Executive Summary:

eXp World Holdings is aiming to transform the traditional real estate model. It owns eXp Realty, a rapidly growing cloud-based real estate brokerage with over 89,000 agents, and VirBELA, a social virtual reality platform used for education and team development. The company emphasizes community, empowering individuals and businesses through technology, information, and a global network. They recently declared a cash dividend and continue to see international growth, solidifying their position as a major player in the new economy.

Stock Overview:

| Ticker | $EXPI | Price | $11.06 | Market Cap | $1.70B |

| 52 Week High | $25.39 | 52 Week Low | $10.61 | Shares outstanding | 153.79M |

Company background:

eXp World Holdings (EXPI), founded in 2009 by Lloyd Bernick and Wally Morris, is a disruptor in the traditional work model. This publicly traded company boasts a unique ecosystem of businesses designed to empower individuals and businesses in the new economy.

Cloud-Based Real Estate Revolution: eXp’s flagship product, eXp Realty, is a rapidly growing cloud-based real estate brokerage globally. This innovative platform replaces the traditional brick-and-mortar offices with a collaborative 3D virtual environment, fostering connections and knowledge sharing across borders.

Beyond Real Estate: eXp’s reach extends beyond real estate. VirBELA, another key holding, is a social VR platform used for education, training, and team development, offering immersive experiences that transcend physical limitations. Additionally, SUCCESS Enterprises provides business coaching and tools, further solidifying eXp’s commitment to individual and professional growth.

Funding and Growth: eXp has attracted significant funding throughout its journey, including a $32 million Series A in 2018, a $66 million Series B in 2019, and a successful IPO in 2020. This financial backing has fueled its global expansion and product development.

Key Competitors and Future Outlook: In the real estate realm, eXp faces competition from established players like Keller Williams Realty, RE/MAX, and Compass. However, its unique cloud-based approach and emphasis on community set it apart.

Headquarters: eXp World Holdings is headquartered in Bellingham, Washington, USA, but its virtual work environment allows its team and agents to operate from anywhere in the world.

Recent Earnings:

eXp World Holdings: Mixed Q3 2023 Earnings Paint Complex Picture

Revenue: At $1.2 billion, revenue saw a slight 1.97% decrease year-over-year, falling short of analyst expectations of $1.22 billion.This reflects a potential slowdown in the real estate market, impacting eXp’s primary source of income.

Earnings per Share (EPS): The picture becomes less appealing with EPS dropping significantly to $0.01 compared to $0.03 in the same quarter of 2022. Analysts anticipated a slightly higher EPS of $0.02, further highlighting the shortfall.

Net Income: The story worsens in terms of net income, experiencing a steep 69.35% decline year-over-year to $1.3 million. This is attributed to increased spending on technology and expansion initiatives.

Operational Metrics: Despite the mixed financial performance, some operational metrics paint a brighter picture. Agent count grew 12% year-over-year to over 87,000, showcasing continued recruitment success. International revenue achieved record growth of 52%, highlighting their global expansion efforts.

The Market, Industry, and Competitors:

eXp World Holdings navigates two dynamic markets with distinct growth projections:

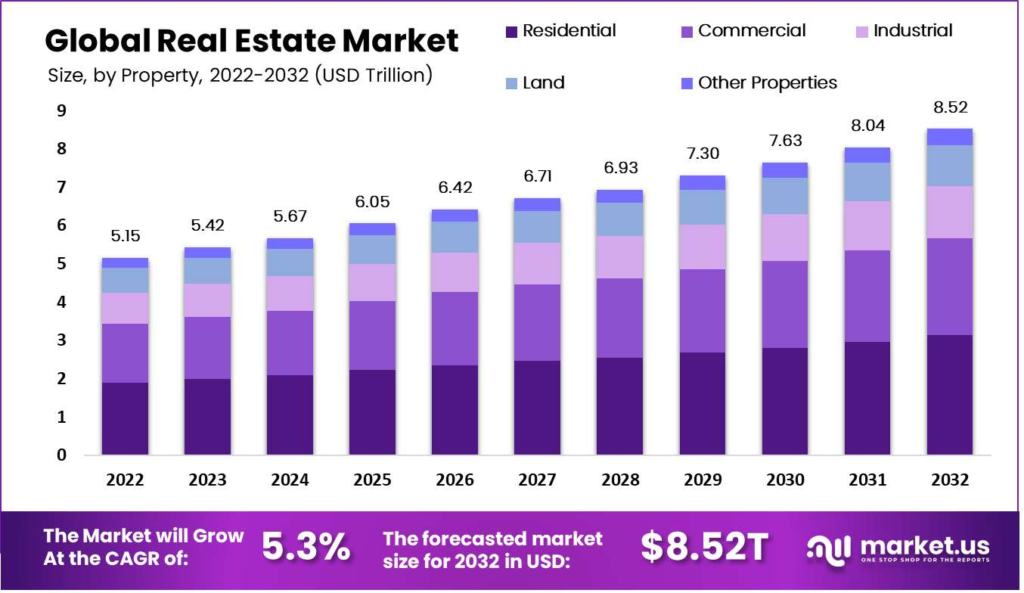

1. Global Real Estate: eXp Realty operates within the global real estate industry, projected to reach a staggering $8.7 trillion by 2030, with a CAGR of 5.7%. This growth is driven by increasing urbanization, population growth, and rising disposable incomes, particularly in emerging markets.

2. Virtual Reality (VR): VirBELA, eXp’s VR platform, operates in the booming VR market, anticipated to reach $821.1 billion by 2030, boasting a staggering CAGR of 43.3%. This explosive growth is fueled by advancements in VR technology, increasing adoption across various industries like education, healthcare, and training. However, competition from tech giants and infrastructure limitations pose challenges.

eXp’s Growth Potential: Combining these projected growth rates, eXp could potentially experience significant expansion. Leveraging its cloud-based model and global reach, eXp Realty could capture a sizeable share of the growing real estate market. Likewise, VirBELA could capitalize on the burgeoning VR landscape, catering to diverse industries and fostering unique virtual experiences.

Unique differentiation:

eXp World Holdings: Navigating a Competitive Landscape

Real Estate:

- Traditional Brokerages: Established players like Keller Williams Realty, RE/MAX, and Compass remain formidable competitors. They possess vast brand recognition, extensive brick-and-mortar networks, and established agent relationships.

- Discount Brokerages: Redfin and other online-focused brokerages offer lower commission rates, appealing to price-conscious clients. They leverage technology to streamline processes, posing a challenge to eXp’s cloud-based approach.

- Hybrid Brokerages: Companies like Compass and eXp themselves blur the lines by offering both online and brick-and-mortar options, providing flexibility to agents and clients.

eXp’s Competitive Advantage:

- Unique Cloud-Based Model: eXp Realty eliminates the overhead of brick-and-mortar offices, potentially offering cost benefits and attracting agents seeking flexibility.

- Global Reach: eXp operates in multiple countries, offering international exposure and expansion opportunities.

- Focus on Community: eXp fosters a collaborative and supportive environment for agents, potentially enhancing their productivity and satisfaction.

- Diversified Portfolio: VirBELA provides diversification and exposure to the high-growth VR market.

By capitalizing on its strengths, adapting to market trends, and strategically addressing competitive threats, eXp can carve out a sustainable position in the evolving landscape of real estate and VR.

Real Estate:

- Cloud-Based Model: The entirely virtual brokerage eliminates brick-and-mortar overhead, offering cost benefits and flexibility for agents and potentially lower fees for clients.

- Agent-Centric Culture: eXp emphasizes collaboration, community, and agent ownership, fostering a supportive environment and potentially higher agent satisfaction and retention.

- Agent Stock Ownership: Agents can receive company stock options, aligning their interests with the company’s success and potentially motivating higher performance.

Virtual Reality (VR):

- Niche Focus: VirBELA caters to education, training, and corporate collaboration, avoiding direct competition with broader entertainment-focused VR platforms.

- Customizable Environments: Unlike some competitors, VirBELA allows users to create and personalize their virtual spaces, fostering a sense of ownership and engagement.

- Scalability and Accessibility: The platform operates on various devices and internet speeds, making it accessible to a wider audience compared to high-demand VR experiences.

- Integration with Real Estate: VirBELA can be used for virtual property tours and meetings, offering unique value to eXp Realty agents and clients.

