Executive Summary:

Yelp, founded in 2004 that connects people with local businesses through its website and mobile app. Yelp features user-written reviews, photos, and tips for almost every kind of local business imaginable. They also offer a service for businesses to claim their profile and manage their online presence. With over 244 million reviews and a focus on trusted local information, Yelp has become a go-to platform for consumers looking to find great places to eat, shop, and explore.

Stock Overview:

| Ticker | $YELP | Price | $39.40 | Market Cap | $2.69B |

| 52 Week High | $48.99 | 52 Week Low | $26.53 | Shares outstanding | 68.28M |

Company background:

Yelp Inc. is founded by Russel Simmons and Jeremy Stoppelman. The company’s headquarters are in San Francisco, California. This platform features crowd-sourced reviews and ratings for local businesses. Businesses can also claim their profile on Yelp to manage their online presence and connect with potential customers.

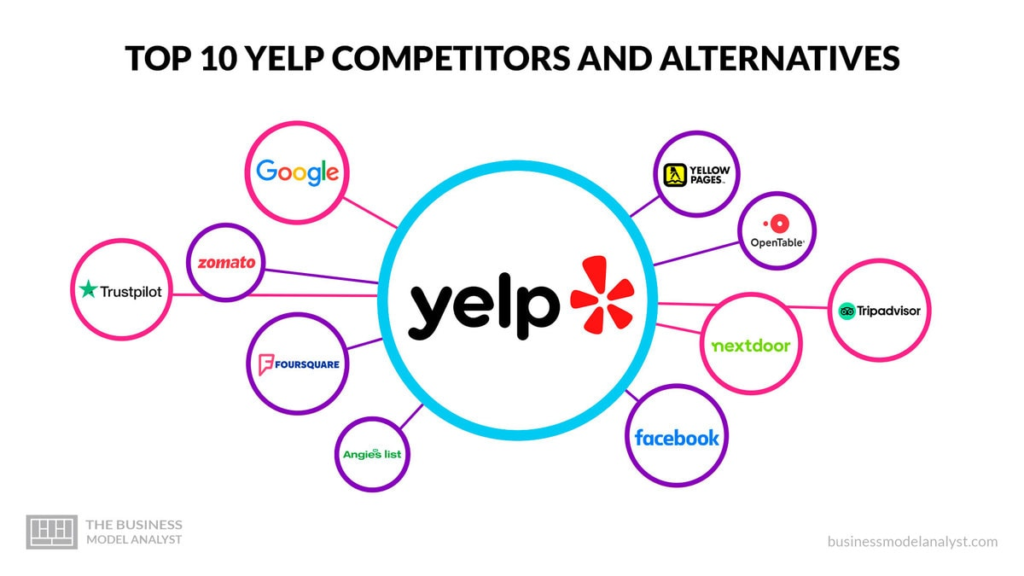

It has become a go-to resource for consumers seeking trusted local information on everything from restaurants and shops to dentists and mechanics. Yelp’s key competitors include tech giants like Google Maps, which offers similar review and business information features, as well as TripAdvisor and Foursquare, both specializing in travel and location-based services.

Recent Earnings:

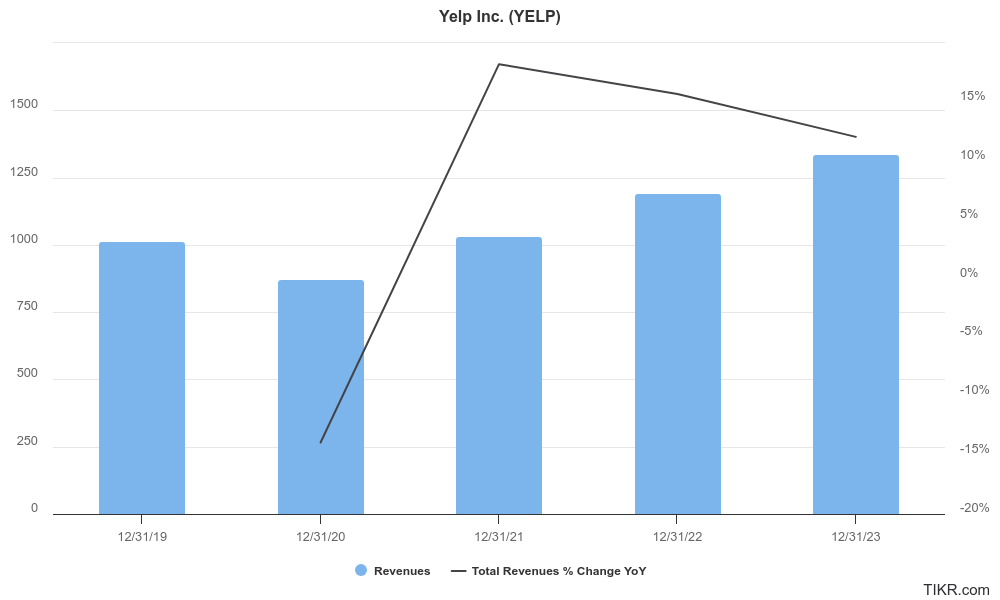

Revenue for Q4 2023 is estimated at $342.38 million, reflecting a 10.76% increase compared to Q4 2022 Earnings per share (EPS) were $0.37, up 32.14% year-over-year [4].

Yelp boasted 544,000 paying advertising locations and over 13 million total reviews on the platform . These metrics along with future earnings reports will be valuable in understanding Yelp’s overall health and future trajectory.

The Market, Industry, and Competitors:

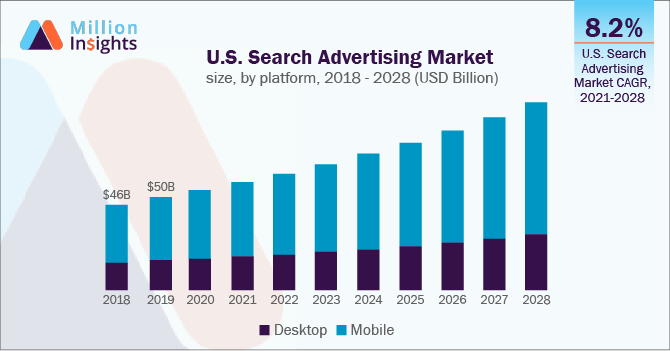

Yelp market is expected to see steady growth in the coming years, driven by the increasing importance of online reviews and the growing local mobile advertising market. Analyst estimates suggest a Compound Annual Growth Rate (CAGR) of around 7-10% for this market until 2030.

Yelp’s future growth will depend on its ability to maintain its position as a leading platform for local reviews, attract new users and businesses, and expand its advertising offerings. Yelp’s ability to innovate and adapt to the changing market landscape will be key to its future success.

Unique differentiation:

Yelp faces competition from several tech giants and niche players in the local business review and advertising space:

- Established Tech Giants: Google My Business is a major competitor, offering local business listings with user reviews and ratings within Google Maps. Google’s vast reach and integration with other products like Search make it a powerful competitor for Yelp.

- Travel and Location-Based Services: TripAdvisor, a popular travel website, also features user reviews and ratings for restaurants, hotels, and attractions. While its focus is broader than Yelp’s core local businesses, it still competes for users seeking recommendations, particularly for travel-related establishments. Foursquare, another location-based service, allows users to explore new places and discover hidden gems.

- Niche Review Platforms and Social Media: In addition to these established players, Yelp also faces competition from niche review platforms catering to specific industries, such as Angi (formerly Angie’s List) for home services or Zomato for restaurants.

- Focus on Local: Yelp prioritizes comprehensive local business information, encompassing a wider range of local businesses than travel-oriented competitors like TripAdvisor.

- User-Generated Content & Community: Yelp fosters a strong user community built around authentic user-written reviews, photos, and tips. This focus on user-generated content can be seen as more credible and reliable compared to competitor platforms that might rely on business-generated content or have a weaker focus on reviews.

- Business Claimed Profiles: Yelp allows businesses to claim and manage their profiles, fostering a two-way communication channel between businesses and potential customers.

Management & Employees:

- Jeremy Stoppelman (Co-founder and Chief Executive Officer): Stoppelman co-founded Yelp in 2004 and continues to steer the company’s vision and product development. He has a background in computer engineering and previously held a leadership position at PayPal.

- Jed Nachman (Chief Operating Officer): Nachman oversees Yelp’s day-to-day operations, focusing on efficiency and smooth business functioning.

- Brian Dean (Senior Vice President, Business Operations and Strategy): Dean spearheads Yelp’s business operations and strategic planning, ensuring alignment with long-term goals.

