Executive Summary:

Founded in 2005, SoundHound is a voice AI pioneer with over a decade of experience in speech recognition, sound identification, and conversational intelligence. They’re known for their popular music recognition app, but are much more than that. Their core business is a voice AI platform called Houndify, empowering companies to build custom voice assistants for cars, smart devices, and beyond. SoundHound recently acquired SYNQ3 to expand their restaurant voice solutions, aiming to become the leading AI provider in that realm. Their vision is ambitious: they want to create a world where voice interactions with technology are so natural and intuitive that they surpass human capabilities, bringing convenience and delight to people’s lives.

SoundHound’s most recent earnings were for the fiscal quarter ending Sep 2023. They reported an earnings per share (EPS) of -$0.09, matching the analysts’ consensus estimates. However, this represents a decline of 40% compared to the previous year’s -$0.15 EPS. Revenue came in at $13.3 million, also meeting expectations but reflecting a modest year-over-year increase of 5%. While meeting estimates is often seen as positive, the lack of significant growth raises some concerns about SoundHound’s future trajectory.

Stock Overview:

| Ticker | $SOUN | Price | $1.82 | Market Cap | $449.4M |

| 52 Week High | $5.11 | 52 Week Low | $1.20 | Shares outstanding | $209.44M |

Company background:

SoundHound AI: A Voice-First Pioneer

Founded in 2005 by Stanford graduates Kayvon Fassadi, Mike Henry, and Kevin Zhou, SoundHound AI has carved a niche as a leader in voice technology. Driven by a vision of seamless human-computer interaction through voice, the company boasts over a decade of experience in speech recognition, sound identification, and conversational intelligence.

Early funding came from prominent Silicon Valley names like Kleiner Perkins Caufield & Byers, Greylock Partners, and Infosys. Over the years, SoundHound has raised over $280 million, fueling product development and strategic acquisitions. SoundHound went public via SPAC in April 2022.

While their popular music recognition app, SoundHound, serves as a familiar face, the company’s core offering is Houndify, a powerful voice AI platform. Houndify empowers businesses to build customized voice assistants for diverse applications, ranging from cars and smart speakers to wearables and robots. Recent acquisition of SYNQ3 strengthens their grip on the restaurant AI market, positioning them to become a major player in that space.

Competition in the consumer voice AI landscape is fierce, with prominent players like Google Assistant, Amazon Alexa, and Microsoft Cortana vying for dominance. SoundHound differentiates itself through its focus on deep customization, open data transparency, and conversational intelligence, allowing businesses to build truly bespoke voice experiences.

Headquartered in Santa Clara, California, SoundHound AI enjoys a vibrant tech ecosystem that fuels its innovation. With a global presence and a growing list of industry partnerships, the company is poised to further transform the way we interact with technology through the power of voice.

Recent Earnings Sep 2023

Revenue stood at $13.3 million, a modest 5% increase year-over-year. This tepid growth raises concerns about the company’s ability to scale its business, particularly considering the intense competition in the voice AI market.

EPS came in at -$0.09, matching analyst estimates. However, compared to the previous year’s -$0.15 EPS, it represents a 40% decline.

License agreements saw healthy growth, indicating increasing adoption of the Houndify platform by businesses. Additionally, active users of their consumer app, SoundHound, remained stable, providing a valuable user base for data collection and potential future monetization.

Forward guidance from SoundHound painted a cautious picture. The company expects continued double-digit revenue growth but refrained from providing specific figures, suggesting uncertainties in their near-term outlook.

The Market, Industry, and Competitor:

SoundHound AI operates in the dynamic and rapidly growing voice assistant and conversational AI market. This market encompasses technologies like speech recognition, natural language processing, and dialogue management, all used to enable natural and interactive voice interactions with devices and services.

