Executive Summary:

NerdWallet, founded in 2009, is a personal finance website and app aiming to empower users to make informed financial decisions. Their team of experts creates objective reviews, comparisons, and guides across various financial products like credit cards, loans, bank accounts, and more. They utilize helpful tools and calculators to simplify complex financial topics, all while maintaining user privacy and security. While NerdWallet doesn’t directly sell financial products, they earn money by promoting these products to their users through affiliate marketing. With over 5,000 deals on offer and personalized insights through account linking, NerdWallet strives to be your one-stop shop for navigating the world of personal finance.

Analysts currently expect them to report earnings per share (EPS) of $0.11 for the fiscal quarter ending December 2023, which would be slightly lower than the $0.12 reported for the same period last year.

Revenue is expected to come in around $138 million, marking a year-over-year decrease of approximately 3%.

Stock Overview:

| Ticker | $NRDS | Price | $15.00 | Market Cap | $1.14B |

| 52 Week High | $21.74 | 52 Week Low | $6.38 | Shares outstanding | 45.31M |

Company background:

NerdWallet, launched in 2009, is a financial website and app designed to empower users with knowledge and tools to make informed financial decisions. Founded by Tim Chen, Jake Gibson, and Jonathan Medved, the company has secured a whopping $1.3 billion in funding, solidifying its position in the fintech industry.

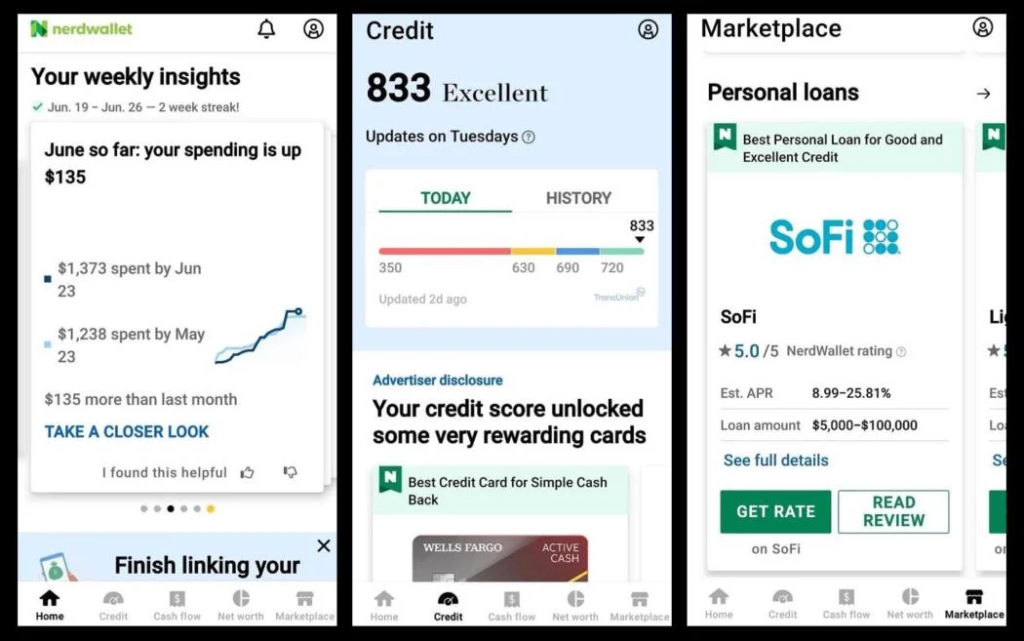

NerdWallet’s core offering is a comprehensive platform packed with valuable resources. Users can access insightful reviews, comparisons, and guides covering a wide range of financial products, including credit cards, loans, bank accounts, and investments. Interactive tools and calculators help simplify complex financial concepts, making them easier to understand and manage. Notably, NerdWallet prioritizes user privacy and security, ensuring information remains confidential.

They partner with various financial institutions, earning commissions when users sign up for products through their platform.

In terms of competition, NerdWallet faces established players like Credit Karma, Intuit, Bankrate, and The Motley Fool. However, NerdWallet distinguishes itself by focusing on unbiased and objective information, empowering users to make independent financial choices. Headquartered in San Francisco, California, NerdWallet has 770 employees.

Recent Earnings:

Revenue and Growth:

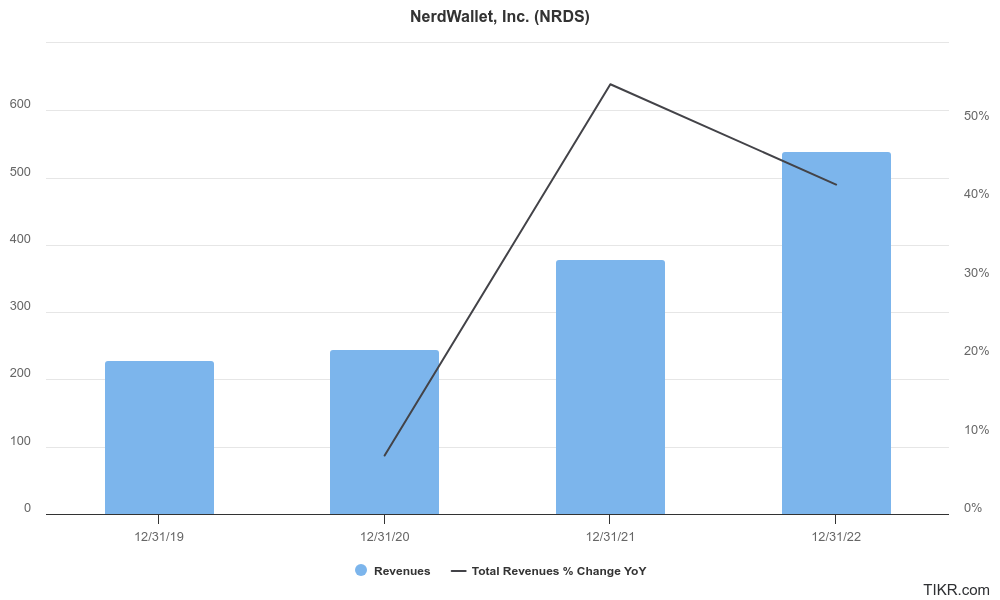

- Q3 2023 revenue reached $152.0 million, representing a 7% year-over-year increase.

- Full-year 2022 revenue reached $538.9 million, marking a 42% year-over-year rise.

EPS and Growth:

- Full-year 2022 diluted EPS was -$0.14, compared to -$0.79 in 2021. This reflected significant progress towards profitability.

Operational Metrics:

- NerdWallet reported strong growth in key operational metrics like monthly unique users (MUUs) and registered users.

- Q4 2022 saw an average of 23.2 million MUUs, up 7% year-over-year.

- Registered users grew to 14.0 million, representing an over 80% year-over-year increase.

Unique differentiation:

In the competitive landscape of personal finance, NerdWallet faces numerous challengers, each vying for user attention and market share. Here are some key competitors:

Direct Competitors:

- Intuit Credit Karma: A major player known for free credit scores and credit monitoring, Credit Karma also offers loan, insurance, and credit card comparisons. It leverages a freemium model with optional paid services, similar to NerdWallet’s affiliate marketing approach.

- Bankrate: A veteran with decades of experience, Bankrate provides comprehensive financial information, comparisons, and reviews. Their focus on traditional advertising differentiates them from NerdWallet’s affiliate model.

While NerdWallet faces stiff competition in the personal finance arena, it stands out through several key differentiators:

Focus on unbiased guidance: Unlike some competitors like Credit Karma, which prioritizes promoting their own financial products, NerdWallet emphasizes independent and objective information. This builds trust and credibility with users who seek genuine guidance, not just sales pitches.

Comprehensive content: NerdWallet goes beyond simple comparisons and reviews. They delve deeper with educational articles, explainer videos, and interactive tools, creating a more holistic learning experience for users.

Personalized approach: By integrating account linking and offering personalized recommendations, NerdWallet tailors its content and suggestions to individual financial situations. This sets them apart from generalized information offered by many competitors.

User-friendly platform: NerdWallet prioritizes a clean and intuitive interface, making it easy for users of all financial literacy levels to navigate and find the information they need.

Transparency and privacy: NerdWallet clearly discloses its revenue model through affiliate marketing and prioritizes user privacy, gaining trust over competitors who might leverage user data for targeted advertising.

Commitment to financial literacy: Beyond just offering tools and comparisons, NerdWallet actively promotes financial education through initiatives like their podcast and blog. This focus on empowering users sets them apart from competitors solely focused on transactions.

Management & Employees:

NerdWallet’s Leadership Team:

Executive Officers:

- Tim Chen: Chief Executive Officer and Chairman of the Board. Founded NerdWallet in 2009 and has led the company to its current success.

- Lauren StClair: Chief Financial Officer. Responsible for overseeing NerdWallet’s financial operations and strategy.

- Kevin Yuann: Chief Business Officer. Leads the company’s business development, partnerships, and marketing efforts.

Financials:

Revenue Growth: NerdWallet has experienced impressive revenue growth over the past five years. Between 2018 and 2022, their annual revenue nearly tripled, jumping from around $188 million to over $538 million. This translates to a compounded annual growth rate (CAGR) of approximately 36%. This growth can be attributed to several factors, including increasing user base, expansion of product offerings, and strategic partnerships.

