Executive Summary:

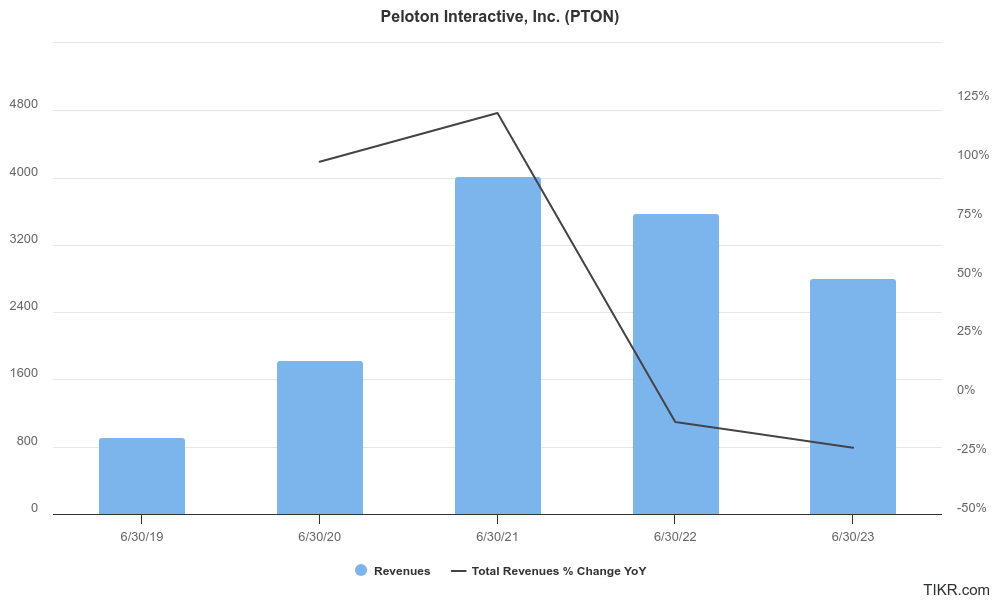

Peloton Interactive Inc. is focused on fitness equipment and media. They’re known for their stationary bikes, treadmills, and rowers with built-in touchscreens that stream live and on-demand fitness classes. These classes are led by instructors and require a subscription service. Peloton boasts a large and loyal community of over 6.6 million members who enjoy the variety of fitness offerings, including cycling, running, yoga, and more. With its immersive experience and focus on community, Peloton strives to make fitness accessible and engaging for people of all levels. During Covid the company dramatically grew earnings and revenue, but has since slowed and is still unprofitable.

Peloton reported a loss per share (EPS) of $0.54 on Feb 1st, which was better than analyst expectations who predicted a loss of $0.58. Revenue was higher, coming in at $743 million compared to analyst estimates of $733.6 million. This represents a year-over-year decrease of 18%.

Stock Overview:

| Ticker | $PTON | Price | $4.70 | Market Cap | $1.72B |

| 52 Week High | $14.36 | 52 Week Low | $3.96 | Shares outstanding | 348.85M |

Company background:

Peloton Interactive Inc., founded in 2012 by John Foley and Hisao Kushi, is an exercise equipment and media company headquartered in New York City. The company is known for its innovative approach to fitness, which combines high-quality exercise equipment with live and on-demand fitness classes streamed through a subscription service.

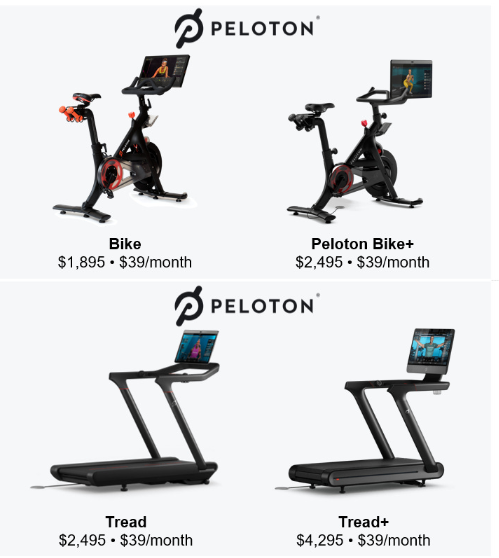

Peloton’s core products are stationary bikes, treadmills, and rowers, all equipped with large touchscreens that provide access to a vast library of fitness classes. Peloton’s focus on interactive elements, such as live leaderboards and virtual high fives, fosters a sense of community and motivates users to stay engaged with their fitness goals.

Peloton has carved out a distinct space in the fitness industry, but it also faces competition from established players like NordicTrack and Echelon, as well as boutique fitness studios like SoulCycle. As Peloton navigates this competitive landscape, it continues to focus on expanding its product offerings, such as the recent addition of the Peloton Guide, a strength training system that uses computer vision technology to track users’ movements.

Recent Earnings:

Comparisons to Analyst Expectations: While the revenue beat analyst estimates, the EPS miss suggests that Peloton might still be facing challenges in the competitive fitness equipment market.

Operational Metrics: Peloton reported 125,000 connected fitness net adds in the quarter, indicating the addition of new subscribers to their fitness equipment and associated services. Additionally, the company’s churn rate, which measures the percentage of subscribers who cancel their service, was 1.24%.

