Executive Summary:

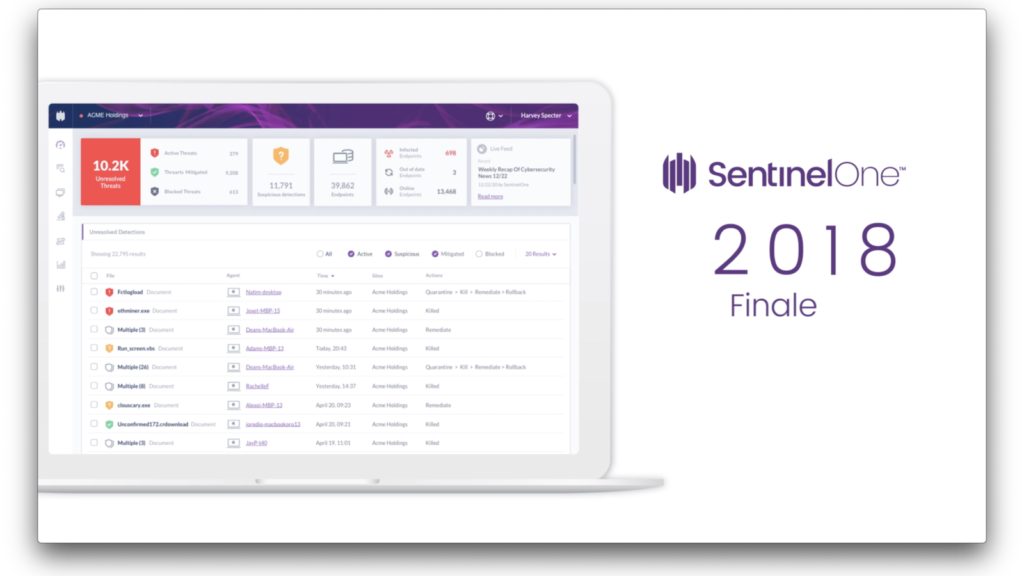

SentinelOne is a leading American cybersecurity company founded in 2013 that specializes in endpoint protection using artificial intelligence and machine learning. Their cloud-based Singularity platform allows enterprises to detect, respond to, and prevent cyber threats across devices, including PCs, IoT devices, and cloud workloads.

SentinelOne reported total revenue jumped 40% year-over-year to $186.4 million. Their Earnings per Share (EPS) came in at -$0.20.

Stock Overview:

| Ticker | $S | Price | $20.15 | Market Cap | $6.30B |

| 52 Week High | $30.76 | 52 Week Low | $13.87 | Shares outstanding | 286.7M |

Company background:

SentinelOne Inc. is a leading cybersecurity company founded in 2013 by Tomer Weingarten, Almog Cohen, and Ehud Shamir. Weingarten, the current CEO, previously led product development for another tech company. Shamir is a renowned cryptographer and computer scientist. SentinelOne has grown significantly since its founding, raising over $1.3 billion in funding across multiple rounds.

The company specializes in cybersecurity solutions powered by artificial intelligence and machine learning. The Singularity platform uses AI and machine learning to detect and prevent threats in real-time, offering enterprises a comprehensive security solution.

SentinelOne faces competition from other established cybersecurity companies like CrowdStrike, Palo Alto Networks, and McAfee. SentinelOne stands out for its focus on autonomous security and its machine learning-powered approach. The company is headquartered in Mountain View, California, with a global presence and over 2,100 employees.

Recent Earnings:

Revenue: Total revenue surged 40% year-over-year to $186.4 million, exceeding analyst expectations of $181.11 million.

EPS: Earnings per Share (EPS) came in at -$0.20, which is a net loss. However, this was narrower than analyst predictions of -$0.24.

Operational Metrics: They reported a 30% increase in customers with an annual recurring revenue (ARR) of $100,000 or more.

