DraftKings Inc. $DKNG is a leading digital sports entertainment and gaming company headquartered in Boston, Massachusetts. Founded in 2012 by Jason Robins, Matt Kalish, and Paul Liberman, the company began as a daily fantasy sports (DFS) platform and has since expanded into online sports betting and iGaming. DraftKings operates across multiple U.S. states, offering a range of products including DFS contests, sportsbook, and online casino games. The company went public in April 2020 through a reverse merger with Diamond Eagle Acquisition Corp. and SBTech, a gaming technology provider. Today, DraftKings is recognized for its innovative approach to digital sports entertainment and its commitment to responsible gaming.

Recent Earnings Overview

On May 8, 2025, DraftKings reported its Q1 2025 earnings. The company posted a revenue of $1.409 billion, marking a 20% year-over-year increase but falling short of the consensus estimate of $1.456 billion. Earnings per share (EPS) came in at -$0.07, aligning with analyst expectations. Notably, the net loss narrowed significantly to $33.86 million from $142.57 million in the same quarter the previous year, indicating improved operational efficiency. Monthly Unique Payers (MUPs) grew by 28% to 4.3 million, showcasing strong customer engagement. The company revised its fiscal year 2025 revenue guidance to a range of $6.2 billion to $6.4 billion, down from the previous estimate of $6.3 billion to $6.6 billion, reflecting a more cautious outlook amid competitive pressures.

Company Background and Evolution

DraftKings was established in 2012 by Jason Robins, Matt Kalish, and Paul Liberman in Watertown, Massachusetts. The trio aimed to revolutionize fantasy sports by introducing daily fantasy sports contests, allowing users to participate in shorter-duration games with immediate results. The company’s innovative approach quickly gained traction, leading to rapid growth and expansion. In April 2020, DraftKings went public through a reverse merger with Diamond Eagle Acquisition Corp. and SBTech, positioning itself as a vertically integrated sports betting and gaming company. This strategic move enabled DraftKings to offer a comprehensive suite of products, including sportsbook and online casino games, leveraging SBTech’s technology platform.

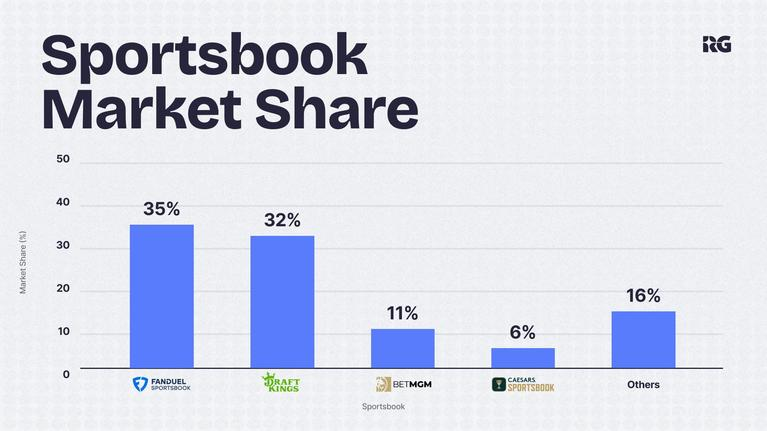

Headquartered in Boston, Massachusetts, DraftKings has expanded its operations across multiple U.S. states, capitalizing on the legalization of sports betting and online gaming. The company’s product offerings include daily fantasy sports contests, a mobile and online sportsbook, and iGaming platforms featuring casino games. DraftKings’ primary competitors in the U.S. market include FanDuel, BetMGM, and Caesars Entertainment, each vying for market share in the rapidly growing online sports betting and gaming industry.

Market Landscape and Growth Projections

The global sports betting market is experiencing significant growth, driven by regulatory changes, technological advancements, and increasing consumer interest. According to Grand View Research, the market is projected to reach $187.39 billion by 2030, growing at a compound annual growth rate (CAGR) of 11% from 2025. In the U.S., the online sports betting market is estimated at $53.78 billion in 2025 and is expected to grow to $93.31 billion by 2030, reflecting a CAGR of 11.65%.

This growth is fueled by the increasing legalization of sports betting across U.S. states, the proliferation of mobile betting platforms, and the integration of advanced technologies such as artificial intelligence and data analytics to enhance user experience. DraftKings, with its strong brand recognition and comprehensive product offerings, is well-positioned to capitalize on these market trends and expand its footprint in the evolving digital sports entertainment landscape.

