Executive Summary:

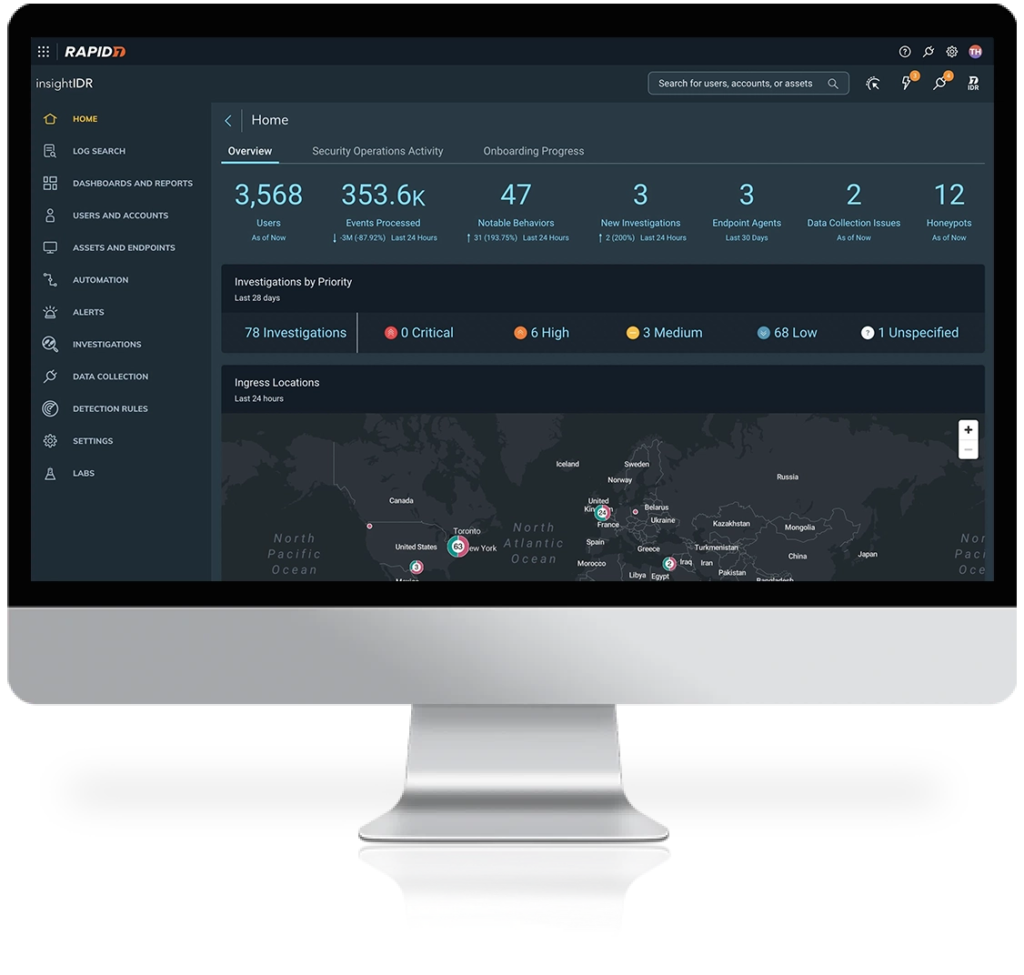

Rapid7 is a cybersecurity company founded in 2000 that offers a variety of solutions to help organizations manage their security posture. Their cloud-based platform, Insight, uses data and analytics to give businesses visibility into their IT environment, identify vulnerabilities, and automate security tasks. This allows security teams to collaborate with IT and development teams to proactively address threats and improve their overall security.

