Executive Summary:

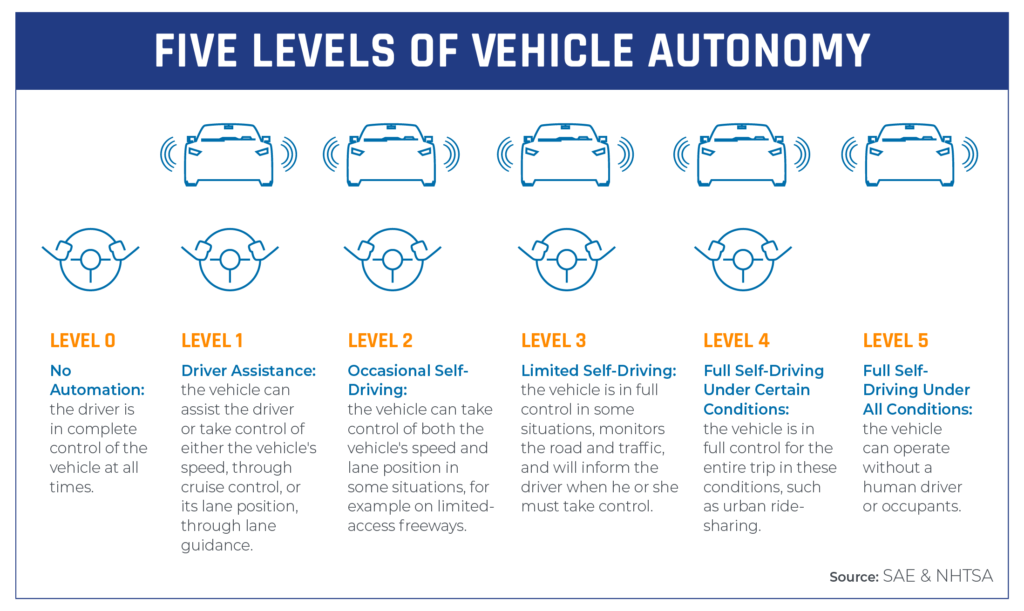

Luminar Technologies is an American company focused on creating lidar and machine perception technologies, primarily for self-driving cars. They’re motivated by a bold goal: saving 100 million lives and 100 trillion hours through improved automotive safety and autonomy. Their Iris lidar hardware and Sentinel software platform are designed to meet the requirements of Level 3 through 5 autonomous vehicles. Partnerships with companies like Nissan and acquisitions in the mapping and lidar production space highlight their strategic growth plans. With innovative technology and a clear mission, Luminar is a key player in the race towards safer and smarter transportation.

