Executive Summary:

Hims & Hers Health Inc.,is a telehealth platform aiming to simplify healthcare access. They connect individuals with licensed professionals virtually, offering solutions for various conditions like sexual health, hair loss, mental health, and skincare. Through online consultations, users can get personalized treatment plans, including prescriptions delivered discreetly.

Founded in 2017, the company operates across the US with separate brands for men (Hims) and women (Hers), and even expanded its services to mental health support in 2020. With its focus on convenience and personalized care, Hims & Hers seeks to empower individuals to feel their best.

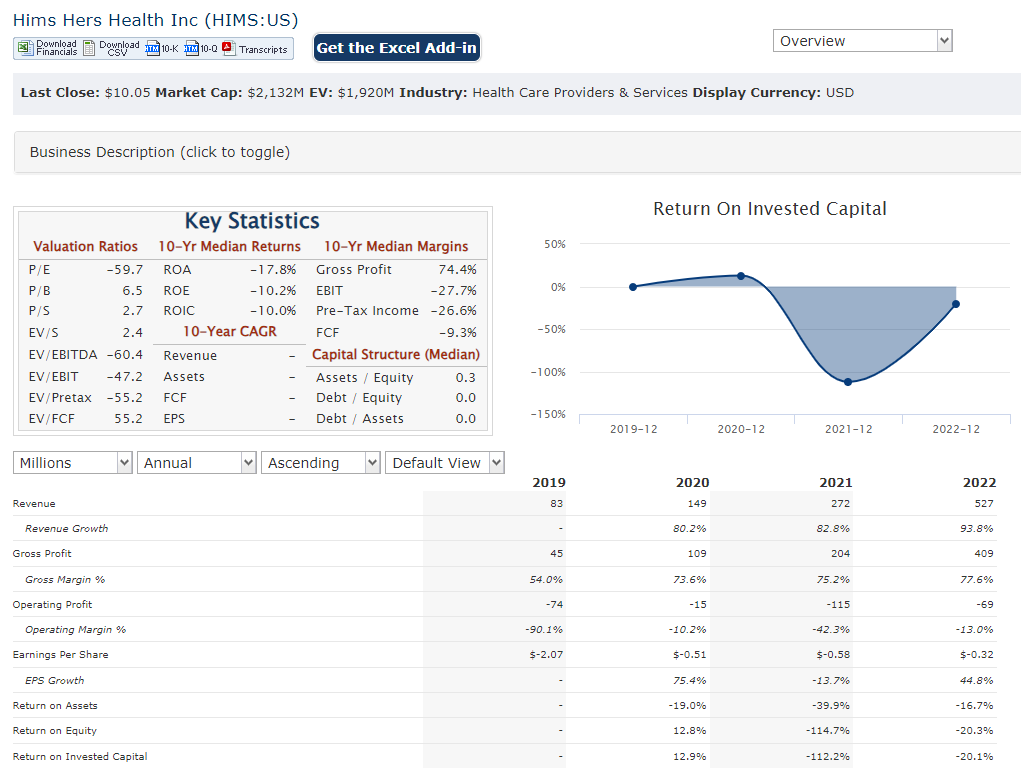

In their most recent earnings report on November 6th, 2023, Hims & Hers delivered strong results, surpassing analyst expectations. Revenue surged 57% year-over-year to $226.7 million, beating analyst estimates of $219.2 million. This impressive growth was accompanied by a narrower net loss of $7.6 million compared to $18.8 million in the same period last year. Even more promising, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) reached $12.3 million, a significant improvement from a $6.1 million loss in the previous year’s Q3. While EPS remained negative at -$0.04, it represented a notable 56% improvement compared to the prior year. This positive performance led the company to raise its full-year revenue guidance to $868-$873 million, exceeding analyst expectations of $830-$850 million.

Stock Overview:

| Ticker | $HIMS | Price | $10.05 | Market Cap | $2.13B |

| 52 Week High | $12.34 | 52 Week Low | $5.65 | Shares outstanding | 203.62M |

Company background:

Hims & Hers: Telehealth for Him and Her

The company was founded by a trio of entrepreneurs: Andrei Andreev, Andrew Dudum, and Jack Jia. Since its inception, Hims & Hers has secured over $197 million in funding, highlighting the market’s interest in their approach.

What they offer: Hims & Hers address a range of conditions through online consultations with licensed healthcare professionals.

acing competition: The telehealth space is heating up, with Hims & Hers encountering rivals like Teledoc Health, Roman Health, and Lemonaid Health.

