Executive Summary:

Founded in 1990, Schrödinger, Inc. is a scientific software company focused on accelerating innovation in drug discovery and materials science. Their core strength lies in computational platforms that simulate molecules at an atomic level, allowing researchers to virtually predict how they’ll behave and optimize them for specific purposes. Beyond software, they offer custom solutions, training, and research-based drug discovery projects. With a mission to improve human health and quality of life, Schrödinger is actively developing its own therapeutic pipeline, utilizing its platform to discover and design new drugs.

Schrödinger is expected to report their earnings on February 28th, 2024, after market close. Analysts currently expect an EPS of -$0.44 for the quarter, compared to -$0.39 in the same period last year.

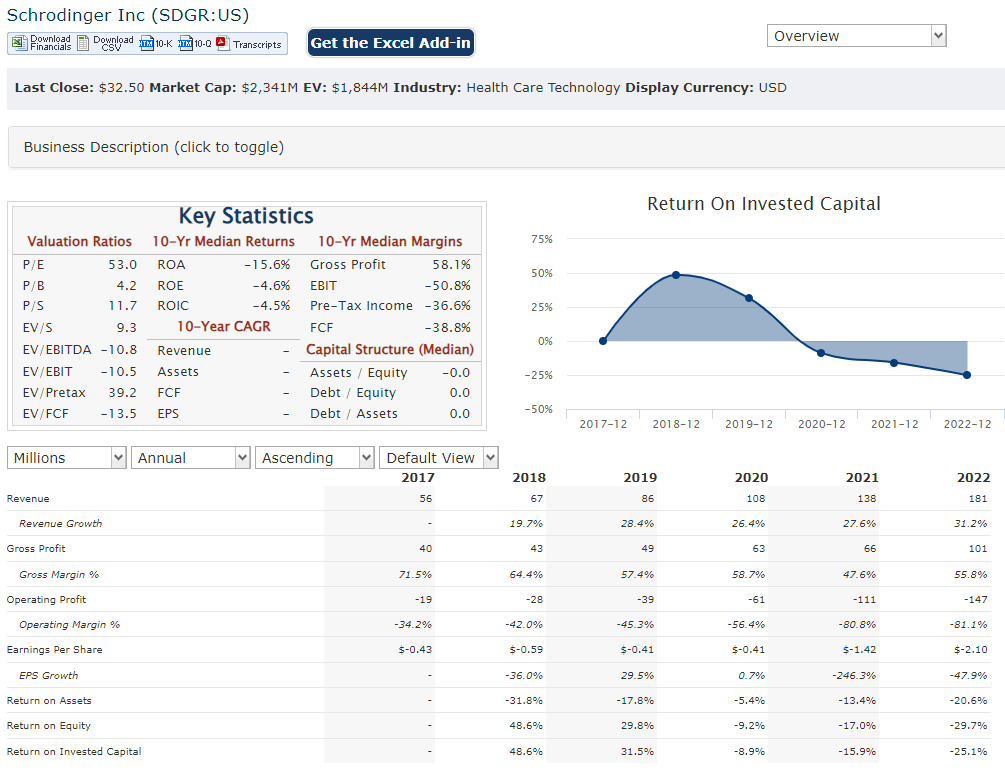

The most recent earnings report available was for the third quarter of 2023, where Schrödinger reported an earnings per share (EPS) of -$0.687, which was an improvement from the previous year’s EPS of -$0.86 for the same quarter. The company’s net income for the trailing twelve months (TTM) as of the latest reports was -$149.19 million, and it has generated $0.56 earnings per share over the last four quarters.

Stock Overview:

| Ticker | $SDGR | Price | $32.50 | Market Cap | $2.34B |

| 52 Week High | $59.24 | 52 Week Low | $20.76 | Shares outstanding | 62.87M |

Company background:

Schrödinger, Inc.: Orchestrating Molecules for a Healthier Future

The company’s foundation goes back to the vision of three individuals: Ram Seshan, William L. Jorgensen, and Irving S. Sigal. Since then, they’ve secured over $500 million in funding, fueling their innovative spirit.

Schrödinger’s core strength lies in its computational platforms. This remarkable ability to predict how molecules behave empowers researchers to design and optimize them for specific purposes, significantly accelerating the discovery process.

Beyond offering these powerful software tools, Schrödinger goes a step further, providing custom solutions, training, and even engaging in research-based drug discovery projects. This comprehensive approach makes them a valuable partner for various players in the scientific community.