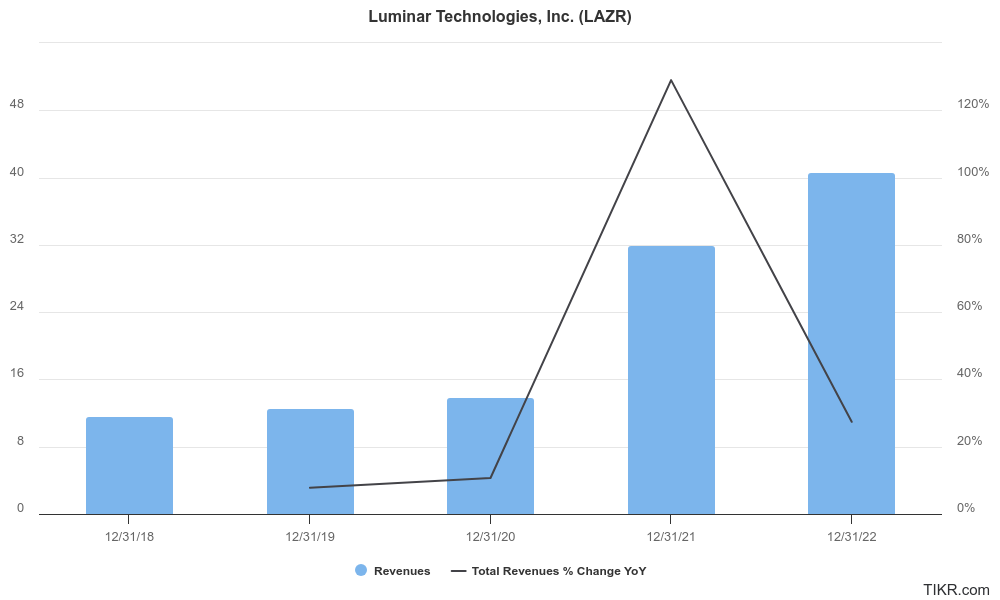

Luminar Technologies reported earnings of -$0.21 per share, beating the estimates of -$0.23 per share, which reflects a positive earnings surprise of 8.70%. In the quarter ending September 30, 2023, Luminar Technologies reported revenue of $17.0 million, up 33% YoY. The company has generated -$1.51 earnings per share over the last year, and earnings are expected to grow in the coming year, from -$1.38 to -$1.05 per share.

Stock Overview:

| Ticker | $LAZR | Price | $2.92 | Market Cap | $1.17B |

| 52 Week High | $10.55 | 52 Week Low | $2.09 | Shares outstanding | 304.86M |

Company background:

Luminar Technologies: Illuminating the Path to Autonomous Cars

Luminar Technologies, founded in 2012 by Austin Russell (CTO) and Jason Eichenholz (former CEO), is a pioneer in lidar technology for self-driving cars. Fueled by over $1.3 billion from investors like Volvo Cars, Daimler Trucks, and BlackRock, Luminar is poised to be a major player in the autonomous vehicle revolution.

Their core products are the Iris lidar sensor and the Sentinel software platform. Iris, known for its long-range perception and high resolution, acts as the “eyes” of self-driving cars, providing a detailed 3D map of the surrounding environment. Sentinel, the brain of the system, interprets the lidar data and makes critical decisions about the vehicle’s behavior. Together, they offer a comprehensive solution for autonomous driving applications.

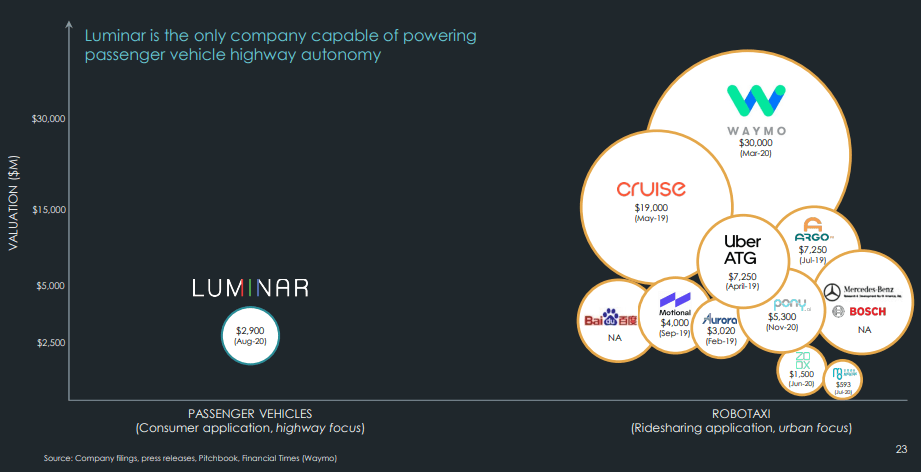

Luminar faces stiff competition from established players like Velodyne Lidar, Quanergy, and Innoviz Technologies. However, they differentiate themselves through their focus on chip-to-cloud integration, offering a more complete and scalable solution. Additionally, their strategic partnerships with automakers like Mercedes-Benz, Volvo, and Nissan give them a significant edge in integrating their technology into production vehicles.

Headquartered in Orlando, Florida, with a major office in Palo Alto, California, Luminar is not just developing technology; they are building an ecosystem for safe and efficient autonomous transportation. Their recent acquisition of Freedom Photonics, a lidar component manufacturer, underscores their commitment to vertical integration and cost reduction. With a clear vision, innovative technology, and strong partnerships, Luminar Technologies is a company to watch in the rapidly evolving autonomous vehicle landscape.

Recent Earnings:

- Analysts predict an EPS of -$0.30 for the Q4 2023 results, which would be a decrease compared to the previous quarter’s -$0.21. This suggests a potential loss widening.

- Revenue is forecasted to reach $21 million, representing a 23.5% increase year-over-year. This indicates continued growth, despite potential EPS decline.

