeting at least 20% growth in both revenue and Adjusted EBITDA for 2024. They authorized a $200 million share repurchase program, demonstrating their commitment to shareholder value.

The Market, Industry, and Competitors:

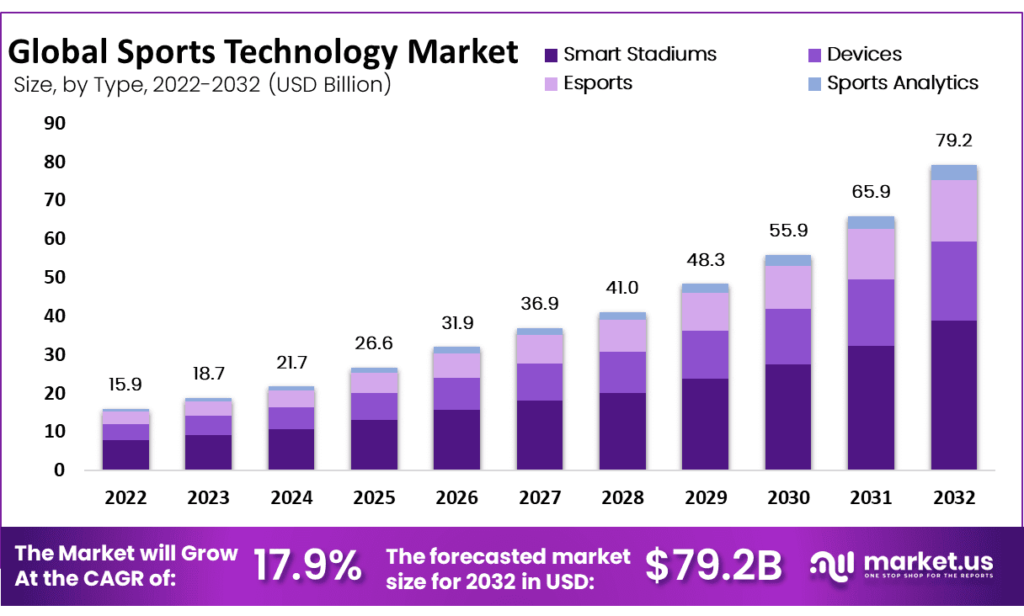

Sportradar Group is a key player in the sports data and technology market, which is expected to experience significant growth in the coming years. Analysts predict a Compound Annual Growth Rate (CAGR) of around 15% for the market by 2030. This growth is fueled by several factors, including the increasing popularity of sports betting, the growing demand for data-driven insights in sports, and the rise of new technologies like artificial intelligence and machine learning.

The company has reported consistent revenue growth, exceeding analyst expectations most recently. With a CAGR of 15%, the market size is estimated to reach over $26 billion by 2030.

Unique differentiation:

- Genius Sports and Stats Perform: These companies, like Sportradar, provide sports data and analytics solutions, catering to similar clientele including sportsbooks, media companies, and sports federations. They compete directly with Sportradar in areas like data collection, analysis, and streaming services.

- Deltatre: While Deltatre doesn’t directly compete in the data collection and analysis realm, they target the same customer base in the sports world. Deltatre specializes in sports and entertainment technology, offering solutions like fan engagement platforms and content streaming. As the sports data and technology market evolves, there could be more overlap between the services offered by Sportradar and Deltatre.

- Focus on Integrity: Sportradar prioritizes maintaining the integrity of sports through its integrity services. This includes fraud detection and prevention, which is crucial for sports betting operators and federations alike.

- Comprehensiveness: While competitors may specialize in specific areas like data analysis or fan engagement, Sportradar offers a more comprehensive suite of solutions. This includes real-time sports data, streaming services, integrity services, fan engagement solutions, and even sports betting content and marketing services.

Management & Employees:

- Executive Chairman: Sportradar is currently chaired by Tony Aquila, who brings extensive experience in the technology and financial sectors.

- CEO: The company’s CEO is Carsten Koerl, one of the founders and a key figure in Sportradar’s growth trajectory.

- Chief Legal Officer & Secretary: Lynn McCreary oversees legal matters and corporate governance, ensuring Sportradar adheres to regulations and best practices.

