Executive Summary:

Celestica Inc. is a Canadian multinational company that designs, manufactures, and supplies electronics for various industries. They operate in over 15 countries and have a presence in sectors like aerospace, healthcare, and consumer electronics. Founded in 1994 as a subsidiary of IBM, Celestica offers a complete lifecycle solution for its clients, from initial design to after-market services.

Revenue reached $2.14 billion. Earnings per share (EPS) also rose significantly, coming in at $0.76 compared to $0.56 the prior year, reflecting a 35.7% jump.

Stock Overview:

| Ticker | $CLS | Price | $49.39 | Market Cap | $5.89B |

| 52 Week High | $51.12 | 52 Week Low | $10.50 | Shares outstanding | 119.26M |

Company background:

Celestica Inc. is a Canadian multinational electronics manufacturing services (EMS) company headquartered in Toronto, Ontario. Founded in 1994, it was originally a subsidiary of IBM before becoming independent in 1996. Celestica doesn’t manufacture its own electronics brand but designs, manufactures and supplies electronics for a wide range of sectors including aerospace, healthcare, consumer electronics, and more.

Celestica offers a complete lifecycle solution for its clients, from the initial design stage of a product to after-market services. This one-stop-shop approach allows their clients to streamline their supply chain and focus on innovation and product development.

Recent Earnings:

Revenue reached $2.14 billion, a respectable 5% increase year-over-year compared to the same period in 2023.

Earnings per share (EPS) also showed significant improvement, rising 35.7% to $0.76 compared to $0.56 in the prior year. This suggests Celestica is translating revenue growth into shareholder value.

The Market, Industry, and Competitors:

Celestica market is expected to grow steadily due to the increasing demand for electronics across various industries like aerospace, healthcare, and consumer electronics. The rise of automation, artificial intelligence, and the Internet of Things (IoT) are all expected to further fuel this demand as more and more devices get embedded with electronics.

Analysts predict a Compound Annual Growth Rate (CAGR) of around 5% for the EMS market over the next few years. This trend suggests that Celestica can benefit from this overall market growth if it can maintain its market share and competitive advantage. By focusing on innovation in areas like miniaturization and efficient manufacturing processes, Celestica can position itself to capture a larger slice of the growing market.

Unique differentiation:

- Sanmina Corporation (SANM): A global leader in EMS, Sanmina offers similar services to Celestica, providing design, manufacturing, and supply chain solutions for a wide range of industries. They boast a strong presence in North America and Asia, and sometimes surpass Celestica in revenue.

- Flex Ltd. (FLEX): Flex Ltd. is a diversified EMS provider with a global network of manufacturing facilities. They compete directly with Celestica for contracts in various sectors, and are known for their expertise in high-volume electronics manufacturing.

- Jabil Inc. (JBL): Jabil Inc. is a reputable EMS company with a strong presence in the automotive and healthcare industries. They are known for their focus on automation and technological innovation, which can be a key differentiator in the competitive EMS landscape.

- Customer Focus: Celestica emphasizes a strong focus on understanding and meeting client needs. This could involve tailoring solutions and offering flexibility throughout the manufacturing process.

- Complete Lifecycle Approach: Their one-stop-shop approach, encompassing design, manufacturing, and after-market services, simplifies the process for clients compared to competitors who might offer more segmented services.

- Innovation: While not always explicitly mentioned, Celestica might be focusing on internal innovation in areas like miniaturization or efficient manufacturing processes. This could give them a cost or quality advantage.

Management & Employees:

- Rob Mionis (President & CEO): Responsible for Celestica’s overall strategy and growth, ensuring success for their global clientele.

- Mandeep Chawla (Chief Financial Officer): Oversees Celestica’s financial health, including budgeting, accounting, and investor relations.

- Yann Etienvre (Chief Operations Officer): Manages Celestica’s global manufacturing operations, ensuring efficiency and quality control.

Financials:

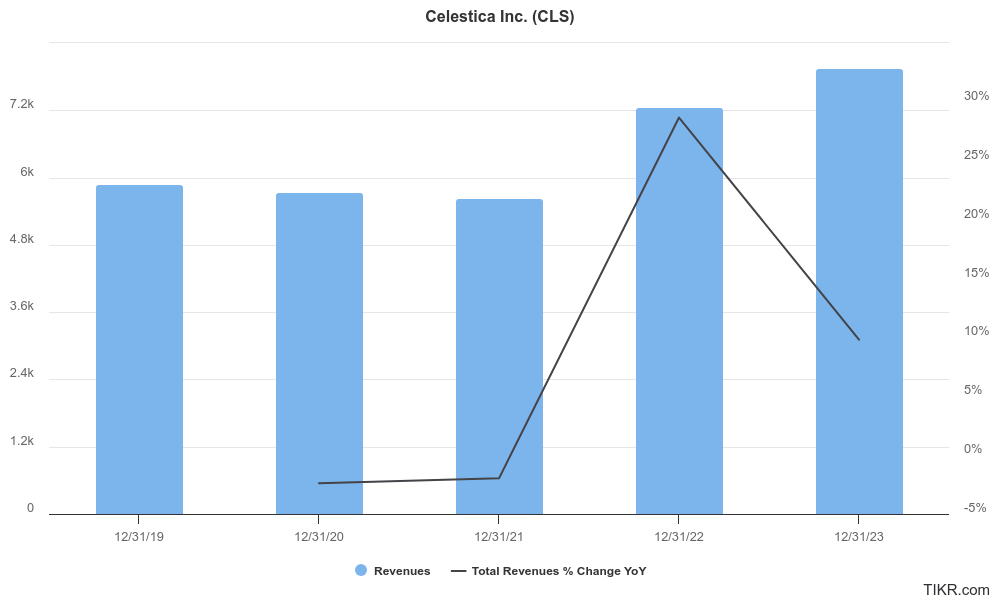

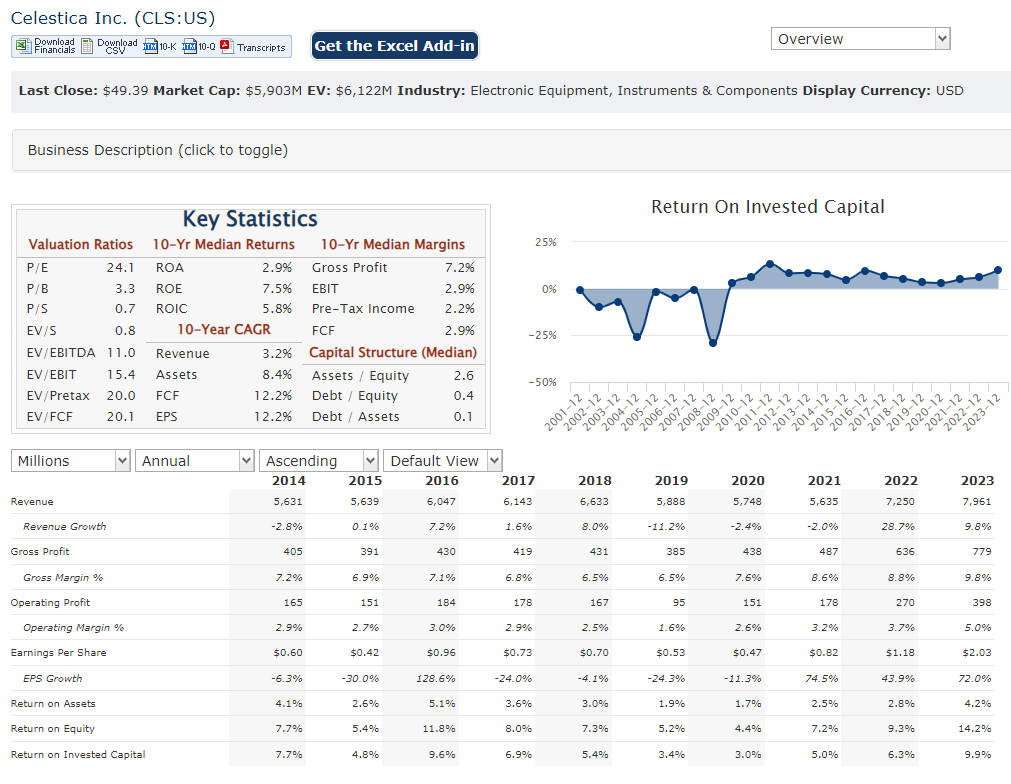

Celestica’s financial performance over the last five years has been one of resilience and rebound. After experiencing a revenue decline from 2019 to 2021, the company bounced back significantly in 2022 with a 28.7% increase in revenue year-over-year. This momentum continued in 2023, with revenue reaching a new high of $7.96 billion. Calculating the Compound Annual Growth Rate (CAGR) for the entire five-year period might be misleading due to the initial decline.

Earnings per share (EPS) mirrored the revenue trend. After a period of stagnation, EPS jumped in 2022 and continued to climb in 2023.

Looking at the balance sheet, Celestica’s financial health appears to be improving. The company’s ability to manage its liabilities and maintain a healthy debt-to-equity ratio would be crucial factors to assess its overall financial stability.

Technical Analysis:

The stock is on a big stage 2 markup (Bullish), hitting multi-year highs on the monthly and weekly chart. On the daily chart, it is also on a stage 2 markup phase and looks like it wants to head higher, although it is very stretched and might make a move back to $47 range. Earnings are on April 24th, which indicates the stock wants to move higher after earnings.

Bull Case:

- Growth of the EMS Market: The Electronic Manufacturing Services (EMS) market is anticipated to experience steady growth due to the ever-increasing demand for electronics across various sectors. This rising tide could lift all boats, benefiting Celestica if it maintains its market share.

- Strong Recent Performance: Celestica’s recent financial performance has been impressive, with rising revenue and earnings in the past two years. This momentum, if sustained, could translate to continued growth in the stock price.

- Healthy Balance Sheet: A strong balance sheet with increasing assets alongside manageable liabilities would indicate Celestica’s financial stability and its ability to invest in future growth opportunities.

Bear Case:

- Rising Costs: Factors like inflation or supply chain disruptions could lead to rising costs for materials and components. If Celestica struggles to pass these costs on to clients, it could eat into their profits.

- Limited Differentiation: While Celestica emphasizes customer focus and a complete lifecycle approach, some bears might argue these aren’t unique enough advantages in the competitive landscape.

- Slow Growth Prospects: Despite recent growth, some analysts might believe the overall growth potential of the EMS market is limited, hindering Celestica’s long-term stock price appreciation.