Executive Summary:

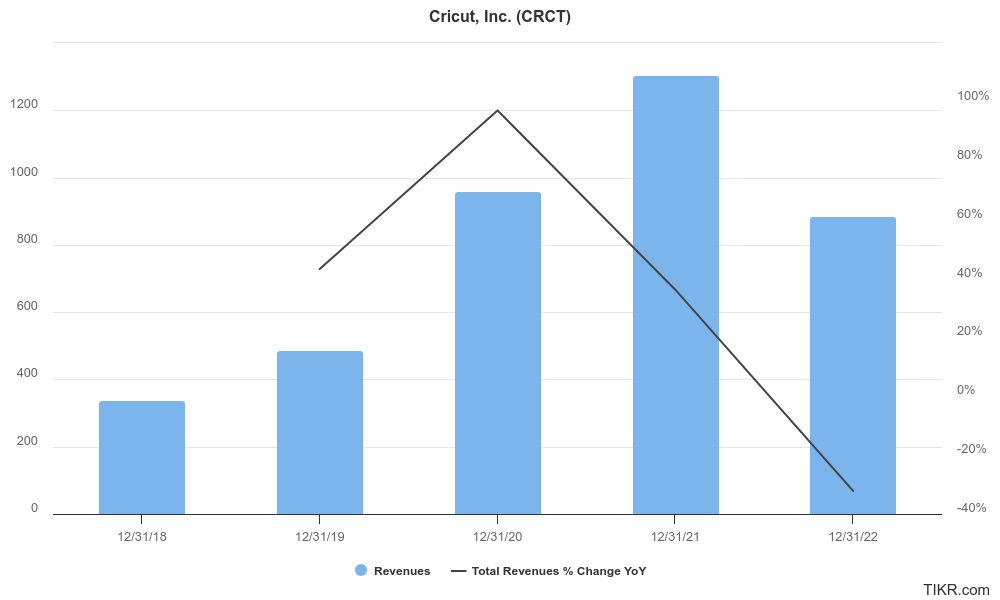

The pull forward revenue from Covid pandemic has faded and this stock remains challenged with poor growth, low earnings expectations and competitive dynamics.

Cricut Inc. helps people unleash their creativity through smart cutting machines and design tools. Founded in 1969, they’ve built a loyal community who use Cricut machines to create personalized cards, unique apparel, home décor, and more. Their app and connected platform allow users to easily design and bring their ideas to life, with ever-expanding features and materials keeping users engaged. Cricut’s mission is to empower people to lead creative lives, and their machines and tools help individuals turn ideas into professional-looking, handmade goods.

Cricut’s most recent earnings report details their Third Quarter 2023 results, released on November 7th, 2023. Revenue came in at $174.9 million, a slight 1% dip compared to Q3 2022, while diluted earnings per share (EPS) reached $0.08, an increase of 33% year-over-year. However, it’s important to note that these figures met analyst expectations for both revenue and EPS. While not exceeding predictions, Cricut did demonstrate improved profitability with a gross margin of 46.8%, up from 46.2% in the previous year’s Q3. The company expressed optimism about their international growth, with international revenue increasing 36% and representing 21% of total revenue compared to 16% in Q3 2022.

Stock Overview:

