Executive Summary:

NextEra Energy, Inc. is a leading U.S. energy company headquartered in Juno Beach, Florida. With a generating capacity of approximately 58 GW, they are a major player in the energy sector. Their subsidiaries include Florida Power & Light, the largest electric utility in Florida, and NextEra Energy Resources, the world’s largest generator of renewable energy from wind and solar. NextEra Energy is committed to clean energy solutions and is a contributor to the development of renewable energy technologies.

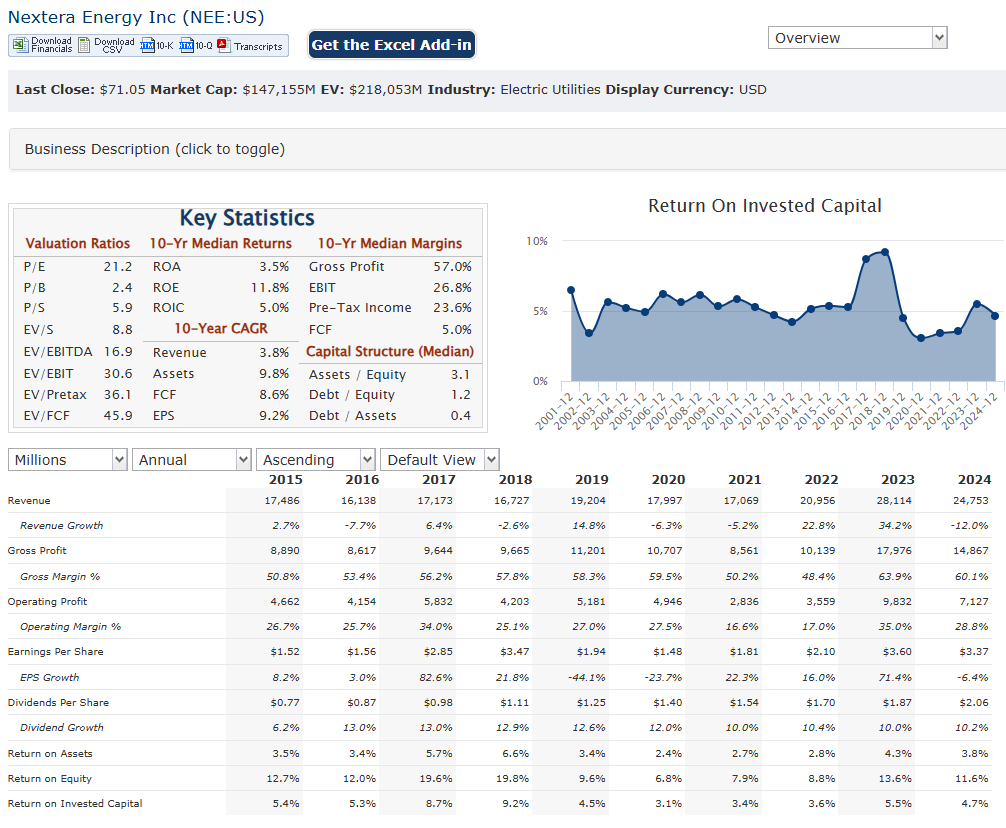

NextEra Energy, Inc. reported adjusted earnings per share (EPS) of $0.53, compared to $0.52 in the same quarter of the previous year. Full-year 2024 adjusted EPS was $3.43, up from $3.17 in 2023, representing year-over-year growth of approximately 8.2%.

Stock Overview:

| Ticker | $NEE | Price | $71.05 | Market Cap | $146.11B |

| 52 Week High | $86.10 | 52 Week Low | $53.95 | Shares outstanding | 2.06B |

Company background:

NextEra Energy, Inc. is a leading American energy company headquartered in Juno Beach, Florida. With a generating capacity of approximately 58 GW, they are a major player in the energy sector. NextEra Energy is committed to clean energy solutions and is a significant contributor to the development of renewable energy technologies.

NextEra Energy’s roots trace back to the Florida Power & Light Company, which was founded in 1925. While the company’s origins are in traditional energy generation, it has undergone a significant transformation in recent decades, driven by a commitment to clean energy and sustainability. NextEra Energy is recognized as a leader in renewable energy, with a vast portfolio of wind and solar projects across the United States and Canada.

