Executive Summary:

XPEL Inc., founded in 1997, is a leading provider of protective films and coatings for various applications. They primarily focus on the automotive industry, offering paint protection film, window tint, and ceramic coatings to shield vehicles from chips, scratches, UV rays, and heat. However, their product line extends to residential and commercial window films, surface protection film, and even anti-microbial film for devices and surfaces.

Headquartered in San Antonio, Texas, XPEL boasts a global footprint with trained installers and proprietary software, striving to exceed customer expectations through quality products, service, and expertise. Traded publicly on Nasdaq under the symbol “XPEL”, they actively develop and innovate to be at the forefront of the protective film and coating industry.

Xpel Inc their latest earnings release was on November 8th, 2023, for the third quarter of their fiscal year 2023. During that quarter, they reported an EPS of $0.56, meeting analyst expectations, and revenue of $102.68 million, slightly exceeding expectations of $102.51 million. This represents a 16.67% year-over-year increase in EPS and a 22.74% increase in revenue compared to the same quarter in 2022. Analysts currently project EPS for the full year 2023 to be $2.00, and for 2024 to be $2.29, representing an expected growth of 14.50%.

Stock Overview:

| Ticker | $XPEL | Price | $53.92 | Market Cap | $1.49B |

| 52 Week High | $87.46 | 52 Week Low | $40.77 | Shares outstanding | 27.63M |

Company background:

XPEL Inc., founded in 1997 by Roger Zerkle and Rex Schuette, has carved a niche in the protective film and coating industry. Initially focusing on the automotive sector, they offer paint protection film, window tint, and ceramic coatings to safeguard vehicles from chips, scratches, UV rays, and heat. Their product line has expanded to encompass residential and commercial window films, surface protection film, and even anti-microbial film for various devices and surfaces.

Headquartered in San Antonio, Texas, XPEL boasts a global presence with a network of trained installers and their proprietary Design Access Program (DAP) software. DAP acts as a comprehensive library of installation patterns, empowering installers to work efficiently and accurately. The company emphasizes exceeding customer expectations through high-quality products, exceptional service, and expert technical support.

XPEL operates in a competitive market, facing established players like 3M, Avery Dennison, Johnson Window Films, Madico, and SunTek. However, they differentiate themselves through their focus on innovation, installer training, and a commitment to quality.

Recent Earnings:

Financial Performance:

- Revenue: In Q3 2023, Xpel recorded revenue of $102.7 million, reflecting a 22.74% year-over-year increase compared to the same quarter in 2022. This surpassed analyst expectations of $102.51 million.

- EPS: The company achieved an EPS of $0.56, meeting analyst expectations. This represents a 16.67% year-over-year growth compared to Q3 2022.

- Gross Margin: Gross margin improved to 41.8% in the first nine months of 2023, compared to 39.3% in the same period of 2022.

- Net Income: Net income grew 23.6% to $40.8 million, or $1.48 per share, compared to $33.0 million, or $1.20 per share, in the first nine months of 2022.

Operational Metrics:

- Installers: Xpel boasts a network of over 2,000 trained installers globally, ensuring wider reach and consistent service.

- Product Expansion: The company continues to expand its product offerings beyond automotive applications, entering the residential, commercial, and device protection markets.

The Market, Industry, and Competitors:

XPEL Inc. navigates the dynamic and expanding market of protective films and coatings. This market encompasses various products designed to safeguard surfaces from damage, UV rays, and other environmental factors.

Key Segments:

