Coupang Inc. $CPNG is a South Korean e-commerce company known for its rapid delivery services and comprehensive online retail platform. Founded in 2010 by Bom Kim, the company has evolved into one of South Korea’s largest online retailers, offering a wide range of products from groceries to electronics. Coupang’s commitment to customer satisfaction is evident in its “Rocket Delivery” service, which guarantees same-day or next-day delivery for millions of items. The company has also expanded its services to include food delivery, video streaming, and fintech solutions, aiming to become a one-stop-shop for consumers. Headquartered in Seoul, Korea, Coupang continues to innovate and expand its footprint in the Asian market.

Company Background and Growth

Coupang was established in 2010 by Bom Kim, a Harvard dropout who envisioned transforming the e-commerce landscape in South Korea. Initially starting as a daily deals platform, the company quickly pivoted to a full-fledged online marketplace. Significant investments from global firms like SoftBank, which invested $1 billion in 2015, fueled Coupang’s rapid expansion. The company’s innovative logistics network, including its “Rocket Delivery” service, set new standards for delivery speed and reliability in the region.

Market Landscape and Growth Projections

South Korea’s e-commerce market is one of the most advanced globally, with a high internet penetration rate and a tech-savvy population. The B2C e-commerce market in South Korea is projected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030, reaching approximately $204.2 billion by 2030. This growth is driven by increasing consumer demand for convenience, a wide variety of products, and rapid delivery.

In addition to e-commerce, the Buy Now, Pay Later (BNPL) sector in South Korea is experiencing significant growth.The BNPL market is expected to grow at a CAGR of 10.1% from 2025 to 2030, reaching $6.94 billion by the end of the forecast period. Coupang’s entry into fintech services positions it well to capitalize on this emerging trend, offering integrated payment solutions to its vast customer base.

Competitive Landscape

Coupang operates in a highly competitive environment, facing challenges from both domestic and international players.In South Korea, competitors include 11st.co.kr, SSG.com, and Naver Shopping, each offering unique value propositions to consumers. Internationally, companies like Alibaba, JD.com, and PDD Holdings are expanding their presence in the Asian market, intensifying competition. Despite this, Coupang’s robust logistics network and customer-centric approach provide a competitive edge

Differentiation and Strategic Advantages

Coupang’s primary differentiation lies in its unparalleled delivery infrastructure. The company’s “Rocket Delivery” service guarantees same-day or next-day delivery for millions of items, a feat achieved through its extensive network of fulfillment centers and last-mile delivery capabilities. This commitment to rapid delivery enhances customer satisfaction and loyalty. Additionally, Coupang’s integrated ecosystem, encompassing e-commerce, food delivery, streaming, and fintech, creates a seamless user experience that is difficult for competitors to replicate.

Leadership Team

Bom Kim serves as the Chief Executive Officer and Chairman of the Board at Coupang. As the founder, Kim has been instrumental in shaping the company’s vision and strategic direction. Gaurav Anand holds the position of Chief Financial Officer, bringing extensive experience in financial management and operations. Another key executive is Harold Rogers, who serves as the General Counsel and Chief Administrative Officer, overseeing legal and administrative functions within the company.