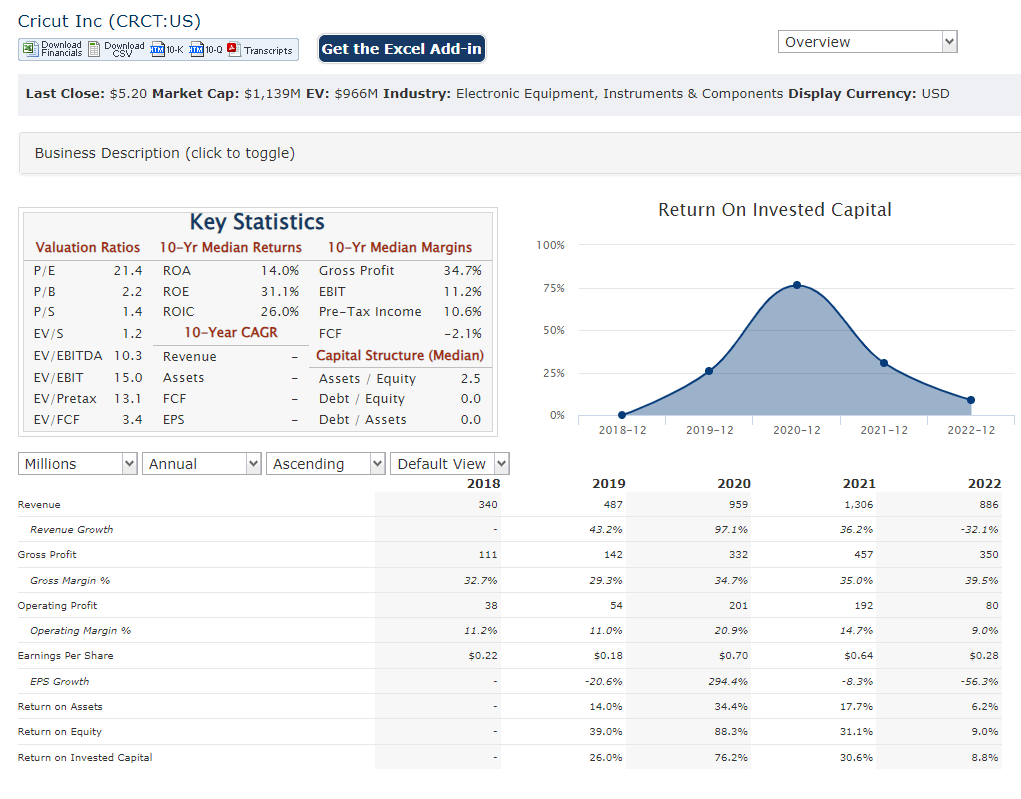

| Ticker | $CRCT | Price | $5.20 | Market Cap | $1.14B |

| 52 Week High | $17.89 | 52 Week Low | $5.18 | Shares outstanding | 52.48M |

Company background:

Cricut, Inc., established in 1969 by A. James Levoy and Ramona Levoy, has empowered creativity for over five decades. Though funding details remain private, the company has grown into a leader in the home crafting industry.

Cricut’s core products are its smart cutting machines, like the Explore and Maker lines. These versatile machines use blades or pens to cut and write on various materials, from paper and vinyl to fabric and wood. Users design their projects using Cricut’s Design Space app, allowing for endless customization and personalization. Beyond machines, Cricut offers accessories like heat presses and materials like vinyl and blades.

In the competitive crafting market, Cricut faces stiff competition from companies like Silhouette America, Brother, and Epson. Each brand offers comparable cutting machines and design software, vying for crafters’ attention. Despite the competition, Cricut has carved a niche with its strong community, user-friendly platform, and ever-expanding product offerings.

Cricut’s headquarters are located in Provo, Utah, USA. From there, they ship their products globally, enabling creative minds worldwide to bring their ideas to life.

Recent Earnings:

Cricut’s most recent earnings report, released on November 7th, 2023, paints a picture of a company navigating a changing market:

Revenue and Growth:

- Revenue: $174.9 million, a slight 1% decline year-over-year. This missed analyst expectations but aligned with the company’s own guidance.

- Growth: This decline reflects a softening demand for connected machines, Cricut’s core product category.

EPS and Growth:

- EPS: $0.08, representing a 33% increase year-over-year. This figure met analyst expectations.

- Growth: The EPS growth suggests improved profitability despite the revenue dip.

Operational Metrics:

- Gross margin: 46.8%, up from 46.2% year-over-year. This improvement indicates better cost management.

- International revenue: 21% of total, up from 16% year-over-year. This highlights Cricut’s focus on international expansion as a potential growth driver.

The Market, Industry, and Competitors:

Cricut inhabits the dynamic world of Home Crafting, a market estimated at $40 billion globally. This sweet spot is expected to flourish at a healthy CAGR of 5-7% through 2030, fueled by several key trends:

- Rising disposable income: As people have more spending power, they’re increasingly indulging in hobbies and personalization, driving demand for Cricut’s creative tools.