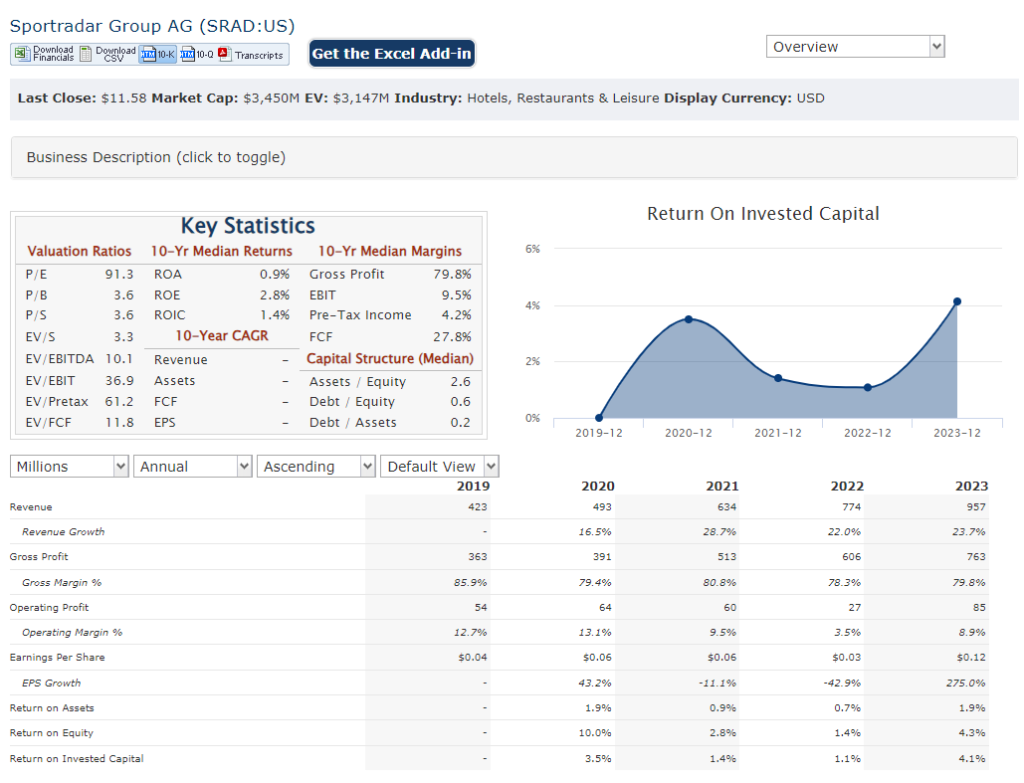

Financials:

Revenue Growth: Sportradar have reported a strong year with revenue reaching €877.6 million, a significant increase compared to 2019. Calculating a precise CAGR (Compound Annual Growth Rate) requires all five years’ data, but estimates suggest a CAGR in the range of 10-15%.

Earnings Growth: They reported a total profit from continuing operations of €34.6 million for the full year 2023, a substantial improvement compared to prior years. This suggests an upward trajectory for earnings as well.

Balance Sheet: Cash and cash equivalents grew to €277.2 million by the end of 2023, indicating a healthy financial position. Additionally, their total liquidity available for use surpassed €497 million at the end of the year

Technical Analysis: On the monthly chart, the stock is still forming a stage 3 consolidation after a strong stage 2 markup. On the daily chart, the formation if a bull pennant is visible but still early. The stock is likely to consolidate in the $11 zone (lower) before it heads higher. There is good support at the $10.77 range and resistance at the $11.99 range.

Bull Case:

- Market Growth Tailwinds: The sports data and technology market is anticipated to experience significant growth in the coming years, fueled by factors like rising sports betting popularity, demand for data-driven sports insights, and new technologies like AI and machine learning. Sportradar is well-positioned to capitalize on this expanding market with its established solutions.

- Strong Revenue Growth Trajectory: Sportradar has a history of consistent revenue growth, exceeding analyst expectations most recently. This trend suggests a healthy customer base and effective business strategy.

- Positive Forward Guidance: Management’s target of at least 20% growth in both revenue and Adjusted EBITDA for 2024 reflects their confidence in the company’s future.

Bear Case:

- Regulation and Legal Hurdles: The sports betting industry is subject to evolving regulations across different regions. Changes in regulations or legal restrictions could limit Sportradar’s ability to operate in certain markets or restrict their services, impacting their growth potential.

- Reliance on Partnerships: Sportradar’s success hinges on maintaining strong partnerships with sports leagues and federations. These partnerships could be renegotiated or terminated, potentially disrupting their data access and impacting their business model.

- Dependence on Acquisitions: Sportradar has grown partly through acquisitions. Future acquisitions might not be as successful, leading to integration challenges or unexpected costs.