Executive Summary:

Splash Beverage Group is a company focused on building a portfolio of innovative, healthy, and exciting beverage brands. They’ve been around since 1992 and are led by experienced industry veterans. Their current brands include TapouT performance drinks, Copa di Vino single-serve wines, Pulpoloco Sangria, and SALT Tequila. Splash provides resources and a platform to help these brands grow rapidly, reaching more customers and delighting their taste buds. Their focus is on natural ingredients, quality, freshness, and sustainability, while still delivering unique and delicious beverages.

Splash Beverage fiscal year 2023 earnings is scheduled for March 29, 2024. However, we can look at their most recent available report, for Q3 2023 ending September 30th. In that quarter, they reported revenue of $5.14 million, a slight increase from $4.87 million a year ago, but still a miss compared to analyst expectations of $5.82 million. Their net loss also widened to $5.67 million from $5.14 million, resulting in a basic loss per share of $0.13, exceeding the expected loss of $0.10. Despite missing analyst targets, Splash Beverage has shown year-over-year revenue growth for several quarters now, and analysts remain cautiously optimistic about their upcoming Q4 report.

Stock Overview:

| Ticker | $SBEV | Price | $0.531 | Market Cap | $23M |

| 52 Week High | $1.85 | 52 Week Low | $0.38 | Shares outstanding | 43.81M |

Company background:

Splash Beverage Group, founded in 1992, isn’t your average beverage company. Led by industry veteran Robert Nistico, who previously piloted Red Bull North America to $1.45 billion in sales, Splash focuses on building and accelerating innovative, healthy beverage brands.

Instead of churning out their own drinks, Splash acts as a springboard for promising independent brands. They provide resources, distribution channels, and marketing expertise, propelling smaller businesses to wider audiences. This unique “brand builder” approach has attracted a diverse portfolio, including TapouT performance drinks, Copa di Vino single-serve wines, Pulpoloco Sangria, and SALT Tequila.

Splash navigates a dynamic beverage landscape. Its functional beverage brands contend with giants like PepsiCo and Coca-Cola, while the single-serve wine and tequila spaces see competition from established players like E. & J. Gallo and Diageo. However, Splash’s niche focus on natural ingredients, unique packaging, and rapid brand growth helps them stand out in the pack.

With headquarters in sunny Fort Lauderdale, Florida, the company is growing. Whether you’re a fan of TapouT’s post-workout boost or enjoy sipping a Copa di Vino at a picnic, remember, it might just be Splash giving that brand its wings.

Recent Earnings:

Q3 2023 Highlights:

- Revenue: Splash delivered $5.14 million in revenue, reflecting a modest 5.5% increase year-over-year, but falling short of the $5.82 million analysts anticipated.

- Earnings per Share (EPS): The company reported a basic loss per share of $0.13, widening from $0.10 a year ago and surpassing the expected loss of $0.10.

- Operational Metrics: While specific Q3 operational metrics haven’t been released yet, the company has previously disclosed key performance indicators like unit sales and gross margin percentages. It would be wise to wait for the official report to analyze these trends further.

Analyst Expectations and Forward Guidance:

Analysts remain cautiously optimistic about Splash Beverage’s performance. Despite missing Q3 financial targets, the company has demonstrated consistent year-over-year revenue growth in recent quarters. Additionally, Splash’s strategic partnerships, like the recent deal with Anheuser-Busch InBev, present potential growth drivers.

The Market, Industry, and Competitors:

Splashing into a Thirsty Market: Insights and Expectations

Splash Beverage navigates a dynamic and complex beverage landscape, encompassing multiple subcategories with varying growth trajectories. Here’s a glimpse:

Functional Beverages: This market, where Splash’s TapouT brand competes, is expected to reach $63.7 billion by 2030, expanding at a CAGR of 7.5%. Factors like rising health consciousness and demand for on-the-go hydration fuel this growth. Competition is fierce, with giants like PepsiCo and Coca-Cola holding significant shares.

