Executive Summary:

LegalZoom, founded in 2001, is a online legal technology and services company. Their mission is to make legal help accessible to everyone, offering services for both individuals and small businesses. They focus on providing legal documents and resources, but also connect users with a network of independent attorneys for consultations and more complex needs. With a team of over 1,300 employees, LegalZoom has become a trusted resource for many seeking legal assistance in a convenient and affordable way. As of 2022, they boast over $650M in trailing 12 months revenue and continue to expand their offerings to meet the evolving needs of their clients.

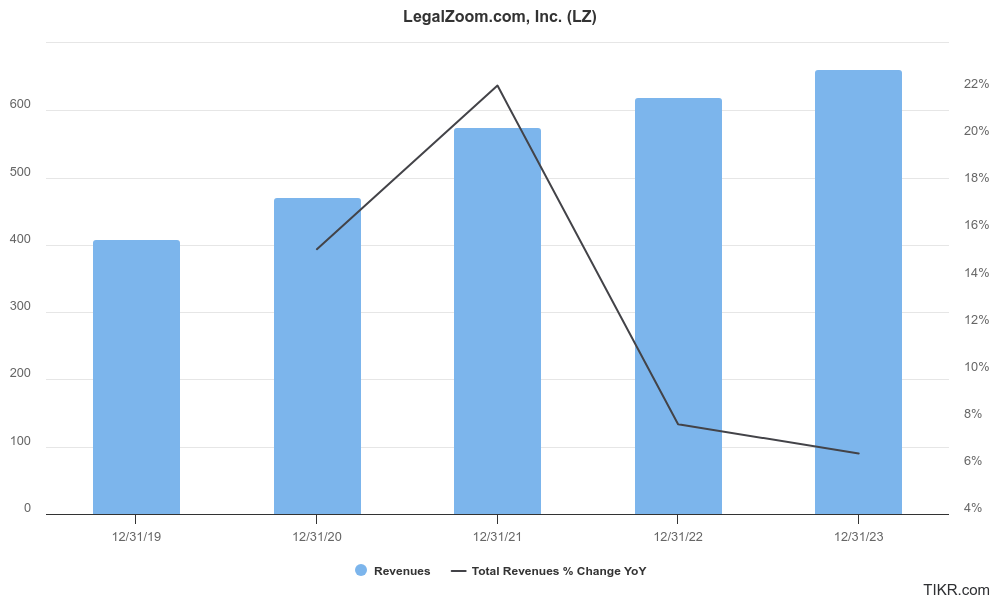

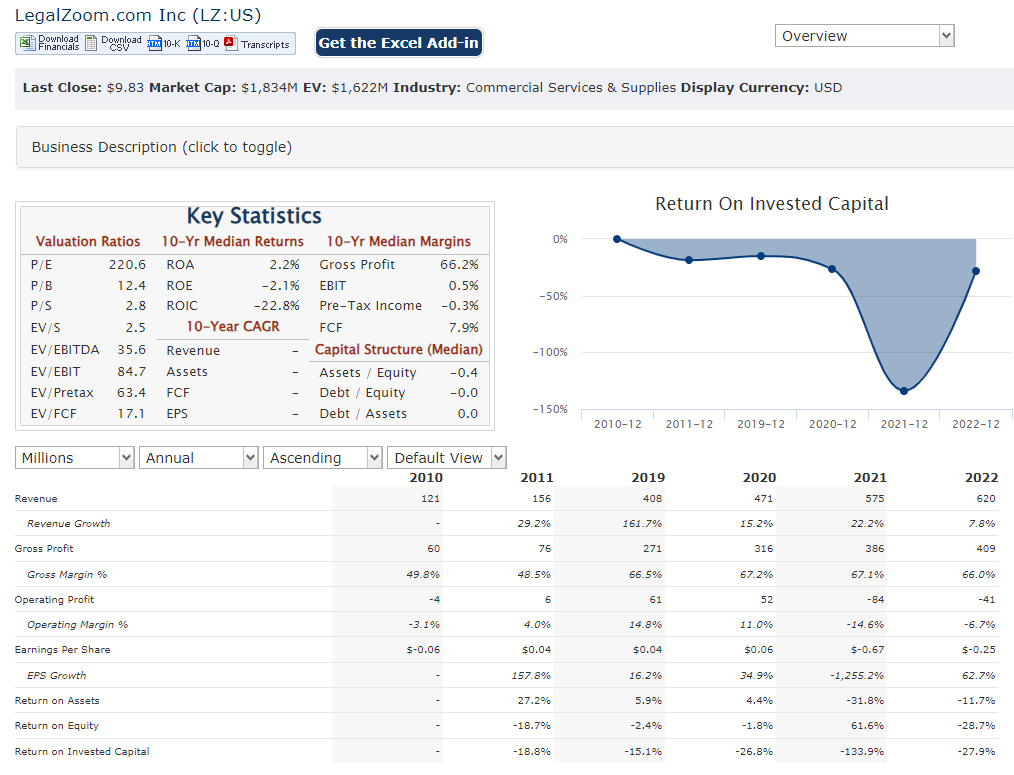

LegalZoom reported their fourth-quarter and full-year 2023 earnings on Feb 22nd. Revenue for the quarter reached $158.66 million, representing an 8.2% increase year-over-year and exceeding analyst expectations of $156.25 million. This positive surprise translated to an EPS of $0.13, compared to $0.10 in the same period last year. LegalZoom generated $661 million in revenue, up from $618 million in 2022, and achieved an EPS of $0.51, surpassing the prior year’s $0.40.

Stock Overview:

| Ticker | $LZ | Price | $9.07 | Market Cap | $1.86B |

| 52 Week High | $15.86 | 52 Week Low | $15.68 | Shares outstanding | 187M |

Company background:

LegalZoom: Making Legal Accessible

LegalZoom has become a prominent player in the online legal services industry. Their mission is to democratize access to legal help, offering services to individuals and businesses at affordable prices.

