Executive Summary:

JinkoSolar, headquartered in Shanghai, is a global leader in the solar industry. They manufacture and sell solar modules and related solutions to diverse customers in over 80 countries. Founded in 2006, the company boasts a strong track record, holding the top spot in global module shipments for several years. They’re known for their “vertical integration” strategy, controlling production from silicon wafers to finished modules. JinkoSolar is committed to innovation and sustainability, recently licensing their TOPCon solar cell technology to another major player in the field. With over 200GW of modules shipped and a presence in 190 countries, they’re a key player in driving the transition to renewable energy.

The most recent earnings report for JinkoSolar Holding is for their Third Quarter of 2023, released on October 30, 2023.

In Q3, JinkoSolar reported earnings per share (EPS) of $0.63, exceeding analyst expectations of $0.56 by 12.5%. Notably, this represents a 188.7% increase year-over-year. Their revenue reached $4.36 billion, surpassing analyst expectations of $4.21 billion by 3.6% and demonstrating a 63.1% increase compared to the same period in 2022. This strong performance was driven by increased module shipments, improved gross margins, and cost reductions in polysilicon.

Stock Overview:

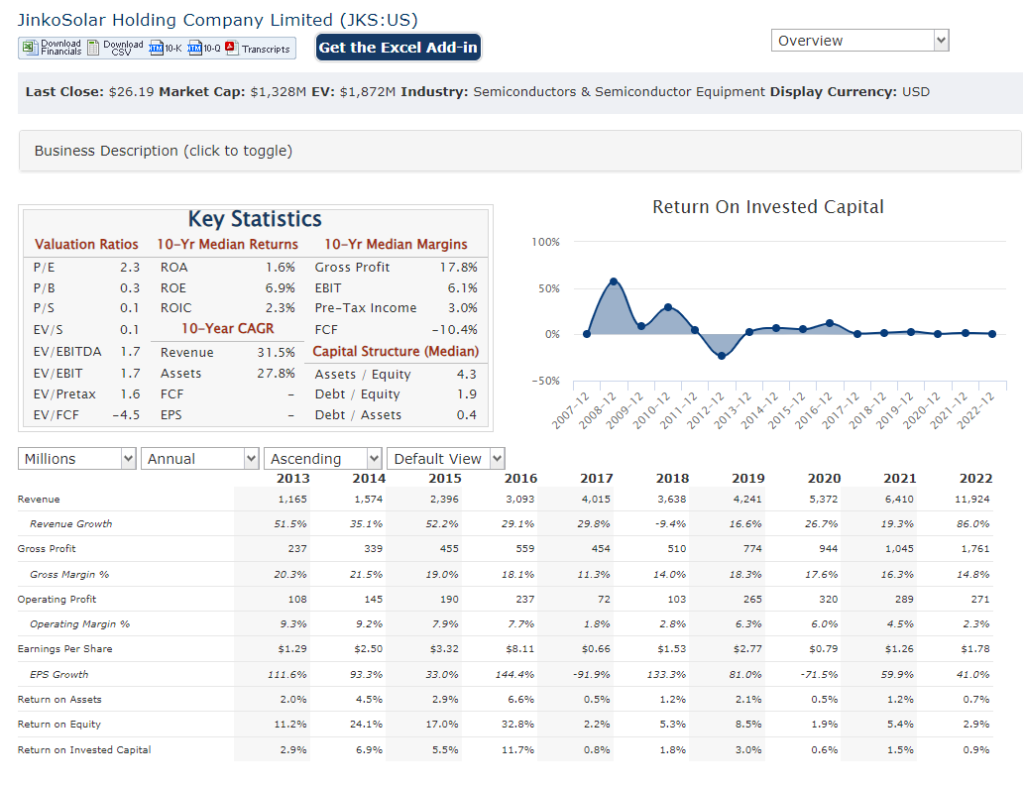

| Ticker | $JKS | Price | $27.38 | Market Cap | $1.35B |

| 52 Week High | $58.96 | 52 Week Low | $23.12 | Shares outstanding | 51.57M |

Company background:

JinkoSolar: A Global Leader in Solar Energy

JinkoSolar, founded in 2006 by Li Hongjun and Kang Yi, is a major player in the solar energy industry. Headquartered in Shanghai, China, the company has grown to become one of the world’s largest and most innovative solar module manufacturers. JinkoSolar operates under a public listing on the New York Stock Exchange (NYSE: $JKS).

Their core business lies in the manufacturing and distribution of a variety of solar products, including silicon wafers, solar cells, and most notably, solar modules. JinkoSolar caters to a diverse clientele, offering solutions for utility-scale, commercial, and residential applications across over 80 countries. They have established a strong international presence with 14 manufacturing facilities spread across China, Southeast Asia, and the United States.

