Executive Summary:

Enphase Energy Inc. is a global energy technology company and the world’s leading supplier of microinverter-based solar and energy storage systems. Enphase’s microinverter systems convert energy at the individual solar module level, offering superior performance and safety compared to traditional string inverters. The company also provides energy storage solutions and a comprehensive energy management platform.

Enphase Energy Inc. reported an EPS of $0.65, which fell short of analysts’ consensus estimates of $0.77. This represents a miss of $0.12 per share. The company’s quarterly revenue was $380.90 million, also below analysts’ expectations of $392.51 million.

Stock Overview:

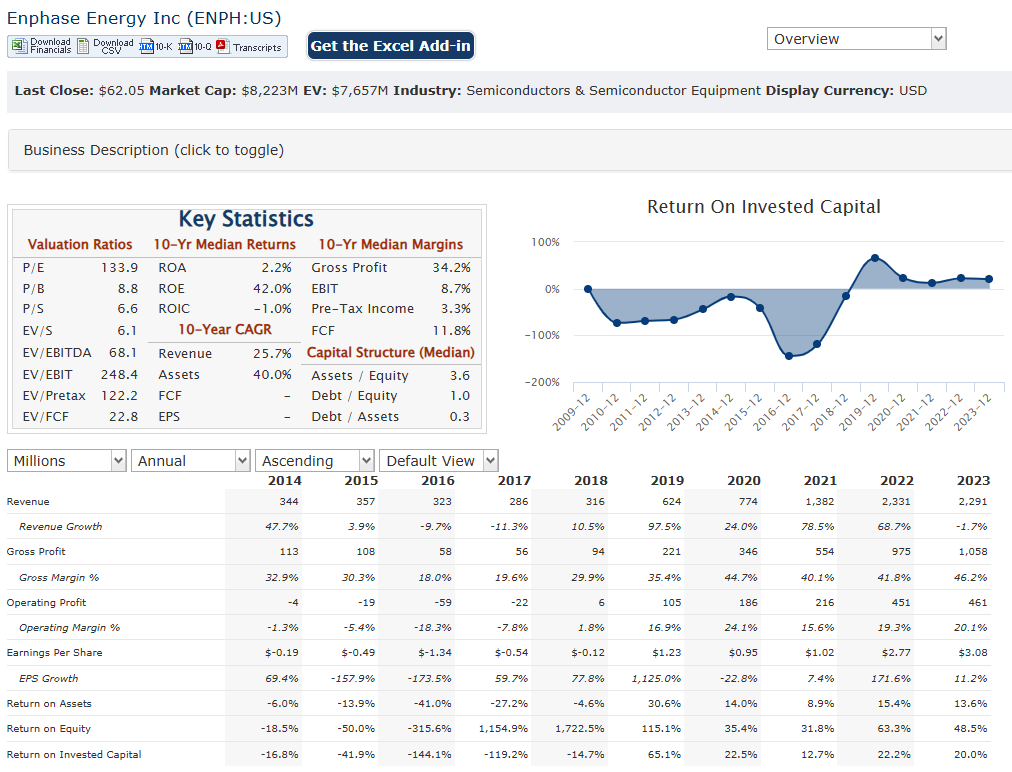

| Ticker | $ENPH | Price | $62.05 | Market Cap | $8.38B |

| 52 Week High | $141.63 | 52 Week Low | $58.33 | Shares outstanding | 135.11M |

Company background:

Enphase Energy, founded in 2006 by Raghu Belur and Martin Fornage, revolutionized the solar industry with its microinverter technology. Belur and Fornage, both experienced engineers, recognized the limitations of traditional string inverters and sought to improve energy harvest, reliability, and safety in solar installations. This approach maximizes energy production, even if some panels are shaded or malfunctioning, and eliminates the single point of failure inherent in string inverter systems.

Initially funded through venture capital, Enphase quickly gained traction due to the clear advantages of its microinverter technology. This funding enabled the company to scale its operations, expand its product line, and establish a global presence. Beyond microinverters, Enphase offers a comprehensive suite of energy management solutions, including battery storage systems and software platforms. These products allow homeowners and businesses to not only generate solar power but also store and manage their energy consumption effectively, moving towards greater energy independence.

Enphase’s key products include their IQ microinverters, which are integrated with individual solar panels, and their IQ Battery systems, which provide energy storage capabilities. They also offer the Enphase Energy System, a comprehensive solution that combines solar generation, battery storage, and energy management software. This integrated approach simplifies installation and provides users with a complete view of their energy ecosystem. The company’s primary competitors include companies like SolarEdge Technologies, which also offers power optimizer technology, and traditional string inverter manufacturers.

Enphase Energy is headquartered in Fremont, California, in the heart of Silicon Valley. This location places them at the center of technological innovation, allowing them to attract top talent and maintain a competitive edge in the rapidly evolving energy sector. Their focus on innovation and commitment to sustainable energy solutions positions them as a key player in the global transition to cleaner energy sources.