NextEra Energy’s core business revolves around electricity generation, transmission, and distribution. They serve millions of customers in Florida through Florida Power & Light, providing reliable and affordable electricity. NextEra Energy Resources, their competitive clean energy business, develops, constructs, and operates renewable energy projects, supplying power to utilities and other customers across the country.

NextEra Energy faces competition from other major energy companies, including traditional utilities and renewable energy developers. Some of their key competitors include Duke Energy, Southern Company, and Exelon Corporation.

NextEra Energy’s commitment to sustainability and clean energy has earned them recognition as a leader in corporate responsibility. The company has set ambitious goals for reducing emissions and increasing its renewable energy capacity.

Recent Earnings:

NextEra Energy reported adjusted earnings per share (EPS) of $3.43, a healthy 8.2% increase compared to $3.17 in 2023. This growth was driven by strong performance in their Florida Power & Light (FPL) subsidiary and continued expansion in their renewable energy business, NextEra Energy Resources. The fourth quarter of 2024 saw adjusted EPS of $0.53, only slightly higher than the $0.52 reported in the same quarter of the previous year.

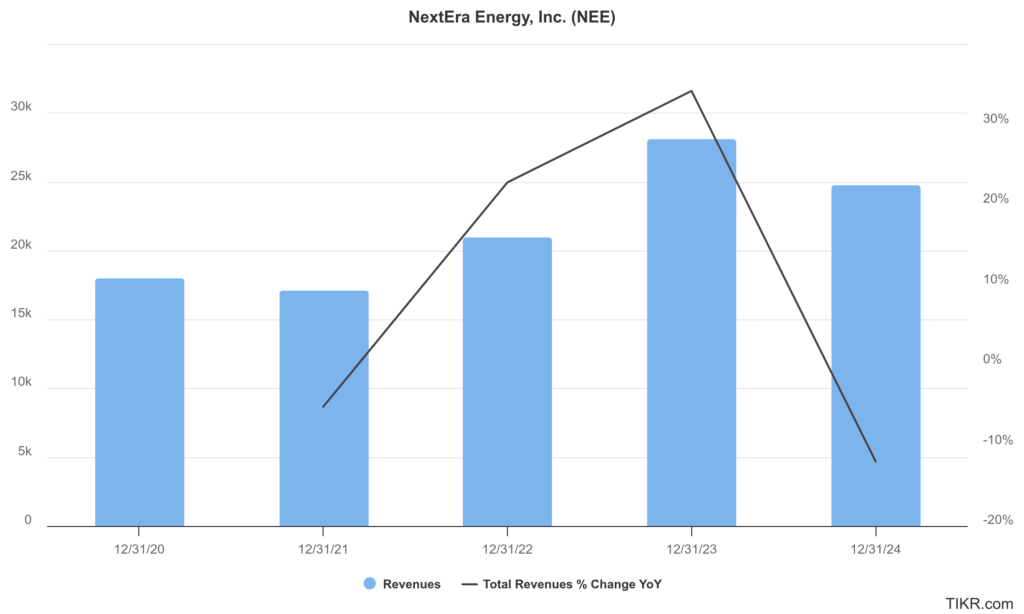

Revenue with a 21.69% year-over-year decrease to $5.38 billion. The company cited factors such as lower regulatory recoveries at FPL and decreased energy sales at NextEra Energy Resources as contributing to the revenue drop.

NextEra Energy Resources added over 12 GW of new renewables and battery storage projects to its backlog, demonstrating its commitment to clean energy expansion. The company also highlighted the progress made in its FPL segment, with continued investments in infrastructure and modernization efforts. NextEra Energy reaffirmed its long-term financial expectations, projecting adjusted EPS in the range of $3.45 to $3.70 for 2025, with further growth expected in 2026 and 2027.

The Market, Industry, and Competitors:

NextEra Energy Inc operates primarily in the utilities sector, focusing on regulated electric services and renewable energy generation. Its subsidiaries include Florida Power & Light (FPL), which is the largest rate-regulated utility in Florida, serving nearly 6 million customer accounts and contributing about 70% of the company’s operating earnings. The other segment, NextEra Energy Resources (NEER), is a leading generator of renewable energy, producing electricity from wind and solar sources across the United States and Canada, with a total generation capacity exceeding 34 gigawatts.

