Executive Summary:

BILL Holdings Inc that provides cloud-based financial automation software for small and midsize businesses (SMBs) worldwide. Their software helps automate accounts payable and receivable transactions, connect with suppliers and customers, manage cash flow, and improve overall office efficiency. They also offer onboarding, implementation support, and ongoing training services.

BILL Holdings Inc reported earnings per share (EPS) of $0.14. Revenue for the quarter was $318.5 million.

Stock Overview:

| Ticker | $BILL | Price | $52.68 | Market Cap | $5.59B |

| 52 Week High | $139.50 | 52 Week Low | $45.90 | Shares outstanding | 106.14M |

Company background:

BILL Holdings Inc formerly Bill.com Holdings Inc was founded in 2006 by René Lacerte, a fintech entrepreneur, the company is headquartered in San Jose, California.

BILL Holdings Inc.’s core product is a financial operations platform that automates tasks such as accounts payable (AP) and accounts receivable (AR) management, expense management, and cash flow forecasting. Their platform helps SMBs streamline financial processes, improve control over spending, and get paid faster. BILL Holdings Inc. also integrates with popular accounting software and offers a variety of services to help businesses get started and maximize their use of the platform.

The company faces competition from other financial automation software providers such as Intuit, AvidXchange, and Tipalti.

Recent Earnings:

BILL Holdings Inc. revenue for the quarter came in at $318.5 million, reflecting a strong 18.52% year-over-year increase. This growth momentum is even more impressive considering BILL Holdings Inc. has been on a tear for the past few years, with annual revenue growth exceeding 64% in 2023

Earnings per share (EPS) were equally impressive at $0.14, significantly beating analyst expectations of -$0.03. This translates to a massive 566.67% beat and a 20% increase year-over-year.

Analysts’ consensus EPS estimates for the current quarter have remained steady at -$0.13. The full-year EPS estimate of $0.46 remains unchanged.

The Market, Industry, and Competitors:

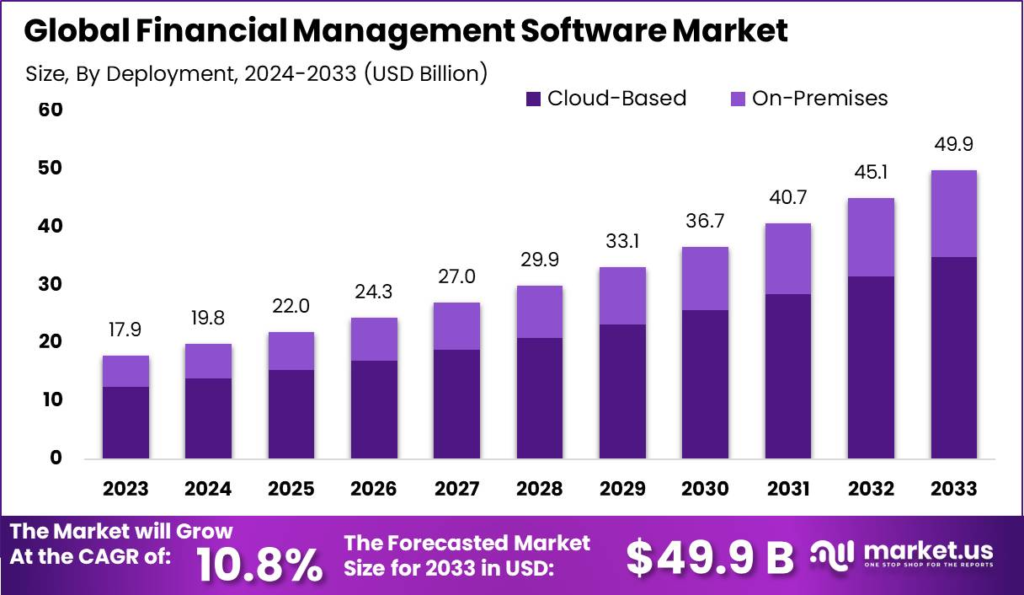

BILL Holdings Inc. operates in the cloud-based financial automation software market for small and midsize businesses (SMBs). SMBs are increasingly adopting cloud-based solutions to streamline their operations and improve efficiency. The growing complexity of financial regulations is making it more challenging for SMBs to manage their finances manually.

The global cloud-based financial management software market to grow at a CAGR of 14.2% from 2022 to 2030.

Unique differentiation:

Intuit: A leading financial software giant, Intuit offers a wide range of products for businesses, including the popular QuickBooks accounting software. While QuickBooks offers some automation features, BILL Holdings Inc. focuses specifically on streamlining accounts payable and receivable processes, making it a more specialized solution for managing cash flow.

AvidXchange: Similar to BILL Holdings Inc., AvidXchange provides a cloud-based platform specifically designed for automating invoice and payment processing. They cater more towards mid-sized and larger businesses, often with complex procurement needs.

Tipalti: This cloud-based platform focuses on global payments and international tax compliance. While BILL Holdings Inc. offers payment functionality, Tipalti caters more towards businesses that operate internationally and require features like multi-currency transactions and tax withholding support.

Focus on SMB Needs: While competitors like AvidXchange cater to mid-sized and larger companies with complex needs, BILL Holdings Inc. keeps its platform user-friendly and specifically addresses the core financial processes of SMBs.

