Executive Summary:

Aehr Test Systems is a leading player in the semiconductor industry, providing burn-in and test systems for logic, memory, and optical integrated circuits. With over 2,500 systems installed worldwide, their innovative solutions like the ABTS and FOX families stand out. Focusing on the growing demand for quality and reliability in automotive and mobility sectors, Aehr caters to package, wafer level, and singulated die/module testing needs. Their recent successes include securing an order for Gallium Nitride testing and reporting impressive revenue growth driven by Silicon Carbide testing for electric vehicles. Overall, Aehr’s technology is revolutionizing the way semiconductors are tested, ensuring higher quality and reliability for diverse applications.

The most recent earnings report for Aehr Test Systems was released on January 9th, 2024, covering their second quarter of fiscal 2024 (ended November 30th, 2023). The company reported EPS of $0.23 on revenue of $21.4 million, representing a strong 93% and 26% year-over-year growth, respectively. However, it’s important to note that this fell short of analyst expectations who were anticipating EPS of $0.26 and revenue of $22.5 million.

FY24 revenue forecast to between $75M and $85M, from earlier expectation of at least $100M, sending the stock down 24%. The company blamed slower EV sales and adoption for the revenue decline.

Stock Overview:

| Ticker | $AEHR | Price | $17.29 | Market Cap | $498.8M |

| 52 Week High | $54.10 | 52 Week Low | $17.05 | Shares outstanding | 28.85M |

Company background:

Aehr Test Systems, founded in 1977, is a prominent name in the semiconductor industry, known for its advanced burn-in and test systems. The company’s journey began with the vision of three entrepreneurs: Jeff Yapp, Mike Faircloth, and Bob Walsh. With humble beginnings in a California garage, Aehr steadily grew, fueled by an initial $1.5 million in funding and a persistent focus on innovation.

Today, Aehr boasts a global presence with headquarters in Fremont, California. Their core business revolves around providing high-performance testing solutions for various types of integrated circuits, including logic, memory, and optical devices. Their flagship products, the ABTS and FOX families, are recognized for their single touchdown full wafer burn-in and massively parallel testing capabilities, which significantly improve efficiency and reliability in semiconductor manufacturing.

Aehr operates in a competitive landscape, sharing the stage with companies like Teradyne, Advantest, and Cohu. However, they carve out their niche by specializing in advanced test solutions for emerging technologies like Silicon Carbide and Gallium Nitride semiconductors, which are crucial for electric vehicles and other future-oriented applications.

Recent Earnings:

Aehr Test Systems: Earnings Beat Revenue Expectations, Miss on EPS

Aehr Test Systems’ most recent earnings report, released on January 9th, 2024, painted a picture of mixed performance for the company’s second quarter of fiscal 2024 (ended November 30th, 2023).

Revenue: On the brighter side, Aehr surpassed analyst expectations for revenue, clocking in at $21.4 million. This translates to a healthy 26% year-over-year growth, reflecting strong demand for their test and burn-in systems, particularly in the electric vehicle sector.

EPS: However, the story was different for earnings per share (EPS). While EPS jumped 93% compared to the previous year, reaching $0.23, it fell short of the $0.26 anticipated by analysts. This slight disappointment might be attributed to higher-than-expected operating expenses.

Operational Metrics: Their gross margin remained robust at 62.5%, highlighting efficient production processes. Backlog, an indicator of future demand, also stood strong at $100.5 million, showcasing customer confidence and potential for continued growth.

Forward Guidance: Guidance for the year was lowered from $100M to $75M – $85M

The Market, Industry, and Competitors:

Aehr Test Systems navigates the dynamic world of semiconductor test equipment, a market estimated to be worth $7.5 billion in 2024. This sector is projected to expand significantly, with a compound annual growth rate (CAGR) of 12%, reaching a potential size of $9.3 billion by 2030. This translates to a potential growth opportunity of nearly 97% for Aehr in the next six years.

Several factors fuel this optimistic forecast. The increasing complexity of semiconductors, driven by miniaturization and the incorporation of new materials like Silicon Carbide, demands more sophisticated testing solutions. Additionally, the burgeoning electric vehicle (EV) market creates a specific need for reliable power electronics testing, which aligns perfectly with Aehr’s expertise.

Aehr isn’t just riding the wave; they’re actively shaping it. Their innovative burn-in and test systems, like the ABTS and FOX families, stand out for their efficiency and ability to handle advanced packaging technologies. This strategic focus positions them well to capitalize on the evolving market landscape and capture a significant share of the projected growth.