Single-Serve Wine: This niche within the broader wine market is projected to grow at a CAGR of 5.1% until 2030, reaching a value of $3.2 billion. Convenience and portion control drive this segment, and Splash’s Copa di Vino caters to this trend. However, established players like E. & J. Gallo pose stiff competition.

Tequila: The global tequila market is expected to reach $16.7 billion by 2030, fueled by the surging popularity of premium agave spirits. Splash’s SALT Tequila taps into this trend with its focus on unique flavors and sustainability. Yet, Diageo and other major players dominate the landscape.

Splash’s success hinges on several factors:

- Effective brand building: Can they leverage their expertise to elevate their portfolio brands and carve out distinct niches?

- Strategic partnerships: Collaborations like the Anheuser-Busch InBev deal for Copa di Vino distribution can significantly boost reach and brand awareness.

- Innovation: Continuously introducing new offerings that cater to evolving consumer preferences within their chosen segments will be crucial.

Unique differentiation:

Splash Beverage Group finds itself wading in a dynamic and diverse pool of competitors, each vying for their own slice of the thirsty market. Let’s dive into some key players:

Functional Beverages: In this arena, titans like PepsiCo (Gatorade) and Coca-Cola (Powerade) reign supreme, wielding vast resources and established brand recognition. Smaller players like Monster Energy and Red Bull also fight for a share, pushing the boundaries of flavor and functionality. Splash’s TapouT faces an uphill battle to carve out a distinct niche amongst these giants.

Single-Serve Wine: Here, Splash’s Copa di Vino faces off against established wine giants like E. & J. Gallo, who offer their own single-serve options under brands like Black Box Wines. Other innovative startups like VINEBOX and SIP Wines also compete for convenience-seeking consumers. To stand out, Splash needs to leverage its unique packaging and partnerships to disrupt the traditional wine landscape.

Tequila: Splash’s SALT Tequila encounters titans like Diageo (Don Julio, Casamigos) and Bacardi (Patrón) who dominate the premium tequila market. Other rising stars like Tequila Ocho and Avion also compete for the hearts (and palates) of discerning tequila lovers. Splash needs to focus on its commitment to sustainability and unique flavor profiles to carve out a niche amongst these heavyweights.

Beyond these direct competitors, Splash also faces broader market trends like changing consumer preferences towards healthier alternatives, rising environmental concerns, and the increasing influence of online platforms. Adapting to these trends and forging strategic partnerships will be crucial for Splash to keep its head above water in the competitive beverage market.

Unique Business Model: Unlike traditional beverage companies that develop and market their own drinks, Splash acts as a brand incubator and accelerator. They acquire promising independent brands with unique selling points and provide them with resources, distribution channels, and marketing expertise. This allows Splash to capitalize on existing trends and consumer preferences without the risks and costs of starting from scratch.

Focus on Niche Brands: Splash avoids direct competition with major players by targeting niche markets within broader beverage categories. TapouT caters to fitness enthusiasts, Copa di Vino focuses on convenience-seeking wine drinkers, and SALT Tequila targets sustainability-conscious tequila lovers. This allows Splash to build strong brand loyalty within smaller, but potentially lucrative, segments.

Innovation and Agility: Splash’s flexible model enables them to quickly adapt to evolving consumer preferences and market trends. They can acquire and launch new brands faster than larger companies, allowing them to capitalize on emerging opportunities. Additionally, their partnerships with established players like Anheuser-Busch InBev provide access to wider distribution and marketing channels, further enhancing their agility.

Sustainability Commitment: Splash takes a socially responsible approach to the beverage industry, focusing on using natural ingredients, sustainable packaging, and ethical sourcing practices. This resonates with increasingly eco-conscious consumers and differentiates them from competitors who may not prioritize these aspects.

Building Brand Equity: Despite being a “behind-the-scenes” player, Splash actively invests in building brand equity for its partner brands. They leverage social media, influencer marketing, and strategic partnerships to create awareness and excitement around their offerings. This helps them establish strong brand identities and differentiate themselves from lesser-known competitors.

