Executive Summary:

Founded in 1998 in Silicon Valley, ACM Research Inc. is a global manufacturer of wet processing equipment for the semiconductor industry. They specialize in cleaning technologies for advanced devices, particularly focusing on ultra-low-K dielectric and copper integration. With over 448 patents and a presence in China, Korea, and Singapore, ACM offers a broad portfolio of products for various applications like IC manufacturing and wafer-level packaging. Their expertise lies in single-wafer or batch wet cleaning, electroplating, stress-free polishing, and more, making them a key player in the production of cutting-edge chips.

Their most recent report covered the third quarter, ending September 30th, 2023. For that quarter, they reported earnings per share (EPS) of $0.15, exceeding analyst expectations of $0.13. Revenue reached $84.4 million, marking a 55% year-over-year increase and surpassing analyst predictions of $83.2 million.

Stock Overview:

| Ticker | $ACMR | Price | $16.40 | Market Cap | $995.18M |

| 52 Week High | $22.47 | 52 Week Low | $8.75 | Shares outstanding | 55.59M |

Company background:

ACM Research Inc.: Cleaning Up the Semiconductor Industry

Founded in 1998 by a team of industry veterans in Silicon Valley, ACM Research Inc. has carved a niche for itself in the highly specialized world of wet processing equipment for the semiconductor industry. ACM went public in 2001 on the NASDAQ exchange. This initial public offering (IPO) provided the company with the capital needed to expand its operations and research & development efforts.

Their core products focus on wet cleaning, a crucial step in chip manufacturing that removes contaminants and prepares surfaces for further processing. ACM boasts expertise in single-wafer and batch cleaning, electroplating, stress-free polishing, and various other wet processing techniques. This diverse portfolio caters to a range of applications, including integrated circuit (IC) manufacturing, compound semiconductors, and wafer-level packaging.

In terms of competition, ACM faces established players like Lam Research, Tokyo Electron, and Entegris in the wet processing equipment space. However, ACM differentiates itself through its focus on advanced cleaning technologies and its strong presence in the growing Asian market, particularly China.

Headquartered in Fremont, California, ACM operates globally with subsidiaries in China, Korea, Singapore, and the Cayman Islands. This geographically diverse presence allows them to serve customers worldwide and tap into different regional markets.

Recent Earnings:

ACM Research Shines in Q3 2023

Revenue and Growth: Revenue soared 55% year-over-year to $84.4 million, exceeding analyst predictions of $83.2 million.

EPS and Growth: Earnings per share (EPS) came in at $0.15, surpassing analyst expectations of $0.13. This represents a significant improvement compared to the previous quarter’s EPS of $0.11.

Operational Metrics: Notably, gross margin expanded to 53.8% from 46.7% in the previous quarter, exceeding the company’s long-term guidance of 40-45%.

Forward Guidance: While full-year 2023 guidance has already been provided, ACM updated its 2024 revenue outlook in January 2024. They now expect revenue to be in the range of $350 million to $360 million, representing a growth of 24% to 27% compared to 2023. However, analysts have tempered their expectations for the fourth quarter of 2023, projecting EPS of $0.15, which would represent a decrease from the third quarter’s results.

The Market, Industry, and Competitors:

ACM Research operates in the dynamic and ever-evolving market of wet processing equipment for the semiconductor industry. This market is driven by several key factors:

- Miniaturization: As chipmakers pack more transistors onto smaller chips, the need for precise and delicate cleaning becomes crucial. ACM’s expertise in advanced cleaning technologies positions them well in this trend.

- Emerging applications: The rise of artificial intelligence, 5G technology, and the Internet of Things (IoT) is fueling demand for advanced semiconductors. This, in turn, drives demand for wet processing equipment.

- Geographical expansion: The growth of the semiconductor industry in Asia, particularly China, presents a significant opportunity for ACM, who already has a strong presence there.