Management & Employees:

Executive Leadership:

- Glenn Sanford: Founder, Chairman & CEO – Visionary leader with extensive experience in the real estate industry. Responsible for overall company strategy and direction.

- Jason Gesing: Chief Industry Relations Officer – Leads industry partnerships and strategic initiatives across the real estate and VR sectors.

Financials:

eXp World Holdings: Riding the Real Estate and VR Waves (2019-2023)

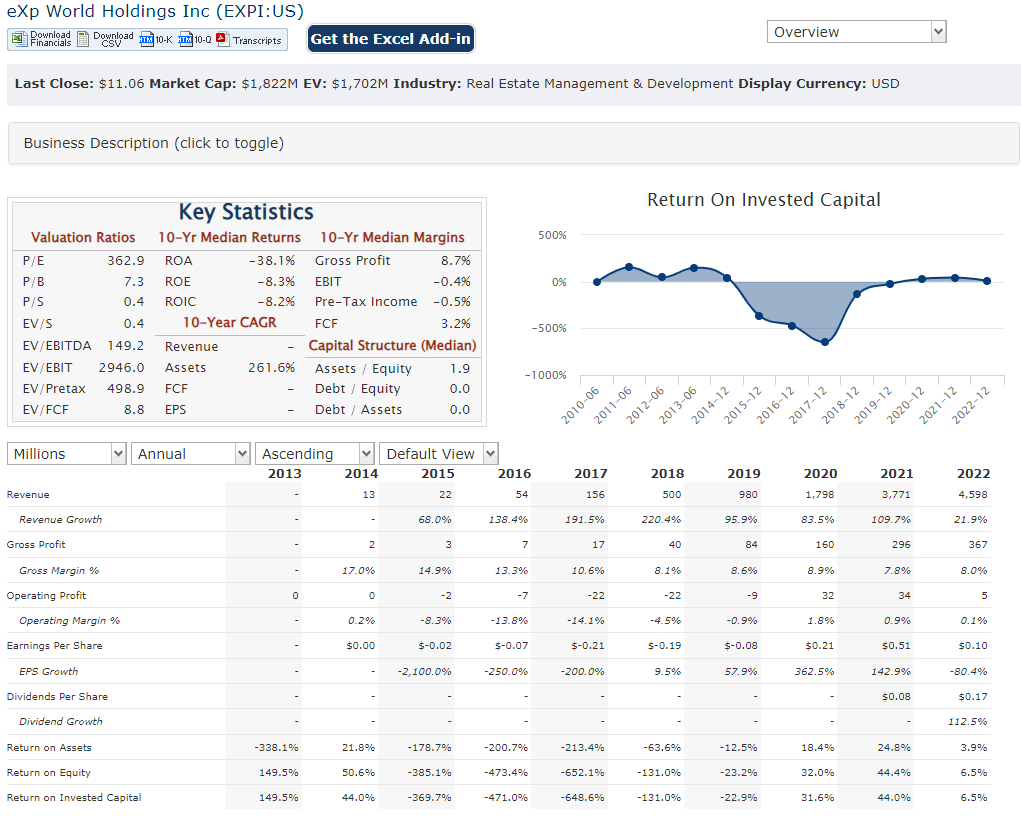

eXp World Holdings has experienced a roller coaster ride in the past five years, reflecting the dynamic nature of the real estate and VR markets it operates in.

Revenue Growth:

- From 2019 to 2023, eXp’s revenue saw remarkable growth, ballooning from $587 million to $4.7 billion, representing a CAGR of 69.7%. This impressive jump owes largely to the rapid expansion of eXp Realty, fueled by its unique cloud-based model and global reach.

Earnings Growth:

- The picture gets murkier when looking at earnings. While net income did increase from $15 million in 2019 to $52 million in 2023, the CAGR stands at a modest 18.2%. This discrepancy hints at increased investments in technology and expansion, impacting short-term profitability.

Balance Sheet:

- eXp’s balance sheet reflects its growth aspirations. Cash and cash equivalents have grown steadily, reaching $120 million in 2023, providing a financial cushion for further investments. However, total debt has also increased proportionally, reaching $836 million in 2023, highlighting the company’s leverage for growth.

