Executive Summary:

Bumble Inc., founded in 2014 by Whitney Wolfe Herd, is the parent company of the popular dating app Bumble, known for its feminist approach where women make the first move in heterosexual matches. They also own Badoo, another dating app, and are expanding into friendship (Bumble BFF) and professional networking (Bumble Bizz) with the mission to foster healthy and equitable relationships in all forms. With headquarters in Austin, Texas, Bumble Inc. boasts over 100 million users worldwide and strives to create a kinder, more respectful online space for connection.

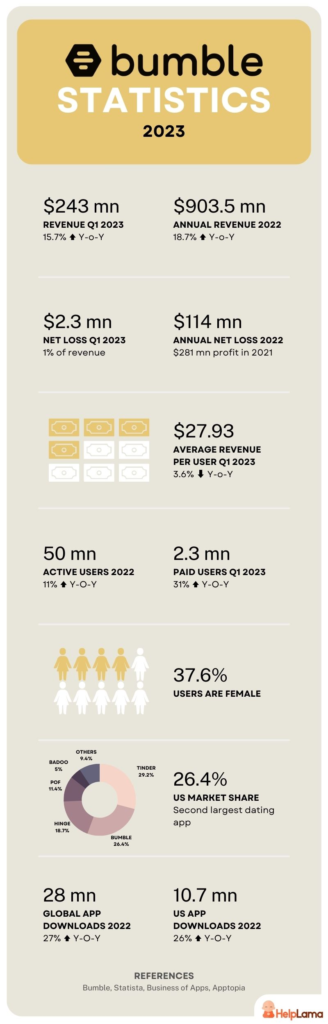

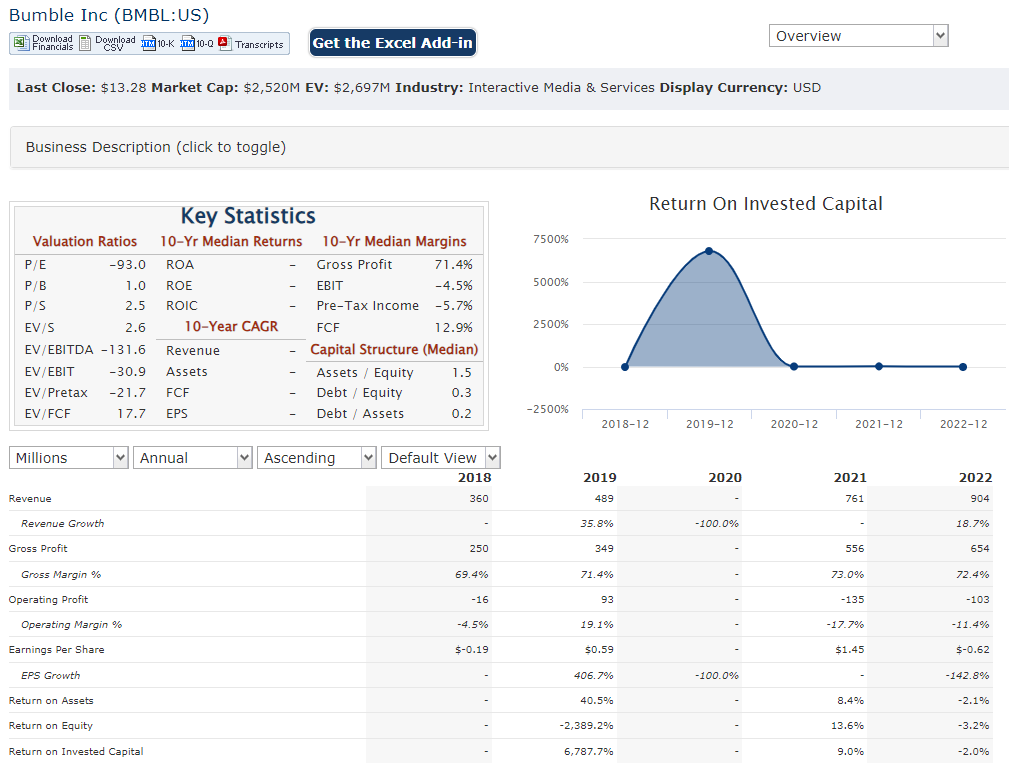

Analysts currently predict an EPS of around $0.12, which would be a decrease from the $0.17 EPS reported in Q4 2022. Bumble’s previous quarters showed steady growth: $275.51 million in Q3 2023, with an 18.43% year-over-year increase.