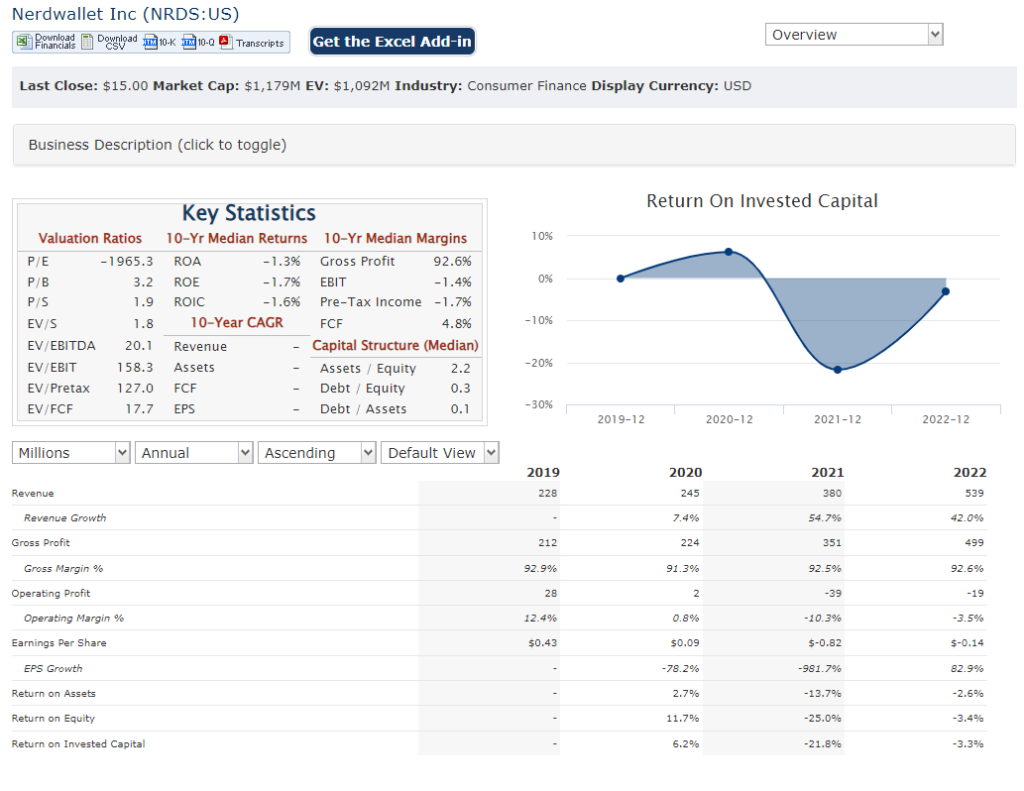

Earnings Growth: While NerdWallet’s revenue has grown significantly, their path to profitability has been gradual. In 2018, they reported a net loss of $83 million. However, by 2022, this loss had narrowed to $19 million. This translates to a CAGR of about -56% for net losses, indicating progress towards profitability despite not quite reaching it yet.

Balance Sheet: NerdWallet’s balance sheet reflects a company in a strong financial position. As of December 31, 2022, they held over $300 million in cash and equivalents and had minimal debt. This healthy financial position provides them with flexibility to invest in growth initiatives and weather market fluctuations.

Technical Analysis:

The monthly chart is trending up, as is the weekly chart – stage 2 markup phase. The stock has very low volume however, and has more than doubled since its low of $6 in Oct 2023. The stock is due for a pullback to $14 range (100 Day MA) with the RSI pointing downwards, and MACD flat to lower.

Bull Case:

Growth in personal finance market: The personal finance market is expected to continue growing driven by factors like increasing mobile banking adoption, rising demand for financial literacy, and a growing millennial and Gen Z demographic entering their prime earning years. This presents a large and expanding market opportunity for NerdWallet.

Strong brand and reputation: NerdWallet has established itself as a trusted source for unbiased and objective financial information. This strong brand and reputation attract users and partners, creating a competitive advantage.

Diversified revenue model: NerdWallet doesn’t rely solely on advertising. They utilize affiliate marketing, subscriptions, and other revenue streams, providing some buffer against economic downturns and fluctuations in any single revenue source.

Product expansion and innovation: NerdWallet continues to expand its product offerings, adding new features and tools to cater to a wider range of user needs. Their focus on innovation could help them attract and retain users in a competitive landscape.

Profitability potential: As NerdWallet’s user base and revenue grow, they are expected to reach profitability, further boosting investor confidence and stock price.

Strategic partnerships: Collaborations with major financial institutions and fintech players could expand NerdWallet’s reach and influence, driving user growth and potential acquisitions.

Valuation potential: Depending on future performance and market conditions, NerdWallet’s stock could be undervalued compared to its growth potential, offering investors an opportunity for capital appreciation.

Bear case:

Intense competition and AI replacement: The personal finance space is crowded with established players like Credit Karma, alongside nimble fintech startups. Maintaining market share and user engagement in this competitive landscape can be challenging, requiring constant innovation and differentiation. However, with AI chatbots such as Google Bard (Gemini) and ChatGPT helping users answer questions directly, the need for a comprehensive content solution based on affiliate marketing goes down.

Reliance on affiliate marketing: While it diversifies revenue streams, NerdWallet largely depends on affiliate marketing, which ties their income to partner performance and market fluctuations. A downturn in the financial services industry or changes in partner relationships could significantly impact their earnings.

Reaching profitability: Though showing progress, NerdWallet hasn’t reached consistent profitability yet. This raises concerns about their ability to generate long-term shareholder value, especially if market conditions deteriorate.

Acquisition risk: While potentially favorable for investors, NerdWallet could be an attractive acquisition target for larger financial institutions seeking to expand their digital offerings. This could limit shareholder value compared to organic growth potential.