Carvana Co. (NYSE: CVNA), founded in 2012 and headquartered in Tempe, Arizona, is a leading e-commerce platform for buying and selling used cars online, best known for its car vending machines and touchless delivery model. For full-year 2024, Carvana reported revenues of approximately $15.2 billion, reflecting a strong recovery with ~26% year-over-year growth after prior years of operational struggles and financial restructuring. Its main competitors include CarMax, Vroom, and Shift Technologies, all vying for a share of the online used car market.

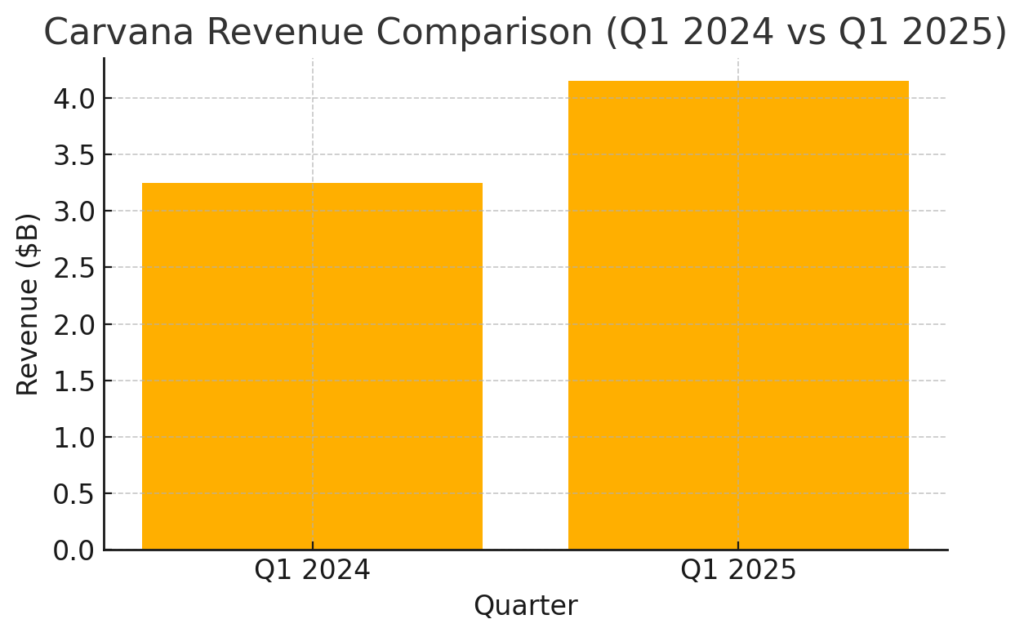

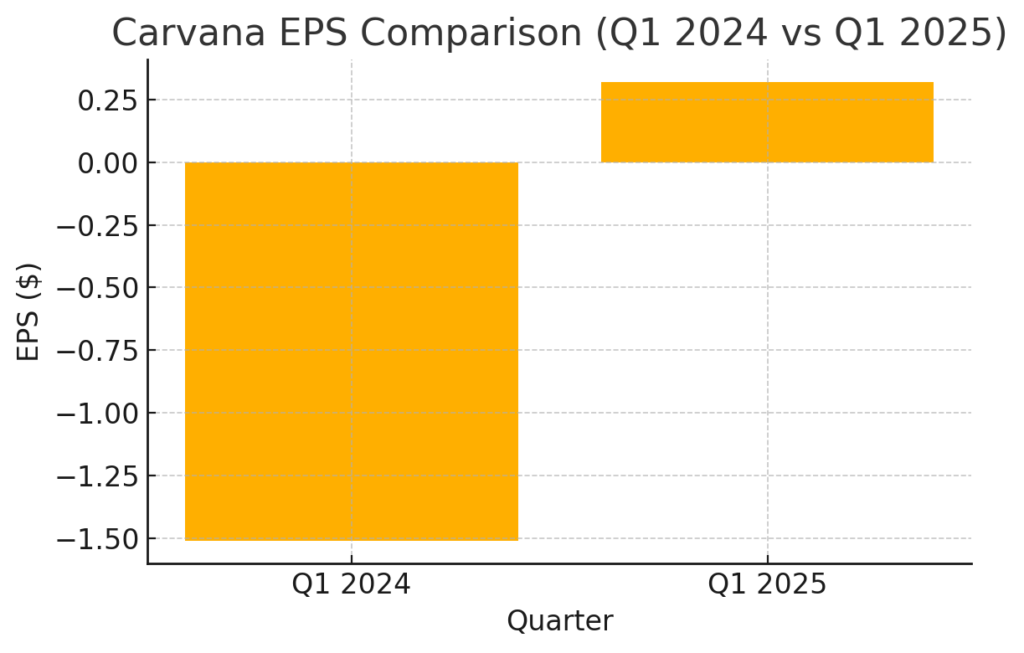

In its most recent Q1 2025 earnings, Carvana reported revenues of $4.15 billion, up 28% from $3.25 billion in Q1 2024, beating analyst expectations of $4 billion. Notably, the company delivered net income of $70 million, a dramatic turnaround from the $286 million loss a year ago, translating to EPS of $0.32 compared to a loss per share of $1.51 last year. This marked Carvana’s third consecutive profitable quarter, driven by higher retail unit sales, improved gross profit per unit, and tight cost controls.