Recent Earnings:

Enphase Energy Inc. recently reported its revenue of $380.9 million, which, while representing an increase from the previous quarter, fell short of analysts’ expectations and showed a decline compared to the same period last year. This revenue reflects a 43% increase in US revenue driven by higher shipments as inventory levels normalized, but also a 15% decrease in European revenue due to softening demand.

Enphase reported $0.65 per diluted share, also missing analyst estimates. The company’s non-GAAP gross margin, including the net IRA benefit, was 48.1%, slightly up from the previous quarter. Excluding the IRA benefit, the non-GAAP gross margin decreased, indicating some pressure on profitability.

Enphase shipped approximately 1.7 million microinverters and 172.9 megawatt-hours of IQ Batteries during the quarter. The company highlighted its progress in introducing new products, such as higher domestic content microinverters for the US market and expanding into new geographical markets. They also emphasized their commitment to innovation, with plans to pilot fourth-generation battery technology.

Looking forward, Enphase provided revenue guidance for the fourth quarter of 2024, projecting a range of $360 million to $400 million. The company expects its gross margin to remain relatively stable, with the non-GAAP gross margin, including the IRA benefit, projected to be in the range of 49% to 52%. Enphase’s management expressed optimism about the long-term growth prospects of the solar and energy storage markets, citing factors such as potential interest rate cuts, ITC adders, and rising power prices.

The Market, Industry, and Competitors:

Enphase Energy, Inc. operates primarily in the renewable energy sector, focusing on the design and manufacture of advanced solar solutions, particularly microinverters, which convert solar energy into usable electricity for residential and commercial applications. The company has established a strong market presence, with approximately 64.1% of its net sales coming from the United States, while also expanding its footprint in international markets like Europe and Asia-Pacific. This growth is driven by increasing adoption of solar technology, favorable government policies promoting renewable energy, and rising consumer awareness regarding sustainable energy solutions.

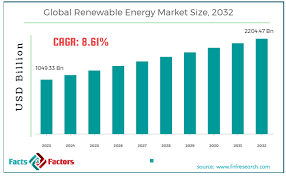

The global renewable energy market is projected to reach $1.99 trillion, growing at a CAGR of 8.6%. Enphase Energy is well-positioned to capitalize on this growth, with analysts forecasting a robust revenue increase of around 35.93% year-over-year despite potential economic headwinds. The company’s strategic acquisitions and product innovations, such as integrating EV charging solutions and enhancing its microinverter technology, are expected to contribute significantly to its growth trajectory. The microinverter market alone is anticipated to grow from $2.4 billion in 2020 to $13.5 billion by 2030, reflecting a CAGR of 19.7%, which underscores the demand for Enphase’s products in the evolving energy landscape.

Unique differentiation:

Enphase Energy faces competition from a variety of companies in the solar and energy storage markets. One of their primary competitors is SolarEdge Technologies, which offers a similar technology with power optimizers that work at the module level. While both companies aim to maximize energy harvest and system reliability, they employ different approaches. SolarEdge’s power optimizers work in conjunction with a central inverter, whereas Enphase’s microinverters operate independently at each solar panel. This difference in architecture leads to varying performance characteristics and cost structures.

Beyond SolarEdge, Enphase also competes with traditional string inverter manufacturers. These companies offer more cost-effective solutions for simpler solar installations where shading and panel mismatch are not significant concerns. Enphase faces competition from other energy storage providers, including companies specializing in battery technology and those offering integrated energy storage solutions. Enphase will need to continue innovating and expanding its product offerings to maintain its competitive edge.

Microinverter Technology: This is arguably Enphase’s biggest strength. Unlike traditional string inverters, Enphase’s microinverters are installed on each individual solar panel.

- Increased Energy Production: If one panel is shaded or malfunctioning, it doesn’t affect the output of the other panels in the system.

- Improved Reliability: The system is more resilient as there’s no single point of failure like with a central string inverter.

- Enhanced Safety: Microinverters operate at lower voltages, reducing the risk of electrical fires.

Integrated Energy Storage Solutions: Enphase offers a complete ecosystem of energy solutions, including their IQ Battery systems. This allows customers to seamlessly integrate solar generation with battery storage and manage their energy consumption effectively.

Comprehensive Energy Management Platform: Enphase provides a user-friendly app that allows customers to monitor their system’s performance, track energy production and consumption, and control their energy storage. This level of visibility and control is a key differentiator.

Management & Employees:

Badri Kothandaraman: As President and CEO, Kothandaraman leads the company’s overall strategy and execution. He has been with Enphase since 2010 and has played a crucial role in its growth and success.

Raghu Belur: Co-founder and Chief Products Officer, Belur is a technology visionary and has been instrumental in developing Enphase’s innovative microinverter technology.