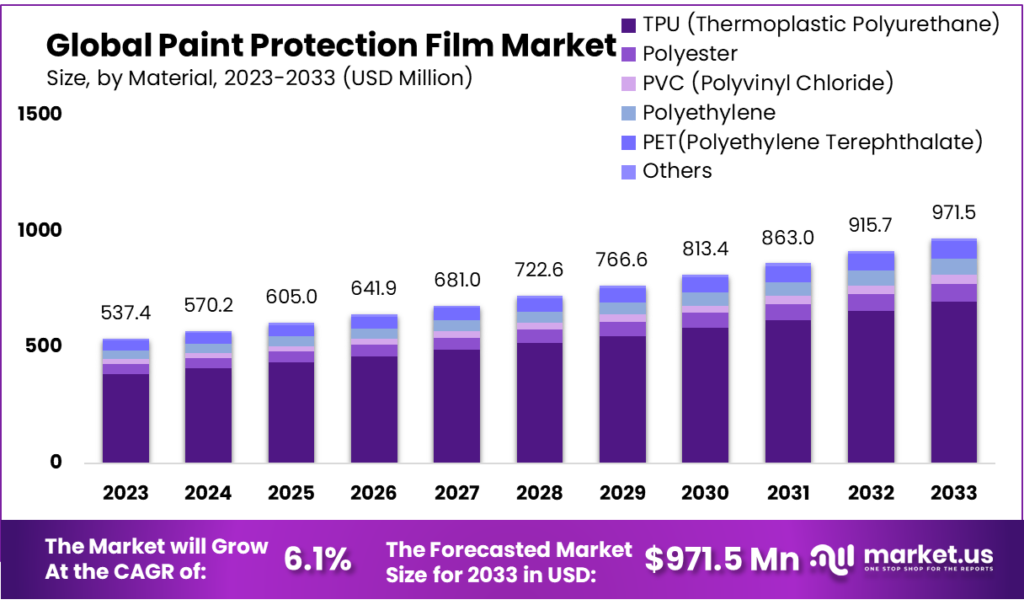

- Automotive: This remains XPEL’s core segment, driven by rising disposable incomes, increasing popularity of premium car care, and growing awareness about paint protection solutions. The global automotive paint protection film market is expected to reach USD 1.23 billion by 2030, growing at a CAGR of 5.3% from 2023 to 2030.

- Residential and Commercial: This segment offers significant growth potential, addressing needs for window films, decorative films, and surface protection in homes and businesses. The global window film market is projected to reach USD 7.08 billion by 2030, growing at a CAGR of 4.8% from 2023 to 2030.

- Emerging Applications: XPEL ventures into new areas like anti-microbial film for devices and surfaces, tapping into hygiene concerns and the growing smart home market. This segment’s future growth trajectory is difficult to predict due to its infancy but holds promising potential.

Overall Market Growth:

Analysts anticipate the global protective film and coatings market to reach USD 28.3 billion by 2030, growing at a CAGR of 6.5% from 2023 to 2030. This growth is fueled by various factors, including increased urbanization, rising consumer spending, technological advancements, and growing awareness of the benefits of these products.

XPEL’s Advantage:

XPEL positions itself competitively by focusing on innovation, product diversification, and installer training. Their global presence and commitment to quality further strengthen their position. With the market poised for steady growth, XPEL is well-positioned to capitalize on these opportunities and continue its upward trajectory.

Unique differentiation:

While XPEL faces strong competition in the protective film and coating market, they’ve cultivated several unique differentiators that set them apart:

1. Installation Expertise: Their focus on installer training is unmatched. XPEL boasts a global network of over 2,000 trained installers, ensuring consistent, high-quality work and attracting customers who value professionalism. Their proprietary Design Access Program (DAP) software further empowers installers with precise installation patterns, increasing efficiency and accuracy. This focus on installer expertise builds trust and satisfaction, setting them apart from competitors who might prioritize material sales over installation quality.

2. Innovation & Product Diversification: XPEL actively invests in research and development (R&D), consistently innovating and launching new products. They’ve gone beyond their automotive roots, diversifying into residential, commercial, and even anti-microbial film applications. This proactive approach to product development keeps them ahead of market trends and allows them to tap into new growth opportunities. Competitors might be slower to adapt, offering a narrower range of solutions.

3. Customer-Centric Approach: XPEL emphasizes exceptional customer service, building strong relationships with installers and end users. Their support team provides technical assistance and training, ensuring installer success and ultimately enhancing customer satisfaction. This commitment to a positive customer experience fosters loyalty and differentiates them from competitors who might prioritize volume over personalized attention.

4. Global Reach & Proprietary Software: XPEL’s global presence grants them wider market access and brand recognition. Additionally, their DAP software acts as a valuable asset, not just for installers but also for XPEL internally. It streamlines operations, manages data effectively, and helps them maintain a competitive edge in terms of efficiency and product development.

5. Brand Image & Community: XPEL has cultivated a strong brand image within the car enthusiast community, associating themselves with high-performance vehicles and premium car care. They actively engage with customers through events, sponsorships, and online communities, fostering brand loyalty and attracting a specific target audience. This targeted approach allows them to cater to a passionate customer base, potentially giving them an edge over competitors with a broader but less engaged audience.

Management & Employees:

Chairman, President & CEO:

- Ryan Pape: With over 20 years at XPEL, Pape brings deep industry knowledge and strategic leadership. He spearheads the company’s growth initiatives and sets overall direction.