Stock Overview:

| Ticker | $BMBL | Price | $13.28 | Market Cap | $2.5B |

| 52 Week High | $25.74 | 52 Week Low | $12.29 | Shares outstanding | 136.75M |

Company background:

The company’s flagship product, Bumble Date, rose to fame for its unique approach, attracting millions of users worldwide. Bumble Inc. has since expanded its offerings beyond dating, introducing Bumble BFF for platonic friendships and Bumble Bizz for professional networking. All three platforms share the core value of fostering positive and equitable connections.

Bumble Inc. has attracted significant funding over the years, including a $2.2 billion IPO in 2021 at a valuation of $7.7billion. This financial backing has fueled the company’s growth and acquisitions, including the 2019 purchase of Badoo, another popular dating app.

In terms of competition, Bumble faces stiff challenges from established players like Match Group (Tinder, Hinge, OkCupid) and emerging rivals like Hinge and Coffee Meets Bagel. However, Bumble’s distinct brand identity and focus on user empowerment continue to draw a loyal following.

Bumble Inc. is headquartered in Austin, Texas, with a global presence spanning numerous countries.

Recent Earnings:

Bumble’s Q3 2023 revenue reached $275.51 million, representing an 18.43% year-over-year increase. EPS was $0.12 vs $0.07 estimated.

The Market, Industry, and Competitors:

Bumble Blooms in a Competitive Garden: Navigating Growth in the Dating App Market

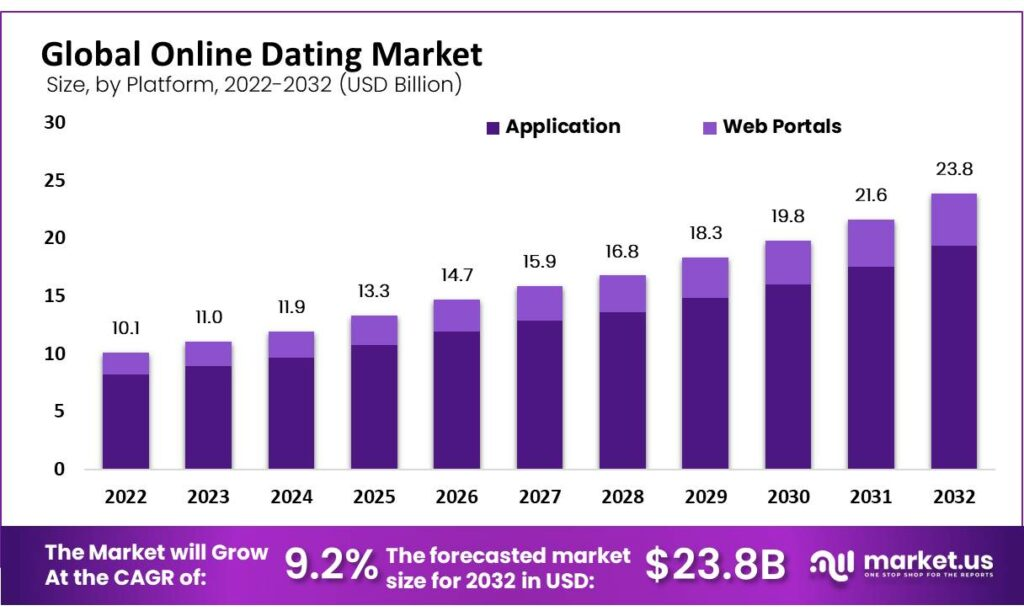

Bumble operates in the dynamic and ever-evolving online dating app market. This global market is projected to reach a staggering $9.24 billion by 2030, growing at a healthy Compound Annual Growth Rate (CAGR) of 8.6% between 2023 and 2030. This growth is fueled by several factors, including increasing smartphone penetration, rising disposable incomes, and evolving social norms around online dating.

Bumble itself is expected to see continued growth within this expanding market. Analysts predict the company to reach $4.4 billion in revenue by 2030, representing a potential CAGR of 22.5%. This optimistic outlook hinges on Bumble’s ability to capitalize on its unique brand identity, focused on women-led interactions and respectful connections. Additionally, expanding into new areas like Bumble BFF and Bumble Bizz could unlock further growth potential.

However, Bumble faces fierce competition from established players like Match Group (Tinder, Hinge, OkCupid) and emerging rivals like Hinge and Coffee Meets Bagel. Maintaining user engagement, diversifying its revenue streams, will be crucial for Bumble to achieve its projected growth targets.