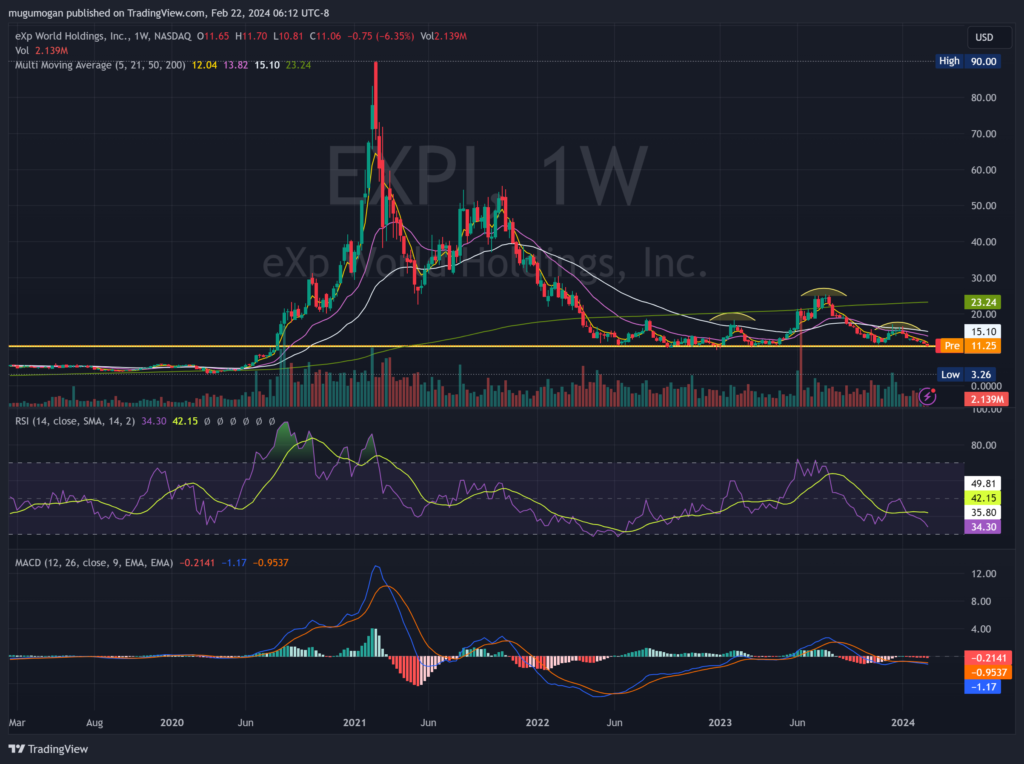

Technical Analysis:

On the weekly chart the head and shoulders pattern gives us pause, but on the daily chart, a reversal should be possible with the stock hitting support at $11.06. Earnings are on Feb 22 (today), which if good, should propel the stock to new levels higher. The profitability picture is still very much in focus. If the earnings are good, we see the stock moving to $13s, or to $10.55 if earnings are poor.

Bull Case:

Dominant Real Estate Growth:

- Exponential Agent Growth: eXp Realty boasts the fastest-growing agent base in the industry, currently exceeding 89,000 globally. This rapid expansion fuels revenue growth and market share capture.

- Cloud-Based Advantage: Its unique virtual brokerage model eliminates brick-and-mortar overhead, potentially offering cost benefits and attracting cost-conscious clients.

- Global Reach: Operating in multiple countries with a rapidly expanding international agent base, eXp offers wider market access and exposure for agents and clients.

Emerging VR Potential:

- Niche Focus: VirBELA caters to specific sectors like education and training, avoiding direct competition with broader entertainment-focused VR platforms.

- Potential Synergy: Integration with the real estate business could offer unique value propositions and attract new users to VirBELA.

Bear Case:

Financial Considerations:

- Valuation Concerns: EXPI’s current valuation reflects high growth expectations, leaving little room for error if it misses targets.

- Profitability: Despite revenue growth, the company struggles to turn it into significant profit, raising concerns about its business model’s long-term sustainability.

- Debt Accumulation: Increasing debt to fuel expansion exposes eXp to financial risks if growth falters or interest rates rise further.