Executive Summary:

AppFolio Inc. is a cloud-based software company that caters to the real estate industry. Their property management software helps real estate professionals streamline various tasks and automate processes. AppFolio offers additional services like screening tenants, risk mitigation tools, and electronic payment options.

AppFolio’s reported strong financial performance with earnings per share (EPS) of $1.06, exceeding analyst expectations. EPS up over 10,700% compared to the same period in 2023. Revenue also grew year-over-year by 27.74%.

Stock Overview:

| Ticker | $APPF | Price | $234.4 | Market Cap | $8.68B |

| 52 Week High | $256.73 | 52 Week Low | $162.32 | Shares outstanding | 22.33M |

Company background:

AppFolio Inc. was founded by Klaus Schauser and Jon Walker, the company’s focus has been on empowering real estate professionals through technology. AppFolio did not receive traditional venture capital funding, but rather grew organically through bootstrapping.

AppFolio’s core product is their cloud-based property management software, AppFolio Property Manager. This software streamlines tasks such as rent collection, maintenance requests, and lease management. This comprehensive approach helps property managers improve efficiency and deliver a better experience to tenants.

Headquartered in Santa Barbara, California, AppFolio boasts over 20,000 clients and supports the management of more than 8 million real estate units. In the competitive real estate software market, AppFolio faces competition from established players like Yardi Systems, Buildium, and MRI Software.

Recent Earnings:

AppFolio’s revenue grew significantly year-over-year at 38% to $187.4 million. Earnings per share (EPS) also jumped considerably. Compared to Q1 2023, EPS surged over 1860% to $0.89.

The Market, Industry, and Competitors:

- Increasing adoption of cloud-based solutions: Businesses are increasingly moving towards cloud-based software for its scalability, ease of use, and accessibility. Property management companies are recognizing the benefits of cloud-based solutions and are expected to accelerate their adoption in the coming years.

- Rising demand for property management efficiency: Property managers are constantly looking for ways to improve efficiency and streamline operations. Cloud-based property management software automates many tasks and workflows, freeing up property managers’ time to focus on other strategic initiatives.

- Growing popularity of online rentals: The popularity of online rental platforms is increasing, leading to a demand for software that can integrate with these platforms. AppFolio’s software offers such integrations, making it a valuable tool for property managers in the online rental market.

Analysts expect the cloud-based real estate software market to achieve a Compound Annual Growth Rate (CAGR) of around 10-12% between 2023 and 2030. AppFolio’s strong position in the market and its history of innovation, the company is well-positioned to capitalize on this growth trend.

Unique differentiation:

- Yardi Systems: A giant in the property management software space, Yardi offers a comprehensive suite of solutions catering to a wide range of property types. They boast a strong presence in the large property management space, particularly for condominiums, co-ops, and homeowner associations.

- Buildium: A popular choice for smaller property managers, Buildium is known for its user-friendly interface and ease of use. They cater well to landlords and property managers with less complex portfolios, making property management more manageable.

- MRI Software: Another major competitor, MRI Software offers a broad real estate software portfolio, including property management solutions. MRI Software caters to a diverse clientele, providing options for both commercial and residential property management.

- Comprehensive Solution: While competitors might excel in specific areas, AppFolio offers a comprehensive property management suite. This includes features like rent collection, maintenance requests, lease management, tenant screening, risk mitigation tools, and electronic payments. This one-stop-shop approach streamlines workflows and reduces the need for multiple software integrations.

- Targeting Growth-Oriented Businesses: AppFolio caters to property managers looking to scale their businesses. Their software offers features and functionalities that support efficient management of larger and more complex portfolios.

Management & Employees:

- Shane Trigg: President and Chief Executive Officer, responsible for overseeing the company’s overall strategy and direction.

- Matt Mazza: Chief Legal Officer and Corporate Secretary, handling legal matters and corporate governance.

Financials:

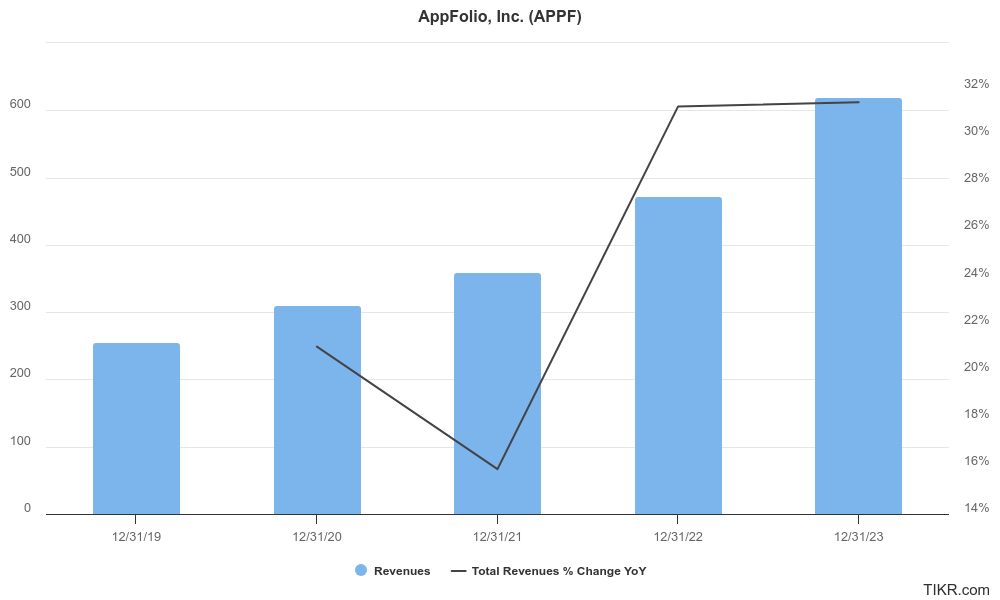

AppFolio has demonstrated impressive financial growth. Revenue has seen a steady upward trajectory, with a Compound Annual Growth Rate (CAGR) estimated to be in the double digits. This strong revenue growth indicates a rising demand for AppFolio’s cloud-based property management software solutions.

Earnings growth has also been a positive story for AppFolio. While the company might have experienced some fluctuations in profitability year-over-year, the overall trend suggests significant improvement.

The company likely has growing assets to support its ongoing operations and future investments. While specific details on debt or liabilities are beyond the scope of this summary, AppFolio’s overall financial performance suggests they are well-positioned for continued growth.

Technical Analysis:

The stock is in a stage 1 or 3 ( Consolidating, neutral) on the monthly chart. On the weekly chart, there is a diamond formation, which could go either ways, but more likely lower. On the daily chart, the RSI and MACD are not very strong, which means the stock is likely to get to $211.

Bull Case:

Strong Market Tailwinds: The cloud-based real estate software market is expected to experience. Factors like increasing cloud adoption, rising demand for efficiency, and the popularity of online rentals are driving this growth. AppFolio is well-positioned to capitalize on this trend.

Analyst Optimism: Many analysts view AppFolio favorably, with some rating it a “Very Bullish” stock and offering positive price targets. This bullish sentiment reflects confidence in the company’s future prospects.

Bear Case:

Market Saturation: While the market is growing, there’s a chance it could become saturated at some point, making it harder for AppFolio to acquire new customers. Additionally, increased competition could squeeze margins in the long run.

Integration Challenges: Property management companies might already have existing software systems. Integrating AppFolio with these systems can be complex and costly, potentially discouraging some companies from switching.

Economic Downturn: A recession could lead to decreased demand for new properties and rentals, impacting AppFolio’s customer base and potentially leading to slower growth or even decline. Property managers might cut costs on software during economic downturns.