Executive Summary:

Mattel is a leading global toy and entertainment company, founded in 1945. They are known for their iconic brands like Barbie, Hot Wheels, Fisher-Price, and American Girl. Mattel’s mission is to create innovative products and experiences that inspire children through play. The company sells products in over 150 countries and is committed to social responsibility through diversity, equity, and sustainability initiatives.

Mattel’s reported a revenue of $809.51 million, a decrease of 0.63% compared to the same period last year. Earnings per share (EPS) were negative at -$0.08, reflecting a significant decline of 73.33% year-over-year.

Stock Overview:

| Ticker | $MAT | Price | $17.33 | Market Cap | $5.96B |

| 52 Week High | $22.64 | 52 Week Low | $16.20 | Shares outstanding | 344.1M |

Company background:

Mattel Inc., a leading global toy and entertainment company, was founded in a Los Angeles garage by Harold Matson and the husband-and-wife team of Elliot and Ruth Handler. While initially focused on picture frames and dollhouse furniture, Mattel found success with its first major toy, the Uke-A-Doodle plastic ukulele, in 1947. The company became a household name with the introduction of Barbie in 1959, the iconic doll that has since become a cultural phenomenon.

Mattel’s portfolio includes some of the world’s most recognizable and beloved brands, including Barbie, Hot Wheels, Fisher-Price, American Girl, Thomas & Friends, UNO, and MEGA. The company offers toys, content, consumer products, digital experiences, and even live events.

Mattel faces competition from other toy giants like Hasbro, the LEGO Group, MGA Entertainment, and Spin Master.

Recent Earnings:

Mattel’s revenue came in at $809.51 million, a slight decrease of 0.63% compared to the same quarter in 2023.

Earnings per share (EPS) were a different story. At -$0.08, EPS fell significantly by 73.33% year-over-year. According to Zacks Investment Research, analysts had predicted an EPS of $0.17, highlighting a wider-than-anticipated loss for Mattel.

The Market, Industry, and Competitors:

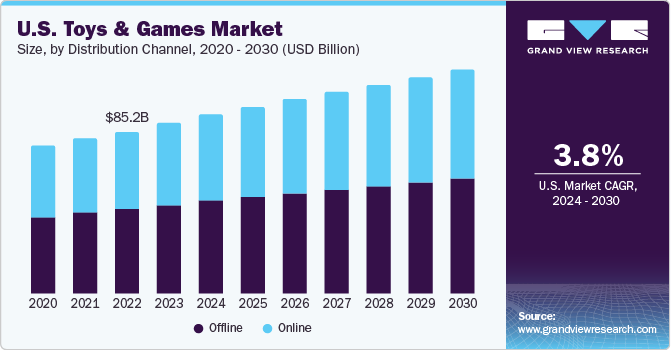

Mattel Inc. operates in the global toys and games market, which was valued at USD 324.7 billion in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030, reaching an estimated size of USD 439.91 billion by 2030. The company’s doll division, which includes the iconic Barbie brand, reported sales of around USD 1.679 billion in 2022, accounting for 73% of the dolls category and 27% of Mattel’s total revenue.The toys and games market is driven by various factors, such as parents’ increased interest in green toys, the resurgence of conventional toys & video games, awareness about the cognitive benefits of building toys, and the rising popularity of mobile-based gaming. Mattel’s partnership with Hasbro to create co-branded toys and games, such as Barbie-branded Monopoly games and Transformers-branded UNO games, is expected to provide opportunities for both companies through broader reach and greater visibility.The online sales of smart toys in the U.S. is expected to grow at a CAGR of 13.5% over the forecast period of 2024 to 2030, driven by the convenience and accessibility of online platforms.

Unique differentiation:

Hasbro: Mattel’s biggest competitor, Hasbro boasts iconic brands like Nerf, Transformers, and My Little Pony. They constantly strive to develop new and exciting products to grab children’s attention.

The Lego Group: The Lego brick is a timeless favorite, and the Lego Group keeps things fresh with innovative new sets and themes. Their focus on creativity and imaginative play sets them apart.

MGA Entertainment: This company owns popular brands like Bratz dolls, L.O.L. Surprise! dolls, and Little Live Pets. They often target specific demographics with trendy and innovative toys, creating a strong presence in the market.

Spin Master: This Canadian company is known for creative and engaging toys and games like Paw Patrol, Kinetic Sand, and Hatchimals. They capitalize on popular trends and characters to capture the market’s fancy.

Brand Portfolio Breadth: While competitors like Hasbro might have strong individual brands, Mattel boasts a wider variety. From Barbie to Hot Wheels to Fisher-Price, they cater to a diverse range of ages, interests, and play styles.

Content & Entertainment Integration: Mattel understands that play extends beyond physical toys. They actively leverage their brands in movies, TV shows, digital experiences, and even live events. This deeper engagement with children strengthens brand loyalty and encourages continued play outside of just the physical toys.

Focus on Social Impact: Mattel increasingly integrates themes of diversity, equity, and inclusion into its products and messaging. They offer dolls with a wider range of ethnicities, body types, and abilities, reflecting a more realistic world for children. This commitment to social responsibility resonates with parents and differentiates them from some competitors.

Management & Employees:

- Ynon Kreiz: Chairman and Chief Executive Officer (CEO) – Responsible for the overall strategy and direction of the company.

- Karen Ancira: Executive Vice President (EVP) and Chief People Officer (CPO) – Leads human resources and talent management initiatives.

- Robbie Brenner: President of Mattel Films – Heads the film division responsible for developing movies based on Mattel’s brands.

Financials:

Mattel’ revenue growth has been modest, with a Compound Annual Growth Rate (CAGR) likely falling somewhere between 0% and 5%. EPS in Q1 2024 indicates potential profitability challenges.

Technical Analysis:

The stock is still tightening (stage 1) on the monthly chart, consolidating on the weekly chart (neutral) and declining (stage 4 bearish) on the daily chart. There is support in the 17 range and resistance in the 18, making this a stock not worth trading for the short term. For the long term, there are better stocks to focus on.

Bull Case:

Social Responsibility Focus: Mattel’s commitment to diversity, equity, and inclusion resonates with parents looking for toys that reflect the real world. This focus can attract a wider customer base and position them favorably in the market.

Potential for Market Growth: The global toy market is expected to see steady growth in the coming years. Factors like rising disposable income and the focus on STEM learning create opportunities for Mattel to capitalize.

Bear Case:

Shifting Play Patterns: The rise of digital entertainment might pull children away from traditional toys. Mattel needs to find ways to integrate digital elements and adapt their products for a changing play landscape.

Execution Risk: Success hinges on Mattel’s ability to execute on its strategic plans. Cost-saving initiatives need to deliver results, and brand extensions through content and experiences must resonate with children.

High Debt Levels: If Mattel carries a significant debt burden, it can limit their ability to invest in growth initiatives and increase financial vulnerability.