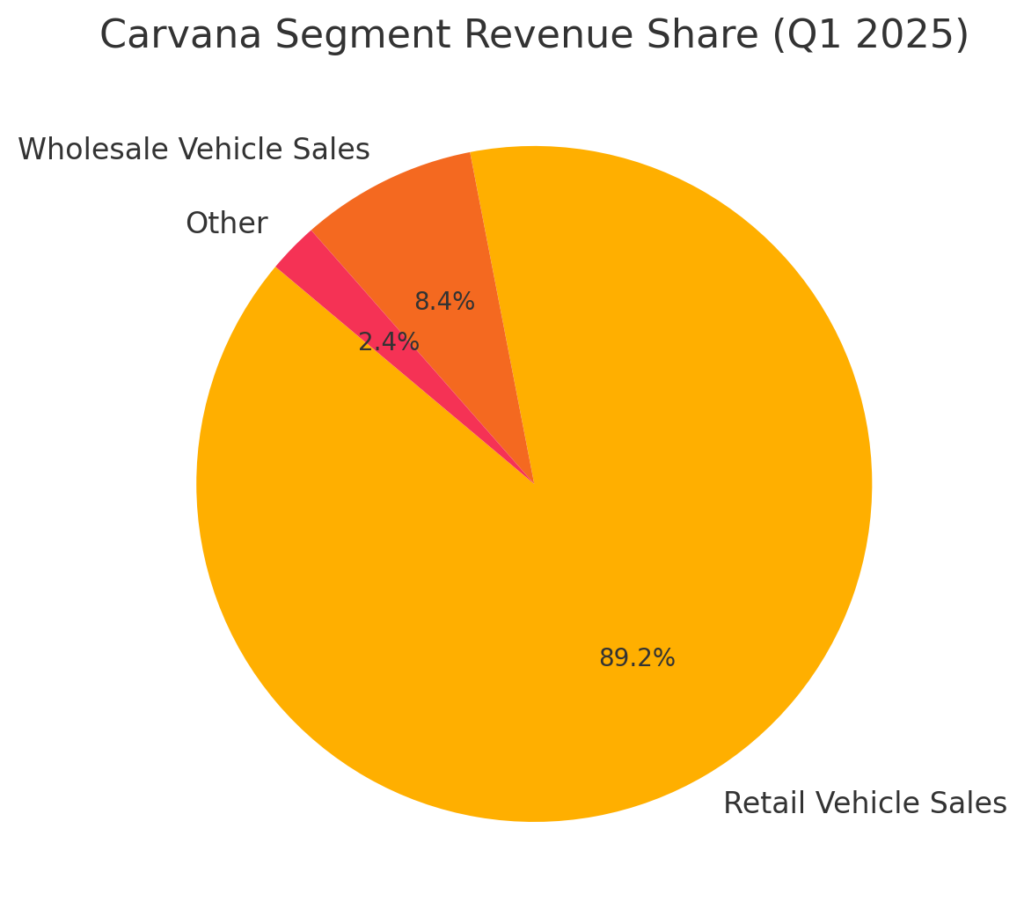

By segment, Carvana generated $3.7 billion from retail vehicle sales (about 89% of total revenue), growing 26% year-over-year, while wholesale vehicle sales contributed $350 million, up 35%. Other revenues, including financing and ancillary products, came in at $100 million, up 22%. The focus on higher-margin units and better sourcing efficiency significantly improved overall profitability metrics.

For the next quarter, Carvana guided for revenues between $4.25 billion and $4.35 billion, implying ~25% year-over-year growth, and reaffirmed its commitment to positive adjusted EBITDA margins for the full year. Management raised its full-year 2025 outlook, forecasting revenues over $17 billion and continued profitability, citing strong demand, stable used car pricing, and improved operational leverage as key drivers.

Carvana’s stock has skyrocketed ~112% year-to-date, fueled by investor optimism over its turnaround story and the return to profitability. Following the Q1 earnings release, shares surged an additional 11% in after-hours trading, reflecting the market’s enthusiasm over the earnings beat, positive cash flow, and stronger-than-expected guidance. The stock has now recaptured much of the ground lost during its 2022-2023 downturn.

CEO Ernie Garcia III highlighted that the company’s biggest achievement this quarter was its operational efficiency gains — specifically, reducing SG&A expenses per unit sold and expanding gross profit per unit to record levels. Garcia emphasized that “disciplined growth, not just top-line growth,” will be the focus going forward, as Carvana aims to sustain profitability and cash generation in a highly competitive market.

Revenue Comparison:

Q1 2025 vs Q1 2024

| Quarter | Revenue ($B) |

|---|---|

| Q1 2024 | 3.25 |

| Q1 2025 | 4.15 |

EPS Comparison:

Q1 2025 vs Q1 2024

| Quarter | EPS ($) |

|---|---|

| Q1 2024 | -1.51 |

| Q1 2025 | 0.32 |

Segment Revenue

- Retail Vehicle Sales: $3.7B (~89%)

- Wholesale Vehicle Sales: $350M (~8%)

- Other (Financing & Ancillary): $100M (~3%)

Segment Revenue

| Segment | Revenue ($B) |

|---|---|

| Retail Vehicle Sales | 3.7 |

| Wholesale Vehicle Sales | 0.35 |

| Other | 0.10 |

The cup and handle on the monthly chart and the stage 3 bullish markup on the weekly chart is supported by a stage 2 markup on the daily chart as well. This stock should head up back to $300 range.