Executive Summary:

NOV Inc is formerly known as National Oilwell Varco, is a major player in the global oil and gas industry. NOV supplies equipment and components used throughout the oil and gas drilling process, from wellbore technologies to drilling rigs. They operate across the world and are known for their commitment to providing safe and efficient solutions for energy production.

Stock Overview:

| Ticker | $NOV | Price | $17.88 | Market Cap | $7.07B |

| 52 Week High | $21.91 | 52 Week Low | $16.78 | Shares outstanding | 395.5M |

Company background:

NOV Inc was founded in 1862 with two of its predecessors, Oilwell Supply and National Supply. These companies, focused on pumps and derricks, eventually merged in 1987 to form National Oilwell. Varco, the other half of NOV, has its origins in 1908. After various acquisitions and mergers, National Oilwell and Varco joined forces in 2005 to create National Oilwell Varco, later shortened to NOV Inc. in 2020.

NOV Inc. is a global leader in oil and gas equipment and services. Headquartered in Houston, Texas, they employ over 27,000 people worldwide. Their core business revolves around providing equipment and components for every stage of oil and gas drilling and production. They are known for their expertise, advanced equipment, and focus on operational efficiency.

NOV faces competition from other major oilfield service companies like Schlumberger, Halliburton, and Baker Hughes.

Recent Earnings:

NOV Inc. Analysts predict earnings per share (EPS) to be $0.35, which would be a slight decrease compared to the $0.39 reported for the same quarter in the previous year.

The Market, Industry, and Competitors:

NOV Inc. market is cyclical, experiencing booms and busts depending on oil prices and global demand. Currently, there’s a push for renewable energy sources, which could dampen long-term demand for oil and gas. However, oil is still a crucial part of the global energy mix, and NOV is positioned to benefit from any resurgence in oil exploration and production activities.

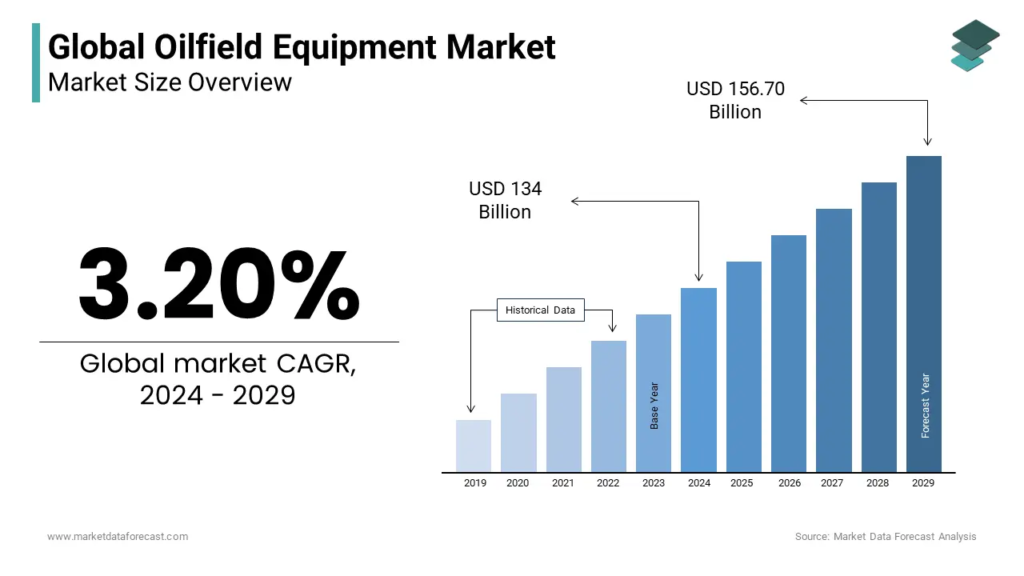

To express this growth as a Compound Annual Growth Rate (CAGR) understanding the underlying market forces – oil price fluctuations, renewable energy adoption, and global development.

Unique differentiation:

Schlumberger and Halliburton: These industry giants offer a wide range of services similar to NOV, including wellbore technologies, drilling rigs, and completion solutions. They often have a larger global footprint and may have an edge in complex projects.