The Market, Industry, and Competitors:

SentinelOne’s Market and Growth Trajectory:

SentinelOne is expected to reach a staggering $53.0 billion by 2030. This market is experiencing explosive growth with a Compound Annual Growth Rate (CAGR) estimated to be between 20-25%.

- The ever-increasing prevalence of cyber threats targeting businesses of all sizes.

- The rising adoption of cloud computing and Internet of Things (IoT) devices, which creates a larger attack surface for hackers.

- The growing demand for autonomous security solutions that can automatically detect and respond to threats without human intervention.

Unique differentiation:

CrowdStrike: A leading competitor known for its cloud-native Falcon platform that offers comprehensive endpoint protection and extended detection and response (XDR) capabilities. Similar to SentinelOne, CrowdStrike leverages machine learning for threat detection and prevention.

Palo Alto Networks: A network security giant that has expanded into endpoint security with its Traps platform. Palo Alto Networks offers a holistic approach to security, integrating network, endpoint, and cloud protection.

McAfee: A well-known name in cybersecurity, McAfee offers a range of endpoint security solutions, including McAfee Endpoint Protection. While McAfee has a strong brand presence, it may not be seen as innovative as SentinelOne by some users.

Autonomous Security: SentinelOne emphasizes its ability to deliver autonomous security. This means their Singularity platform uses advanced AI and machine learning to automatically detect, analyze, and respond to cyber threats in real-time, with minimal human intervention.

- Faster response times: Threats can be neutralized quicker, minimizing potential damage.

- Reduced workload for security teams: Automation frees up security personnel to focus on more strategic tasks.

- Scalability: The platform can effectively manage security across a large number of devices without needing significant human resources.

Machine Learning-Powered Approach: While other competitors use machine learning, SentinelOne goes a step further. Their Singularity platform utilizes a next-generation approach to machine learning called “deep learning”. Deep learning algorithms are trained on massive amounts of data, allowing them to identify complex patterns and anomalies that may indicate a cyber threat. This advanced approach aims to provide more accurate threat detection and prevention compared to traditional machine learning methods.

Management & Employees:

Tomer Weingarten (CEO & Chairman): A co-founder, Weingarten has served as CEO since SentinelOne’s inception in 2013. He brings extensive product development experience from his previous role at Toluna Holdings Limited.

Michael Cremen (President & Chief Revenue Officer): Cremen leads the global sales organization and is responsible for driving revenue growth.

Financials:

Revenue Growth: SentinelOne reported total revenue of $621.2 million. Analysts predict the company will maintain this trajectory, with revenue reaching an estimated $53.0 billion by 2030.

Earnings Growth: They have reported net losses in recent quarters. Their EPS loss narrowed compared to analyst expectations. They achieved their first ever quarter of positive free cash flow, a significant milestone towards future profitability.

Balance Sheet: The company has raised over $1.3 billion in funding, indicating a strong cash position to fuel future growth initiatives. Their achievement of positive free cash flow also suggests a healthier financial outlook.

Technical Analysis:

The stock is reversing off a short pullback on the monthly chart and is forming a bull flag on the weekly chart. The daily chart is more formative of a bull run, which it should after a touch back to the $19s. A 2-3 month target should be the $24 range again.

Bull Case:

Strong Market Tailwinds: The cybersecurity market is booming, fueled by rising cyber threats and the increasing adoption of cloud and IoT devices. This creates a massive opportunity for SentinelOne’s endpoint security solutions.

Path to Profitability: While not yet profitable, SentinelOne’s narrowing EPS loss and achievement of positive free cash flow indicate improving financial efficiency and a potential future path to profitability.

Bear Case:

Macroeconomic Risks: A broader economic downturn could impact IT spending and slow down SentinelOne’s customer acquisition.

Lower-Than-Expected ARR: Annual Recurring Revenue (ARR) is a key metric for subscription-based companies like SentinelOne. If their ARR growth falls short of expectations, it could indicate weaker customer retention or slower product adoption.