Martin Fornage: Also a co-founder, Fornage focuses on advanced technologies at Enphase. He brings extensive experience in electronics design and has been crucial in developing the company’s power train and communication systems.

Financials:

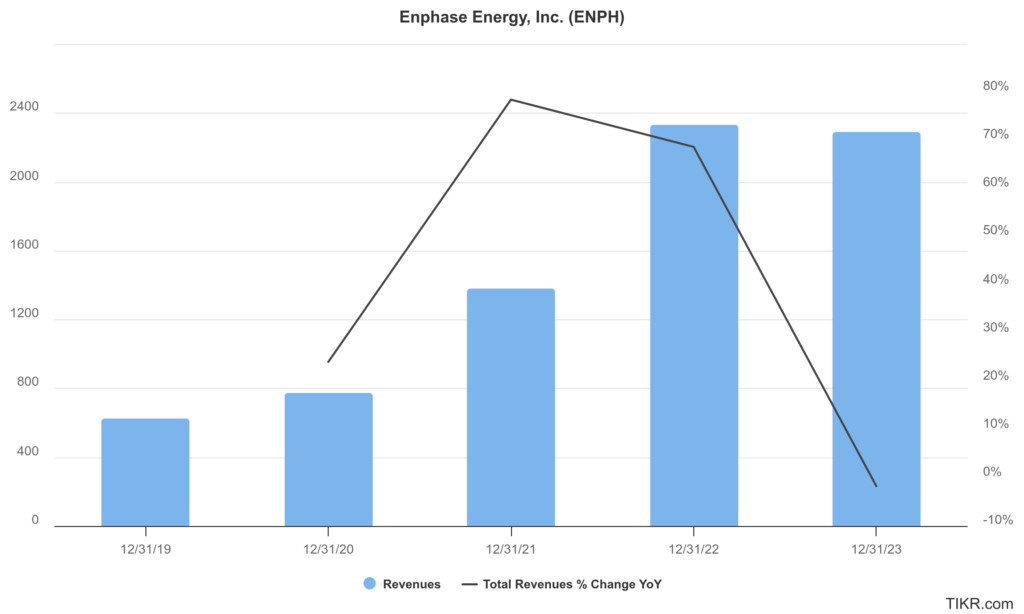

Enphase Energy, Inc. has reported net sales of approximately $624.3 million, which surged to $2.331 billion in 2022, reflecting a remarkable compound annual growth rate (CAGR) of 78.46% during this period. Dropping to $2.291 billion, marking a decrease of 1.72% from the previous year. The company is projected to rebound with an anticipated revenue of $1.695 billion in 2024 and further growth to $2.007 billion by 2026.

The company’s net income fluctuated over the years, starting from about $116.7 million in 2019 and peaking at $153.8 million in 2022 before settling at approximately $146.9 million in 2023. The overall CAGR for net income from 2019 to 2023 stands at around 7.76%, showcasing resilience despite the recent revenue challenges. The EBITDA reflect similar trends, with an increase from $116.8 million in 2019 to $723.8 million in 2022, followed by a slight increase to $749 million in 2023.

The company transitioned from a net debt of -$146 million in 2019 to a peak net debt of -$322 million in 2022, indicating a robust cash position relative to its liabilities. By the end of 2023, Enphase’s net debt was reported at approximately -$401 million, highlighting its ability to sustain operations without reliance on external financing.

The company’s strategic focus on innovation and market expansion positions it well for continued success as it aims to capitalize on the increasing demand for solar energy solutions.

Technical Analysis:

The stock is in a stage 4 markdown (bearish) on the monthly chart, in a range, stage 3 neutral, on the weekly chart, and stage 4 markdown (bearish) on the daily chart. The near term move is likely to the lower end of 53, where a bounce might be in.

Bull Case:

Continued Strong Demand for Solar and Energy Storage: The global transition to clean energy is accelerating, driving significant demand for solar and energy storage solutions. Enphase, a leading provider of these technologies, is well-positioned to benefit from this trend. Government incentives, decreasing costs of solar and battery systems, and increasing consumer awareness of environmental issues are all contributing to this growth.

Favorable Industry Trends: Several industry trends support the bull case for Enphase. These include the increasing adoption of distributed generation, the rise of microgrids, and the growing demand for energy independence. Enphase’s solutions are well-suited to address these trends, positioning the company for long-term growth.

Bear Case:

Dependence on Incentives and Regulations: Government incentives and regulations heavily influence The renewable energy industry. Changes in these policies, such as reductions in subsidies or unfavorable changes to net metering policies, could negatively impact demand for Enphase’s products.

Supply Chain Disruptions: Like many other companies, Enphase has faced supply chain challenges in the past. Continued disruptions could impact the company’s ability to meet demand and could lead to increased costs.

Geopolitical Risks: Enphase operates in a global market, and geopolitical events, such as trade tensions or political instability, could negatively impact its business.