- Operational metrics like gross margin and non-GAAP free cash flow have shown improvement in previous quarters, which could be a positive sign for future profitability.

The Market, Industry, and Competitors:

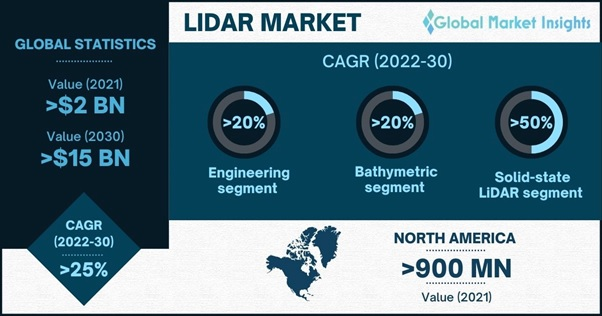

Luminar Technologies navigates the exciting yet challenging world of Lidar technology for self-driving cars. This market holds immense potential, fueled by the increasing demand for safer and more autonomous vehicles. Here’s a glimpse into its landscape and future prospects:

Market Landscape: The Lidar market for self-driving cars is currently in its early stages of growth, with various players vying for dominance. Luminar competes with established names like Velodyne Lidar, Quanergy, and Innoviz Technologies. However, Luminar differentiates itself through its chip-to-cloud approach, offering a more integrated and scalable solution. Additionally, strategic partnerships with automakers like Mercedes-Benz, Volvo, and Nissan give them a crucial edge in integrating their technology into production vehicles.

Growth Expectations: The future of this market appears bright. According to a McKinsey & Company report, the Lidar market for self-driving cars is expected to reach a staggering $2 billion by 2030. This translates to a compound annual growth rate (CAGR) of between 32.4% and 42.2%, with an average of 37.3%. These figures highlight the immense potential for growth within this industry.

Key Factors Driving Growth: Several factors are propelling this market forward. Firstly, the increasing focus on automotive safety and the potential for accident reduction through autonomous vehicles is a major driver. Secondly, government regulations and incentives aimed at promoting autonomous vehicle development are creating a supportive environment. Finally, advancements in artificial intelligence and sensor technology are making self-driving cars a more viable reality, further boosting market growth.

Unique differentiation:

Despite competition, Luminar holds several advantages:

- Technological Leadership: Their Iris lidar boasts superior performance and range compared to many competitors.

- Strategic Partnerships: Collaborations with major automakers provide valuable validation and potential sales channels.

- Chip-to-Cloud Integration: Their comprehensive software platform differentiates them from sensor-only providers.

Luminar Technologies stands out in the autonomous vehicle Lidar market with several unique differentiators:

Technological Leadership:

- High-Performance Lidar: Luminar’s Iris sensor boasts superior range, resolution, and field of view compared to many competitors. This translates to more accurate and detailed perception of the environment, crucial for safe and reliable autonomous driving.

- Solid-State Technology: Unlike some competitors relying on mechanical scanning, Luminar’s Lidar uses solid-state technology. This offers advantages like smaller size, lower cost, and improved reliability – key factors for mass adoption in vehicles.

Chip-to-Cloud Integration:

- Comprehensive Solution: Luminar goes beyond just offering a sensor. Their Sentinel software platform processes the lidar data and makes critical decisions, providing a complete solution for automakers. This simplifies integration and reduces development time.

- Data Infrastructure: Luminar is building a global lidar data infrastructure to support autonomous vehicles by enabling real-time high-definition mapping and localization. This could provide a valuable ecosystem for the industry.

Strategic Partnerships:

- Major Automaker Collaborations: Luminar has secured partnerships with renowned automakers like Mercedes-Benz, Volvo, and Nissan. This not only validates their technology but also provides a clear path to production vehicles and future revenue streams.

- Vertical Integration: The recent acquisition of Freedom Photonics, a lidar component manufacturer, signifies Luminar’s commitment to vertical integration. This could lead to cost reduction and control over key aspects of their technology.

Additional Differentiators:

- Focus on Safety: Luminar’s mission to save lives through improved automotive safety resonates with stakeholders and differentiates them from competitors solely focused on market share.

- Strong Leadership: Founder Austin Russell’s technical expertise and vision attract talent and inspire confidence in the company’s future.