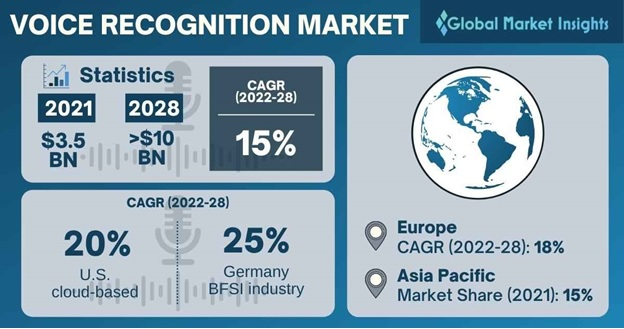

An explosive growth trajectory for this market, with global estimates reaching $10 billion by 2028. This translates to a Compound Annual Growth Rate (CAGR) of around 13% from 2023 to 2030, highlighting the immense potential for companies like SoundHound.

Several factors fuel this growth. The increasing penetration of smart devices, including wearables, smart speakers, and connected appliances, is boosting demand for voice-based interfaces. Additionally, advancements in AI technologies like deep learning are constantly improving the accuracy and sophistication of voice assistants, making them more appealing and useful for users.

However, the market is also highly competitive, with established players like Google, Amazon, and Apple dominating the landscape. SoundHound’s success hinges on its ability to differentiate itself through strong technical capabilities, deep customization options for businesses, and innovative applications for its technology beyond just traditional voice assistants.

Despite the challenges, SoundHound’s focus on open data transparency, conversational intelligence, and tailored voice experiences sets them apart.

Unique differentiation:

SoundHound AI faces a fiercely competitive landscape in the voice AI market, grappling with both established tech giants and nimble startups. Here’s a breakdown of their major rivals:

Google Assistant, Amazon Alexa, and Microsoft Cortana hold the lion’s share of the market, boasting vast user bases, deep integration with their ecosystems, and constant innovation. Smaller players like Jasper, Snips, and Sensory offer customized voice solutions for specific applications, often with niche-focused strengths.

Open Data Transparency: Unlike most closed-source AI systems, SoundHound offers open data transparency, allowing developers and businesses to access and understand the underlying algorithms powering their voice solutions. This fosters trust and enables deeper customization, empowering businesses to create truly bespoke voice experiences.

Conversational Intelligence: SoundHound’s technology excels at natural language processing and dialogue management, resulting in more intelligent and engaging voice interactions. Their AI goes beyond simple keyword recognition, understanding context, intent, and even emotions, leading to conversations that feel more human-like.

Deep Customization: One of SoundHound’s biggest strengths is the ability to deeply customize their voice platform for specific applications and brands. This allows businesses to integrate their branding, personality, and unique features into their voice assistants, resulting in a more integrated and seamless user experience.

Focus on Specific Use Cases: While competitors like Google Assistant aim for broad appeal, SoundHound focuses on excelling in specific use cases. For instance, their Houndify platform shines in areas like automotive voice assistants, where a deep understanding of context and safety measures is crucial.

Strong Partnerships: SoundHound actively seeks strategic partnerships with major players in diverse industries, like car manufacturers and hospitality chains. This expands their reach, leverages existing ecosystems, and opens doors to new market segments.

In essence, SoundHound’s differentiation lies in their commitment to open data, advanced conversational AI, deep customization, targeted use cases, and strategic partnerships.

Management & Employees:

Keyvan Mohajer (CEO & President): An engineering PhD from Stanford, Keyvan drives the company’s vision of transforming human-computer interaction through natural voice experiences.

James Hom (Chief Product Officer): Another Stanford graduate, James spearheads product development and advancement, ensuring SoundHound’s technology caters to both consumer and enterprise needs. He holds a Bachelor’s degree in Computer Science.

Majid Emami (Chief Science Officer & Senior VP Engineering): With a PhD in Electrical Engineering, Majid leads the charge in technological innovation, developing the core speech recognition and machine learning systems that power SoundHound’s products.

