Executive Summary:

Carrier Global Corporation is a leading provider of heating, ventilation, air conditioning (HVAC), and refrigeration systems, building automation, and fire and security technologies. The company’s products encompass a wide range of solutions, including furnaces, air conditioners, heat pumps, ductless systems, refrigeration equipment, boilers, indoor air quality products, compressors, and refrigeration equipment. Carrier offers its products to various markets, such as food retail, residential, industrial, and commercial market, pharmaceuticals, food service, and transportation sectors.

Stock Overview:

| Ticker | $CARR | Price | $69.77 | Market Cap | $62.6B |

| 52 Week High | $83.32 | 52 Week Low | $53.13 | Shares outstanding | 897.23M |

Company background:

Carrier Global Corp is a global provider of intelligent climate and energy solutions. Its product portfolio includes heating, ventilation, air conditioning (HVAC), refrigeration, fire, and security technologies. The company serves residential, commercial, industrial, and transportation customers worldwide. Carrier’s products are designed to improve energy efficiency, enhance indoor air quality, and contribute to a more sustainable future.

The company was founded in 1915 by Willis Carrier, an American engineer. It was acquired by United Technologies in 1979 and spun off as an independent company in 2020. Carrier is headquartered in Palm Beach Gardens, Florida, and has over 52,000 employees in 160 countries.

Carrier’s key competitors include Johnson Controls, Daikin Industries, Ingersoll Rand, and Trane Technologies. Their products are used in a variety of applications, including commercial buildings, data centers, food and beverage facilities, and transportation. The company also provides a range of services, including installation, maintenance, and repair.

Carrier is committed to innovation and sustainability. The company has a number of research and development centers around the world and is constantly developing new products and technologies to meet the evolving needs of its customers.

Recent Earnings:

Carrier Global Corp recently reported revenue surged 21.4% year-over-year to $5.98 billion, driven by robust organic growth across all segments and the contribution from the recently acquired Viessmann Climate Solutions. This outpaced analyst estimates of $5.82 billion.

Adjusted EPS reached $0.53, a substantial increase from $0.32 in the prior-year period. This beat the consensus analyst estimate of $0.50. The strong EPS performance was attributed to higher revenues, improved operating margins, and lower share count.

Order backlog remained strong, indicating healthy demand for the company’s products and services. The company also highlighted progress in its strategic initiatives, such as the integration of Viessmann and the expansion of its digital offerings.

The company expects adjusted EPS to be in the range of $2.70 to $2.80, implying a significant year-over-year increase. This guidance reflects the company’s confidence in its ability to capitalize on favorable market conditions and execute its growth strategy.

The Market, Industry, and Competitors:

Carrier Global Corp operates in the global climate and energy solutions market, which encompasses a wide range of products and services, including heating, ventilation, air conditioning (HVAC), refrigeration, fire, and security technologies. The company serves a diverse customer base across various sectors, including residential, commercial, industrial, and transportation.

The global climate and energy solutions market is expected to exhibit significant growth in the coming years, driven by factors such as increasing urbanization, rising energy costs, and growing concerns about climate change. The global HVAC market is projected to grow at a CAGR of around 5-6% from 2023 to 2028. This growth is expected to be driven by factors such as rising demand for energy-efficient solutions, increasing adoption of smart technologies, and growing demand for indoor air quality solutions.

Carrier Global Corp is well-positioned to capitalize on the growth opportunities in this market. Carrier is investing heavily in research and development to develop innovative and sustainable solutions that meet the evolving needs of its customers.

Unique differentiation:

Johnson Controls: A global leader in building technologies, Johnson Controls offers a comprehensive range of HVAC, building automation, and fire safety products and services.

Daikin Industries: A Japanese multinational corporation known for its high-quality HVAC and refrigeration systems, Daikin is a major competitor in both residential and commercial markets.

Trane Technologies: A leading global provider of climate control and building services solutions, Trane Technologies competes with Carrier across various market segments.

Ingersoll Rand: A diversified industrial company with a strong presence in the climate control market, Ingersoll Rand offers a range of HVAC and refrigeration products.

Comprehensive Product Portfolio: Carrier offers a wide range of products and services across various segments, providing customers with a one-stop shop for their climate and energy needs.

Global Reach and Scale: With a presence in over 160 countries, Carrier has a significant global reach and scale, allowing it to serve customers worldwide and leverage its resources effectively.

Focus on Sustainability: Carrier is committed to developing and delivering sustainable solutions that help customers reduce their environmental impact and achieve their sustainability goals.