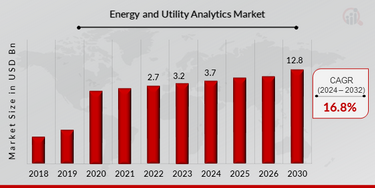

NextEra Energy aims to capitalize on the anticipated 38% increase in U.S. power demand over the next two decades, driven by factors such as industrial electrification and advancements in technology. The company is positioned to grow its renewable energy and storage capacity, with expectations of adding approximately 375-450 gigawatts of renewables and storage by 2030. The adjusted EBITDA is projected to grow at a CAGR of about 16-17% from 2023 to 2030, while NextEra expects its adjusted earnings per share (EPS) to grow by 6-8% annually during this period.

Unique differentiation:

NextEra Energy operates in a highly competitive energy market, facing challenges from both traditional utilities and other renewable energy developers. Some of their main competitors include established players like Duke Energy and Southern Company, which are large, diversified utilities with significant operations in electricity generation, transmission, and distribution.

NextEra Energy faces competition from companies like Iberdrola, a global renewable energy giant with a strong presence in wind power, and Enel Green Power, another major international player with a diverse portfolio of renewable energy projects. These companies are actively developing and acquiring renewable energy projects, competing with NextEra Energy for new opportunities and market share. The competitive pressures in the energy market are intense, driving companies like NextEra Energy to innovate, improve efficiency, and expand their renewable energy offerings to maintain their leadership position.

Financial Strength and Scale: As a Fortune 200 company, NextEra Energy possesses significant financial resources and scale. This allows them to fund large-scale renewable energy projects, invest in advanced technologies, and pursue strategic acquisitions, giving them a competitive edge over smaller players.

Vertically Integrated Operations: NextEra Energy has a vertically integrated business model, with operations spanning electricity generation, transmission, and distribution. This provides them with greater control over their operations and allows them to optimize efficiency and cost-effectiveness across the value chain.

Financials:

NextEra Energy Inc has reported total revenues of approximately $24.75 billion, reflecting a notable increase from $19.2 billion in 2020. This growth trajectory corresponds to a compound annual growth rate (CAGR) of about 6.3%. The company’s regulated utility segment, Florida Power & Light (FPL), has been a contributor to this revenue increase, benefiting from rising customer demand and regulatory capital investments.

NextEra Energy’s adjusted earnings per share (EPS) rose from $1.36 in 2020 to approximately $1.51 in 2024, indicating a CAGR of around 2.7% during this timeframe. The company’s net income attributable to NextEra Energy was reported at $3.118 billion for 2024 compared to $2.757 billion in 2023, showcasing a year-over-year increase that underscores its operational efficiency and successful project origination efforts in renewable energy resources.

NextEra’s total assets amounting to approximately $100 billion as of the end of 2024, supported by liquidity and access to capital markets for future growth initiatives. The company reported net available liquidity of about $12 billion, providing it with ample resources to fund its ambitious expansion plans in renewable energy and infrastructure projects.

Technical Analysis:

The stock is on a stage 4 decline on the monthly chart (Bearish). The weekly chart is more bearish with a head and shoulders pattern and stage 4 decline (which seems to be recovering). The daily chart has another head and shoulders pattern forming which is negative and a move to the support at $66 is more likely in the short term.

Bull Case:

Dominant Position in Renewable Energy: NextEra Energy is the world’s largest generator of renewable energy from wind and solar, positioning it perfectly to capitalize on the global shift towards clean energy. As demand for renewable energy continues to rise, NextEra is poised to benefit significantly.

Continued Growth in Renewable Energy Capacity: NextEra Energy has a massive and growing backlog of renewable energy projects, ensuring a strong pipeline of future growth. Their commitment to investing in and developing new renewable energy projects signals their dedication to staying ahead of the curve.

ESG Leadership: NextEra Energy’s strong commitment to environmental, social, and governance (ESG) principles aligns with the growing focus on sustainability among investors. This can attract investors who prioritize ESG factors in their investment decisions.

Bear Case:

Regulatory and Political Risks: The energy sector is heavily regulated, and changes in government policies or regulations could negatively impact NextEra Energy’s operations and profitability. This includes potential changes to renewable energy incentives or policies related to utility operations.

Interest Rate Sensitivity: As a capital-intensive business, NextEra Energy relies on debt financing for its projects. Rising interest rates could increase borrowing costs, making it more expensive to fund new projects and potentially impacting profitability.

Weather-Related Risks: NextEra Energy’s operations, particularly its Florida Power & Light subsidiary, can be impacted by severe weather events such as hurricanes. These events can cause significant damage to infrastructure and disrupt operations, leading to increased costs and reduced revenue.