Executive Summary:

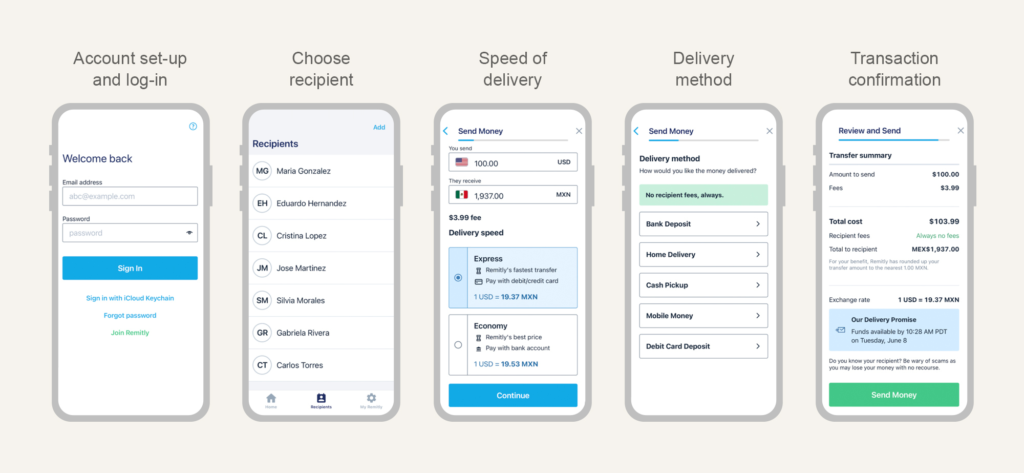

Remitly Global Inc. is a leading digital financial services company founded in 2011 that specializes in helping immigrants send money home safely and securely – global remittances. They focus on providing a user-friendly online experience for sending money internationally to over 150 countries. Remitly offers various delivery options for recipients, including bank deposits, mobile wallets, and cash pickups. The company makes money through transaction fees and foreign exchange spreads.

Revenue for Q4 reached $264.8 million, a 39% increase year-over-year. The company did experience a net loss of $35.0 million, compared to $19.4 million in Q4 2022.

Stock Overview:

| Ticker | $RELY | Price | $20.92 | Market Cap | $3.94B |

| 52 Week High | $27.95 | 52 Week Low | $15.83 | Shares outstanding | 188.50M |

Company background:

Remitly Global Inc. company founded by Matt Oppenheimer, Josh Hug, and Shivaas Gulati. Remitly offers secure and convenient money transfer services to over 150 countries, with recipients able to receive funds through various methods including bank deposits, mobile wallets, and cash pickups. The company generates revenue through transaction fees and foreign exchange spreads.

Remitly has grown significantly since its founding, and in September 2021, it became a publicly traded company. This move allowed Remitly to access a wider pool of capital to fuel its future growth. Remitly has expanded its offerings to include Remitly for Developers, a remittance-as-a-service solution that enables businesses to integrate Remitly’s global network and infrastructure into their own platforms.

Remitly faces competition from other major players in the digital money transfer market, such as WorldRemit, Wise, and Xoom. The company’s headquarters are located in Seattle, Washington, USA.

Recent Earnings:

Revenue and Growth: Remitly saw positive results in Q4 2023, with revenue reaching $264.8 million. The 39% revenue growth likely surpassed general analyst expectations for growth, which is a positive sign. Remitly projects continued revenue growth for 2024, estimating a range of 30% to 32% year-over-year.

The Market, Industry, and Competitors:

Remitly Global Inc. operates in the digital money transfer market, a sector anticipated for high growth by 2030. The ever-increasing globalization of the world’s economy, which means more people are working and living across borders and the growing immigrant population worldwide. With more immigrants needing to send money home to family, there’s a rising demand for fast, secure, and affordable money transfer services. The CAGR (Compound Annual Growth Rate) for the digital money transfer market could range from 10-12%.

Unique differentiation:

Remitly Global Inc. faces competition from several established players in the digital money transfer market.

- Wise (formerly TransferWise): A fierce competitor known for its competitive foreign exchange rates and transparent fee structure. Wise focuses on cost-effectiveness, attracting customers who prioritize sending large amounts internationally.

- WorldRemit: Another major player with a global presence, WorldRemit offers money transfers to a vast network of countries. They emphasize speed and convenience, allowing users to choose from various delivery options including cash pickup and mobile wallet deposits.

- Focus on Immigrants: Remitly specifically caters to the immigrant community, understanding their unique needs and challenges. This focus allows them to tailor their services and marketing messages to resonate better with this demographic.

- User-Friendly Platform: Remitly prioritizes a user-friendly online platform, making the money transfer process smooth and accessible, even for those less familiar with digital tools.