Baker Hughes: Another major competitor, Baker Hughes provides a comprehensive suite of oilfield services, overlapping significantly with NOV’s offerings. They may compete fiercely on specific projects, particularly when it comes to pricing and technological advancements.

TechnipFMC: This company focuses more on the downstream oil and gas sector, but they also have a strong presence in subsea equipment and technologies used during well completion. They could be a competitor for NOV in specific segments of the market.

Focus on Efficiency and Reliability: NOV prioritizes designing equipment and solutions that optimize drilling and production operations. This translates to lower costs for their clients and a reputation for dependable performance.

Breadth of Offerings: While some competitors might specialize in specific areas, NOV boasts a comprehensive portfolio encompassing wellbore technologies, drilling rigs, completion equipment, and ongoing production solutions. This allows them to serve clients with a one-stop shop approach for their oil and gas needs.

Commitment to Safety: Safety is a paramount concern in the oil and gas industry. NOV prioritizes incorporating advanced safety features in their equipment and fostering a culture of safety within their organization. This can be a deciding factor for clients seeking reliable and responsible partners.

Management & Employees:

Clay C. Williams: Chairman, President & CEO. Clay has extensive experience within the oil and gas industry, having held various leadership positions at NOV and its predecessors.

Jose Bayardo: Senior Vice President & CFO. Jose is responsible for NOV’s financial operations and strategy.

Craig L. Weinstock: Senior Vice President & General Counsel. Craig oversees legal matters and ensures NOV operates compliantly.

Financials:

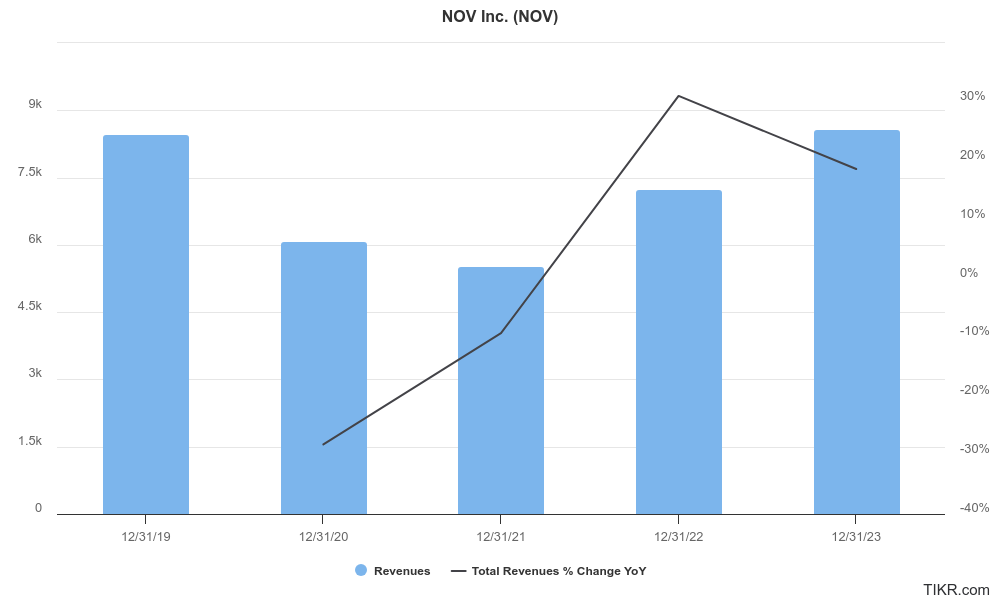

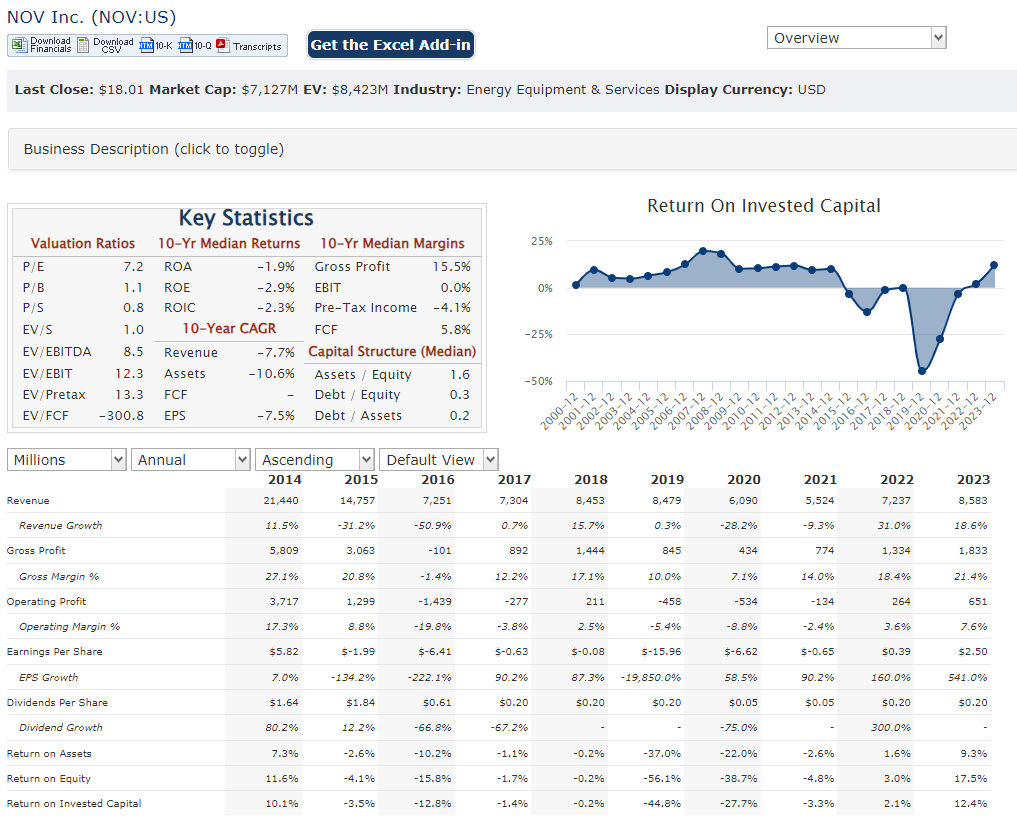

NOV Inc.’s revenue growth for NOV has likely been modest in the last 5 years. The global oil and gas industry has experienced fluctuations, it’s difficult to pinpoint a Compound Annual Growth Rate (CAGR).

Earnings growth for NOV might show a similar pattern to revenue. There could be years with strong growth followed by periods of stagnation or even decline depending on market conditions.

NOV’s debt levels might have fluctuated depending on their capital expenditure needs. They invest heavily in research and development to stay competitive, and this can impact their debt-to-equity ratio. Ideally, they would aim to maintain a healthy balance between funding growth initiatives and managing their debt burden.

Technical Analysis:

After the big stage 4 decline the slow stage 1 base building and stage 2 markup is seen on the weekly chart, but a stage 4 decline again on the daily chart. We would avoid investing in this oil stock given how slow the movement has been even with higher oil prices in Late 2023.

Bull Case:

Resurgent Oil and Gas Market: Bulls believe that global oil demand will pick up in the coming years. Factors like population growth and increasing energy needs in developing economies could lead to more drilling activity, benefiting NOV’s core business of supplying equipment and services.

Broad Portfolio: Unlike some competitors with a narrower focus, NOV offers a comprehensive suite of solutions across the oil and gas production cycle. This one-stop-shop approach could be appealing to clients seeking a streamlined experience.

Value Play: If NOV’s stock price is perceived as undervalued compared to its future earnings potential, value investors might see an opportunity for long-term capital appreciation.

Bear Case:

Declining Oil Demand: Bears believe that the push for renewable energy sources will lead to a long-term decline in oil demand. This could significantly reduce NOV’s customer base and revenue potential.

Volatile Oil Prices: Fluctuations in oil prices can significantly impact the oil and gas industry. Periods of low oil prices might lead to decreased drilling activity and lower demand for NOV’s equipment and services.

Limited Upward Potential: If the oil and gas market remains stagnant, NOV might struggle to achieve significant revenue or earnings growth, limiting the stock’s upside potential for investors.