Management & Employees:

- Patrick Goris, Senior Vice President and Chief Financial Officer

- Ajay Agrawal, Senior Vice President of Global Services, Business Development, and Strategy

- Thomas Heim, President of Residential and Light Commercial HVAC EMEA

- Saif Siddiqui, President of HVAC APAC

- Hakan Yilmaz, Senior Vice President of Technology and Sustainability

Financials:

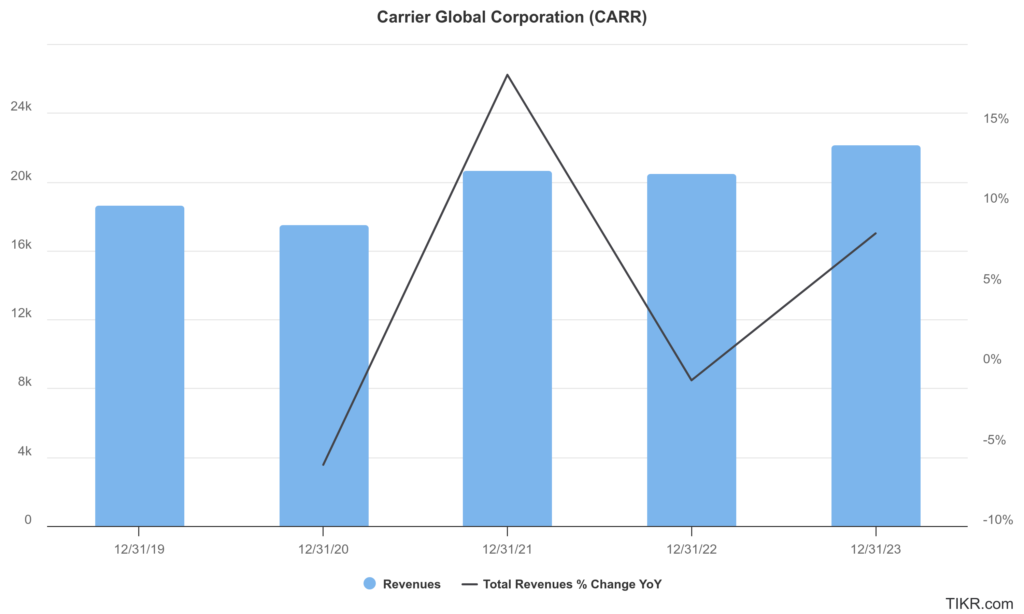

Carrier Global Corporation has reported total sales of approximately $22.1 billion, reflecting an 8% increase from 2022, driven by a 3% organic growth rate. This upward trajectory in revenue is part of a broader trend, as the company has experienced a compound annual growth rate (CAGR) in revenue of about 6%. This consistent growth can be attributed to Carrier’s strategic focus on expanding its product offerings and enhancing operational efficiencies, particularly in its HVAC and refrigeration segments.

With GAAP earnings per share (EPS) increasing to $1.58 in 2023, which represents a significant gain of 53% compared to the previous year. Adjusted EPS for the same period was reported at $2.73, up 33% year-over-year. Carrier has achieved a CAGR in net income of approximately 12%, showcasing its ability to not only grow revenues but also improve profitability through effective cost management and operational improvements.

The company reported net cash flows from operating activities of $2.6 billion in 2023, with free cash flow reaching $2.1 billion, marking a substantial increase of 49% from the prior year. This strong cash generation capability has allowed Carrier to invest in strategic initiatives while also returning capital to shareholders through share repurchases and dividends. The company’s commitment to disciplined capital allocation is evident in its increased share repurchase authorization to $4.7 billion as of late 2024.

Carrier’s outlook remains positive as it continues to focus on its core business areas while navigating portfolio transformations. The expected completion of divestitures and continued investment in high-growth segments are anticipated to further enhance its financial performance. Carrier is well-positioned to capitalize on future market opportunities and deliver sustained shareholder value.

Technical Analysis:

The stock is on a decline stage 4 markdown in the monthly and weekly charts. The daily chart is in stage 3 consolidation (neutral) and looks like it is reversing, but the outlook for the stock is not great with a move to $60-$65 more likely in the near term.

Bull Case:

- Focus on Sustainability: Carrier’s commitment to developing and delivering sustainable solutions aligns with the growing demand for energy-efficient and environmentally friendly technologies. This focus can enhance the company’s reputation and attract environmentally conscious customers.

- Strategic Acquisitions: Carrier’s acquisition of Viessmann Climate Solutions expands its product portfolio and geographic reach, providing new growth opportunities. The successful integration of Viessmann and other strategic acquisitions can significantly enhance Carrier’s market position.

Bear Case:

- Supply Chain Disruptions: Ongoing supply chain disruptions could impact the availability of critical components, potentially leading to production delays and higher costs.

- Integration Risks: The successful integration of recent acquisitions, such as Viessmann Climate Solutions, is crucial for long-term growth. Integration challenges could disrupt operations, impact profitability, and create unforeseen costs.

- Regulatory and Policy Changes: Changes in government regulations and policies related to energy efficiency, emissions, and environmental standards could impact Carrier’s product offerings and operating costs.