JinkoSolar stands out through its vertically integrated business model, controlling various stages of production from raw materials to finished modules. This approach grants them greater control over quality and costs, contributing to their industry-leading position. Furthermore, they prioritize research and development, recently licensing their advanced TOPCon solar cell technology, showcasing their commitment to innovation.

JinkoSolar faces stiff competition from other major players like Longi Solar, Canadian Solar, First Solar, and Hanwha Q CELLS. Each competitor brings its own strengths and specialties to the table, driving continuous innovation and development across the industry.

Recent Earnings:

JinkoSolar’s Q3 2023 Earnings: Continued Strength and Outperformance

JinkoSolar reported strong and positive financial results for their third quarter of 2023, surpassing analyst expectations and further solidifying their position as a leading solar player.

Revenue and Growth: JinkoSolar achieved revenue of RMB 31.83 billion (US$4.36 billion) in Q3 2023, representing a 3.7% increase sequentially and a significant 63.1% surge year-over-year. This impressive growth was driven by robust demand for their solar modules, particularly their premium high-efficiency N-type products. These N-type modules accounted for over 60% of total shipments, highlighting their increasing popularity and technological advancement.

EPS and Growth: JinkoSolar delivered earnings per share (EPS) of US$0.63, outperforming analyst expectations of US$0.56 by a notable 12.5%. This translates to an impressive 188.7% increase compared to the EPS of US$0.21 in Q3 2022. This significant improvement primarily stems from increased sales volume, improved gross margins, and cost reductions in key materials like polysilicon.

Operational Metrics: Beyond financial figures, JinkoSolar reported other positive operational metrics. Module shipments reached 21.4 GW, representing a significant 107.9% increase year-over-year. This substantial growth underscores their strong production capabilities and growing market share. Furthermore, their gross margin expanded to 19.3%, up from 15.7% in Q2 2023, indicating efficiency improvements and cost management effectiveness.

The Market, Industry, and Competitors:

JinkoSolar operates in the dynamic and rapidly growing global solar energy industry, expected to experience monumental growth in the coming years. Driven by increasing concerns about climate change, government initiatives supporting renewable energy, and decreasing solar panel costs, the market is poised for a significant surge. Experts predict a staggering 1,400% growth by 2030, reaching an installed capacity of 1,865 GW. This translates to a remarkable compound annual growth rate (CAGR) of 14.3% from 2023 to 2030.

Several factors contribute to this optimistic outlook. Firstly, government policies around the world are increasingly favoring renewable energy sources, with many countries setting ambitious targets for solar power adoption. Secondly, the cost of solar panels has been steadily declining, making them a more attractive option for both businesses and individuals. Additionally, technological advancements are leading to more efficient solar panels, further driving market expansion.

Within this booming market, JinkoSolar is well-positioned to capitalize on growth opportunities. Their vertically integrated business model allows them to control costs and ensure quality throughout the production process. They are also at the forefront of technological innovation, with their N-type TOPCon solar cells offering superior performance. Furthermore, their global reach and diverse customer base position them to benefit from growth across different regions.

While the solar market presents exciting prospects, JinkoSolar also faces challenges. Competition is fierce, with other major players vying for market share. Additionally, fluctuations in raw material prices and trade policies can impact profitability. Despite these challenges, JinkoSolar’s strong track record, commitment to innovation, and strategic positioning suggest they are well-equipped to navigate the market and capture its significant growth potential.

Unique differentiation:

Chinese Giants:

- Longi Solar: This major competitor leads the market in monocrystalline silicon technology, known for its high efficiency and performance.

- JA Solar: Another Chinese powerhouse, JA Solar boasts a strong presence in both domestic and international markets, offering a diverse range of solar products.

- Canadian Solar: Though originating in Canada, this company operates globally with a vertically integrated model similar to JinkoSolar’s. They excel in high-quality modules and system solutions.

Global Players:

- First Solar: This American company stands out with its thin-film solar panels, a unique technology suited for specific applications. They offer competitive pricing and specialize in utility-scale projects.

- Hanwha Q CELLS: This South Korean conglomerate brings a diversified portfolio to the table, including solar panels, energy storage solutions, and other renewable energy technologies. They leverage their strong brand recognition and global reach.

Beyond these key players, numerous regional and technology-specific competitors keep JinkoSolar on its toes. The competitive landscape constantly evolves, pushing for innovation, cost reduction, and efficiency improvements across the industry.

JinkoSolar’s success hinges on its ability to maintain its edge through strategic partnerships, technological advancements, and cost optimization.

While JinkoSolar holds its own against competitors in the solar market, their key differentiation lies in a combination of factors:

1. Vertical Integration: Unlike many competitors who outsource parts of their production, JinkoSolar operates a vertically integrated model, controlling various stages from silicon wafers to finished modules. This approach grants them greater control over quality, costs, and production efficiencies, potentially leading to a competitive edge.