Competitive Landscape

DraftKings operates in a highly competitive market, with key players including FanDuel, BetMGM, and Caesars Entertainment. FanDuel, owned by Flutter Entertainment, holds a significant market share in the U.S. online sports betting industry, leveraging its extensive customer base and diversified product offerings. BetMGM, a joint venture between MGM Resorts International and Entain, has established a strong presence through strategic partnerships and a robust rewards program. Caesars Entertainment, with its acquisition of William Hill, has expanded its digital gaming operations, integrating its extensive casino network with online platforms.

Despite the intense competition, DraftKings differentiates itself through its vertically integrated technology platform, innovative product offerings, and strong brand loyalty. The company’s focus on user engagement, personalized experiences, and responsible gaming practices contributes to its competitive advantage in the dynamic online gaming industry.

Unique Differentiation

DraftKings’ unique differentiation lies in its vertically integrated technology stack, which enables the company to control the end-to-end user experience, from platform development to customer engagement. This integration allows for rapid innovation, seamless product updates, and personalized offerings tailored to user preferences. Additionally, DraftKings’ early entry into the daily fantasy sports market provided a substantial user base and brand recognition, facilitating its expansion into sportsbook and iGaming. The company’s commitment to responsible gaming and data-driven strategies further enhances its position as a leader in the digital sports entertainment industry.

Management Team

- Jason Robins: Co-founder and Chief Executive Officer, Jason Robins has led DraftKings since its inception in 2012. Under his leadership, the company has evolved from a daily fantasy sports platform to a comprehensive digital sports entertainment and gaming company.

- Alan Ellingson: Appointed as Chief Financial Officer in May 2024, Alan Ellingson oversees DraftKings’ financial strategy and operations. He previously served as Senior Vice President of Finance and Analytics, contributing to the company’s financial planning and analysis functions.

- Matt Kalish: Co-founder and President of DraftKings North America, Matt Kalish plays a pivotal role in the company’s strategic initiatives and market expansion efforts across the continent.

Financial Performance Overview

Over the past five years, DraftKings has demonstrated robust revenue growth, reflecting its successful expansion and market penetration. The company’s revenue increased from $614.53 million in 2020 to $4.768 billion in 2024, representing a five-year CAGR of approximately 60.39%. This growth trajectory underscores DraftKings’ ability to scale its operations and capture market share in the burgeoning online gaming industry.

Despite consistent revenue growth, DraftKings has yet to achieve profitability, reporting a net loss of $33.86 million in Q1 2025. However, the company’s net loss has narrowed significantly from previous years, indicating progress toward financial sustainability. DraftKings continues to invest in customer acquisition, technology development, and market expansion, which are critical components of its long-term growth strategy.

The company’s balance sheet reflects a strong liquidity position, enabling it to fund strategic initiatives and navigate the competitive landscape. DraftKings’ focus on operational efficiency and cost management is expected to contribute to improved margins and eventual profitability as the company scales its operations and capitalizes on market opportunities.

Bull Case for DraftKings Stock

- Market Leadership: DraftKings holds a significant market share in the U.S. online sports betting and iGaming industry, positioning it as a leader in a rapidly growing market.

- Robust Revenue Growth: The company has demonstrated strong revenue growth over the past five years, with a five-year CAGR of approximately 60.39%, indicating successful market expansion and customer acquisition.

- Technological Innovation: DraftKings’ vertically integrated technology platform allows for rapid innovation and personalized user experiences, providing a competitive edge in the digital gaming industry.

Bear Case for DraftKings Stock

- Profitability Challenges: Despite revenue growth, DraftKings has yet to achieve profitability, with ongoing investments in customer acquisition and technology development impacting margins.

- Regulatory Risks: The online gaming industry is subject to complex and evolving regulations, which could impact DraftKings’ operations and expansion efforts.

- Intense Competition: The market is highly competitive, with major players like FanDuel, BetMGM, and Caesars Entertainment vying for market share, potentially affecting DraftKings’ growth prospects.

The stock is in a stage 4 markdown on the monthly and weekly charts but is showing signs of a stage 1 consolidation and reversal on the daily chart. The near term price action should consolidate in the $31 to $39 zone and then head higher.