California HQ: Hims & Hers has its headquarters in San Francisco, California, but its reach extends far beyond. They operate across all 50 U.S. states, making their services accessible to a vast population.

By focusing on convenience, personalized care, and a wider range of health needs, Hims & Hers is carving out a niche in the telehealth market.

Recent Earnings:

Hims & Hers Shines in Q3 2023, Outpacing Expectations

Revenue and Growth: Revenue surged 57% year-over-year to $226.7 million, surpassing analyst estimates of $219.2 million. This significant growth demonstrates strong momentum and market response to their services.

EPS and Growth: While net loss remained negative at -$0.04 per share, it represented a positive 56% improvement from the previous year. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) reached $12.3 million, a remarkable turnaround from a $6.1 million loss in Q3 2022.

Comparing to Expectations: Both revenue and adjusted EBITDA exceeded analyst expectations, showcasing the company’s ability to deliver strong results. This positive performance strengthens investor confidence and reinforces their growth trajectory.

Operational Metrics: Key operational metrics were equally impressive. Hims & Hers added 1.4 million new subscribers in Q3, bringing their total base to over 8 million. Average revenue per user (ARPU) also increased, indicating better monetization of their growing customer base.

Forward Guidance: Buoyed by their stellar performance, Hims & Hers raised their full-year revenue guidance to $868-$873 million, exceeding analyst expectations of $830-$850 million. They also project to be profitable by the first half of 2024, suggesting a significant milestone in their financial journey.

The Market, Industry, and Competitors:

Hims & Hers Navigates the Booming Telehealth Market

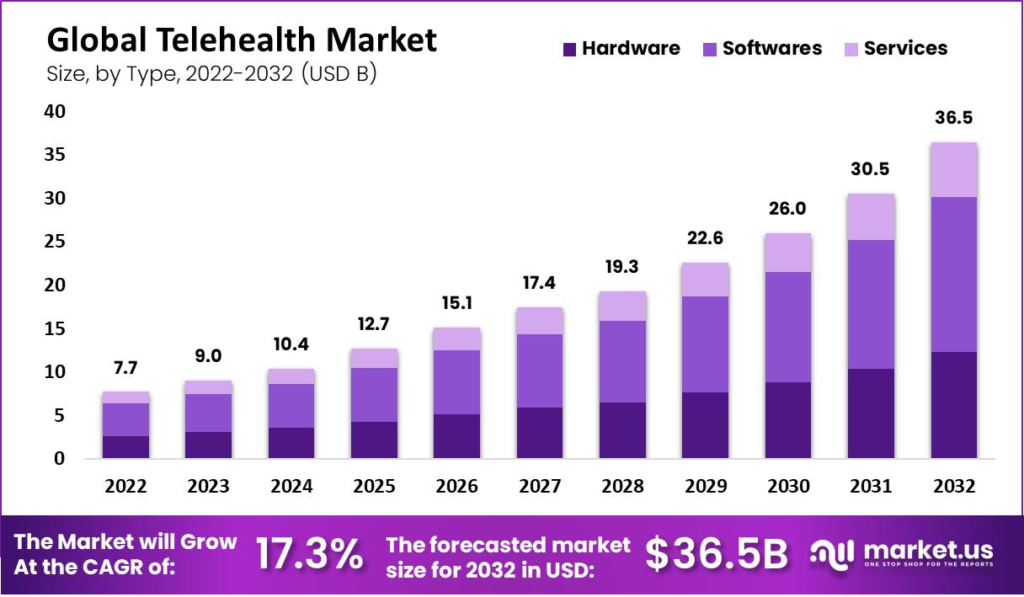

Hims & Hers operates in the dynamic and rapidly growing telehealth market. This market encompasses virtual healthcare services across various specialties, offering convenience and accessibility to patients. Driven by factors like increasing internet penetration, rising healthcare costs, and growing awareness of telehealth options, the market is expected to reach a staggering USD 75.32 billion by 2030, reflecting a phenomenal CAGR of 22.40%.

This significant growth presents exciting opportunities for Hims & Hers. Their focus on personalized experiences, diverse service offerings, and strategic partnerships positions them well to capitalize on this trend.