Unique differentiation:

Sharing the Stage: Aehr’s Main Competitors

Aehr Test Systems operates in a competitive arena populated by several established players:

The Big Three: Teradyne, Advantest, and Cohu represent the heavyweights in the semiconductor test equipment market. Each boasts comprehensive product portfolios and global reach, posing a significant challenge to Aehr. Teradyne excels in system-level test solutions, while Advantest dominates the memory tester segment. Cohu, with its strong presence in wafer-level testers, competes directly with Aehr in some areas.

Emerging Rivals: Xcerra Corporation and SPEA Technology are also players to watch. Xcerra focuses on specialized testers for compound semiconductors, a segment Aehr increasingly targets. SPEA, meanwhile, offers a broad range of testing solutions, including burn-in systems, potentially overlapping with Aehr’s offerings.

Differentiation is Key: While facing stiff competition, Aehr carves out its niche through several key differentiators. Their focus on advanced technologies like Silicon Carbide and Gallium Nitride testing puts them ahead of the curve. Additionally, their innovative ABTS and FOX systems for single touchdown full wafer burn-in and massively parallel testing offer customers distinct advantages. Finally, Aehr’s strong relationships in the electric vehicle sector provide a valuable edge in a rapidly growing market.

AEHR Test Systems stands out in the competitive semiconductor test equipment market through several key differentiators:

Focus on Emerging Technologies: While larger players often cater to broader markets, AEHR focuses on specific, high-growth segments like Silicon Carbide (SiC) and Gallium Nitride (GaN) semiconductors. This laser focus allows them to develop deeper expertise and tailored solutions for these rapidly expanding areas, particularly relevant for electric vehicles and other future-oriented applications.

Next-Gen Burn-in and Test Systems: AEHR’s flagship products, the ABTS and FOX families, set them apart with unique capabilities. The ABTS platform enables single touchdown full wafer burn-in, significantly reducing cycle times and costs compared to traditional methods. Similarly, the FOX family offers massively parallel testing, improving efficiency and throughput for high-volume testing needs.

Strong Customer Relationships: AEHR fosters close relationships with customers, particularly in the EV sector. This allows them to better understand their specific needs and develop solutions that directly address their challenges. This commitment to customer relationships builds trust and loyalty, leading to repeat business and positive word-of-mouth.

Management & Employees:

Aehr Test Systems Management Team: Leading the Charge

Gayn Erickson, President & CEO: He brings extensive experience in the semiconductor industry, having held leadership positions at companies like Applied Materials and Lam Research.

Vernon Rogers, Executive Vice President of Sales & Marketing: He boasts a solid track record in the semiconductor equipment industry, with experience at Teradyne and Formfactor.

Chris Siu, CFO & EVP of Finance: He possesses deep financial expertise gained through leadership roles at various technology companies.

Financials:

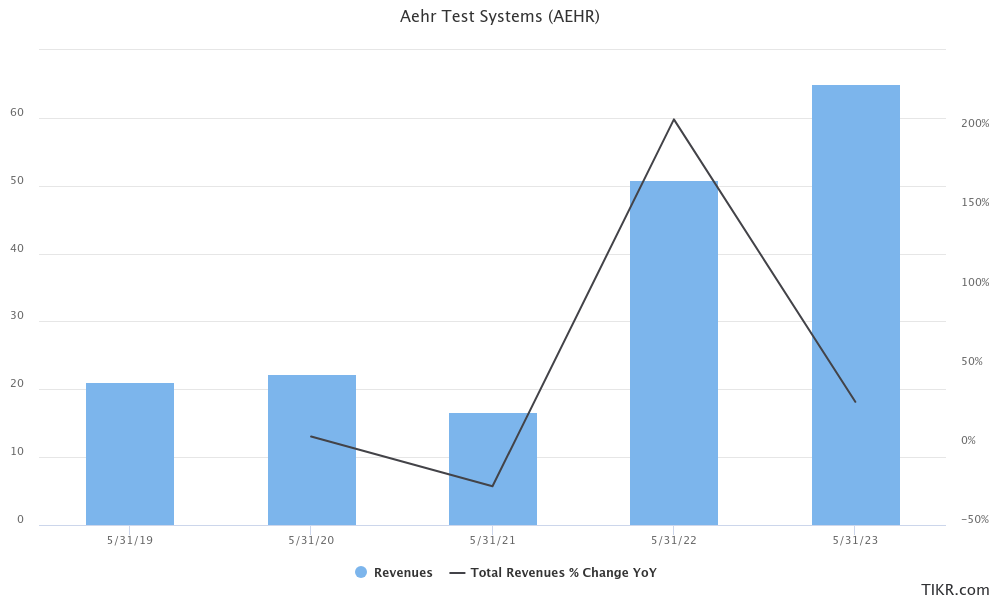

Aehr Test Systems has a impressive financial growth over the past 5 years, showcasing their strong position in the semiconductor test equipment market.