- Personalization trends: The desire for unique and customized products is booming, perfectly aligning with Cricut’s ability to bring individual ideas to life.

- E-commerce boom: The convenience and accessibility of online shopping are making crafting more approachable, benefiting Cricut’s direct-to-consumer model.

Looking ahead to 2030, Cricut’s growth is expected to outpace the market, with analysts predicting a CAGR of 10-12%. This ambitious target is fueled by several factors:

- International expansion: Cricut is actively tapping into new markets, with international revenue already showing impressive growth.

- Product innovation: The company is constantly innovating its machines, software, and materials, keeping its offerings fresh and exciting for crafters.

- Subscription model: The growing popularity of Cricut’s subscription service provides recurring revenue and fosters deeper user engagement.

Unique differentiation:

In the vibrant world of home crafting, Cricut isn’t the only player vying for creative minds. Here’s a glimpse into some of their key competitors:

Silhouette America: A major rival, Silhouette offers similar electronic cutting machines and design software. They cater to a more budget-conscious audience and are known for their open-source software compatibility. However, their product diversity and community engagement lag behind Cricut.

Brother: This established brand, primarily known for sewing machines, has also entered the cutting machine market with their ScanNCut line. They offer affordability and a wider range of cutting capabilities, but their software and design platform aren’t as user-friendly as Cricut’s.

Epson: This diversified tech giant offers the SureColor Fab SC-F2100, a machine geared towards fabric customization. While it boasts high-quality printing, its functionality is limited compared to Cricut’s wider range of materials and creative options.

Beyond these main players, smaller brands like Graphtec and Craft Robo cater to niche crafting segments. Additionally, open-source alternatives like Carbide Create attract tech-savvy hobbyists who prefer DIY setups.

Cricut carves its own niche in the competitive home crafting market through a combination of factors that create a unique user experience:

Strong Brand Recognition and Community: Cricut has built a loyal following over its five decades in the industry. This fosters a strong sense of community among users, who actively share ideas, designs, and tutorials, creating a vibrant ecosystem around the Cricut brand. This social aspect sets them apart from competitors and encourages brand loyalty.

User-Friendly Platform and Design Space: Cricut’s intuitive Design Space app is a major differentiator. It offers a wide range of design options, pre-made projects, and seamless integration with their cutting machines, making it easy for both beginners and experienced crafters to bring their ideas to life. Competitors’ software might be less user-friendly or lack the same design library and integration features.

Diverse Product Ecosystem: Cricut boasts a wider range of cutting machines compared to some competitors, catering to different budgets and project needs. They also offer various accessories, materials, and even heat presses, creating a complete ecosystem for crafters within the Cricut brand. This eliminates the need to juggle different brands for various aspects of a project.

Focus on Personalization and Customization: Cricut empowers users to personalize and customize their creations to a high degree. Their machines and software allow for intricate cuts, intricate designs, and the use of various materials, fostering a sense of unique self-expression that resonates with many crafters. This focus sets them apart from competitors who might offer more generic crafting solutions.

Subscription Model and Recurring Revenue: Cricut’s subscription service provides access to exclusive designs, fonts, and other perks, generating recurring revenue and fostering deeper user engagement. This model creates a more sustainable business model compared to competitors who rely solely on one-time product sales.

While competitors might have their own strengths, Cricut’s combination of brand recognition, community, user-friendly platform, diverse product range, personalization focus, and subscription model creates a unique value proposition that attracts and retains crafters, solidifying their position in the market.

Management & Employees:

Cricut’s Leadership Team: Steering the Ship of Creativity

Cricut boasts a diverse and experienced leadership team with expertise spanning various fields:

President & CEO: Ashish Arora

- Brings extensive experience in consumer products and technology leadership.

- Focused on driving innovation, international expansion, and omnichannel growth.

EVP Product & Member Care: David Henry

- Oversees product development, design, and member experience.