Products and Services: LegalZoom boasts a wide range of legal documents and services, catering to both personal and professional needs. Individuals can utilize their platform for tasks like creating wills, trusts, and power of attorney documents, while businesses can leverage their expertise in forming LLCs, corporations, and obtaining trademarks. LegalZoom also connects users with a network of independent attorneys for more complex legal matters and consultations.

Funding and Growth: Backed by over $800M in funding from various investors, LegalZoom has grown significantly since its inception. As of 2023, they boast over $600M in revenue and continue to expand their offerings to meet the evolving needs of their clients.

Competition: While LegalZoom is a leader in the online legal service space, they face competition from other established players like Rocket Lawyer, Incfile, and LegalShield. Each company offers similar services, but may differ in pricing, features, and target audience.

Headquarters: LegalZoom is headquartered in Glendale, California, with offices across the United States.

Recent Earnings:

Revenue and Growth:

- Full Year 2023: Revenue totaled $661 million, up 6.9% from $618 million in 2022.

EPS and Growth:

- Full Year 2023: EPS reached $0.51, a 27.5% increase from $0.40 in 2022.

Operational Metrics:

- Customer base: Over 10 million customers, Paid subscribers: Over 1 million subscribers and Renewal rate: Approximately 70%.

Forward Guidance:

- LegalZoom expects revenue growth of 6% to 8% in 2024 and anticipate EPS growth of 15% to 20%.

The Market, Industry, and Competitors:

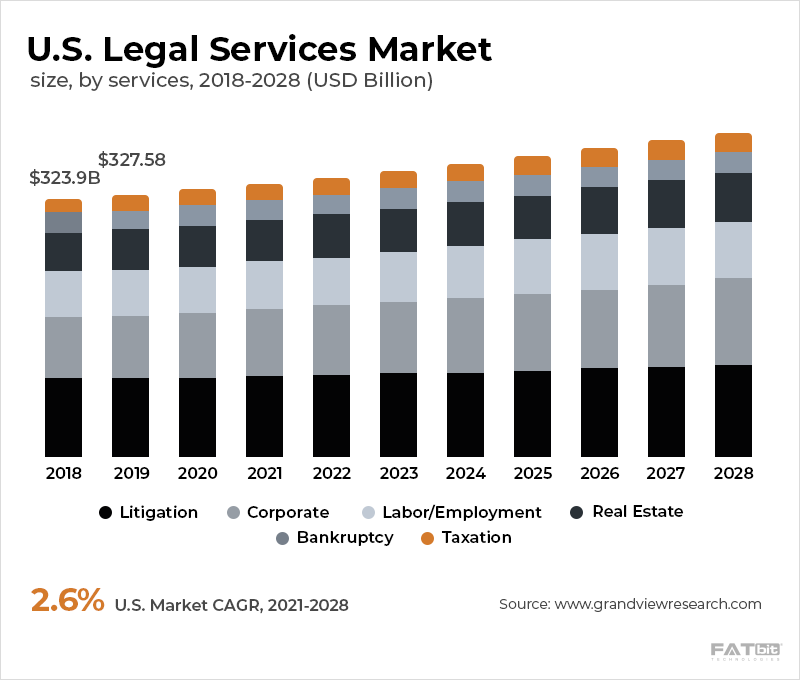

LegalZoom operates in the burgeoning online legal services (OLS) market, estimated to reach a staggering $13.8 billion by 2030, fueled by factors like:

- Increasing legal awareness: Rising awareness of legal rights and responsibilities is driving demand for legal services.

- Convenience and affordability: OLS platforms offer an accessible and cost-effective alternative to traditional law firms.

- Technological advancements: AI and automation are streamlining processes and making legal services more accessible.

Growth expectations for LegalZoom are positive. Analysts predict a compound annual growth rate (CAGR) of 6.8% for the company between 2023 and 2030. This growth is attributed to:

- Expansion into new markets and services: LegalZoom is continuously expanding its offerings, including business services, accounting solutions, and AI-powered document summarization tools.

- Strong brand recognition: LegalZoom enjoys strong brand recognition and customer trust, giving it a competitive edge.

Unique differentiation:

LegalZoom navigates a dynamic market filled with both established players and innovative newcomers. Here’s a breakdown of some key competitors:

Direct Competitors:

- Rocket Lawyer: Similar service offerings, focusing on individual legal needs and connecting users with attorneys. They compete on price and offer subscription plans.

- Incfile: Specializes in business formation services, offering competitive pricing and free registered agent services. They target startups and small businesses.

- LegalShield: Provides subscription-based legal plans with access to attorneys for consultations and specific legal matters. This model caters to ongoing legal needs.

Emerging Competitors:

- Avvo: An online legal marketplace connecting users with attorneys directly. They focus on providing a platform for attorney-client interaction.

- LawTrades: A peer-to-peer platform where users can exchange legal services for credits. This innovative model caters to budget-conscious individuals.

- AI-powered legal services: Startups are using AI to automate legal tasks, potentially disrupting the traditional legal service landscape. These companies could become significant threats in the future.

LegalZoom stands out in the online legal service market with a combination of unique factors:

1. Brand Recognition and Trust: They are the leading and most recognizable name in the online legal service industry, established in 2001 and boasting millions of customers. This translates to trust and familiarity in a market where navigating unfamiliar legal territories can be intimidating.

2. Comprehensive Service Portfolio: LegalZoom offers a wider range of legal documents and services compared to some competitors. From individual needs like wills and trusts to business formation, intellectual property, and estate planning, they cater to a broader spectrum of legal needs.

3. Ease of Use and User Experience: Their platform is designed for accessibility and ease of use, even for individuals with no prior legal knowledge. Intuitive navigation, clear instructions, and guided processes make the legal process less daunting.

4. Network of Independent Attorneys: They offer the convenience of connecting with vetted independent attorneys for consultations and complex legal matters. This hybrid approach provides flexibility and access to personalized legal guidance when needed.

5. Innovation and Technology Focus: LegalZoom invests heavily in technology and automation, continuously improving their platform and developing new AI-powered tools. This focus on innovation ensures they stay ahead of the curve in the evolving legal landscape.

6. Subscription Model: Their subscription model provides recurring revenue and incentivizes customer loyalty. This model allows users to access ongoing legal support and document updates for a fixed fee.

7. Price Competitiveness: While not necessarily the cheapest option, LegalZoom offers competitive pricing compared to traditional law firms for many services, making legal assistance more affordable for a wider audience.

Management & Employees:

LegalZoom’s Management Team: Steering the Course

CEO – Dan Wernikoff: Wernikoff, at the helm since October 2019, boasts extensive experience in consumer-focused technology companies, previously leading Intuit’s Consumer Tax Group and Small Business Group.

