Executive Summary:

Founded in 2004, The Vita Coco Company $COCO is a publicly traded leader in the coconut water market, selling their flagship beverage alongside other brands like Runa clean energy drinks and PWR LIFT protein water. Beyond delicious and hydrating products, they prioritize social responsibility through their “Coconuts For Good” initiative, aiming to positively impact 1 million people in coconut farming communities. With a mission to deliver healthy, sustainable, and tasty drinks, Vita Coco is building a modern beverage platform for the future, blending purpose with profit.

Their most recent report covered Q3 2023, released on October 31, 2023:

- Revenue: $138.06 million, marking an 11% increase year-over-year but a slight 1.13% dip compared to the previous quarter. This exceeded analyst expectations by around 2%.

- EPS: $0.49, a significant 108.93% jump from Q3 2022 but a 15.69% decrease from Q2 2023. This also surpassed analyst predictions by about 8 cents.

Stock Overview:

| Ticker | $COCO | Price | $20.42 | Market Cap | $1.16B |

| 52 Week High | $33.29 | 52 Week Low | $14.24 | Shares outstanding | 56.76M |

Company background:

Born in 2004 from a chance encounter in a New York City bar, The Vita Coco Company has blossomed into a leading player in the plant-based beverage industry. Founders Michael Kirban, Ira Liran, and Brendan Bresnihan were struck by the potential of coconut water, and embarked on a mission to bring its natural goodness to the mainstream. Fueled by over $750 million in funding, they transformed Vita Coco from a niche product into a household name.

Today, the company boasts a diverse portfolio beyond its flagship coconut water. Brands like Runa offer clean energy drinks with a guayusa tea base, while PWR LIFT caters to fitness enthusiasts with protein-infused water. They haven’t strayed from their roots, though, with Vita Coco still reigning supreme in the coconut water market.

The road to success hasn’t been without competition. Harmless Harvest and Zico pose significant challenges, while established giants like Goya Foods also offer coconut water options. Despite this, Vita Coco has carved its niche by emphasizing ethical sourcing, sustainability practices, and social responsibility through their “Coconuts For Good” initiative.

With headquarters in New York City, The Vita Coco Company is a global brand with products sold in over 30 countries. Their commitment to healthy, delicious, and responsible beverages positions them well for continued growth in the ever-evolving beverage landscape.

Recent Earnings:

Vita Coco’s Q3 2023 Earnings: A Mixed Bag with Bright Spots

The Vita Coco Company’s most recent earnings release, covering Q3 2023, presented a picture of mixed results with promising signs. Let’s break it down:

Revenue: Sales reached $138.06 million, marking an 11% increase year-over-year. This growth trend is positive, but a slight 1.13% dip compared to the previous quarter raised some eyebrows. While it remained above analyst expectations by around 2%, the slowdown needs monitoring.

EPS: Earnings per share jumped significantly by 108.93% compared to Q3 2022, reaching $0.49. This surpasses analyst predictions by about 8 cents, showcasing improved profitability. However, a 15.69% decrease compared to Q2 2023 suggests some volatility.

Forward Guidance: Vita Coco raised its full-year net sales and adjusted EBITDA guidance. This indicates confidence in achieving their financial goals despite the slight Q3 2023 revenue dip. Additionally, they announced a $40 million share repurchase program, signaling faith in their future prospects and a commitment to returning value to shareholders.

The Market, Industry, and Competitors:

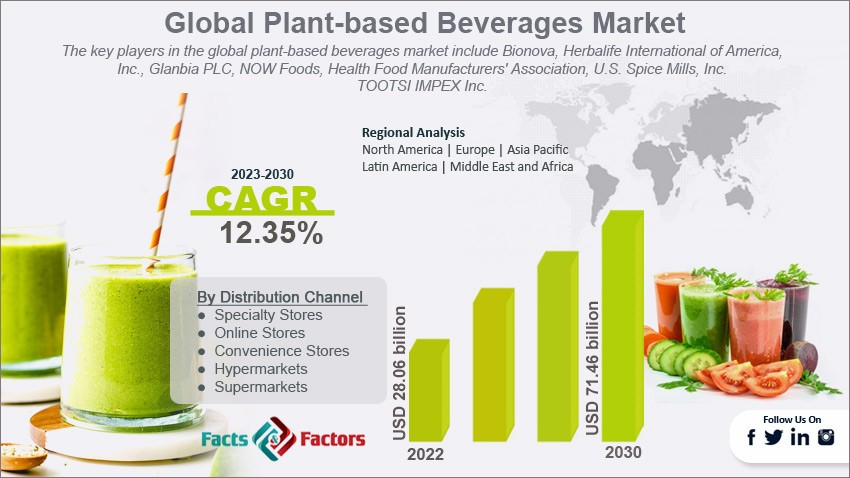

The Vita Coco Company swims in the vast and dynamic plant-based beverage market, encompassing various segments with exciting growth prospects. Here’s a breakdown:

Market Landscape: Vita Coco primarily competes in three key segments:

- Plant-based Beverages: This broad market is expected to reach $32.4 billion by 2030, surging at a CAGR of 11.2%. Consumers increasingly seek plant-based alternatives for health and sustainability reasons.

- Coconut Water: Vita Coco dominates this niche, commanding over 50% market share. The segment is projected to hit $16.31 billion by 2030, growing at a CAGR of 14.3%. Rising health awareness and demand for natural hydration fuel this growth.

- Functional Beverages: This segment, encompassing products like Runa energy drinks, is anticipated to reach $49.69 billion by 2030, driven by a CAGR of 10.5%. Consumers seek beverages with added benefits like energy, protein, or immunity support.

Growth Expectations: The overall picture for Vita Coco’s market segments is promising. The anticipated double-digit CAGRs across all three segments present significant growth opportunities. Vita Coco’s strong brand recognition, focus on innovation, and commitment to sustainability position them well to capitalize on these trends.

Challenges and Opportunities: While the market offers exciting possibilities, competition remains fierce. Established players like PepsiCo and new entrants constantly innovate. Additionally, fluctuations in raw material prices and educating consumers about plant-based benefits pose challenges. Nevertheless, Vita Coco’s focus on ethical sourcing, social responsibility, and product diversification can solidify their position as a leader in the ever-evolving beverage landscape.

Unique differentiation:

Vita Coco’s Battleground: Navigating the Competitive Landscape

Vita Coco doesn’t stand alone in the booming plant-based beverage market.

Direct Coconut Water Rivals:

- Harmless Harvest: Focused on organic, fair-trade coconut water, they position themselves as the ethical alternative. Their smaller market share creates a niche competition.

- Zico: This Coca-Cola owned brand remains a strong contender, though they’ve seen some market share decline. Their marketing muscle and wider distribution pose a constant challenge.

- Goya Foods: This established giant offers coconut water alongside a diverse product portfolio, making them a broad competitor in the beverage aisle.

Beyond Coconut Water:

- PepsiCo: With their Naked Juice and Tropicana brands, PepsiCo taps into the broader plant-based beverage market, vying for consumer attention and shelf space.

- Blue Diamond Growers: Their Almond Breeze line offers plant-based milk alternatives, competing with Vita Coco’s diversification efforts into the protein water and energy drink segments.

- New Entrants: The market constantly sees innovative startups like Califia Farms and Ripple disrupting the space, keeping Vita Coco on their toes

While Vita Coco faces strong competition in the plant-based beverage market, they have cultivated several unique differentiations that give them an edge:

1. First-Mover Advantage: They were one of the earliest entrants in the premium coconut water market, establishing strong brand recognition and loyalty that carries weight to this day.

2. Ethical Sourcing & Sustainability: Their “Coconuts For Good” initiative emphasizes fair trade practices and community support, resonating with consumers seeking responsible brands.

3. Beyond Coconut Water: They’ve strategically diversified their portfolio with brands like Runa and PWR LIFT, catering to evolving consumer needs for functional beverages and protein options.

4. Commitment to Quality & Natural Ingredients: Vita Coco focuses on minimal processing and high-quality ingredients, positioning themselves as a pure and authentic option compared to competitors with added sugars or artificial flavors.

5. Storytelling & Transparency: They effectively connect with consumers by sharing the stories of their farmers and highlighting their commitment to sustainability, fostering trust and brand loyalty.

6. Innovation: Vita Coco continuously expands their offerings with new flavors, formats, and functionalities, maintaining consumer interest and staying ahead of trends.

It’s important to note that competitors like Harmless Harvest also emphasize ethical sourcing, while Zico and Goya offer wider distribution networks. However, Vita Coco’s combination of first-mover advantage, brand recognition, ethical practices, portfolio diversification, and commitment to quality creates a compelling offering that sets them apart. Their ability to maintain and leverage these differentiations will be crucial for their continued success in the dynamic plant-based beverage market.