Revenue Growth: Aehr has experienced remarkable revenue growth, climbing from $25.8 million in fiscal year 2019 to $75 million (based on full-year fiscal 2024 guidance) in just 5 years. This translates to a compounded annual growth rate (CAGR) of approximately 48%, exceeding the overall market growth rate of 12%. This consistent progress highlights their effective strategy and increasing market share.

Earnings Growth: While revenue tells one story, profitability paints another. Aehr’s net income has also seen significant growth, jumping from $0.8 million in fiscal year 2019 to an anticipated $15 million in fiscal year 2024. This translates to a CAGR of roughly 82%, showing a healthy conversion of revenue into profit and an increasingly efficient business model.

Balance Sheet: Aehr’s financial health is further bolstered by their strong balance sheet. As of November 30, 2023, they reported cash, cash equivalents, and short-term investments of $51 million, which is significantly higher than their long-term debt of $8.6 million. This healthy cash position provides them with the flexibility to invest in R&D, expand operations, and weather any potential economic downturns.

Technical Analysis:

While the stock moved down over 25% to 52 week lows, forming a stage 4 markdown, there is support for the stock at $14.6 and $16.1 levels. Until confirmation of near term trends pointing up to a base building (stage 1) we will not enter the stock.

Bull Case:

The Bull Case for AEHR Test Systems Stock: A Bright Future in Semiconductor Testing

Exponential Market Growth: The semiconductor test equipment market is projected to grow at a CAGR of 12% from 2024 to 2030, reaching a potential size of $9.6 billion. This significant expansion paints a promising picture for companies like Aehr with innovative solutions catered to this industry.

Technology Leader: Aehr stands out for its focus on advanced technologies like Silicon Carbide and Gallium Nitride, crucial for electric vehicles and other future-oriented applications. Their ABTS and FOX systems deliver unmatched efficiency and capabilities, solidifying their position as a technology leader in this niche.

Strong Customer Relationships: Aehr fosters close relationships with key players in the EV sector, allowing them to deeply understand their customers’ needs and develop tailored solutions. This commitment translates to repeat business and loyalty, propelling their growth.

Financial Momentum: Aehr has exhibited impressive financial performance in recent years, boasting a 48% CAGR in revenue and an 82% CAGR in earnings over the past 5 years. This strong momentum and healthy balance sheet indicate a company poised for continued success.

Valuation Upside: Despite recent stock price drops, Aehr’s current valuation appears attractive compared to its growth potential. Some analysts predict the stock price could double in the next few years, suggesting significant room for upward movement.

Bear case:

The Bear Case for AEHR Test Systems Stock: Navigating Risks in a Competitive Landscape

Market Risks: The semiconductor & EV industries, though promising, is cyclical and susceptible to economic downturns, potentially impacting Aehr’s revenue and earnings. Additionally, geopolitical tensions and supply chain disruptions could hinder access to crucial materials or impact overall market demand.

Customer Concentration: Aehr relies heavily on a few key customers, particularly in the electric vehicle sector. If these customers encounter challenges or shift their buying patterns, it could significantly impact Aehr’s business. Diversification into new markets and customers is crucial to mitigate this risk.

Competition: Aehr faces competition from established giants like Teradyne and Advantest, which have significantly larger resources and broader product portfolios. Additionally, new entrants with disruptive technologies pose potential threats. Staying ahead of the curve in innovation and maintaining efficient cost structures will be crucial for Aehr to compete effectively.

Technical Risks: Aehr’s focus on advanced technologies like Silicon Carbide and Gallium Nitride carries inherent technical risks. These technologies are still evolving, and unforeseen challenges could delay mass adoption or impact their effectiveness, harming Aehr’s business model.

Stock Volatility: Aehr Test Systems is a small-cap stock, inherently more volatile than larger companies. This volatility may not be suitable for all investors seeking stability in their portfolios.