Management & Employees:

Luminar Technologies boasts a leadership team with diverse expertise and a shared vision for revolutionizing transportation through lidar technology. Here’s a snapshot of the key players:

Executive Team:

- Austin Russell: Founder & CEO, a young visionary with deep technical expertise in photonics and a passion for safety. He brings entrepreneurial drive and strategic direction to the company.

- Tom Fennimore: Chief Financial Officer, with extensive experience in the automotive industry, navigating financial planning and growth strategies.

- Jason Eichenholz: Co-Founder & Chief Technology Officer, a laser and photonics pioneer holding numerous patents, responsible for leading R&D and bringing innovative technology to market.

- Alan Prescott: Chief Legal Officer, a seasoned legal professional providing expertise in corporate governance, compliance, and risk management.

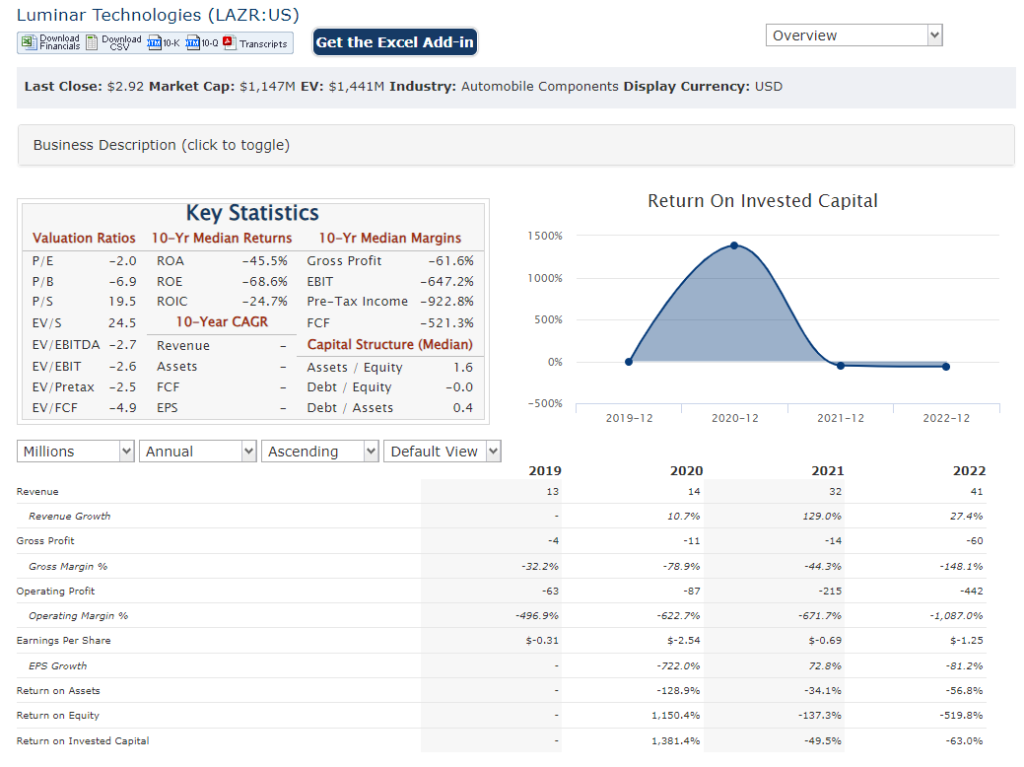

Financials:

Revenue Growth: Luminar has demonstrated impressive revenue growth since going public. In 2021, they generated $16.4 million, followed by a significant jump to $49.9 million in 2022, representing a remarkable 203% year-over-year increase. This upward trend reflects growing interest in lidar technology and Luminar’s strategic partnerships with major automakers.

Earnings Growth: While revenue has soared, Luminar is still in the early stages of commercialization and remains unprofitable. In 2021, they reported a net loss of $469.8 million, decreasing slightly to $455.5 million in 2022. This is primarily due to ongoing research and development expenses and investments in expanding their production capabilities. While the company hasn’t reached profitability yet, the significant decline in net losses hints at potential future improvements.

Balance Sheet: As of December 31, 2022, Luminar boasts a strong financial position with $2.28 billion in cash and cash equivalents, providing ample resources for further growth and investment. Their total debt remains relatively low at $68.2 million, demonstrating a healthy financial structure.