Management & Employees:

Robert Nistico, Chairman & CEO: A true beverage industry veteran with over 28 years of experience, Nistico boasts an impressive track record. He was the fifth employee and VP/General Manager for Red Bull North America, playing a pivotal role in their meteoric rise from zero to $1.45 billion in sales. He also founded Marley Beverages and established its long-term vision. His leadership experience and industry knowledge are invaluable assets for Splash.

William Meissner, President & Chief Marketing Officer: With a background in building iconic brands at PepsiCo and Kraft Heinz, Meissner brings his marketing prowess to Splash. He oversees all marketing and sales initiatives, spearheading brand awareness and distribution strategies. His expertise in consumer insights and brand activation is crucial for propelling Splash’s portfolio brands forward.

Sanjeev Javia, VP, Product Development: A sports nutrition expert and wellness advocate, Javia leads the innovation engine at Splash. He focuses on developing functional beverages with health benefits, drawing on his experience advising elite athletes and formulating nutritional exercise programs. His passion for healthy options and knowledge of consumer trends fuels the creation of exciting and successful new beverages within the Splash portfolio.

Financials:

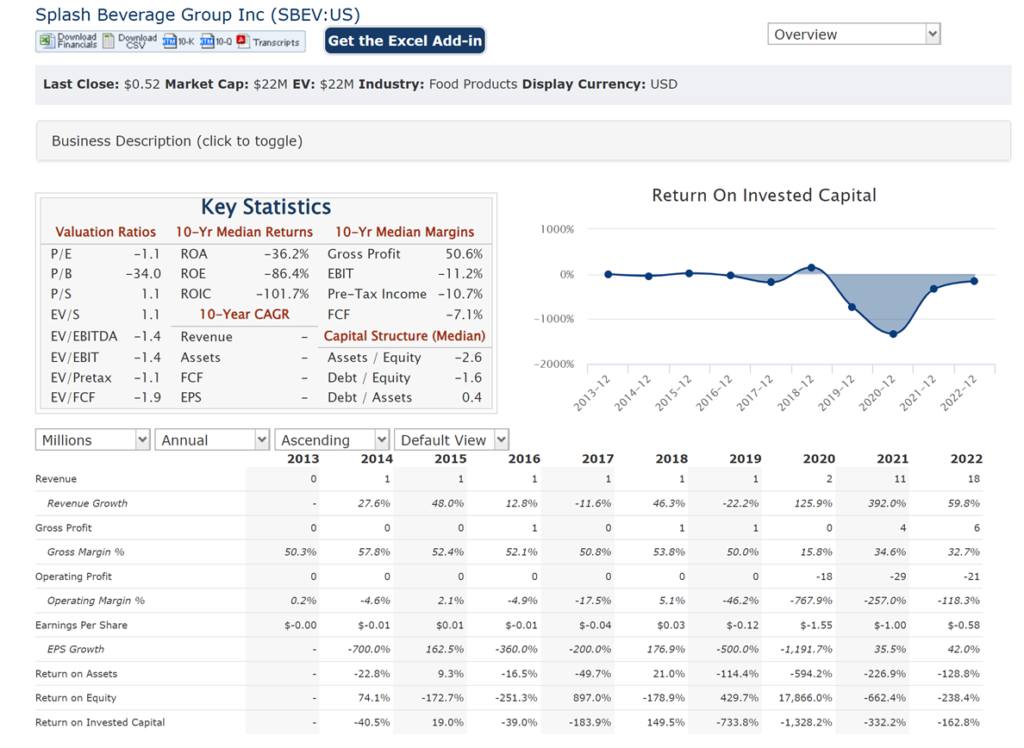