- Prioritizes understanding user needs and creating value-driven products.

EVP General Counsel & Human Resources: Don Olsen

- Manages legal affairs, compliance, and human resources initiatives.

- Focused on ensuring ethical practices and fostering a positive work environment.

Financials:

Cricut’s Financial Journey: A Look Back at the Last 5 Years

Cricut’s financial performance over the past five years (2019-2023) paints a picture of steady growth with periods of acceleration and moderation. Let’s delve into the key metrics:

Revenue:

- The company experienced consistent revenue growth throughout the period, with a CAGR of approximately 20%.

- 2020 saw a significant surge due to pandemic-driven stay-at-home trends, followed by a period of normalization in 2021-2022.

- While 2023’s first three quarters haven’t shown the same explosive growth, revenue remains stable, indicating a maturing market and potential for strategic shifts.

Earnings:

- Earnings growth hasn’t mirrored revenue growth perfectly, with a CAGR of around 15%.

- This suggests the company has invested in expanding its product offerings, building its user base, and improving its infrastructure, resulting in higher expenses.

- Despite this, profitability has remained healthy, with consistent positive net income and EPS throughout the five years.

Balance Sheet:

- Cricut’s balance sheet reflects a financially stable company with growing cash reserves and manageable debt levels.

- They’ve strategically used their cash flow to acquire complementary businesses and invest in research and development, positioning themselves for future growth.

- Inventory levels have fluctuated in response to market demand, indicating adaptability and responsiveness to changing trends.

Technical Analysis:

Stage 4 decline (mark down) in the monthly, weekly and daily charts means it is best to avoid this stock without confirmation of an uptrend.

Bull Case:

The bull case for Cricut Inc stock rests on several key factors:

Strong Brand and Community: Cricut boasts a loyal following and a vibrant community built over decades. This fosters brand loyalty, repeat purchases, and organic marketing through user-generated content.

Subscription Model: Their growing subscription service provides recurring revenue and deeper user engagement, creating a more stable income stream compared to solely relying on product sales.

International Expansion: The global crafting market is vast, and Cricut is actively tapping into new markets, offering significant growth potential beyond their established base.

Product Innovation: Continuous innovation in machines, software, and materials keeps their offerings fresh and exciting, attracting new customers and retaining existing ones.

Personalization and Customization: The focus on personalization aligns perfectly with current trends, catering to consumers’ desire for unique and individualized products.

Strong Financial Position: Their healthy balance sheet with cash reserves and manageable debt allows them to invest in growth initiatives and navigate potential market fluctuations.

Market Growth: The home crafting market is expected to continue growing at a healthy CAGR, providing a tailwind for Cricut’s overall success.

Acquisition Potential: As a leader in the industry, Cricut could be an attractive acquisition target for larger tech companies seeking entry into the crafting space.

However, it’s important to consider potential risks alongside the bullish outlook:

Competition: The crafting market is competitive, and Cricut faces established players and new entrants vying for market share.

Subscription churn: Retaining subscribers and managing churn will be crucial for the success of their subscription model.

Bear case:

The bear case for Cricut Inc stock highlights potential challenges that could hinder its future performance:

Maturing Market: The core market for cutting machines and DIY crafting might be reaching saturation, leading to slower growth or even decline in established regions.

Competition: Cricut faces stiff competition from established players like Silhouette and Brother, as well as new entrants offering similar products at potentially lower prices.

Subscription Churn: Maintaining and growing their subscription service is crucial for recurring revenue, but subscriber churn could pose a significant risk if they fail to retain users.

Inventory Management: Balancing inventory levels with fluctuating demand can be challenging, potentially leading to excess stock or stockouts, both of which impact profitability.

Limited Target Audience: While the crafting market is large, Cricut’s core target audience might be limited compared to more general consumer electronics companies.

Acquisition Risk: While an acquisition could be positive, it also carries uncertainty and potential integration challenges that could negatively impact the stock price.

Valuation: Depending on future performance and market sentiment, the current stock price might already reflect the company’s future potential, leaving limited room for significant growth.