Financials:

SoundHound AI: A Financial Rollercoaster Over Five Years

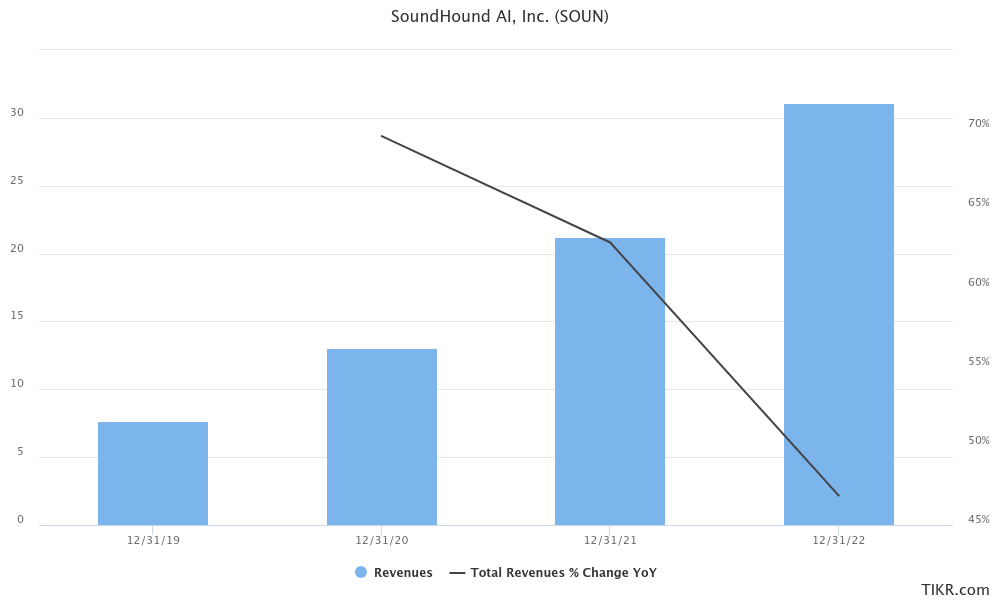

The past five years for SoundHound AI have been a whirlwind of ups and downs, with remarkable revenue growth alongside persistent struggle towards profitability.

Revenue Growth: The company has experienced impressive top-line growth, achieving a Compound Annual Growth Rate (CAGR) of around 45% from 2019 to 2023. This translates to revenue jumping from a mere $8 million in 2019 to $38 million in 2023, showcasing substantial progress in market traction.

Earnings: However, this revenue growth hasn’t yet translated into consistent profitability. Earnings per share (EPS) remained negative throughout the past five years, with a CAGR of roughly -40%. While the rate of decline seems to be slowing down, reaching -$0.09 in 2023, the company still needs to navigate towards positive EPS to reassure investors.

Balance Sheet: SoundHound’s balance sheet paints a mixed picture. Cash and cash equivalents have fluctuated over the years, reaching a high of $130 million in June 2023 but dipping below $50 million by the end of the year. This reflects ongoing efforts to fund operations while searching for sustainable revenue streams.

In summary, SoundHound AI has shown impressive revenue growth but still battles for profitability. Their future hinges on effectively maximizing their market opportunities and optimizing their financial performance. Only time will tell if they can navigate the financial terrain and emerge as a sustainable leader in the voice AI revolution.