The Market, Industry, and Competitors:

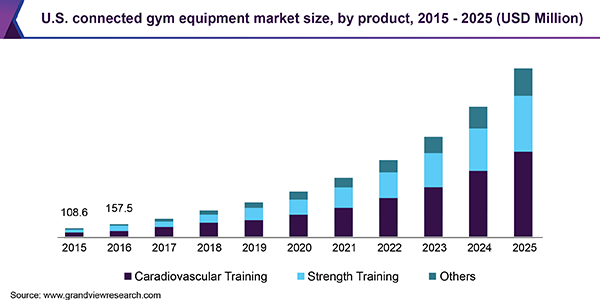

Peloton Interactive Inc. operates in the home fitness equipment and connected fitness market, which is expected to experience significant growth in the coming years:

- Increasing focus on health and wellness: As people become more aware of the importance of staying healthy, the demand for convenient and effective home fitness solutions is rising.

- Technological advancements: Advancements in technology have led to the development of more innovative and interactive fitness equipment, making home workouts more engaging and effective.

- Growing popularity of on-demand fitness: The popularity of on-demand fitness classes and streaming services is creating a convenient and accessible way for people to exercise at home.

Market research firm Grand View Research estimates that the global home fitness equipment market will reach USD 51.36 billion by 2030, growing at a CAGR of 9.4% from 2023 to 2030.

Unique differentiation:

Peloton Interactive faces competition from both established and emerging players in the fitness equipment and connected fitness space.

Established Players:

- NordicTrack and Echelon: These companies offer similar home fitness equipment, such as bikes and treadmills, at more affordable price points compared to Peloton. They also provide access to on-demand fitness classes, though the variety and instructor quality may not be as extensive as Peloton’s offerings.

- Boutique Fitness Studios: Studios like SoulCycle and Barry’s Bootcamp offer a different kind of competition, focusing on in-person group fitness experiences. While Peloton provides a sense of community through its online platform, it cannot fully replicate the energy and social interaction of a live group fitness class.

Emerging Players:

Peloton differentiates itself from competitors through a combination of factors:

1. Integrated Hardware and Software: Peloton offers a seamless integration of high-quality fitness equipment with its on-demand and live fitness classes. This eliminates the need for users to purchase separate equipment and subscriptions, creating a convenient and user-friendly experience.

2. Focus on Community and Live Interaction: Peloton fosters a strong sense of community through its interactive features – live leaderboards, virtual high fives, and instructor shout-outs.

3. Content Variety and Premium Instructor Quality: Peloton boasts a diverse library of on-demand and live classes led by experienced and charismatic instructors. This variety caters to different fitness interests and preferences, while the instructors’ expertise and motivational style contribute to a premium user experience.

4. Brand Image and Exclusivity: Peloton has cultivated a strong brand image associated with luxury, innovation, and exclusivity. This resonates with a specific segment of the market willing to pay a premium for a high-end home fitness experience.

Management & Employees:

- Barry McCarthy (Chief Executive Officer): Previously served as CFO of Spotify and Netflix.

- Karen Boone (Chief Financial Officer): Extensive experience in finance roles at various companies, including CFO of Monster Beverage.

- Dara Trevor-Smith (Chief Marketing Officer): Held marketing leadership roles at companies like PepsiCo and Mondelez International.

Financials:

Revenue: Between 2019 and 2021, Peloton’s revenue skyrocketed, achieving a compound annual growth rate (CAGR) of over 140%. This explosive growth was fueled by rising demand for home fitness solutions during the pandemic.

Earnings: Peloton has yet to turn a consistent profit, reporting net losses throughout the past five years. While the company experienced significant losses in 2022 and 2023, the rate of loss has slowed down compared to previous years.

Balance Sheet: Peloton’s balance sheet reflects its rapid growth in the past few years. The company significantly increased its cash position to support expansion and product development.

Technical Analysis:

Peloton shares are still in stage 4 (markdown) phase in the daily chart and are range bound in accumulation (stage 1) phase in the weekly chart. We would not be buyers of this stock.

Bull Case:

- Market Growth: The home fitness equipment and connected fitness market is expected to continue growing significantly in the coming years, driven by factors like increasing health and wellness awareness and technological advancements. This growth could benefit Peloton as a leading player in the space.

- Cost Management and Efficiency: Peloton is actively taking steps to improve its cost structure and operational efficiency. These efforts, combined with potential revenue growth, could lead to improved profitability and shareholder value.

- Loyal Customer Base: Peloton boasts a dedicated and passionate customer base who appreciate the company’s high-quality equipment, engaging content, and sense of community. This loyalty could translate to continued subscription growth and customer retention, even in a competitive market.

Bear Case:

- High Customer Acquisition Costs: Peloton spends heavily on marketing and advertising to acquire new customers. If the company cannot demonstrate a clear pathway to profitability, investors may become wary of its ability to justify these high costs.

- Limited Product Portfolio: While Peloton has recently launched new products like the Peloton Guide, its core offerings remain focused on cycling and running. This could limit its appeal to a broader customer base interested in a wider variety of fitness options.

- Erosion of Brand Image: Recent controversies surrounding product safety and customer service issues could tarnish Peloton’s brand image and erode customer trust. This could negatively impact its ability to attract and retain customers.