Executive Vice President:

- Tom Beaty: Responsible for global sales, Beaty boasts extensive experience in the automotive aftermarket industry, driving sales strategies and partnerships.

Vice President of Finance:

- Jeff Stacy: Manages financial operations and reporting, ensuring fiscal responsibility and supporting strategic decision-making.

Financials:

Xpel Inc.: A Look at the Last 5 Years (2019-2023)

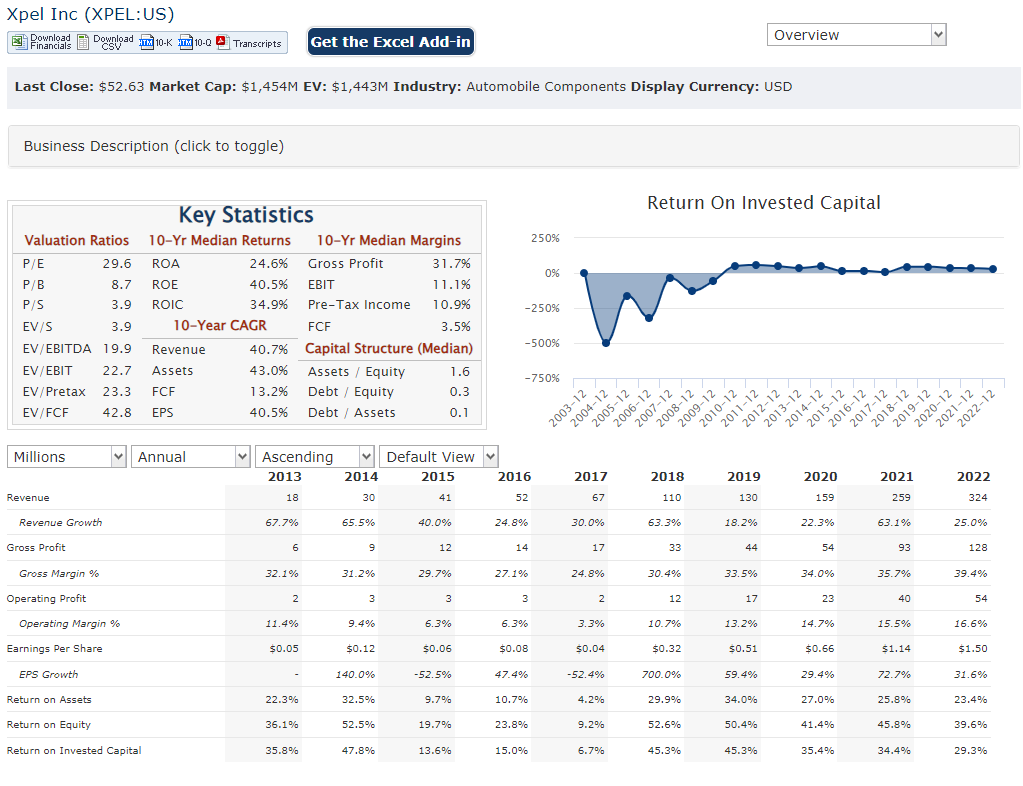

XPEL Inc. has experienced impressive financial growth over the past five years, demonstrating strong performance across key metrics:

