Executive Summary:

Tidewater Inc. is a major player in the offshore energy industry, headquartered in Houston, Texas. They boast a large fleet of vessels specifically designed to support offshore oil and gas exploration and production globally. Founded in 1956, they are credited with creating the very concept of the “work boat” for this purpose. With over 60 years of experience, Tidewater provides a variety of services including transporting crews and supplies, towing rigs, and more. Their website highlights their commitment to safety, a large and well-trained crew, and a global reach.

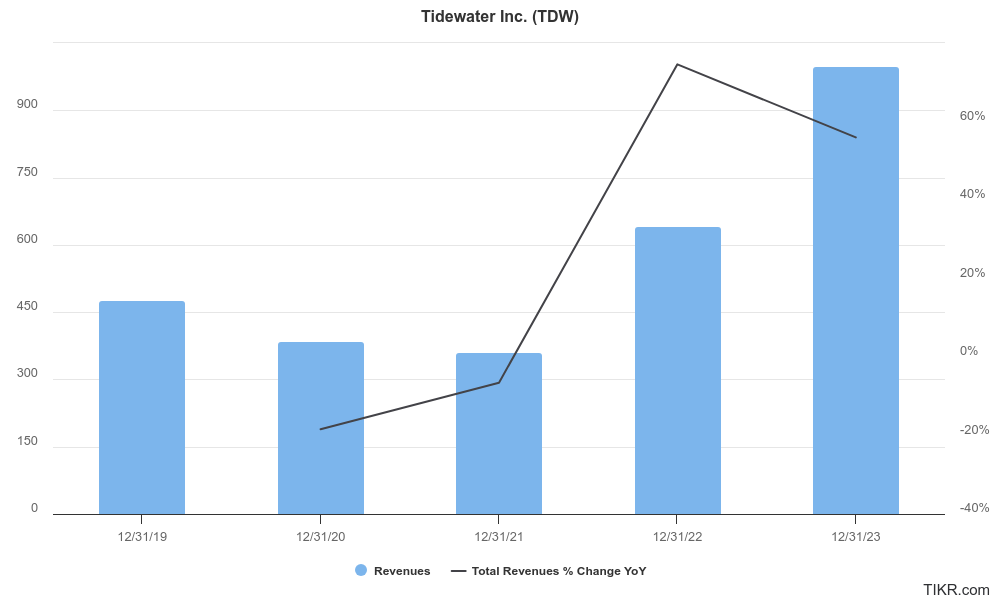

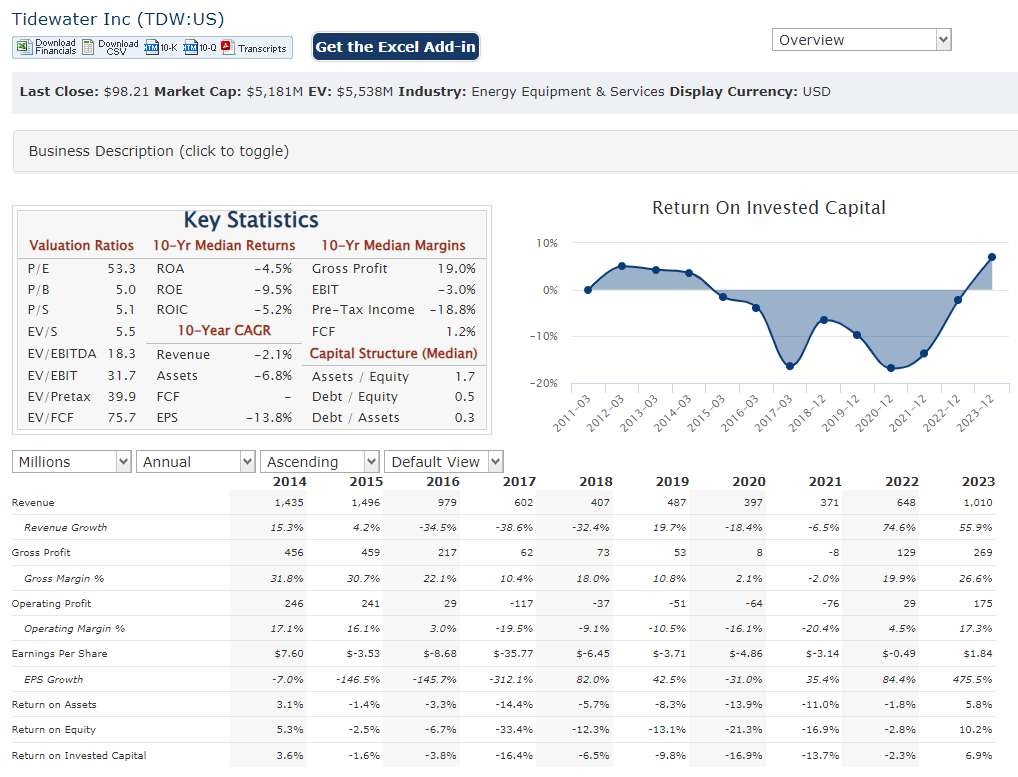

Tidewater reported strong results with revenue of $1.01 billion, a significant 55.9% increase compared to 2022. Earnings per share (EPS) came in at $0.70, which reflects a substantial 250% year-over-year growth.

Stock Overview:

| Ticker | $TDW | Price | $98.21 | Market Cap | $5.13B |

| 52 Week High | $101.10 | 52 Week Low | $39.41 | Shares outstanding | 52.27M |

Company background:

Tidewater Inc. is a leading provider of offshore service vessels (OSVs) for the global energy industry. By a group of investors led by the Laborde family.

They offer a comprehensive range of services crucial for offshore energy projects, including transporting crew and supplies, towing and anchoring mobile rigs, and aiding in offshore construction. Their emphasis is on their focus on safety, highly trained crews, and global reach, with over 90% of their fleet operating internationally.