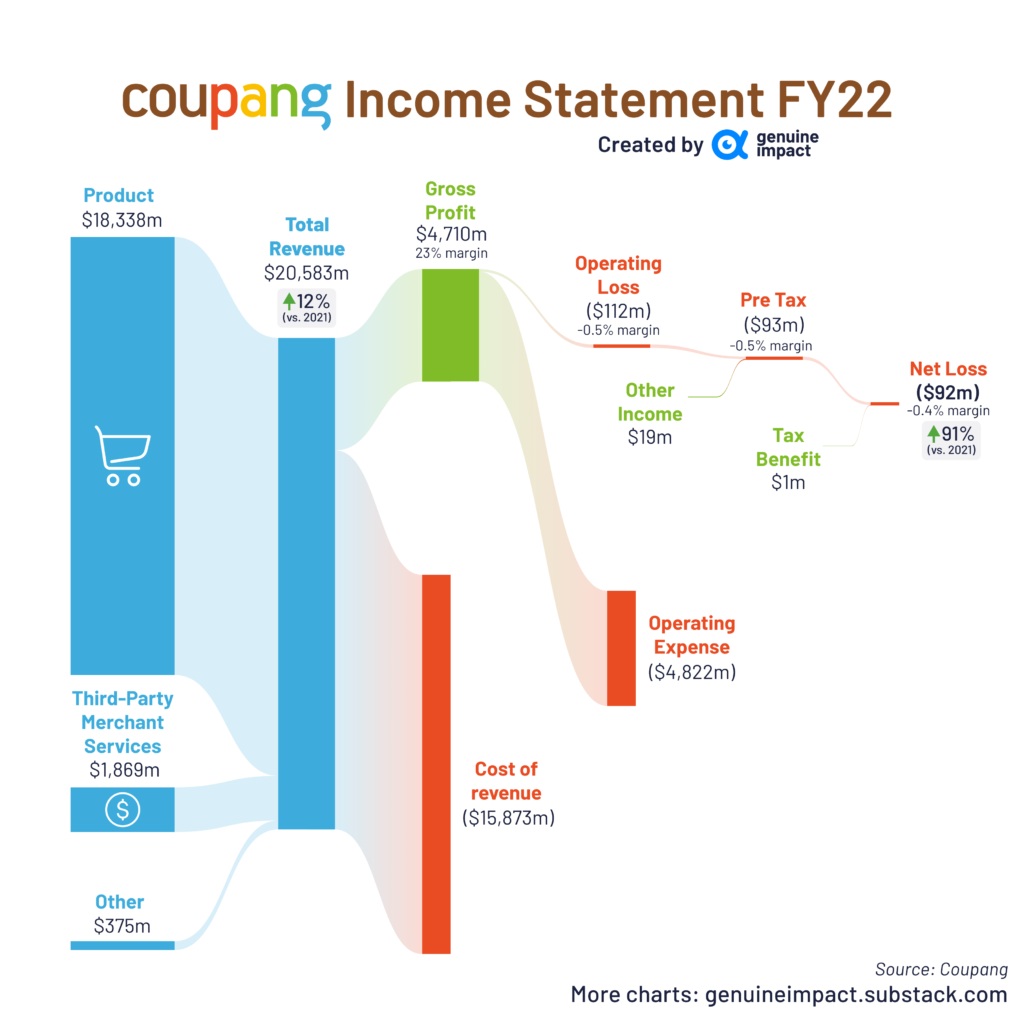

Financial Performance Overview

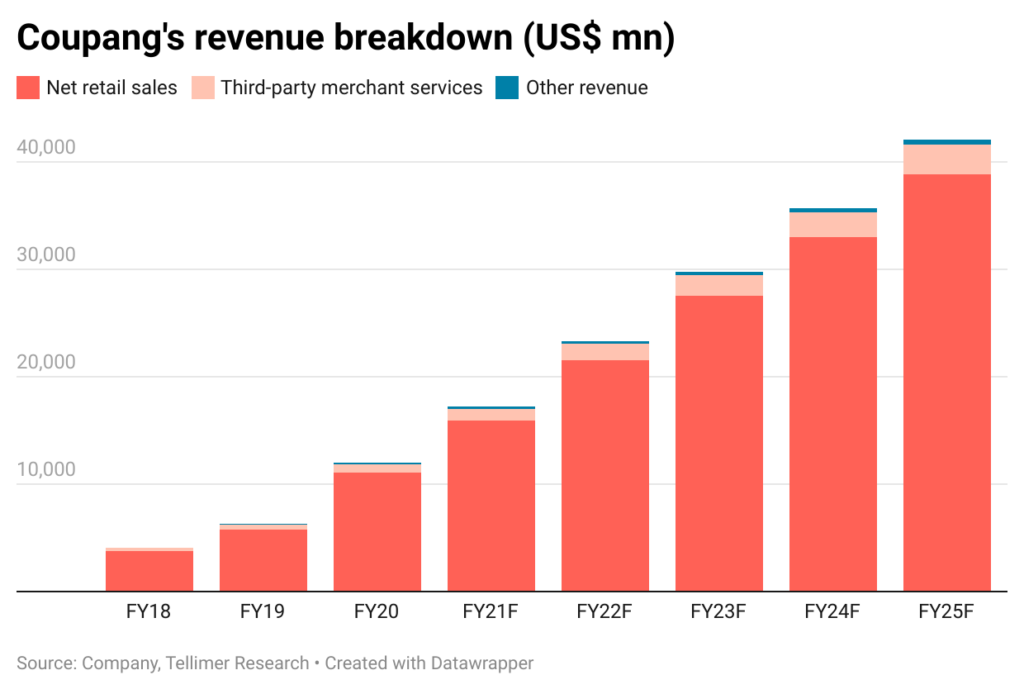

Over the past five years, Coupang has demonstrated impressive financial growth. The company’s revenue increased from $11.97 billion in 2020 to $30.27 billion in 2024, reflecting a CAGR of approximately 26%. This growth is attributed to the expansion of its product offerings and customer base.

Coupang’s gross profit also saw significant improvement, rising from $1.99 billion in 2020 to $8.83 billion in 2024. This indicates enhanced operational efficiency and cost management. The company’s operating income turned positive in recent years, reaching $563 million in 2024, showcasing a successful transition towards profitability.

On the balance sheet, Coupang maintains a healthy financial position with total assets of $15.3 billion and total liabilities of $11.2 billion as of the latest reporting period. The company’s debt-to-equity ratio stands at 36.7%, and it holds cash and short-term investments amounting to $5.9 billion, providing ample liquidity for future investments and operations.

Bull Case for Coupang Stock

- Dominant market position in South Korea with a strong brand and customer loyalty.

- Robust logistics and delivery infrastructure that sets industry standards.

- Diversified service offerings, including e-commerce, food delivery, streaming, and fintech, creating multiple revenue streams.

Bear Case for Coupang Stock

Potential regulatory challenges and market saturation in South Korea may limit growth.

Intense competition from both domestic and international players could pressure margins.

High capital expenditures required to maintain and expand logistics infrastructure.

Coupang Inc. $CPNG reported its Q1 2025 earnings, showcasing solid growth in key financial metrics. The company achieved net revenues of $7.91 billion, marking an 11% year-over-year increase on a reported basis and a 21% rise on a constant currency basis. While this revenue figure fell slightly short of the consensus estimate of $8.02 billion,Coupang’s diluted earnings per share (EPS) stood at $0.06, surpassing the expected $0.05 and improving from $0.00 in the same quarter last year. Net income attributable to Coupang stockholders reached $107 million, a significant increase from $5 million in Q1 2024. Adjusted EBITDA also saw a notable rise, climbing 36% year-over-year to $382 million, with a margin expansion of 88 basis points to 4.8%