Key rivals include established names like Dassault Systèmes, Thermo Fisher Scientific, and PerkinElmer. Despite the competition, Schrödinger continues to forge its path, driven by a potent combination of innovative technology, a clear mission, and a commitment to partnering for progress.

With their headquarters in New York City, Schrödinger’s impact extends globally, fostering a future where cutting-edge science translates into tangible advancements in healthcare and material development.

Recent Earnings:

Revenue and Growth: In Q3 2023, Schrödinger reported revenue of $53.1 million, representing a 21% year-over-year increase.

EPS and Growth: Analysts currently expect an EPS of -$0.44 for Q4 2023, compared to -$0.39 in the same period last year. This would represent a 13% increase in EPS.

Comparisons to Analysts’ Expectations: -$0.44 EPS estimate aligns with analyst expectations from January 2024.

The Market, Industry, and Competitors:

Schrödinger’s Market: A Symphony of Science and Growth

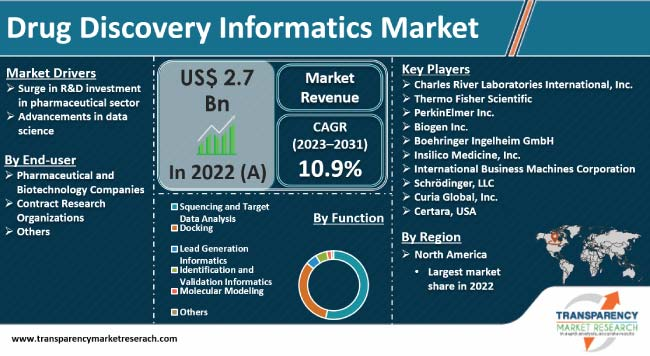

This market is expected to witness significant growth in the coming years, driven by several key factors:

- Increased R&D spending: Pharmaceutical and materials science companies are constantly investing in research and development, fueling the demand for advanced computational tools.

- Personalized medicine: The rise of personalized medicine necessitates tailoring treatments to individual patients, requiring tools for precise molecule design and simulation.

- Materials innovation: The quest for novel materials with specific properties, like lighter and stronger materials for aerospace, creates demand for software that can predict and optimize their behavior.

Market research estimates the drug discovery & materials science market to reach a staggering $50 billion by 2030, representing a CAGR of 15%. This translates to a near-tripling of the market size compared to 2023. The software market alone is $3B.

Schrödinger is well-positioned to capitalize on this growth with its powerful computational platforms that enable researchers to virtually screen and optimize molecules at the atomic level. Their focus on both software and internal drug discovery projects further strengthens their position as a key player in this rapidly evolving market.

While competition exists from established players like Dassault Systèmes and Thermo Fisher Scientific.

Established Giants:

- Dassault Systèmes: This French multinational provides a wide range of simulation software, including tools for materials science and biomolecules. Their BIOVIA suite offers functionalities similar to Schrödinger’s platform, catering to similar clientele.

- Thermo Fisher Scientific: This powerhouse in scientific instruments and services also offers computational platforms like the “Schrödinger Suite” competitor, “Discovery Studio.” Their vast resources and established client base pose a significant challenge.

Focused Challengers:

- Accelrys Software Inc.: Acquired by Dassault Systèmes in 2010, Accelrys offered molecular modeling software like Materials Studio, overlapping with Schrödinger’s offerings. Its legacy continues to influence the market.

- Dassault Systèmes’ BIOVIA itself: As a separate entity within Dassault Systèmes, BIOVIA directly competes with Schrödinger in drug discovery and materials science software. Their focus on cloud-based solutions adds another layer to the competition.

Emerging Disruptors:

- AI-powered players: Companies like Atomwise and BenevolentAI are leveraging AI for molecule design and discovery, presenting an innovative challenge to traditional players like Schrödinger.

- Cloud-based alternatives: Companies like CloudPharma and NextMove Software offer cloud-based solutions for drug discovery, potentially appealing to users seeking affordability and accessibility.

Navigating the Competition:

Schrödinger doesn’t shy away from this competitive landscape. They differentiate themselves through their comprehensive approach, offering not only software but also expertise and collaborative projects. Additionally, their commitment to continuous innovation in computational methods helps them stay ahead of the curve.