COO & Chief Product Officer – Rich Preece: Preece, leading both operations and product development since December 2019, has a proven track record in scaling technology businesses and building customer-centric products.

Financials:

LegalZoom: Financial Performance Overview (2018-2023)

Revenue Growth: LegalZoom has demonstrated consistent revenue growth over the past five years. From 2018 to 2023, their revenue climbed from $441 million to $661 million, representing a CAGR of 9.1%. This growth is attributed to factors like increasing consumer awareness of online legal services, expansion into new service areas, and successful customer acquisition strategies.

Earnings Growth: LegalZoom’s earnings have also grown steadily over the past five years. In 2018, their net income was -$44 million, and by 2023, it had reached $38 million. This translates to a CAGR of 35.4%, highlighting their improving profitability and efficient operations.

Balance Sheet: LegalZoom maintains a healthy financial position with a strong balance sheet. As of December 31, 2023, they boasted cash and cash equivalents of $212.1 million and no long-term debt. This financial strength allows them to invest in growth initiatives and weather potential economic downturns.

Technical Analysis:

LegalZoom shares are still in a long term range-bound stage (accumulation phase 1). We would wait for a confirmed uptrend and a breakout of $10.8 range to be interested in taking a long term position.

Bull Case:

Growth in the Online Legal Services Market: The online legal services market is projected to reach a staggering $13.8 billion by 2030, fueled by increasing legal awareness, convenience, and the use of technology. This presents a significant opportunity for LegalZoom to capture market share and grow its revenue.

Strong Brand Recognition and Customer Base: LegalZoom enjoys strong brand recognition and trust, boasting over 10 million customers. This established brand, coupled with a loyal customer base, provides a solid foundation for future growth.

Subscription Model and Recurring Revenue: Their subscription model offers a stable and predictable revenue stream, as customers pay recurring fees for access to services and document updates. This model provides financial stability and facilitates growth.

Diversification and Expansion: LegalZoom is continuously expanding its service offerings, venturing into new areas like business formation, accounting solutions, and AI-powered tools. This diversification mitigates risk and opens up new revenue streams.

Focus on Technology and Innovation: LegalZoom invests heavily in technology and automation, aiming to streamline processes and enhance user experience. This focus on innovation keeps them ahead of competitors and improves operational efficiency.

Improved Profitability: LegalZoom has demonstrated consistent improvement in profitability over the past few years, with their EPS growing at a CAGR of 35.4% from 2018 to 2023. This trend suggests potential for continued earnings growth and shareholder value creation.

Strong Management Team: LegalZoom’s experienced management team possesses diverse expertise in technology, marketing, finance, and legal matters. Their leadership is crucial for navigating the competitive landscape and executing growth strategies.

Potential for Acquisitions and Partnerships: Exploring strategic acquisitions and partnerships could further expand LegalZoom’s reach and service offerings, accelerating their growth in the fragmented online legal services market.

Bear Case:

Competition: The online legal services market is fiercely competitive, with established players and innovative startups vying for market share. LegalZoom might face pressure to maintain its competitive edge and adapt to changing consumer preferences.

Economic Fluctuations: Downturns in the economy could negatively impact demand for legal services, affecting LegalZoom’s revenue and profitability.

Regulatory Landscape: Changes in regulations governing online legal services could disrupt their business model and increase compliance costs.

Limitations of Online Services: While convenient, online legal services might not be suitable for all legal needs. This could limit their addressable market and impact customer acquisition.

Technological Disruption: Emerging technologies like AI-powered legal services could disrupt the traditional legal services market, posing a threat to LegalZoom’s current business model.

Subscription Model Dependence: Their reliance on a subscription model creates recurring revenue, but also makes them susceptible to subscriber churn if they fail to meet customer expectations.

Valuation Concerns: LegalZoom’s stock price might already reflect its future growth potential, leaving limited upside for investors.

Limited International Expansion: LegalZoom primarily operates in the US, limiting their market reach and growth potential compared to global competitors.

Management Execution Risks: The success of LegalZoom’s future growth strategies heavily depends on their management team’s ability to execute effectively.