Executive Summary:

Knife River Holding, formerly known as Knife River Corporation before a spinoff in June 2023, is a construction materials supplier in the central, western and southern United States. They mine and sell crushed stone, sand, and gravel along with other building materials like concrete and asphalt. Knife River also offers contracting services for construction projects.

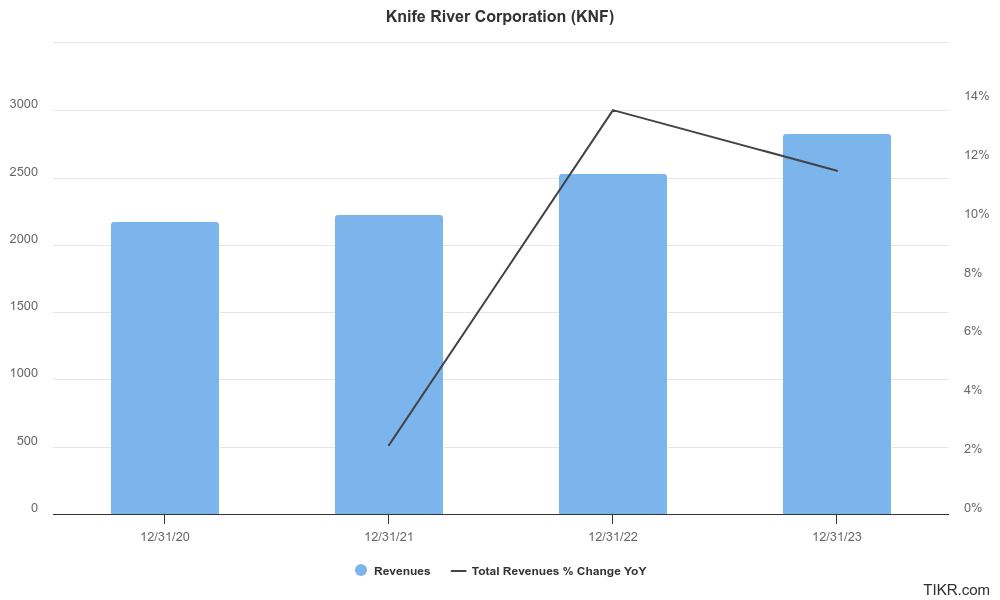

Knife River Holding have strong financial performance with full-year revenue of $2.8 billion, a 12% increase over 2022. Earnings per share (EPS) were $2.58, up 47% year-over-year.

Stock Overview:

| Ticker | $KNF | Price | $79.51 | Market Cap | $4.49B |

| 52 Week High | $81.52 | 52 Week Low | $33.67 | Shares outstanding | 56.57M |

Company background:

Knife River Corporation, founded in 1917, is a major supplier of construction materials in the central, western and southern United States. The company’s long history speaks to its enduring role in the construction industry.

They also provide contracting services, offering a one-stop shop for construction needs. Knife River spun off from MDU Resources and became a publicly traded company on the New York Stock Exchange.

As a leading construction materials supplier, Knife River faces competition from industry giants like Vulcan Materials Company, Martin Marietta Materials, CEMEX, and Eagle Materials.

Recent Earnings:

The revenue reached $2.8 billion, reflecting a healthy 12% increase compared to 2022. This growth can be attributed to several factors, including price increases across their core product lines and a longer construction season across their operating footprint. EPS earnings per share also saw a significant improvement, jumping 47% year-over-year to reach $2.58. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) rose 38% to $432.4 million for the full year, with the margin expanding by 2.9 percentage points to a healthy 15.3%.

The Market, Industry, and Competitors:

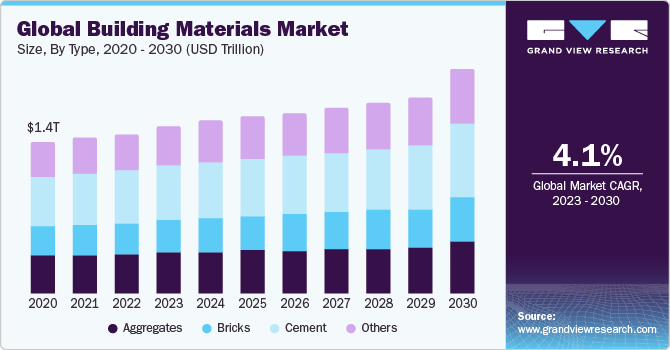

Knife River Corporation market is heavily influenced by infrastructure spending, which is expected to see significant growth in the coming years. The American Society of Civil Engineers estimates a $2.59 trillion infrastructure funding gap over the next decade, and both federal and local governments are prioritizing investments in roads, bridges, and other projects.