Technical Analysis:

We would not be buyers of $LAZR stock at this point. On the monthly chart, the stock is still range bound, on the weekly is still in decline and on the daily chart it is experiencing a bearish head and shoulders pattern. Of the many LIDAR companies, however this seems to have a better setup than $OUST and $INVZ.

Bull Case:

The Bull Case for Luminar Technologies Stock: Navigating the Autonomous Highway

Leading-Edge Technology: Luminar’s Iris lidar sensor boasts superior performance and range compared to many competitors. Their solid-state technology holds advantages in size, cost, and reliability, crucial for mass adoption in vehicles.

Strategic Partnerships: Collaborations with major automakers like Mercedes-Benz, Volvo, and Nissan validate their technology and provide clear paths to production vehicles and future revenue streams.

Comprehensive Solution: Unlike just offering a sensor, Luminar’s Sentinel software platform helps automakers with data processing and decision-making, simplifying integration and reducing development time.

Growing Lidar Market: The overall Lidar market for self-driving cars is expected to reach a staggering $2 billion by 2030, with a compound annual growth rate (CAGR) of 32.4% to 42.2%. This massive potential market size presents significant growth opportunities for Luminar.

Vertical Integration: The acquisition of Freedom Photonics signifies their commitment to cost reduction and control over key aspects of their technology, potentially improving margins and profitability in the long run.

Strong Leadership: Founder Austin Russell’s technical expertise and vision attract talent and instill confidence in the company’s future.

Focus on Safety: Luminar’s mission to save lives resonates with stakeholders and differentiates them from pure market share-driven competitors.

Healthy Financial Position: Strong cash reserves and low debt provide resources for continued investment and growth.

Potential Market Disruption: If self-driving car technology achieves widespread adoption, Luminar’s leadership position could translate into significant market share and profitability.

Regulatory Tailwinds: Increasing government support for autonomous vehicle development could accelerate industry growth and benefit Luminar.

Investor Optimism: Despite recent market fluctuations, analyst ratings still skew bullish, with an average price target significantly higher than the current share price.

First Mover Advantage: As a leader in solid-state Lidar technology, Luminar could establish a dominant position in the market if they maintain their technological edge.

Data Infrastructure Play: Building a global Lidar data infrastructure for real-time mapping and localization could create a valuable ecosystem beyond just selling sensors, opening up additional revenue streams.

Bear case:

The Bear Case for Luminar Technologies Stock: Braking on the Autonomous Road

Overvaluation: Despite lacking profitability, Luminar’s high price-to-sales ratio indicates a premium valuation based on future expectations that may not materialize.

Competition: Established players and emerging rivals pose a constant threat, and maintaining their technological edge could prove difficult in the long run.

Slow Path to Profitability: The company continues to burn cash through research and development, and the timeline for achieving profitability remains unclear, raising concerns for investors seeking short-term gains.

Regulatory Delays: Government regulations and safety standards for autonomous vehicles could evolve slower than anticipated, hindering market adoption and impacting Luminar’s revenue growth.

Technological Roadblocks: Technical hurdles and unforeseen challenges in scaling their technology for mass production could derail their progress and erode investor confidence.

Limited Partnerships: While major collaborations are a positive sign, their reliance on a few automakers creates dependence and exposes them to partner-specific risks.

Macroeconomic Headwinds: Rising interest rates and a potential economic slowdown could dampen investor sentiment and reduce funding opportunities for early-stage technology companies.

Valuation Correction: A broader market correction or sector-specific decline in autonomous vehicle enthusiasm could lead to a significant drop in Luminar’s stock price.

First Mover Disadvantage: While being first can offer advantages, being early also means navigating uncharted territory and bearing the cost of development, potentially benefiting later entrants who learn from their mistakes.

Data Privacy Concerns: Building a global Lidar data infrastructure raises concerns about data privacy and security, requiring careful navigation and potential regulatory scrutiny.

Execution Risk: Executing their ambitious plans flawlessly within a rapidly evolving landscape is crucial for success, and any missteps could erode investor confidence and hinder their progress.

Overoptimistic Market Forecasts: The projected size and growth rate of the Lidar market may be overly optimistic, leading to disappointment if reality falls short.