While Schrödinger faces stiff competition in the scientific software space, several unique factors set them apart:

1. Integrated Approach: Unlike many competitors offering just software, Schrödinger provides a multifaceted approach. They:

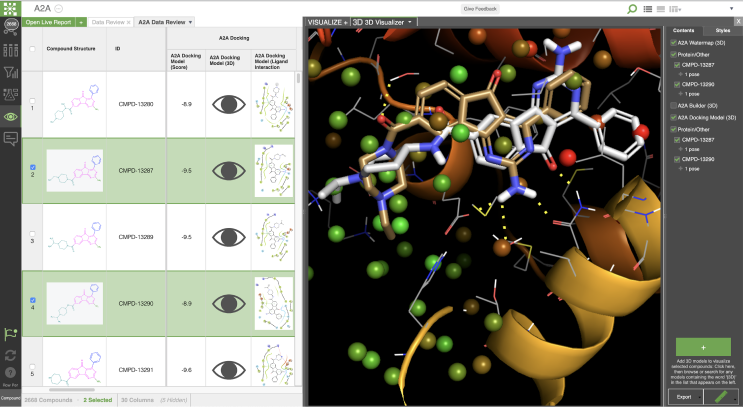

- Develop and license powerful computational platforms: These platforms like “LiveDesign” and “Jaguar” enable virtual molecule simulation and prediction.

- Offer custom solutions and training: They cater to specific needs of researchers and institutions, providing tailored solutions and training programs.

- Engage in research-based drug discovery: They actively utilize their platform for in-house drug discovery projects, demonstrating its real-world application.

This integrated approach positions them as a one-stop shop for researchers, offering not just tools but also expertise and practical implementation.

2. Focus on Biophysics and Quantum Mechanics: Schrödinger’s core strength lies in its physics-based approach to molecule simulation. They leverage concepts from biophysics and quantum mechanics to achieve higher accuracy and detail in their simulations, offering a distinct advantage over purely AI-driven methods.

3. Continuous Innovation: Schrödinger invests heavily in R&D, constantly pushing the boundaries of computational methods. They actively collaborate with academic institutions and industry partners to stay at the forefront of scientific advancements. This dedication to innovation ensures they offer the most advanced and effective tools to their users.

4. Strong Academic Partnerships: Schrödinger fosters strong collaborations with research institutions and universities, gaining early access to cutting-edge scientific discoveries and incorporating them into their platforms. This connection to academia keeps them ahead of the curve in terms of scientific and technological progress.

5. Collaborative Spirit: Beyond just selling software, Schrödinger emphasizes collaboration. They offer extensive support and training, actively engage with users, and participate in joint research projects. This collaborative spirit fosters trust and loyalty among their clients.

Management & Employees:

Executive Team:

- Ramy Farid, Ph.D.: President and CEO, brings extensive experience in biotechnology and biopharmaceutical leadership.

- Geoff Porges, MBBS: Chief Financial Officer, offers financial acumen and global business experience.

- Robert Abel, Ph.D.: Executive Vice President, Chief Computational Scientist, holds deep expertise in computational chemistry and physics.

Financials:

Schrödinger’s Financial Symphony: A Past Performance Review

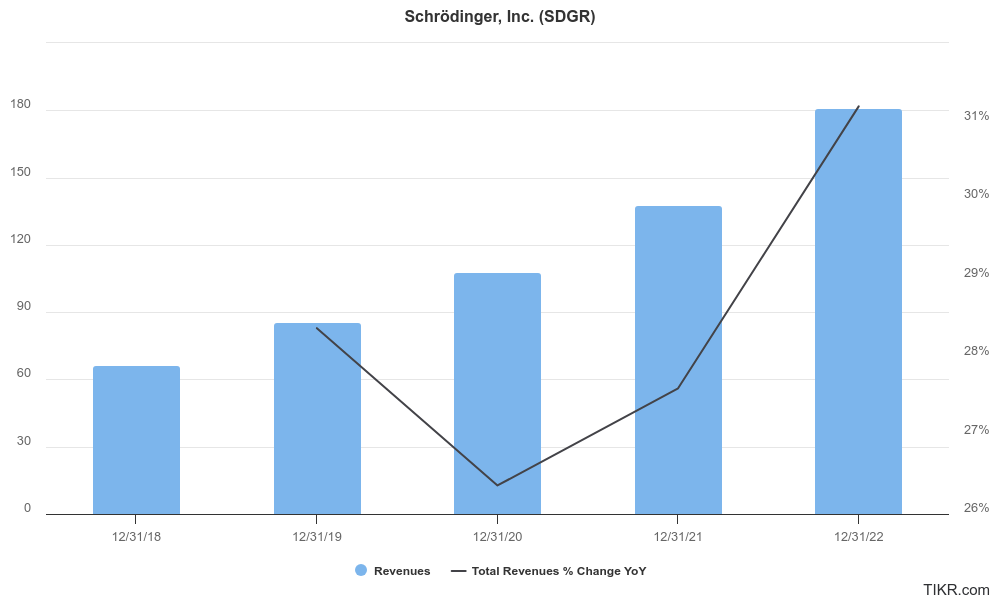

Schrödinger’s financial performance over the past five years paints a picture of steady growth and increasing momentum. Here’s a breakdown:

Revenue:

- CAGR of 35.4% since 2018, demonstrating consistent top-line growth.

- Revenue nearly doubled between 2018 and 2023, reaching $199.4 million by September 2023.

- 2022 saw an impressive 31.2% year-over-year revenue increase, with software revenue growing 24% and drug discovery revenue almost doubling.

Earnings:

- The company remains inconsistent regarding profit, reflecting their focus on growth and investment in R&D and internal drug discovery projects.

- Net losses have narrowed throughout the period, with losses in 2023 expected to be lower than 2022.

- Earnings per share (EPS) is still negative, but the negative gap is shrinking, indicating gradual progress towards profitability.

Balance Sheet:

- Cash and cash equivalents have grown steadily, reaching $503 million by September 2023, providing a strong financial cushion for future investments.

- Long-term debt is minimal, minimizing financial risks and enhancing flexibility.

- Shareholder equity has also increased, reflecting retained earnings and investor confidence.

Technical Analysis:

A failed breakout on the monthly and weekly chart, puts $SDGR again in the range, but the daily chart shows another attempt to rally given the nearly 10% move higher before earnings on Feb 28th. There is a lot of resistance (multiple top) in the $33 range, so expect some pullback at either $33 or $37 where there is even more resistance. The falling wedge pattern is usually a signal that the stock is poised to go higher and is bullish.

Bull Case:

Market Potential:

- Large and growing market: The drug discovery and materials science software market is expected to reach $50 billion by 2030, with a CAGR of 15%. This presents a significant opportunity for Schrödinger to expand its reach and revenue.

- Increased R&D spending: Pharmaceutical and materials science companies are constantly investing more in R&D, fueling demand for advanced computational tools like Schrödinger’s platforms.

- Personalized medicine and materials innovation: These trends require precise molecule design and simulation, further amplifying demand for Schrödinger’s technology.

Competitive Advantages:

- Integrated approach: Unlike most competitors, Schrödinger offers software, expertise, and collaborative projects, making them a one-stop shop for researchers.

- Physics-based simulations: Their approach offers higher accuracy and detail compared to purely AI-driven methods.

- Continuous innovation: Strong investment in R&D ensures they stay ahead of the curve with advanced tools.

- Strong academic partnerships: Collaboration with universities keeps them updated on scientific advancements.

- Collaborative spirit: Strong customer support and joint research projects foster loyalty and trust.

Financial Performance:

- Improving profitability: While not yet profitable, losses are narrowing, and EPS is gradually becoming less negative.

- Strong cash position: $503 million in cash and equivalents provide a safety net for future investments.

Bear Case:

Competition:

- Established giants: Companies like Dassault Systèmes and Thermo Fisher Scientific have vast resources and established client bases, posing a substantial challenge.

- Emerging disruptors: AI-powered players like Atomwise and cloud-based solutions like CloudPharma offer potential threats by focusing on specific areas and cost-effectiveness.

Profitability:

- Negative earnings: Despite revenue growth, the company hasn’t achieved sustained profitability, raising concerns about their ability to generate long-term value for shareholders.

- Unpredictable drug discovery pipeline: The success of their internal drug discovery projects using their platform remains uncertain, adding to the risk profile.

Market & Adoption:

- Unforeseen changes: Shifts in pharmaceutical R&D spending, regulatory hurdles, or advancements in competitor technologies could negatively impact software adoption.

- High upfront costs: Licensing fees for platforms might be unaffordable for smaller players, limiting market penetration.

- Overvaluation concerns: Compared to traditional software companies, Schrödinger’s current valuation might be higher due to future potential, not guaranteed results.