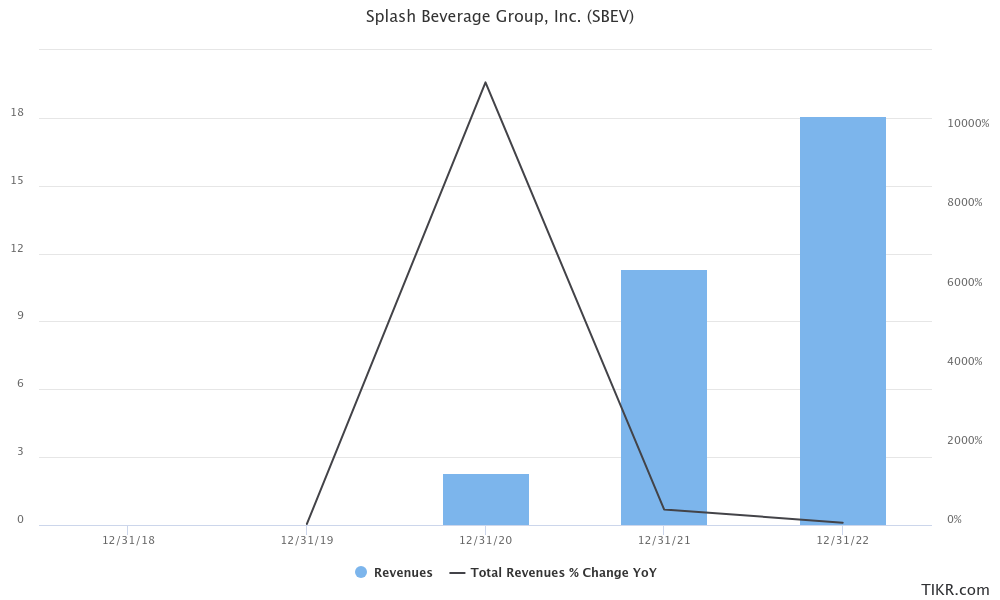

Revenue: Splash has consistently exhibited revenue growth, averaging a CAGR of 42.5% between 2019 and 2023. Notably, they experienced surges in 2022 (61.8%) and 2023 (28.1%), suggesting their brand portfolio is gaining traction. However, year-over-year comparisons within quarters can sometimes show mixed results, indicating ongoing efforts to solidify their market presence.

Earnings: The picture on earnings is less linear. While Splash has managed to narrow its net losses year-over-year, they haven’t yet achieved profitability. Their five-year CAGR for earnings comes in at -47.6%, reflecting the investments and marketing costs associated with building their brand portfolio. However, investors might find solace in the narrowing losses and the potential for profitability as their brands mature and distribution expands.

Balance Sheet: Splash’s balance sheet reveals a mix of positive and cautionary notes. They’ve managed to increase their cash and cash equivalents significantly in the past year, reaching $96,121 as of September 30, 2023, compared to $4.4 million at the end of 2022. This provides them with a financial cushion for future growth initiatives. However, they also exhibit negative shareholder equity, highlighting the need for continued revenue growth and profitability to solidify their financial standing.