Management & Employees:

The Vita Coco Company boasts a seasoned leadership team with diverse expertise guiding their growth in the plant-based beverage market. Here’s a quick overview of some key members:

Executive Team:

- Michael Kirban: Co-founder and Executive Chairman, bringing vision and entrepreneurial spirit.

- Martin Roper: Chief Executive Officer, with experience leading The Boston Beer Company and driving revenue growth.

- Corey Baker: Chief Financial Officer, ensuring financial stability and strategic investments.

- Jonathan Burth: Chief Operating Officer, overseeing efficient operations and supply chain management.

Financials:

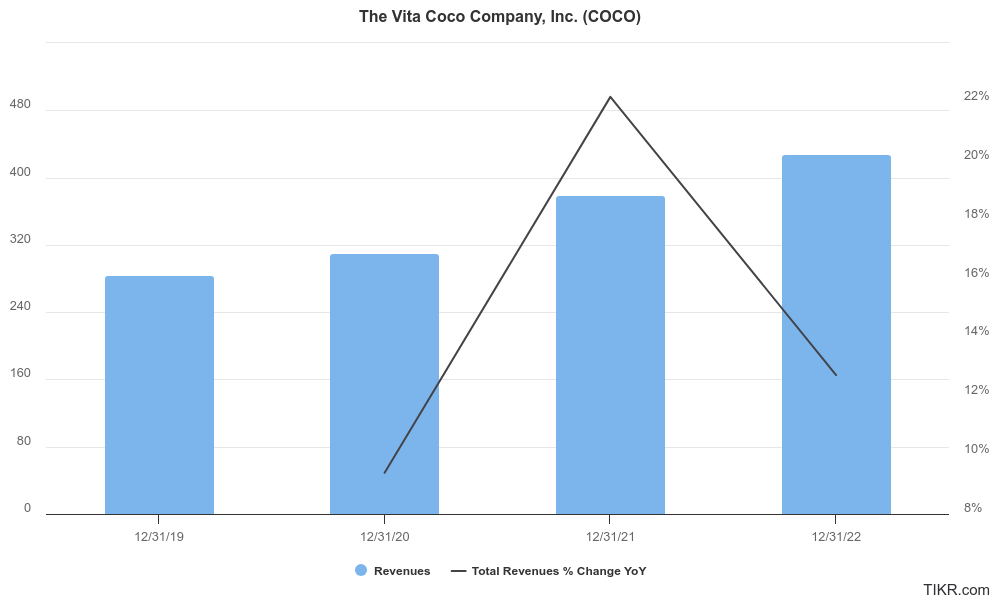

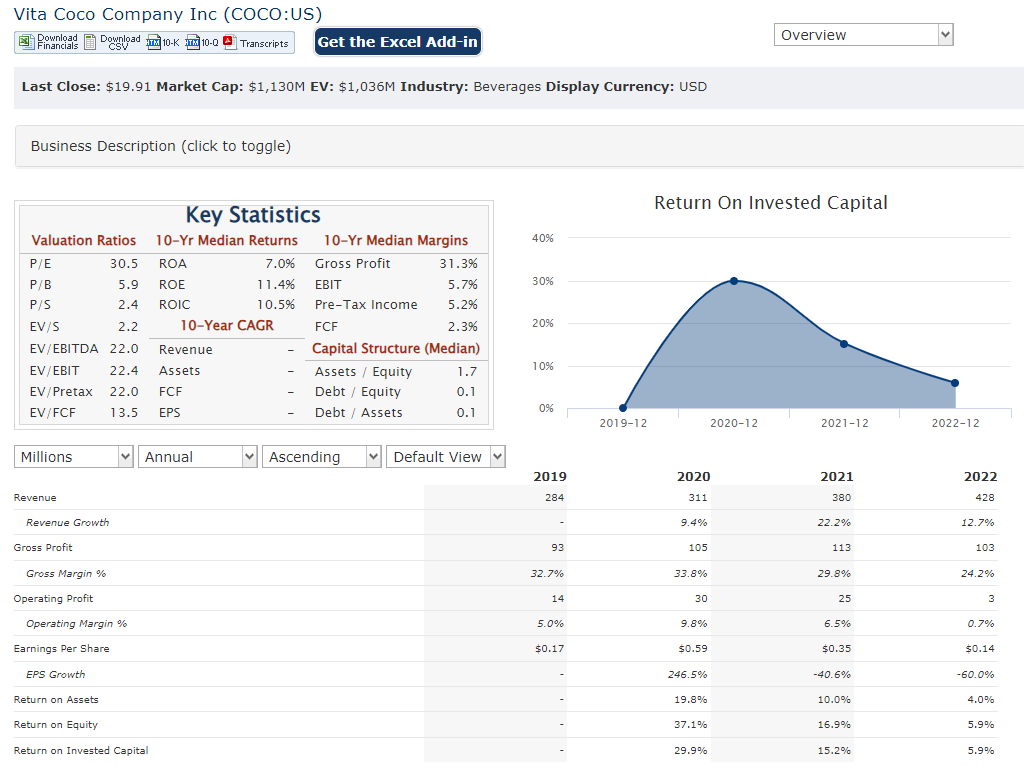

The past five years have seen Vita Coco navigate a dynamic beverage landscape, with their financial performance reflecting both ups and downs. Let’s dive in:

Revenue: Between 2018 and 2023, Vita Coco’s revenue experienced a compound annual growth rate (CAGR) of 10.7%, reaching $551 million in 2023. While not always consistent, this growth signifies their expansion within the market.

Earnings: The company’s earnings journey showcased more volatility. They saw a significant CAGR of 83.4% between 2018 and 2022, driven by cost-cutting efforts and improved margins. However, 2023 presented a challenge, with net income declining by 33.6%. This recent dip requires further monitoring in the coming quarters.

Balance Sheet: Looking at Vita Coco’s balance sheet, their cash and equivalents have fluctuated. They started strong in 2018 with $72.7 million but dipped to $20.8 million in 2021 before rebounding to $50.8 million in 2023. Their long-term debt has also seen variations, reaching a peak of $210.8 million in 2020 but stabilizing around $170 million in recent years.

Technical Analysis:

The long term chart indicates a stage 4 decline. with a likely reversal at $20 range, but that is to be confirmed. In the weekly chart, the confirmation of the reversal is still unclear as well. On the daily chart (short term), the stock seems to show better signs of reversal, after a head and shoulders pattern.

This should take the stock from $20 range to $30 range in 3-4 months.

Bull Case:

1. Strong Market Growth: The plant-based beverage market is booming, with a projected CAGR of 11.2% reaching $32.4 billion by 2030. As a leader in coconut water and venturing into other segments, Vita Coco is well-positioned to capitalize on this trend.

2. Brand Recognition & Differentiation: Vita Coco boasts strong brand recognition as the “original” premium coconut water, backed by their “Coconuts For Good” initiative and commitment to ethical sourcing. They’ve also strategically diversified with Runa and PWR LIFT, catering to broader consumer needs.

3. Innovation & Adaptability: The company constantly innovates with new flavors, formats, and functionalities, maintaining consumer interest and staying ahead of trends. This adaptability keeps them relevant in a dynamic market.

4. Leadership & Expertise: Vita Coco benefits from a seasoned leadership team with diverse experience in marketing, sales, and financial management. Their expertise contributes to strategic decision-making and navigating market challenges.

5. Recent Earnings Beat: While Q3 2023 revenue growth dipped slightly, significant EPS growth and exceeding analyst expectations provide a positive sign for future profitability.

Bear Case:

The bear case for Vita Coco Company stock highlights potential concerns investors should consider:

1. Volatile Earnings and Margins: Despite recent EPS growth, Vita Coco’s earnings history shows volatility, with a decline in net income in 2023. Unstable margins raise concerns about consistent profitability and future growth potential.

2. Intense Competition: The plant-based beverage market is crowded with established giants like PepsiCo and innovative startups. Vita Coco faces pressure to maintain market share and defend its premium positioning against aggressive competitors.

3. Limited Distribution Network: Compared to larger rivals, Vita Coco’s distribution network might be limited, hindering their ability to reach a wider audience and expand sales.

4. Dependence on Coconut Water: While dominant, coconut water growth might saturate, and consumers could shift preferences towards other functional beverages. Overreliance on this segment could pose a risk if trends change.

5. Raw Material Price Fluctuations: Coconut prices rely on various factors, and any significant fluctuations could impact production costs and margins, squeezing profitability.