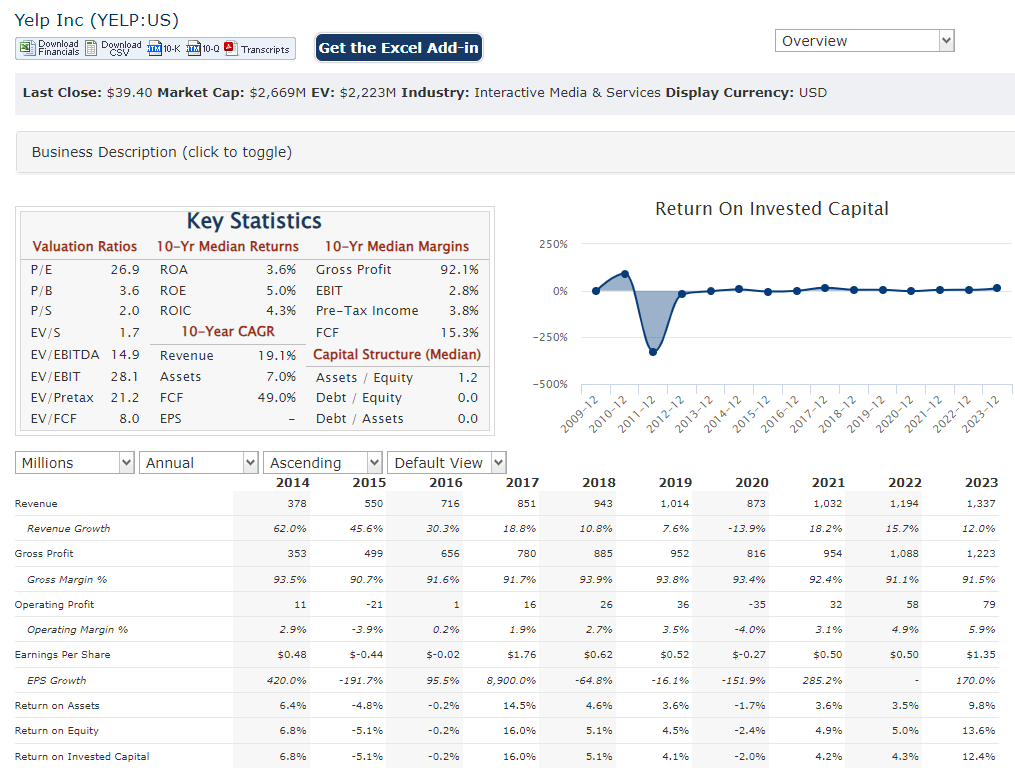

Financials:

Revenue has seen consistent growth, with a Compound Annual Growth Rate (CAGR) estimated to be around 5-7% .

Earnings growth, however, has been more volatile. While some years saw positive net income, there were also periods of losses. Estimates suggest a CAGR for earnings growth in the single digits, though potentially lower than the revenue CAGR.

Yelp’s balance sheet has also seen some fluctuations. The company has taken on debt in the past, but more recent reports indicate a reduction in debt levels.

Technical Analysis: On the monthly and weekly chart the stock is still range-bound. The shorter-term daily chart has a bear flag (Bearish) and we would expect shares to get to $35 soon. It might be a good entry at the $35 range for a move to the $40s in 2-4 month time-frame.

Bull Case:

- Continued Growth in Local Online Reviews and Advertising: The market for local business reviews and advertising is expected to keep growing steadily in the coming years.

- Innovation and Adaptation: If Yelp can stay ahead of the curve by innovating its platform and adapting to user needs, it can solidify its position in the market. This could involve features like leveraging artificial intelligence for more targeted recommendations or integrating with other local service providers.

- Improved Profitability: Recent trends suggest Yelp is moving towards a more stable and profitable financial future. This could make the stock more attractive to investors seeking long-term growth.

Bear Case:

- Vulnerability to Economic Downturn: During economic downturns, local businesses often cut back on advertising expenses. This could negatively impact Yelp’s revenue stream, which heavily relies on advertising from local businesses.

- Monetization Challenges: Despite a focus on advertising, Yelp might face difficulties in effectively monetizing its user base compared to competitors with more integrated offerings.

- Reliance on User-Generated Content: While user-generated content is a strength, it also presents challenges. Yelp needs to manage the quality and accuracy of reviews, which can be subjective and potentially manipulated by businesses or competitors.