While Tidewater is a public company and doesn’t require funding in the traditional sense, it’s noteworthy that they recently strengthened their market position through a business combination with GulfMark Offshore in 2018. This merger significantly expanded Tidewater’s fleet and solidified their place as the world’s leading OSV operator. Some of their key competitors include Crowley Maritime Corporation, Hornbeck Offshore Services, and Swire Pacific Offshore Services.

Recent Earnings:

- Revenue: Tidewater’s revenue for Q4 2023 reached $1.01 billion, reflecting a significant increase of 55.9% compared to the same period in 2022.

- EPS: Earnings per share (EPS) came in at $0.70, representing a substantial 250% year-over-year growth.

- Analyst Expectations: Analysts have forecasted an EPS of $0.49 for the fiscal quarter ending March 2024. We can expect an update on how the actual EPS compared to this forecast soon.

Operational Performance and Forward Guidance

Tidewater’s report also highlighted positive operational metrics. The average day rate for their vessels increased, indicating a rise in market demand for their services.

Considering the strong Q4 performance and the positive analyst forecast for the current quarter, we might expect continued optimism regarding the company’s future.

The Market, Industry, and Competitors:

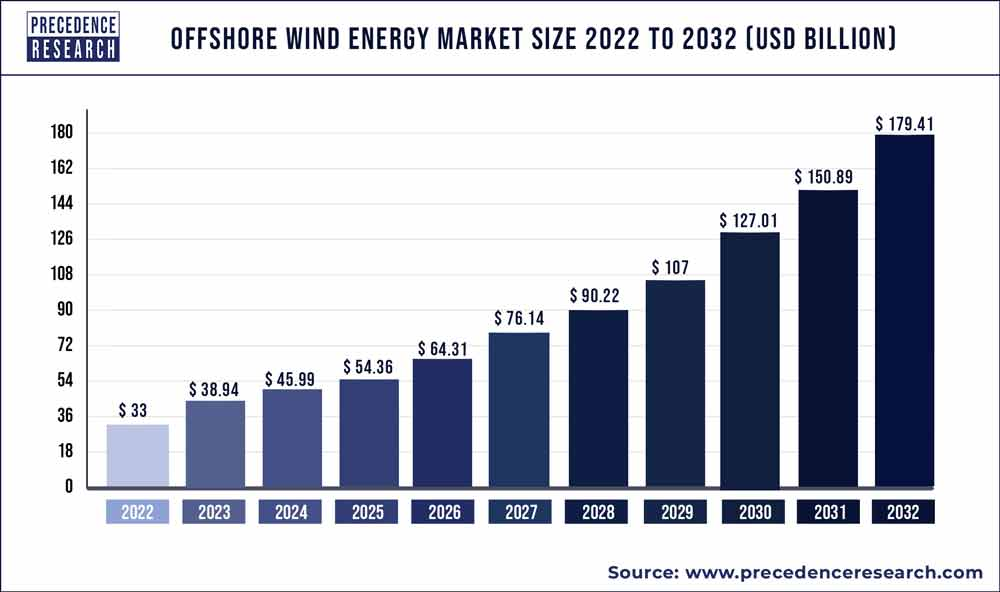

Tidewater Inc. market is expected to experience steady growth in the coming years, driven by a few key factors. Firstly, as the global demand for oil and gas is expected to rise, there will be a corresponding increase in offshore exploration and production activities. This will necessitate more vessels to support these operations, creating a positive outlook for OSV companies like Tidewater.