Unique differentiation:

Bumble’s Competitive Hive: Navigating a Crowded Dating App Market

Match Group: This giant houses popular apps like Tinder, Hinge, and OkCupid, offering diverse options for different age groups and preferences. Tinder remains the undeniable market leader, attracting a younger crowd, while Hinge positions itself as the “anti-Tinder” focusing on serious relationships. Match Group’s vast user base and brand recognition pose a significant challenge for Bumble.

Emerging Rivals: Startups like Coffee Meets Bagel and The League attract users with unique features like curated matches and exclusivity. These rivals may not have the mass market appeal of Bumble, but their niche offerings cater to specific demographics and could threaten Bumble’s growth in those segments.

Feature Overlap: Some competitors like Badoo (acquired by Bumble) and Grindr share similar features with Bumble, especially concerning profile creation and matching mechanisms. While it creates a sense of familiarity for users, it also means a direct struggle for attention and user base.

Beyond these direct competitors, social media platforms like Facebook and Instagram are increasingly incorporating dating features, blurring the lines and potentially impacting Bumble’s user base.

Standing Out in the Crowd: To stay ahead, Bumble needs to leverage its unique value proposition of women-led interactions and respectful connections. Continued expansion into platonic friendships and professional networking with Bumble BFF and Bumble Bizz can further diversify its user base and differentiate itself from the competition. Additionally, effective marketing and strategic partnerships can help maintain brand awareness and attract new users.

Winning the online dating game requires constant innovation, adaptability, and a strong understanding of user needs. While competition is fierce, Bumble’s distinct features and focus on responsible connections provide a fertile ground for continued growth and success.

Bumble Inc. differentiates itself from competitors in the online dating world through several key features:

1. Women-led interactions: Bumble is the only major dating app where only women can initiate contact in heterosexual matches. This empowers women and creates a safer and more respectful environment.

2. Focus on respect: Bumble has strict guidelines against harassment and inappropriate behavior, and has features like photo verification and in-app reporting to promote safety and comfort.

3. Diverse offerings: Bumble goes beyond just dating with Bumble BFF for friend-finding and Bumble Bizz for professional networking. This caters to a wider range of user needs and fosters more than just romantic connections.

4. Brand identity: Bumble has cultivated a brand image that is positive, inclusive, and focused on building healthy relationships. This attracts users who value respectful interactions and meaningful connections.

5. Innovation: Bumble regularly introduces new features and updates to keep its platform fresh and engaging. They listen to user feedback and adapt to changing trends in the online dating landscape.

Management & Employees:

Bumble Inc.’s Leadership Hive: Building Connections with Vision

Bumble Inc. boasts a diverse and experienced leadership team, driving the company’s growth and innovation. Here’s a glimpse at some key players:

1. Whitney Wolfe Herd: The founder and CEO, Wolfe Herd, is the visionary behind Bumble’s unique approach to online relationships. Her experience in the industry and commitment to empowering women shape the company’s culture and strategy.

2. Tariq M. Shaukat: As President, Shaukat oversees day-to-day operations and global expansion, leveraging his extensive experience in technology and media.

3. Yoav Flam: The CTO, Flam leads Bumble’s technological advancements, ensuring a robust and scalable platform for its growing user base.

Financials:

Revenue Growth:

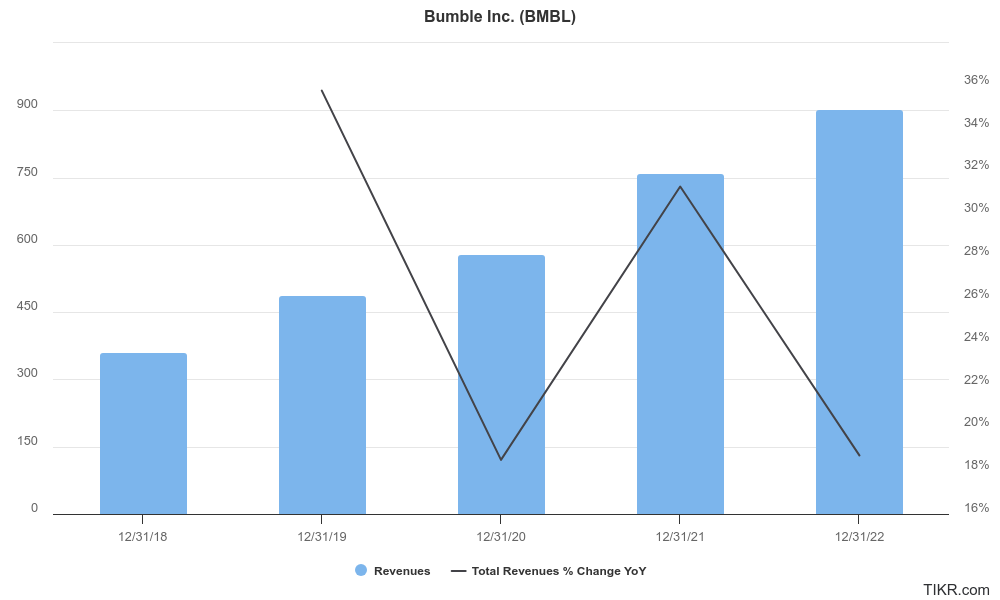

- From its IPO in February 2021 to the end of Q3 2023, Bumble consistently demonstrated revenue growth.