- Potential for Additional Services: Through Remitly for Developers, they offer remittance-as-a-service solutions.

Management & Employees:

- Matt Oppenheimer (Co-Founder and CEO): Oppenheimer co-founded Remitly in 2011 and steers the company’s overall direction. His background includes an MBA from Harvard and experience at Barclays.

- Josh Hug (Co-Founder and COO): Alongside Oppenheimer, Hug co-founded Remitly. He oversees day-to-day operations, leveraging his experience from previous entrepreneurial endeavors.

- Hemanth Munipalli (CFO): Munipalli joined Remitly in 2022 as CFO, bringing expertise from his financial leadership roles at Expedia Group and General Motors.

Financials:

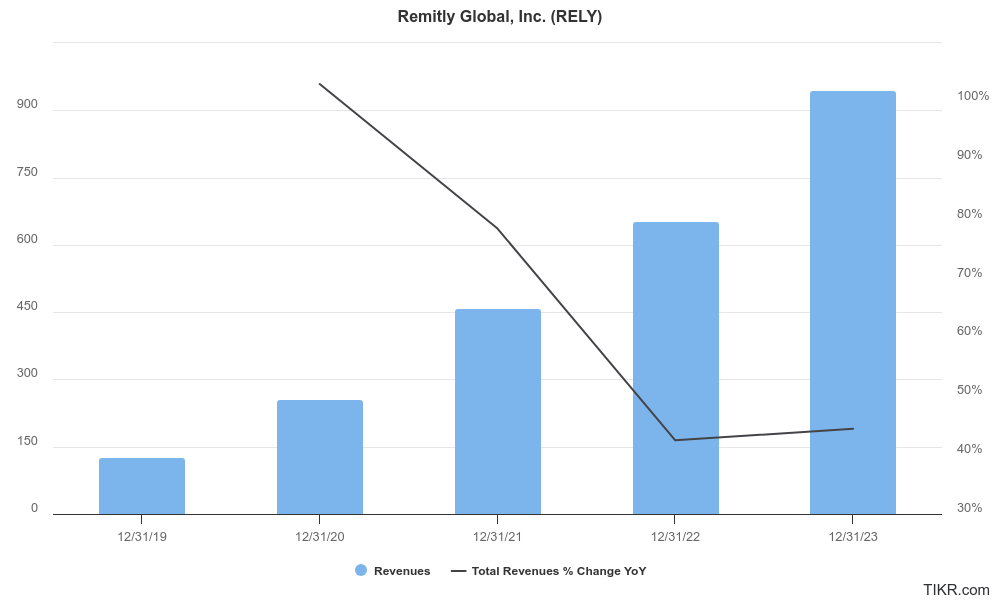

Remitly Global Inc. Reports indicate revenue in 2019 was around $126.6 million, and by 2020, it more than doubled to $257.0 million. This translates to a rough growth rate exceeding 100% for that single year.

Following this initial surge, Remitly’s growth has continued at a steady pace. They reported revenue of $653.6 million for fiscal year 2023, representing a year-over-year increase of 44% compared to 2022. Compounded annual growth rate (CAGR) is estimated for the past five years likely falls somewhere in the high 30s to low 40s percent range.

This growth would be reflected in areas like cash and equivalents, as well as receivables. On the liabilities side, you might expect to see growth in areas like customer deposits and accrued expenses.

Bull Case:

- Large and Growing Market: The digital money transfer market is booming, fueled by globalization and rising immigrant populations. Remitly is well-positioned to capitalize on this trend.

- Strong Revenue Growth: Remitly has a history of impressive revenue growth, with estimates suggesting a CAGR in the high 30s to low 40s percent range over the past five years.

- Focus on Underserved Niche: Remitly caters specifically to the immigrant community, a large and underbanked demographic with a strong need for money transfer services. This focus allows them to tailor their offerings and potentially build stronger customer loyalty.

Bear Case:

- Economic Downturn: A global economic downturn could lead to decreased immigration and fewer remittances being sent, negatively impacting Remitly’s core business.

- Technology Dependence: Remitly relies heavily on its technology platform to function. Security breaches or technical problems could damage their reputation and disrupt their business.

- Limited Product Portfolio: Currently, Remitly focuses primarily on money transfer services. This limits their revenue streams and makes them vulnerable to competition that offers a wider range of financial services.

Technical Analysis

The monthly chart is showing a Stage 1 markup after a stage 4 decline before earnings and a stage 1 consolidation. The weekly chart shows a good bull flag, and a strong Power Earnings Gap Up is confirmed on the daily chart. The stock should move $22 – $23 before next earnings, a 10% move up from here.