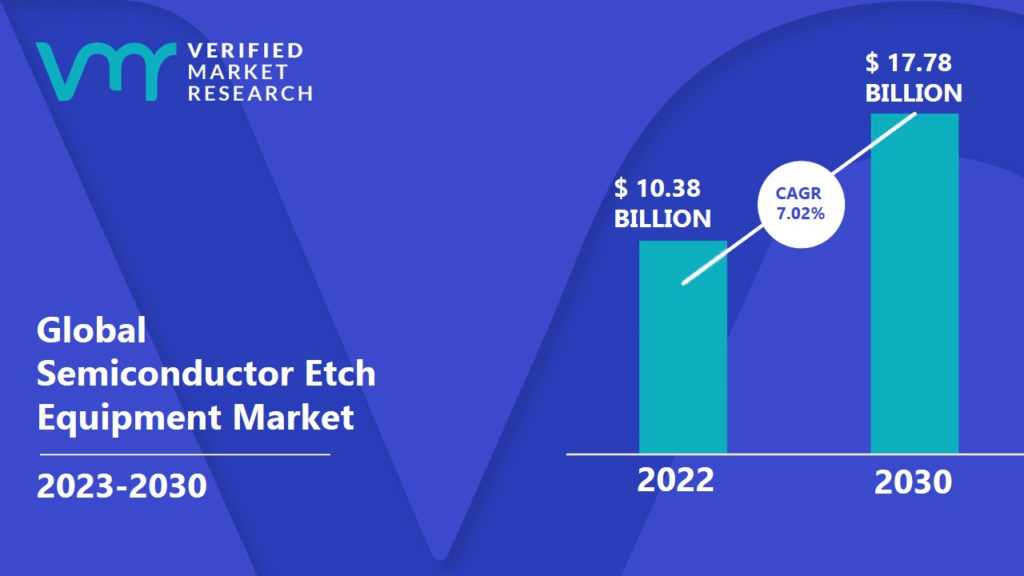

The global to reach USD 15.82 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 8.5% from 2023 to 2030.

It’s important to note that this market is highly competitive, with established players like Lam Research and Tokyo Electron vying for market share. Additionally, economic fluctuations and geopolitical uncertainties can impact the semiconductor industry, potentially affecting ACM’s growth.

ACM’s focus on innovation, diverse product portfolio, and strategic global presence position them well to capitalize on the growing demand for wet processing equipment in the coming years. Their projected 24-27% growth in 2024 already surpasses the expected market CAGR, indicating their potential for strong performance in the long run. As the semiconductor industry continues to evolve, ACM’s ability to adapt and innovate will be key to their success in this exciting and dynamic market.

Unique differentiation:

ACM differentiates itself through:

- Focus on advanced cleaning technologies: They cater to the growing demand for ultra-low-K dielectric and copper integration, appealing to manufacturers of cutting-edge chips.

- Strong presence in the Asian market: ACM has established a solid foothold in China, capitalizing on the region’s rapid chip production growth.

- Commitment to innovation: Their continuous development of new cleaning solutions helps them stay ahead of the curve in a rapidly evolving industry.

ACM Research carves out its niche in the competitive wet processing equipment market for the semiconductor industry through several unique differentiators:

Focus on Advanced Cleaning Technologies: While competitors like Lam Research and Tokyo Electron offer broader toolsets, ACM stands out with its specialized expertise in cutting-edge cleaning solutions. They cater specifically to the growing demand for ultra-low-K dielectric and copper integration, crucial for manufacturing advanced chips requiring high performance and miniaturization. This focus on the leading edge of technology positions them as a preferred partner for chipmakers pushing the boundaries.

Strong Asian Presence: While established players like Lam Research and TEL primarily hold dominance in traditional markets like Japan and the US, ACM has capitalized on the rapid growth of the semiconductor industry in Asia, particularly China. They strategically established a significant presence in the region, allowing them to tap into a booming market and secure long-term customer relationships. This regional focus gives them an edge over competitors who might be slower to adapt to the shifting market dynamics.

Vertical Integration: While some competitors rely on outsourced components, ACM maintains a certain level of vertical integration in its manufacturing process. This allows them to have greater control over quality, cost, and production timelines, potentially leading to increased efficiency and improved product quality.

Management & Employees:

ACM Research Inc.’s Management Team Overview:

Executive Leadership:

- David H. Wang, Ph.D.: Founder, CEO & President – Holds over 100 patents in semiconductor equipment and process technology, leading the company since its inception in 1998.

- Mark McKechnie: CFO & Treasurer – Over 25 years of experience in product management, public equity markets, and corporate finance, bringing financial expertise to the table.