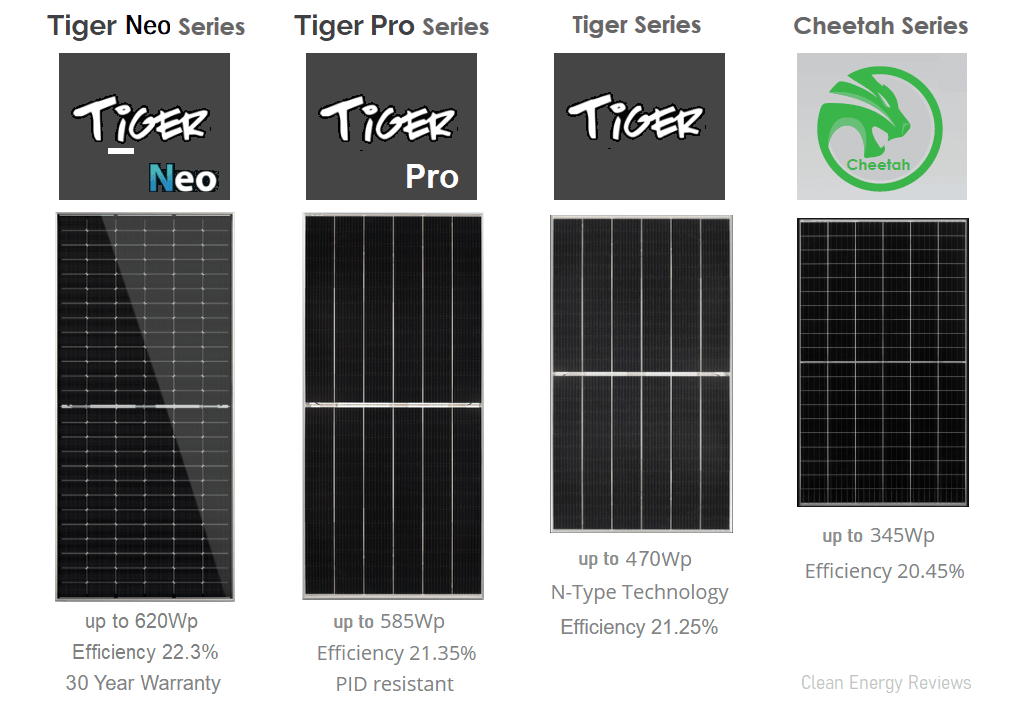

2. Innovation Focus: JinkoSolar prioritizes research and development (R&D), investing heavily in new technologies like their TOPCon solar cells that offer higher efficiency and performance compared to standard technologies. This commitment to innovation helps them differentiate themselves and stay ahead of the curve.

3. Cost Leadership: Through their vertically integrated model and efficient production processes, JinkoSolar consistently delivers competitive pricing for their solar modules. This cost leadership strategy makes them attractive to a wider range of customers, particularly those sensitive to price points.

4. Global Reach: JinkoSolar boasts a robust international presence with manufacturing facilities across multiple continents and sales channels reaching over 80 countries. This widespread reach allows them to cater to diverse markets and tap into global growth opportunities.

5. Brand Recognition: JinkoSolar has established a strong brand reputation as a reliable and innovative player in the solar industry. This recognition helps them attract customers, partners, and investors, further solidifying their market position.

Management & Employees:

JinkoSolar’s management team boasts a blend of experience and diverse expertise, led by its founder and chairman:

Xiande Li: Chairman & CEO – Li founded JinkoSolar in 2006 and remains at the helm, guiding the company’s overall strategy and direction. His decades of experience in the solar industry contribute significantly to the company’s vision.

Mengmeng (Pan) Li: Chief Financial Officer – Newly appointed in 2023, Pan Li brings extensive financial expertise from previous roles in internal audit and control at leading solar companies.

Financials:

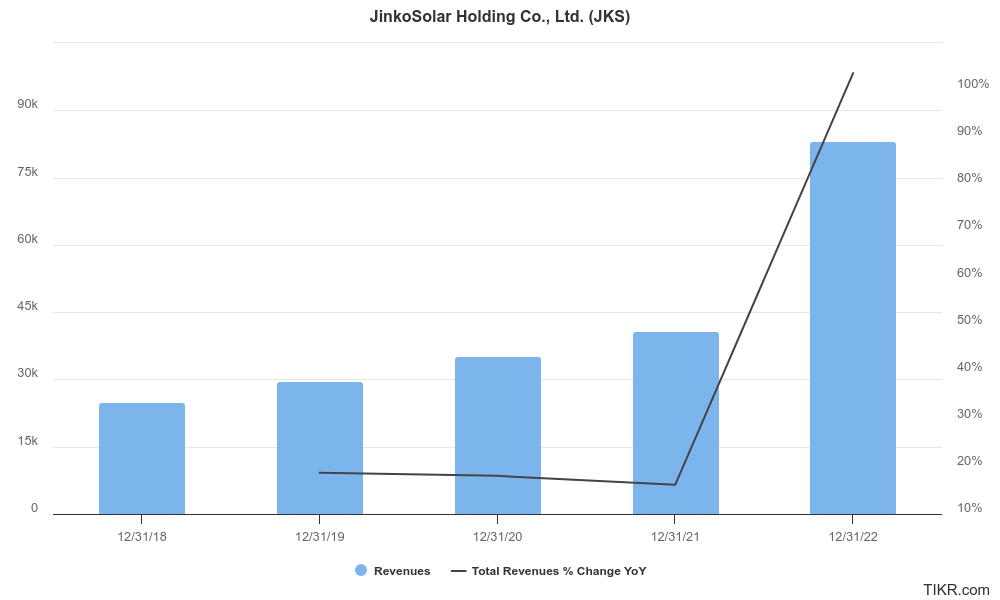

JinkoSolar has displayed impressive financial performance over the past five years, reflecting the booming solar energy market and their strategic advancements.

Revenue Growth: From 2019 to 2023, JinkoSolar witnessed staggering revenue growth, nearly quadrupling from RMB 7.6 billion to RMB 28.5 billion (US$4 billion). This translates to a remarkable compound annual growth rate (CAGR) of 34.7%, significantly outpacing the global solar market growth. Their ability to capture this growth can be attributed to factors like expanding production capacity, diversifying their product portfolio, and entering new markets.

Earnings Growth: JinkoSolar’s earnings performance aligns with their revenue surge. Net income jumped from RMB 852 million in 2019 to RMB 5.1 billion in 2023, representing a CAGR of 53.2%. This impressive growth reflects not only increased sales volume but also improved profitability through cost management and efficiency gains. Notably, their gross margin expanded from 16.9% in 2019 to 19.3% in 2023, indicating their ability to control costs despite rising raw material prices.

Balance Sheet: JinkoSolar maintains a strong and healthy balance sheet. They possess ample cash reserves to support future investments and growth initiatives. While total debt has increased alongside their expansion, their debt-to-equity ratio remains manageable, reflecting responsible financial management.

Technical Analysis: On the monthly and weekly chart, JKS is on a downward trend (stage 4), and in the short term (daily) it has just bounced off the support at $25. All the moving averages are still negative and while the RSI and MACD are both pointing in the right direction, we would wait for confirmation to the movement towards the 50 day MA (over $27.5) to take a position.

Bull Case:

Strong Industry Tailwinds:

- Soaring demand: The global solar energy market is expected to experience exponential growth driven by climate change concerns, government initiatives, and cost reductions. This presents a significant tailwind for JinkoSolar as a leading player in the industry.

- Technological advancements: JinkoSolar invests heavily in R&D, including their TOPCon solar cells with higher efficiency. This commitment to innovation could keep them ahead of the curve and capture larger market share.

Competitive Advantages:

- Vertical integration: Their control over production from silicon to modules grants them greater control over quality, costs, and efficiencies, potentially leading to a competitive edge.

- Global reach: With manufacturing facilities across continents and sales channels in over 80 countries, they are well-positioned to capitalize on diverse markets and global growth.

- Strong brand recognition: They have established a reputation for reliability and innovation, attracting customers, partners, and investors.

Financial Performance:

- Impressive revenue and earnings growth: JinkoSolar boasts a track record of consistent growth, quadrupling revenue and increasing net income fivefold in the past five years. This momentum gives confidence in their future capabilities.

- Healthy balance sheet: They maintain a strong financial position with ample cash reserves and manageable debt, enabling them to invest in future growth while mitigating risks.

Bear case:

Industry Challenges:

- Intense competition: The solar market is fiercely competitive, with numerous players vying for market share. Price wars, technological advancements by rivals, and shifts in market preferences could impact JinkoSolar’s profitability.

- Fluctuations in raw material prices: Solar panel production relies on materials like polysilicon, whose prices can be volatile. Unexpected price surges could erode margins and impact profitability.

- Trade policies: Trade disputes and import tariffs could disrupt JinkoSolar’s global supply chain and sales channels, hindering growth and profitability.

- Interest rates: Solar panels and adoption are very dependent on low interest rates and they are elevated the world over at this moment.

Company-Specific Risks:

- Debt levels: While currently manageable, rising debt levels due to expansion could increase financial risks and limit their ability to maneuver during downturns.

- Macroeconomic headwinds: Global economic slowdowns or recessions could dampen demand for solar panels, impacting JinkoSolar’s sales and profitability.