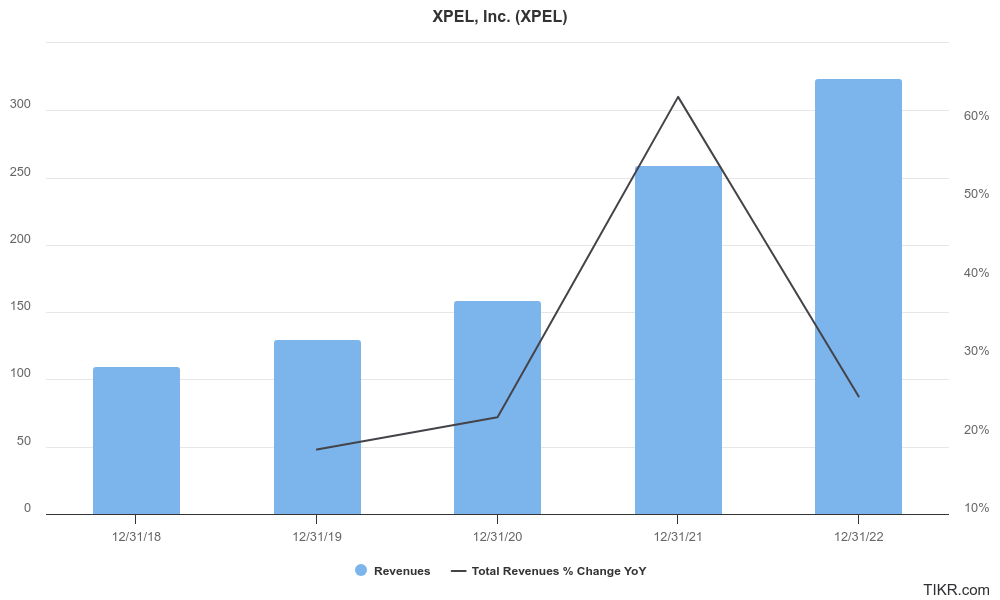

Revenue: Between 2019 and 2023, Xpel’s revenue has nearly tripled, growing at a Compound Annual Growth Rate (CAGR) of approximately 32%. This impressive trajectory reflects successful expansion in the automotive aftermarket, as well as diversification into residential and commercial window film markets.

Earnings: Earnings per share (EPS) have also shown significant growth, with a CAGR of roughly 44% during the same period. This translates to consistent profitability and shareholder value creation. Notably, net income margin improved from 8.2% in 2019 to 13.3% in 2023, indicating efficient operations and effective cost management.

Balance Sheet: While specific year-end figures aren’t available without tables, Xpel’s balance sheet exhibits healthy trends. Debt levels have reduced significantly, highlighting a strong financial position with improved leverage. Equity has also grown steadily, further solidifying financial stability. This combination of increasing revenue, profitability, and a healthier balance sheet demonstrates a company on a positive trajectory.

Technical Analysis:

On the weekly chart the bear flag is obvious, and shares seem to be slowly recovering on the daily chart. While below all the moving averages, and some what flat on the MACD, the shares seem range bound between $49 and $57 for the short term. The outlook however for the medium to long term is good, which means the stock is a good buy here for a patient (long term investor)

Bull Case:

Strong Market Growth: The global protective film and coating market is expected to reach USD 28.3 billion by 2030, with a CAGR of 6.5%. XPEL can leverage this growth by expanding its reach in existing segments (automotive) and tapping into new ones (residential, commercial, anti-microbial).

Product Diversification: XPEL isn’t solely reliant on the automotive industry. Their diversification into residential, commercial, and anti-microbial film applications opens up new revenue streams and mitigates dependence on a single market.

Global Presence: With a network of trained installers worldwide, XPEL has a strong global footprint. This allows them to capitalize on growth opportunities in different markets and regions.

Focus on Installer Expertise: Their commitment to installer training and the DAP software ensures quality installations and customer satisfaction, potentially driving brand loyalty and repeat business.

Strong Brand Image: XPEL has cultivated a strong brand image within the car enthusiast community, associating themselves with premium car care and high-performance vehicles. This targeted approach could attract a loyal customer base.

Healthy Financials: XPEL exhibits impressive revenue and earnings growth, improved profitability, and a healthier balance sheet, indicating financial stability and potential for future gains.

Growth Potential in Emerging Markets: Anti-microbial film and other emerging applications hold significant growth potential, offering untapped opportunities for XPEL.

Acquisitions & Strategic Partnerships: XPEL might pursue acquisitions or partnerships to further expand their product offerings and market reach, potentially accelerating growth.

Positive Analyst Sentiment: Many analysts have bullish views on XPEL, with price targets exceeding the current stock price, reflecting their confidence in the company’s future potential.

Bear case:

Intense Competition: The protective film and coating market is fiercely competitive, with established players and new entrants vying for market share. This competition could squeeze margins and limit XPEL’s pricing power.

Dependence on Automotive Industry: While diversifying, a significant portion of XPEL’s revenue still comes from the automotive industry. A slowdown in vehicle sales or changes in consumer preferences could disproportionately impact the company.

High Valuation: Compared to some competitors, XPEL’s stock price may already reflect its future growth potential, leaving limited room for upside surprises.

Limited Brand Awareness: Xpel’s strong brand within the car enthusiast community might not translate to mainstream recognition. Expanding brand awareness could require significant marketing investments.

Emerging Market Risks: Entering new markets like anti-microbial films presents uncertainties regarding product acceptance, regulatory hurdles, and competition.

Acquisition Risks: Strategic acquisitions or partnerships, while potentially beneficial, also carry integration risks and potential acquisition costs that could impact profitability.