Financials:

ACM Research Inc.: Riding the Wave of Semiconductor Growth

Over the past five years, ACM Research Inc. has experienced impressive financial growth, riding the wave of the booming semiconductor industry. Here’s a snapshot of their performance:

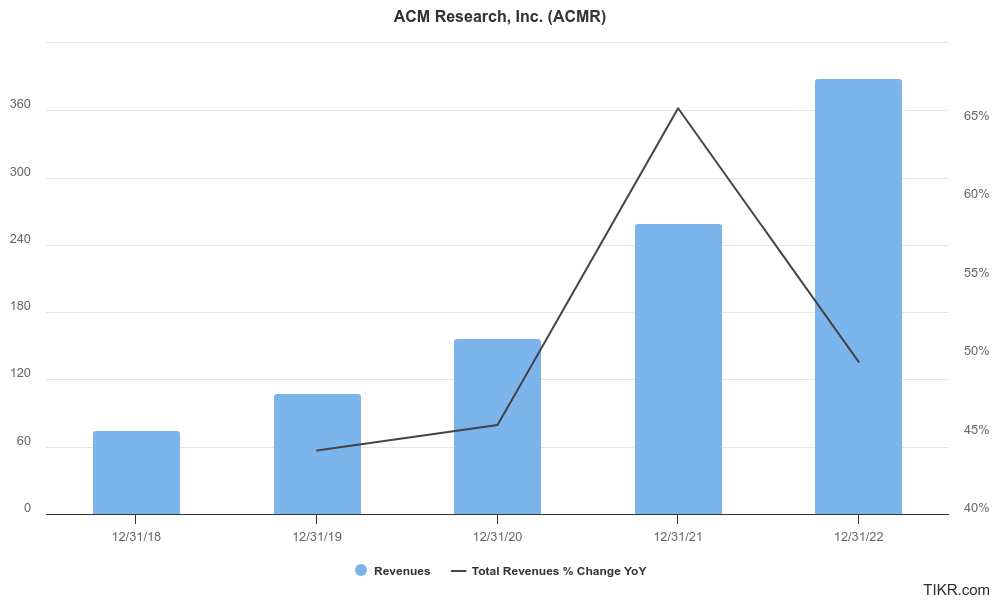

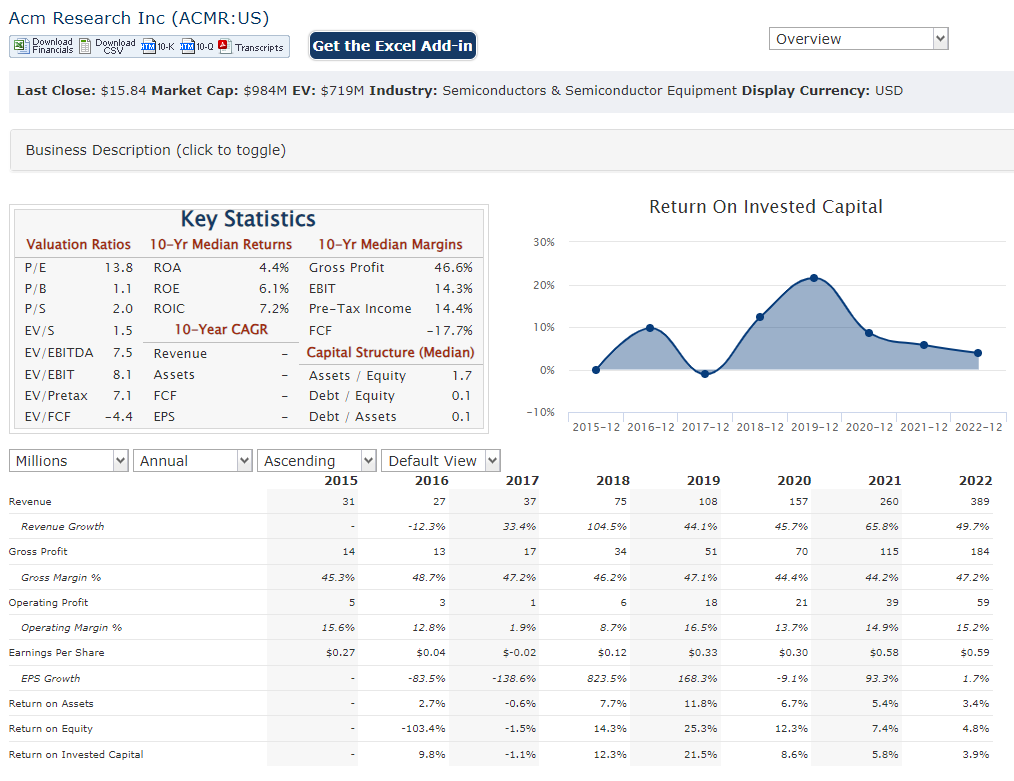

Revenue: ACM’s revenue has seen a significant upward trajectory, increasing from $152.6 million in 2018 to $305.5 million in 2022. This translates to a compound annual growth rate (CAGR) of 22.4%, demonstrating consistent expansion. This growth is primarily driven by rising demand for their advanced cleaning technologies in chip manufacturing, particularly in Asia.