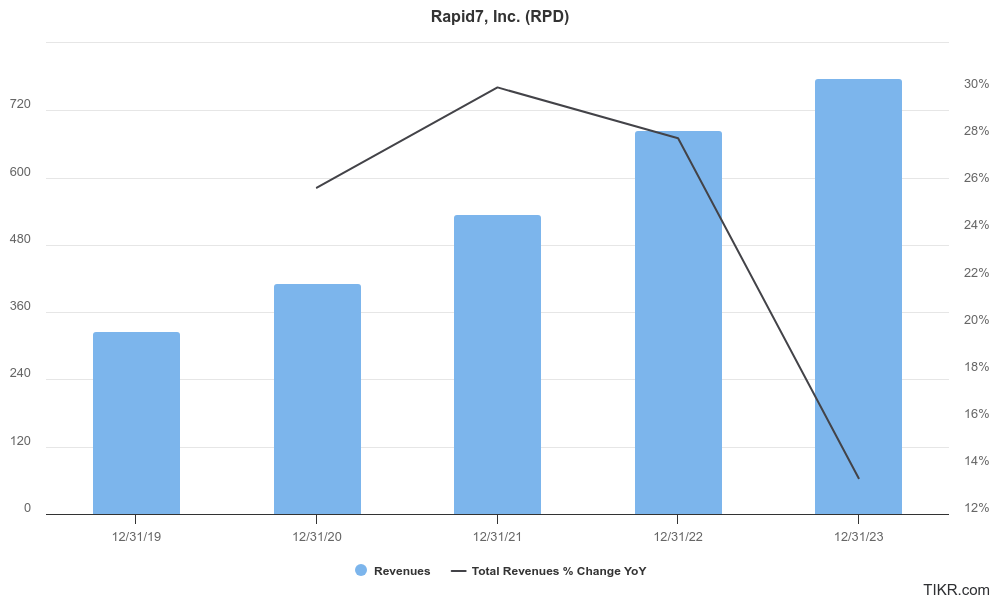

Revenue grew 11% year-over-year to $205.27 million. Earnings per share (EPS) also jumped significantly, reaching $0.33 compared to a loss of $0.19 per share.

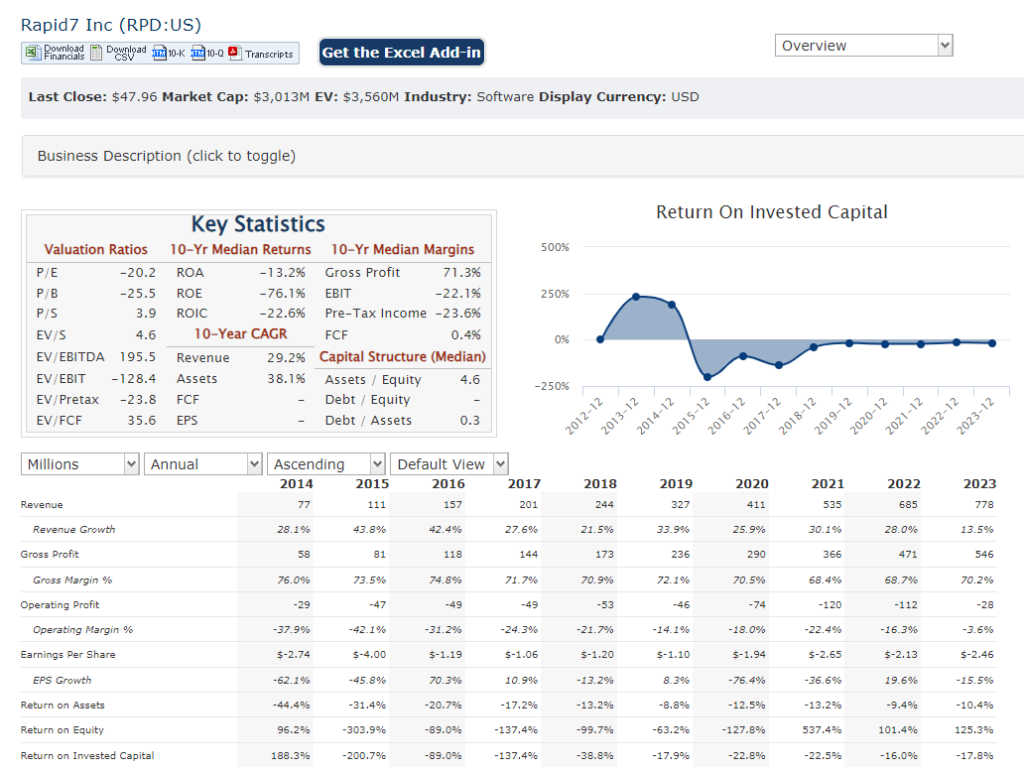

Stock Overview:

| Ticker | $RPD | Price | $47.96 | Market Cap | $2.97B |

| 52 Week High | $61.88 | 52 Week Low | $39.49 | Shares outstanding | 61.71M |

Company background:

Rapid7 was founded by Phil Mimick and Craig Lurey, is a cybersecurity company headquartered in Boston, Massachusetts. They have achieved this by providing a comprehensive suite of security solutions that empower businesses to proactively manage their IT environment and minimize risk.

Rapid7’s collects data from various security tools, analyzes it for threats, and provides actionable insights to security teams. This allows for better collaboration between security, IT and development teams. In addition to Insight, Rapid7 offers a variety of other security solutions, including vulnerability management, incident response, and security orchestration, automation, and response (SOAR) solutions.

Rapid7 faces competition from established security firms like Palo Alto Networks, McAfee, and CrowdStrike, as well as emerging players in the cybersecurity space. Rapid7 continues to grow and innovate, attracting over 11,500 customers with their commitment to simplifying complex cybersecurity challenges.

Recent Earnings:

- Revenue and Growth: Revenue reached $205.27 million in Q4 2023, reflecting an 11% increase year-over-year.

- EPS and Growth: Earnings per share (EPS) also showed significant improvement. It jumped to $0.33 compared to a loss of $0.19 per share in the same period last year.

- Operational Metrics: Rapid7 annual recurring revenue (ARR) reached $806 million as of Q4’23, showcasing a healthy 13% year-over-year growth.