Secondly, the trend of renewable energy development offshore is also likely to contribute to market growth. While wind farms utilize different types of vessels compared to traditional oil and gas rigs, there will still be a demand for crew transfer, maintenance, and other support services that Tidewater can provide.

Unique differentiation:

- Hornbeck Offshore Services: A major competitor headquartered in Covington, Louisiana. Hornbeck boasts a significant fleet of OSVs catering to similar services as Tidewater, including crew and supply transport, rig moves, and emergency response. They focus on the Americas, the Middle East, and Southeast Asia.

- Harvey Gulf International Marine: Another strong competitor based in New Orleans, Louisiana. Harvey Gulf offers a range of offshore support services in the Americas, specializing in shallow-water and complex environments. Their fleet includes high-performance crew boats and anchor handling tug supply vessels.

- Trico Marine Services: A Singapore-based company with a global presence, particularly strong in Southeast Asia and the Middle East. Trico offers a comprehensive range of OSV services, including platform supply, emergency response, and subsea support. They focus on fuel efficiency and environmental sustainability in their operations.

- Global Reach: Tidewater boasts the largest fleet of OSVs in the industry, with over 90% operating internationally in over 60 countries. This extensive global presence allows them to cater to a wider range of clients and projects compared to competitors with a more regional focus.

- Safety and Training: Tidewater emphasizes its commitment to safety and highly trained crews. This focus on a skilled workforce and a strong safety record can be a significant advantage when competing for contracts, especially with clients prioritizing these aspects.

- Experience and Versatility: With over 65 years in the industry, Tidewater possesses extensive experience in all aspects of offshore service vessel operations. Their fleet offers a diverse range of vessels designed for various tasks, from crew and supply transport to rig moves and offshore construction.

Management & Employees:

- Todd Busch (President & CEO): Appointed in January 2020, Busch leads the company’s overall strategy and operations.

- Aaron DeGodny (Chief Commercial Officer): Oversees Tidewater’s sales and marketing efforts, ensuring they secure new contracts and maintain strong client relationships.

- William (Bill) Collins (Vice President, Quality, Health, Safety, Security, Environment (QHSE): Responsible for upholding Tidewater’s rigorous safety standards and environmental practices across all operations.

Financials:

- Revenue: Overall revenue growth for the past five years is not significant. However, 2023 saw a substantial increase compared to previous years. This uptick is likely due to rising demand for offshore support services and higher day rates for Tidewater’s vessels.

- Earnings Growth: Earnings haven’t necessarily exhibited consistent growth over the past five years. 2023’s Q4 results displayed a significant jump in EPS compared to the same period in 2022. This indicates improved profitability for the company.

- Balance Sheet: Tidewater’s financial position is strengthening. The company’s cash flow generation in Q4 2023 indicates a healthy financial stance, but high debt compared to cash.

Technical Analysis: On the weekly chart the stock is on an mark up (stage 2, bullish) and a bull flag has formed on the daily chart. There might be a pull back to the 21 day Moving average at $93, but this stock should head higher given the growth and high oil prices.

Bull Case:

- Rising Demand in Offshore Energy: The global demand for oil and gas is expected to keep rising in the coming years. This will necessitate more activity in offshore exploration and production, leading to a greater need for Tidewater’s OSVs for crew transfer, supply transport, and other support services.

- Strong Fleet and Global Reach: Tidewater boasts the largest fleet of OSVs globally, with a presence in over 60 countries. This extensive network allows them to capitalize on opportunities across the world and cater to a wider range of clients.

- Benefitting from Renewables: While wind farms utilize different types of vessels, there’s still a demand for crew transfer, maintenance, and support services that Tidewater can provide in the offshore renewable energy sector.

Bear Case:

- Volatile Oil Prices: A major risk for Tidewater is the fluctuation of oil prices. If oil prices experience a sustained decline, it could dampen exploration and production activities in the offshore energy sector.

- Overdependence on Oil & Gas: Tidewater’s core business heavily relies on the offshore oil and gas industry. The transition towards renewable energy sources could pose a long-term threat. While they might benefit from some aspects of the renewable sector, it might not fully offset the decline in traditional oil and gas activity.

- High Debt Levels: While specific debt figures are not included here, some analysts might be concerned about potential high debt levels for Tidewater. Large debt burdens can limit the company’s financial flexibility and restrict its ability to invest in growth opportunities or weather downturns.