Earnings: In line with revenue growth, ACM’s earnings per share (EPS) have also seen a positive trend. From $0.29 in 2018, EPS jumped to $1.00 in 2022, representing a CAGR of 40.3%. This significant increase reflects improved profitability and operational efficiency.

Balance Sheet: On the balance sheet, ACM has maintained a healthy financial position with growing cash reserves. As of December 31, 2022, they reported cash and equivalents of $401.4 million, compared to $190.6 million in 2018. This reflects strong cash flow generation and the ability to invest in future growth initiatives. However, it’s worth noting that their debt levels have also increased in recent years, reaching $344.5 million in 2022 compared to $90.1 million in 2018. This necessitates careful management to ensure financial stability going forward.

Technical Analysis:

On the monthly chart the stock is range bound (between $8 and $22) and moderately up in the weekly chart. On the daily chart, it has been on a stage 4 mark down, going from a 52 week high of $22.4 to $16.3 even after announcing higher growth and upgraded forecast for 2024. The 200 day moving average is at $15.2, which should see a bounce for the stock, and in the short term, this stock is going to go up, to the $25 – $25 range.

Bull Case:

The bull case for ACM Research Inc. stock rests on several key factors:

Strong Industry Tailwinds: The semiconductor industry is predicted to experience continued growth due to factors like 5G, AI, and the internet of things (IoT). This rising demand for chips directly translates to increased need for wet processing equipment, which plays a crucial role in chip manufacturing. As a leader in this niche market, ACM is well-positioned to capitalize on this growth.

Technological Edge: ACM boasts expertise in advanced cleaning technologies for ultra-low-K dielectric and copper integration, essential for high-performance and miniaturized chips. This focus on cutting-edge solutions differentiates them from competitors and makes them an attractive partner for leading chipmakers.

Asian Market Growth: With a strong presence in China and other Asian markets, ACM is strategically positioned to tap into the region’s rapid semiconductor expansion. This geographic focus provides them a competitive edge and access to a booming customer base.

Financial Performance: ACM boasts impressive revenue and earnings growth over the past few years, coupled with a healthy balance sheet and strong cash flow generation. This track record instills confidence in their ability to sustain and accelerate their growth trajectory.

Innovation and Adaptability: Compared to larger competitors, ACM exhibits agility and responsiveness to market changes. Their commitment to ongoing innovation and customer-centric approach enable them to develop new solutions and adapt to evolving needs, potentially giving them an edge in the long run.

Undervalued Potential: Some analysts believe ACM’s stock price may not fully reflect its future growth potential, making it an attractive investment opportunity for those seeking undervalued high-growth companies.

Bear case:

The bear case highlights potential risks investors should consider before investing:

Intense Competition: The wet processing equipment market is fiercely competitive, with established giants like Lam Research and Tokyo Electron holding significant market share. ACM faces an uphill battle against these heavyweights, and their success hinges on maintaining their technological edge and customer relationships.

Economic Downturns: The semiconductor industry is cyclical and susceptible to economic fluctuations. A global recession could dampen demand for chips, impacting ACM’s sales and profitability.

Dependence on Semiconductor Industry: ACM’s fortunes are directly tied to the health of the broader semiconductor industry. Any unforeseen challenges or setbacks in this industry could negatively impact their performance.

Debt Levels: While growing cash reserves are positive, ACM’s rising debt levels pose a potential risk. Managing their debt effectively and maintaining financial stability will be crucial for sustainable growth.

Valuation Concerns: Although some believe ACM is undervalued, others argue the stock price already reflects its future potential, leaving limited room for significant upside. Thorough due diligence and valuation analysis are necessary before investing.

Execution Risk: Successfully turning their potential into actual results requires consistent execution of their growth strategies. Any missteps or delays in product development or market penetration could hinder their progress.

Geopolitical Uncertainties: Trade tensions and other geopolitical issues can disrupt supply chains and impact market sentiment, potentially affecting ACM’s operations and financials.

Macroeconomic Factors: Rising interest rates and inflation can impact business costs and consumer spending, indirectly affecting the semiconductor industry and ACM’s performance.

All analysts have a strong buy on the stock, and if the reversal does come, this stock should head higher, with the only concern being the exposure to China.