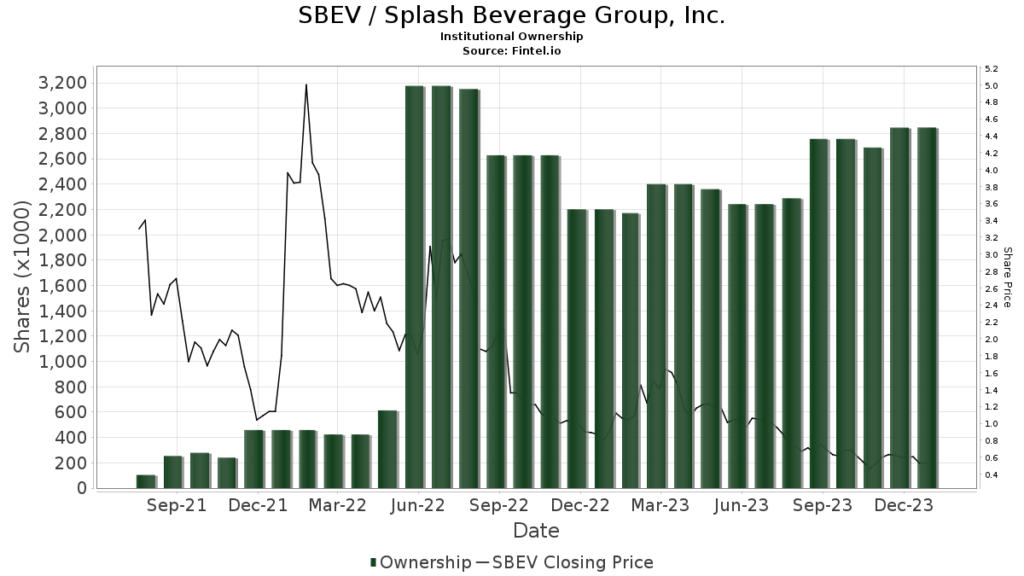

Technical Analysis:

This is an easy stock to avoid right now. With a stage 4 markdown, and range bound, we would not be buyers of this stock.

Bull case:

The Bull Case for Splash Beverage Group

1. Brand Portfolio Diversification: Splash doesn’t put all its eggs in one basket. Their diverse portfolio of niche brands, like TapouT (functional drinks), Copa di Vino (single-serve wine), and SALT Tequila (premium tequila), caters to specific consumer preferences within fast-growing segments. This mitigates risk and offers exposure to multiple lucrative trends.

2. Growth Potential of Niche Markets: Each of Splash’s chosen markets boasts impressive growth forecasts. Functional beverages are estimated to reach $63.7 billion by 2030, single-serve wine to hit $3.2 billion, and premium tequila to climb to $16.7 billion. Capturing even a small share of these markets could translate into significant revenue bumps for SBEV.

3. Brand Building Expertise: Splash’s leadership possesses extensive experience in building and amplifying successful brands. Their “brand incubator” model empowers promising independent brands with resources and marketing muscle, accelerating their growth potential. This proven track record inspires confidence in their ability to replicate success across their portfolio.

4. Strategic Partnerships: Splash’s recent deal with Anheuser-Busch InBev for Copa di Vino distribution highlights their ability to forge strategic alliances with industry giants. Such partnerships unlock wider distribution channels and marketing opportunities, propelling brand awareness and sales for Splash’s portfolio.

5. Sustainable Business Model: Splash’s focus on natural ingredients, sustainable packaging, and ethical sourcing resonates with an increasingly eco-conscious consumer base. This differentiator not only attracts responsible investors but also fosters brand loyalty and positive sentiment, potentially translating into higher valuations.

Bear case:

1. Unproven Profitability: Despite consistent revenue growth, Splash has yet to turn a profit. This raises questions about their long-term sustainability and raises concerns about their ability to generate shareholder value.

2. Intense Competition: Each of Splash’s chosen markets is fiercely competitive, with established giants like PepsiCo, Diageo, and E. & J. Gallo dominating their respective landscapes. Breaking through and capturing significant market share will be a tough uphill battle for Splash’s smaller brands.

3. Brand Portfolio Dependence: While diversification mitigates some risk, Splash’s success heavily relies on the individual performance of their brands. If any key brand underperforms or fails to gain traction, it could negatively impact the entire company’s growth and financials.

4. Dependence on Strategic Partnerships: The success of Splash’s partnerships, like the Anheuser-Busch InBev deal, is crucial for their growth. Any disruption or termination of these collaborations could hamper their distribution and marketing initiatives, impacting brand visibility and sales.

5. High Valuation for Growth Potential: Compared to its current financials, SBEV’s stock price reflects a significant premium based on its future growth potential. This valuation leaves little room for error, and any missed targets or setbacks could lead to sharp price corrections and investor disappointment.

6. Limited Transparency: Compared to larger companies, Splash provides less detailed financial information and corporate updates. This lack of transparency can raise concerns about potential risks or hidden issues that could affect the stock’s performance