Breaking down the revenues by segments, the Product Commerce segment generated $6.87 billion, up 6% year-over-year on a reported basis and 16% on a constant currency basis. This segment’s gross profit increased by 17% to $2.15 billion, with a gross profit margin of 31.3%, up over 300 basis points from the previous year. Adjusted EBITDA for Product Commerce was $550 million, reflecting an 18% increase year-over-year. The Developing Offerings segment, encompassing international operations, Eats, Play, Fintech, and Farfetch, reported revenues of $1.04 billion, a substantial 67% year-over-year growth. Although this segment still operates at a loss, the adjusted EBITDA improved by $18 million year-over-year to negative $168 million, indicating progress toward profitability.

Looking ahead, Coupang has not provided specific revenue or EPS guidance for the next quarter or the full year.However, the company continues to focus on expanding its customer base and enhancing operational efficiencies. The active customer count in the Product Commerce segment grew by 9% year-over-year to 23.4 million, demonstrating continued market penetration. Coupang’s strategic initiatives, including investments in technology and process innovation, are expected to support long-term growth and margin expansion.

In terms of stock performance, Coupang’s shares closed at $24.00 on May 6, 2025, reflecting a modest increase of 0.04% for the day. Year-to-date, the stock has gained approximately 9.19%, indicating positive investor sentiment. Following the earnings release, the stock experienced some volatility in after-hours trading, which is common as investors digest the new financial information.

The stock is in a stage 1 consolidation stage on all 3 timeframes (monthly, weekly and daily). We are not yet looking for a position until it breaks out of the $30 range.