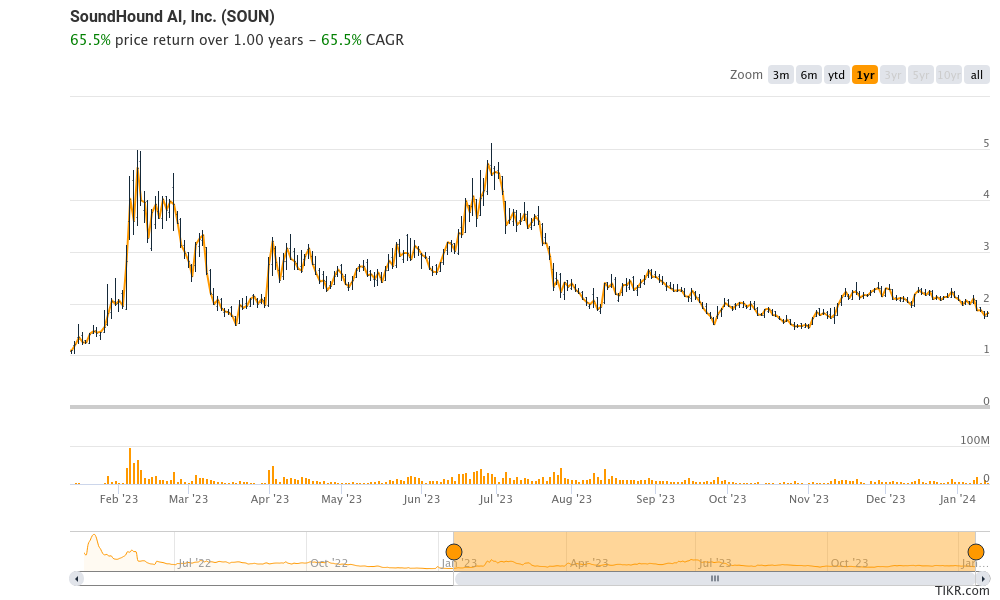

Technical Analysis:

SoundHound is in a consolidation phase as the major trend after a big jump in early 2023 on the AI hype. After a stage 4 decline, the stock is still in a stage 1 accumulation phase. With a double top in the $2.3 range, this should consolidate further until the revenue growth is confirmed.

Bull case:

The bull case for SoundHound AI (SOUN) stock rests on several key arguments:

Rapidly Growing Market: The voice AI market is projected to reach a staggering $10 billion by 2030, fueled by the proliferation of smart devices and increasing consumer comfort with voice interaction. This provides an enormous addressable market for SoundHound to tap into.

Unique Differentiation: SoundHound’s open data philosophy, advanced conversational intelligence, and deep customization capabilities allow businesses to build truly bespoke and engaging voice experiences. This stands out from the closed-source, one-size-fits-all approach of many competitors.

Strategic Partnerships: Collaborations with major players like car manufacturers and hospitality chains expand SoundHound’s reach, leverage existing ecosystems, and open doors to new market segments. These partnerships further strengthen their market position and potential for growth.

Acquisition Strategy: Recent acquisitions like SYNQ3 solidify SoundHound’s presence in specific growth areas like the voice-driven restaurant market. This targeted approach allows them to focus resources and gain critical industry expertise.

Improving Financials: While still unprofitable, SoundHound’s revenue growth is outpacing its losses, with the rate of EPS decline slowing down. Additionally, cost-cutting measures and increased monetization efforts could push them towards profitability sooner than expected.

Tech Giant Acquisition Potential: With their unique technology and promising market trajectory, SoundHound becomes an attractive acquisition target for tech giants seeking to solidify their dominance in the voice AI space. A potential acquisition could lead to a significant premium for SOUN shareholders.

Bear case:

Fierce Competition: SoundHound faces steep competition from established tech giants like Google, Amazon, and Microsoft, all with dominant market positions and vast resources. Competing against these players for market share and partnerships will be a major challenge.

Unproven Profitability: Despite impressive revenue growth, SoundHound continues to struggle with profitability, raising concerns about their ability to manage costs and generate sustainable earnings. Achieving significant scale and operational efficiency is crucial for their long-term success.

Limited Portfolio: SoundHound’s focus on specific use cases like automotive and restaurant voice assistants exposes them to potential market fluctuations within those sectors. A broader product portfolio would mitigate risk and offer more diversified growth opportunities.

Valuation Concerns: Compared to other AI companies, SoundHound currently has a higher valuation relative to its revenue and profitability. This raises concerns about a potential correction if investor sentiment towards the stock sours.

Negative Analyst Sentiment: Some financial analysts remain skeptical about SoundHound’s long-term prospects, highlighting their lack of profitability and challenging competitive landscape. These negative reports can influence investor confidence and impact stock price.

Overall, while SoundHound offers exciting potential in the booming voice AI market, potential investors should carefully consider the bear case concerns. We would not recommend a position in SoundHound at this point.