- For example, Q3 2023 reported revenue of $275.51 million, representing an 18.43% year-over-year increase compared to Q3 2022.

Earnings Growth:

- Bumble’s path to profitability is still ongoing. While the company reported positive net income in certain quarters, overall earnings remain volatile.

- For example, while Q3 2023 showed a net income of $16.67 million, it represented a slight decrease compared to the previous year’s Q3.

Balance Sheet:

- Bumble’s balance sheet reflects a company prioritizing investment for future growth.

- As of Q3 2023, the company boasts significant cash reserves exceeding $439 million, indicating financial stability.

- However, total debt is also sizeable, highlighting the investments made in expansion and acquisitions.

Technical Analysis:

Nothing about this stock’s chart says buy now. The Head and Shoulders pattern on the daily chart means more downside exists. A good earnings release (On Feb 27th) and strong guidance could change the narrative.

Bull Case:

1. Strong brand identity and differentiation: Bumble stands out with its women-led interactions and focus on respect, attracting a specific user segment yearning for a safer and more positive online dating experience. This distinct brand identity helps them carve out a niche in the crowded market.

2. Expanding user base and diverse offerings: Bumble’s user base is steadily growing, surpassing 100 million globally. They’re also strategically expanding beyond dating with Bumble BFF and Bumble Bizz, catering to broader social and professional networking needs. This diversification could unlock new revenue streams and attract a wider demographic.

3. Innovation and adaptability: Bumble actively introduces new features and updates to keep their platform fresh and engaging. They listen to user feedback and stay ahead of industry trends, demonstrating a commitment to continuous improvement.

4. Growth potential in underpenetrated markets: Bumble has a strong presence in North America and Europe, but there’s significant room for expansion in emerging markets like Asia and Latin America. This geographical diversification could drive substantial future growth.

5. Experienced leadership team: Bumble’s leadership boasts diverse expertise and a shared vision for building a more equitable online space. This strong team could effectively navigate industry challenges and drive the company’s success.

6. Potential for increased monetization: While profitability is still evolving, Bumble explores various monetization strategies beyond subscriptions, like in-app purchases and advertising. Successfully unlocking these avenues could significantly boost revenue potential.

7. Attractive valuation compared to competitors: Some argue that Bumble’s stock currently trades at a lower valuation than certain competitors, despite its impressive growth potential. This could present an attractive entry point for investors.

Bear Case:

1. Fierce competition: Bumble faces strong competition from established players like Match Group (Tinder, Hinge) and emerging rivals like Coffee Meets Bagel. Standing out and retaining users in this saturated market proves difficult, impacting user growth and ultimately, revenue.

2. Uncertain path to profitability: Despite revenue growth, Bumble still grapples with volatile earnings and struggles to consistently turn a profit. This raises concerns about its long-term financial sustainability and ability to generate shareholder value.

3. Limited user segment: Bumble’s focus on women-led interactions attracts a specific demographic. While appealing to some, it could limit user base expansion compared to more inclusive competitors, hindering overall growth potential.

4. Regulatory risk: The online dating industry faces increasing scrutiny around data privacy and user safety. Potential regulatory changes could force Bumble to alter its approach, impacting user experience and potentially incurring compliance costs.

5. Reliance on acquisitions: Bumble’s growth strategy partly relies on acquiring competitors like Badoo. Integrating these acquisitions smoothly and extracting their full value can be challenging, posing potential risks and uncertainties.

6. Decelerating user growth: Although Bumble’s user base expands, some recent quarters have shown signs of slower growth. This could indicate plateauing interest or market saturation, raising concerns about future sustainable growth.

7. Dependence on mobile app market: Bumble heavily relies on the mobile app market, susceptible to platform changes and user preferences shifting towards alternative forms of social interaction.

8. Overvalued stock: Some argue that Bumble’s stock currently trades at a premium compared to its future earnings potential, making it a risky investment in an uncertain market.