The market is also becoming increasingly competitive, with established players and new entrants vying for market share. Hims & Hers’ success will depend on their ability to continue innovating, expanding their offerings, and maintaining a strong focus on customer satisfaction. If they can effectively navigate these dynamics, the future looks bright for Hims & Hers in the booming telehealth market.

Unique differentiation:

Navigating a Crowded Telehealth Landscape: Hims & Hers’ Competitors

Direct-to-consumer telehealth giants: Teladoc Health and Amwell are major players offering broad-based telehealth services, including chronic disease management, mental health consultations, and specialist consultations. These companies pose a significant threat to Hims & Hers, especially in areas like mental health.

Niche competitors: Companies focused on specific healthcare areas, like Roman (men’s health), Keeps (hair loss), and The Pill Club (birth control and women’s health), compete directly with Hims & Hers in their core verticals. These targeted players often have deeper expertise and brand recognition within their niches.

Retail giants: Amazon’s foray into telehealth with Amazon Care poses a potential threat, given their vast resources and logistics expertise. The integration with their pharmacy business could further disrupt the market.

While Hims & Hers faces stiff competition in the telehealth space, they have carved out a niche with some key differentiators:

1. Focus on lifestyle-driven healthcare: Instead of solely addressing specific medical conditions, Hims & Hers positions itself as a partner in improving users’ overall well-being and self-care. This resonates with customers seeking comprehensive solutions for concerns like sexual health, hair loss, and skin health.

2. Dual brand strategy: By operating separate brands for men (Hims) and women (Hers), they cater to the specific needs and preferences of each demographic, offering targeted products and marketing messages. This personalized approach helps them build deeper connections with their audience.

3. Discreet and convenient experience: Hims & Hers prioritizes discretion and convenience throughout the user journey. Online consultations, discreet packaging, and home delivery of prescriptions ensure a comfortable and confidential experience, especially for sensitive topics.

4. Data-driven personalization: The company leverages data from consultations and user behavior to personalize treatment plans and product recommendations. This tailored approach improves customer satisfaction and engagement.

5. Complementary product bundles: Hims & Hers offers curated product bundles combining medications and non-prescription solutions, addressing various aspects of a specific concern. This creates a more holistic approach and increases customer value.

6. Expanding service offerings: Hims & Hers actively expands its service portfolio beyond its core offerings, adding areas like mental health and dermatology. This diversification attracts a wider audience and increases potential revenue streams.

7. Strategic partnerships: Collaborations with key players like pharmacy chains and healthcare providers broaden their reach and enhance credibility, making them a more attractive option for new users.

Management & Employees:

Hims & Hers Management Team Overview:

Executive Team:

- Andrew Dudum, CEO and Co-founder: Brings experience in building innovative companies and spearheads Hims & Hers’ overall vision and strategy.

- Melissa Baird, COO: Responsible for daily operations, ensuring smooth functioning across departments.

- Mike Chi, CMO: Oversees marketing and customer acquisition efforts, leveraging his deep expertise in branding and growth.

- Yemi Okupe, CFO: Handles financial management and strategic financial planning.

Financials:

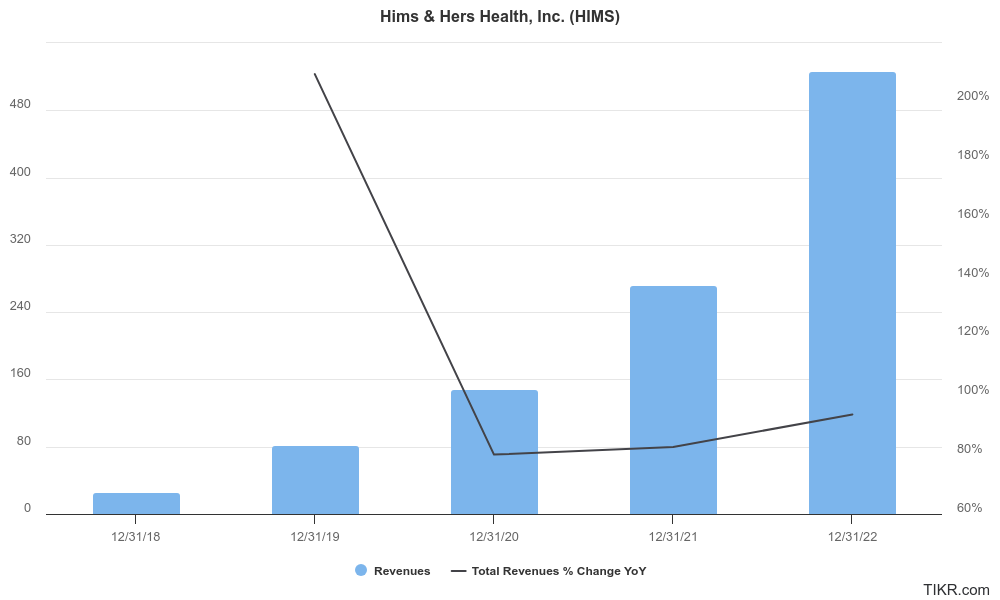

Hims & Hers has experienced significant growth in its short history, painting a dynamic picture of its financial performance over the past five years.

Technical Analysis:

An attempted rally failed at the $12 mark a year ago but shares are on a stage 2 markup phase on the monthly chart, attempting another move up, with resistance at the $12 mark. On the weekly chart, there is good support at the $8.7 mark, but shares seem range bound so far.

On the daily chart, shares have broken up beyond a key resistance at $9.9 and should head higher, first to $10.97 and then back to $12.

Bull Case:

Bull Case for Hims & Hers Stock:

1. Booming Telehealth Market: The telehealth market is experiencing explosive growth, fueled by convenience, accessibility, and rising healthcare costs. This trend offers considerable space for Hims & Hers to expand and capture a larger market share.

2. Strong Growth Trajectory: The company has demonstrated impressive revenue growth, exceeding 50% year-over-year in recent quarters. This momentum, coupled with expanding service offerings and international expansion plans, indicates continued growth potential.

3. Diversified Product Portfolio: Hims & Hers caters to a diverse range of healthcare needs beyond its core offerings, creating a broader customer base and reducing reliance on any single product or service.

4. Data-Driven Personalization: Leveraging user data allows for personalized treatment plans and product recommendations, enhancing customer satisfaction and engagement, leading to higher retention and potential upselling.

5. Strategic Partnerships: Collaborations with major healthcare providers and pharmacies bolster credibility and reach, attracting new users and increasing revenue streams.

6. Path to Profitability: The company projects achieving profitability in 2024, which would be a significant milestone and unlock further investor confidence.

7. Strong Management Team: The experienced leadership team possesses expertise in healthcare, technology, and marketing, crucial for navigating the competitive landscape and driving growth.

8. Positive Analyst Sentiment: Most analysts hold positive views on Hims & Hers, with an average price target significantly higher than the current stock price, indicating further upside potential.

9. Attractive Valuation: Compared to some competitors, Hims & Hers trades at a lower valuation, potentially making it a more attractive investment opportunity for some investors.

10. Untapped International Potential: Expanding into international markets holds significant growth potential, further bolstering the company’s long-term outlook.

Bear Case:

1. Fierce Competition: The telehealth market is crowded with established players and nimble startups, all vying for market share. This intense competition could hamper Hims & Hers’ growth and squeeze their margins.

2. Customer Acquisition Costs: Acquiring new customers is expensive, and Hims & Hers spends heavily on marketing and advertising. Failure to maintain these costs or diminishing returns on such investments could dent profitability.

3. Regulatory uncertainty: The telehealth industry faces evolving regulations, and stricter rules could increase compliance costs and limit the scope of services offered, impacting Hims & Hers’ business model.

4. Sustainability of Growth: The company’s impressive revenue growth might not translate to sustainable profits. Continued losses and concerns about future profitability could deter investors and negatively impact the stock price.

5. Dependence on Key Partnerships: Collaborations with external partners like pharmacies and healthcare providers are crucial for growth. Changes in these partnerships or their terms could disrupt the business model and affect revenue streams.

6. Data Privacy Concerns: Telehealth platforms handle sensitive user data, and any data breaches or privacy violations could damage brand reputation and lead to regulatory scrutiny and legal challenges.

7. Technological Disruption: New technologies and digital health innovations could emerge, rendering Hims & Hers’ current offerings obsolete and requiring significant investments to adapt and keep up.

8. Macroeconomic headwinds: Broader economic downturns or recessions could negatively impact consumer healthcare spending, potentially affecting Hims & Hers’ customer base and revenue.

9. Valuation concerns: Some analysts argue that the stock price already reflects future growth potential, leaving limited room for significant upside unless the company exceeds expectations.

10. Limited brand recognition: Compared to established healthcare brands, Hims & Hers might struggle with brand recognition and trust, especially in new markets.