Industry analysts project a healthy Compound Annual Growth Rate (CAGR) for the construction materials market in the United States. Analysts generally predict a CAGR in the range of 3-5% for the industry until 2030. This aligns well with Knife River’s historical growth trajectory and their focus on strategically located operations in high-growth markets. Their strong financial performance, strategic acquisitions, and established presence, Knife River is well-positioned to capitalize on this market growth and potentially exceed the broader industry CAGR.

Unique differentiation:

- Vulcan Materials Company: A North American leader in the production of aggregates, asphalt, and ready-mix concrete. Vulcan boasts a vast national footprint and significant production capacity, making them a major competitor across all of Knife River’s product lines.

- Martin Marietta Materials: Another major industry player, Martin Marietta focuses on aggregates, cement, and related building materials. Their strong presence in the southeastern and central United States overlaps considerably with Knife River’s core markets, leading to head-to-head competition for projects and customers.

- CEMEX: A global construction materials company with a significant presence in the United States. CEMEX offers a broad product range including cement, aggregates, and ready-mix concrete, similar to Knife River. Their international scale and brand recognition can be an advantage, but Knife River might counter with its focus on high-quality products and customer service within its specific regions.

- Regional Focus: Unlike some national giants, Knife River concentrates its operations in the central, western, and southern United States. This allows them to develop deep customer relationships, potentially offering a more responsive and localized service compared to competitors with a broader reach.

- Operational Efficiency: As evidenced by their rising EBITDA margin, Knife River might have an edge in streamlining operations and controlling costs. This efficiency could translate into competitive pricing and potentially higher profitability.

- Customer Focus: Although difficult to quantify, Knife River emphasizes its commitment to customer satisfaction. This could involve factors like reliable product quality, on-time deliveries, and responsive service, creating a strong value proposition for repeat business.

- Strategic Acquisitions: Knife River might utilize strategic acquisitions to expand its footprint or acquire specific product lines, allowing them to fill gaps in their offerings and potentially differentiate themselves from competitors with a more static product range.

Management & Employees:

- Brian R. Gray: President and CEO. Gray has been with Knife River for over a decade, leading the Northwest segment before being appointed President in 2023 and then CEO. He is credited with acquisitions and implementing safety and training programs.

- Nathan W. Ring: Chief Financial Officer. Ring brings 21 years of experience to the role, having held various financial positions with Knife River and its former parent company, MDU Resources Group.

- Karl A. Liepitz: Vice President, Chief Legal Officer and Secretary. Liepitz has nearly two decades of experience with Knife River, previously serving as general counsel for MDU Resources.

Financials:

Revenue Growth: Knife River has demonstrated consistent revenue growth over the past five years. Their most recent full-year figures for 2023 showed a 12% increase compared to 2022. This positive trend aligns with the construction materials industry’s overall growth trajectory, fueled by rising infrastructure spending needs. Calculating a Compound Annual Growth Rate (CAGR) for the entire five-year period would require more specific data, but industry estimates suggest a CAGR in the range of 3-5% for the construction materials market.

Earnings Growth: Knife River’s earnings performance has also been positive in recent years. Their 2023 results boasted a 47% jump in earnings per share (EPS) compared to 2022. This growth reflects not just rising revenue but also potentially improved operational efficiency.

Balance Sheet: Knife River’s most recent earnings release doesn’t provide specific details on their balance sheet. The company’s spin-off from MDU Resources in June 2023 suggests a focus on financial independence.

Technical Analysis:

The stock is on a markup phase 2 in all 3 time frames and is a consistent performer. Valuations look good but growth is slowing. We would be buyers closer to the $74 (100 Day Moving Average) area.

Bull Case:

Strong Industry Tailwinds: The construction materials market in the United States is expected to see significant growth in the coming decade, driven by rising infrastructure spending needs. This translates directly to increased demand for Knife River’s core products like crushed stone, sand, and gravel.

Solid Financial Performance: Knife River’s recent financial results are positive, with consistent revenue growth and a jump in earnings per share for 2023. This indicates a healthy financial foundation for future expansion.

Potential for Outperformance: While industry CAGR for construction materials is estimated at 3-5%, Knife River’s focus on high-quality products, customer service, and strategic acquisitions could position them to exceed this industry growth rate.

Bear Case:

Vulnerability to Weather: Knife River’s business depends heavily on construction activity, which can be negatively affected by severe weather events. A particularly harsh winter or unpredictable weather patterns could disrupt production and sales.

Limited Geographic Focus: While a regional focus can be an advantage, it also exposes Knife River to fluctuations in specific markets. An economic downturn in their core operating regions could disproportionately impact their performance compared to a more nationally diversified competitor.

Limited Track Record: As a public company, Knife River only has a short track record. Investors seeking a long history of consistent performance might be hesitant until the company demonstrates its ability to sustain growth over a more extended period.