The Market, Industry, and Competitors:

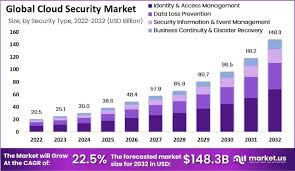

The increasing reliance on technology by businesses of all sizes, coupled with the ever-evolving threat landscape, is driving the demand for robust security solutions. Analysts predict the global cybersecurity market to reach a staggering $40.8 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 13.4%. This growth is fueled by the rising number of cyberattacks, increasing regulatory compliance requirements, and the growing adoption of cloud computing and IoT devices.

Rapid7 offers a comprehensive suite of security solutions that simplify complex challenges, empowering businesses to proactively manage their IT environment and minimize risk. By leveraging data and analytics, Insight provides valuable insights to security teams, enabling them to collaborate effectively with IT and development teams to address threats and improve overall security posture.

Unique differentiation:

- Legacy giants: Palo Alto Networks, McAfee, and CrowdStrike are well-recognized companies offering a broad range of security solutions, including firewalls, endpoint protection, and intrusion detection systems. These companies may have a wider brand recognition and larger customer base, but their offerings might be more complex and less focused on automation and collaboration.

- Cloud Security: With the increasing adoption of cloud computing, companies specializing in cloud security solutions pose a challenge to Rapid7. These companies may have a deeper understanding of cloud-specific threats and vulnerabilities.

- Security Orchestration, Automation, and Response (SOAR): Rapid7 offers SOAR solutions within its Insight platform. However, dedicated SOAR vendors might provide more advanced automation and orchestration capabilities.

- Focus on Simplicity and Automation: Rapid7’s Insight platform is designed to simplify complex security challenges. By offering a unified platform with data analytics and automation capabilities, Rapid7 empowers businesses to streamline their security operations and free up security teams to focus on strategic initiatives.

- Collaboration: Insight facilitates collaboration between security, IT, and development teams. This integrated approach allows for better communication and faster response times to security threats.

- Cloud-Based Platform: This makes it easier for businesses to deploy and scale their security solutions without the burden of managing additional hardware or infrastructure.

Management & Employees:

- Corey Thomas: who serves as both Chairman and Chief Executive Officer. leadership in technology and security expertise.

- Tas Giakouminakis: Co-founder and Chief Technology Officer, instrumental in shaping Rapid7’s technology vision and product development.

- Andrew Burton: President and Chief Operating Officer, responsible for overseeing global operations and driving company growth.

Financials:

- Revenue Growth: Rapid7’s revenue has demonstrated a steady upward trend over the last five years. This positive trend suggests a Compound Annual Growth Rate (CAGR) in the double digits for the past several years.

- Earnings Growth: While Rapid7 isn’t consistently profitable yet, their earnings have shown signs of significant improvement. This substantial increase indicates a positive trajectory for their earnings growth.

- Balance Sheet: Rapid7 might translate to higher operating expenses impacting short-term profitability. Their increasing ARR (annual recurring revenue) suggests a growing customer base with predictable revenue streams, which is a positive indicator for their overall financial health.

Technical Analysis: On the monthly and weekly chart, the stock is in stage 2 markup, with higher highs and higher lows. The daily chart is bearish however, in a stage 4 decline, although there are signs of a base building in the $47 zone for a reversal. Neither the MACD or the RSI are positive, which indicates the stock should be range bound in the $45 – $50 zone for a while, unless a strong catalyst moves the stock in either direction. Given the number of other good cybersecurity stocks, we would be inclined to pass on this stock for the short term.

Bull Case:

- Market Growth Tailwinds: The cybersecurity market is projected for explosive growth, fueled by factors like rising cyber threats, regulatory compliance needs, and cloud adoption. Rapid7 is well-positioned to capitalize on this growth with its comprehensive security platform, Insight.

- Strong Financial Performance: Rapid7 has demonstrated consistent revenue growth and is making strides towards profitability. Their increasing ARR signifies a growing customer base with recurring revenue streams. This financial strength allows them to invest in innovation and stay ahead of the curve.

- Potential for Acquisition: The cybersecurity space is ripe for consolidation. Rapid7’s strong platform and customer base could make them an attractive acquisition target for a larger security company, potentially leading to a significant stock price increase for Rapid7 shareholders.

Bear Case:

- Market Saturation: The cybersecurity market is growing rapidly, but there’s a chance it could become saturated as more companies enter the space. This could lead to increased competition on price and features, putting pressure on Rapid7’s margins and profitability.

- Valuation Concerns: Depending on the current stock price, Rapid7 might be priced for future growth that may not be guaranteed. Investors might be hesitant if the stock price reflects overly optimistic future earnings potential.

- Integration Challenges: Rapid7’s security platform, Insight, aims to integrate various security functions. These challenges could impact the platform’s performance and reliability, potentially leading to customer dissatisfaction and churn.