Comprehensive Platform: Unlike competitors like Intuit’s QuickBooks with limited automation features, BILL Holdings Inc. offers a comprehensive platform that automates accounts payable (AP), accounts receivable (AR), expense management, and cash flow forecasting – all in one place.

Integration with Accounting Software: BILL Holdings Inc. integrates seamlessly with popular accounting software used by SMBs, allowing for a smooth flow of data and eliminating the need for duplicate entries.

Management & Employees:

René Lacerte (CEO and Founder): Lacerte, a fintech entrepreneur, founded BILL Holdings Inc. in 2006. He brings a wealth of knowledge and vision to the company.

John Rettig (President and Chief Financial Officer): Rettig oversees both business operations and financial health of BILL Holdings Inc., ensuring financial stability and growth.

Financials:

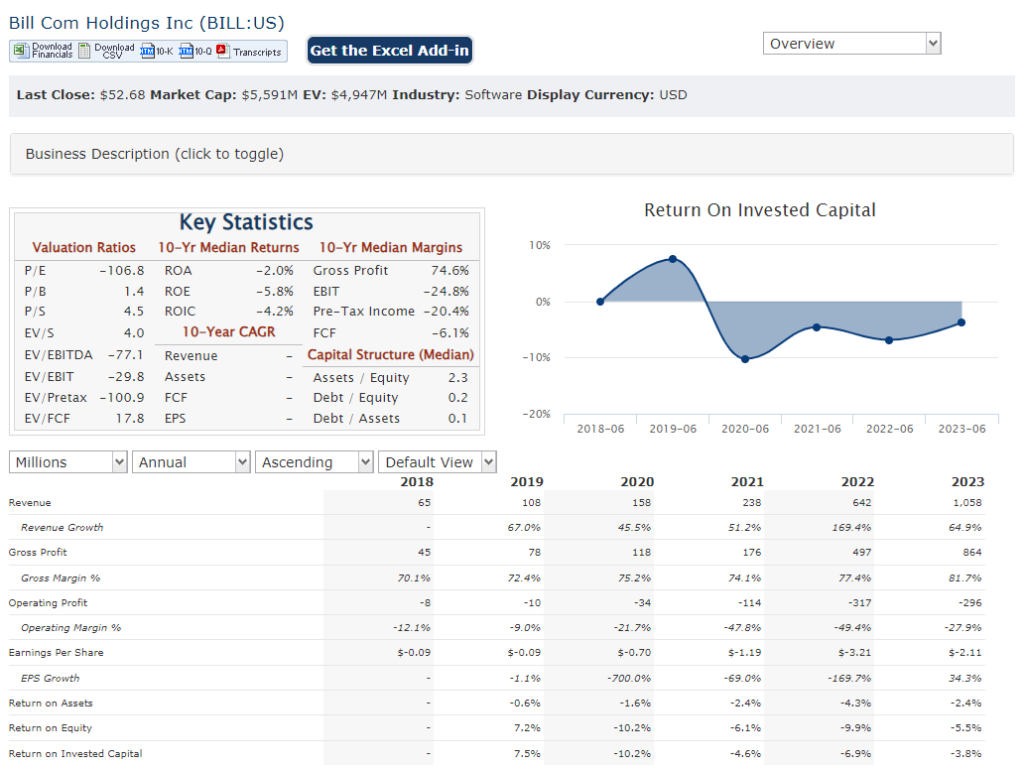

BILL Holdings Inc revenue has seen a strong upward trajectory, with a Compound Annual Growth Rate (CAGR) exceeding 64%]. This impressive growth indicates a rising demand for their cloud-based financial automation software solutions among small and midsize businesses (SMBs).

Earnings haven’t always mirrored the revenue growth. While there have been fluctuations year-to-year, the overall trend seems positive. BILL Holdings Inc. is still in a growth phase, prioritizing market share and customer acquisition over immediate profitability.

BILL Holdings Inc. seems to be in a healthy financial position. They have manageable debt levels and sufficient cash flow to support ongoing operations and future investments in product development and growth initiatives.

Technical Analysis:

On all three time frames, monthly, weekly and daily, the charts are in a downtrend (stage 4 markdown, bearish). It should revisit $45 range soon.

Bull Case:

Large and Growing Market: The market for cloud-based financial automation software for SMBs is expected to experience significant growth in the coming years, driven by factors like increasing cloud adoption and the complexity of financial regulations. BILL Holdings Inc. is well-positioned to capitalize on this expanding market.

Focus on Automation: Automation is a central theme for BILL Holdings Inc., helping SMBs save time, reduce errors, and free up resources to focus on strategic initiatives.

Bear Case:

Valuation Concerns: BILL Holdings Inc.’s stock price might be inflated based on future growth expectations. If they fail to meet those expectations, the stock price could experience a correction.

Integration Challenges: Integrating their platform with various accounting software requires ongoing maintenance and adaptation. Any difficulties in maintaining smooth integration could impact customer adoption and satisfaction.

Macroeconomic Downturn: An economic slowdown could lead to decreased spending by SMBs, impacting BILL Holdings Inc.’s customer acquisition and revenue growth.