Executive Summary:

Array Technologies, $ARRY founded in 1989 and headquartered in Albuquerque, New Mexico, specializes in utility-scale solar tracker technology. They design and manufacture solar trackers that are engineered to withstand harsh environments and maximize energy production from solar panels. They also offer a variety of services including project management, design, and technical support for solar energy developments around the world. Array Technologies is committed to clean energy and sees solar tracking technology as key to a sustainable future.

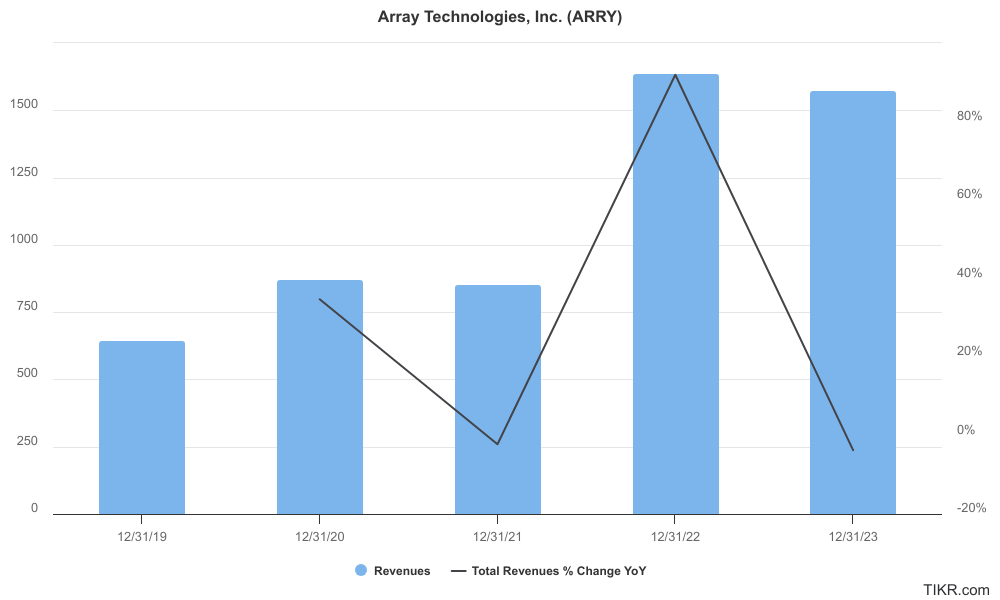

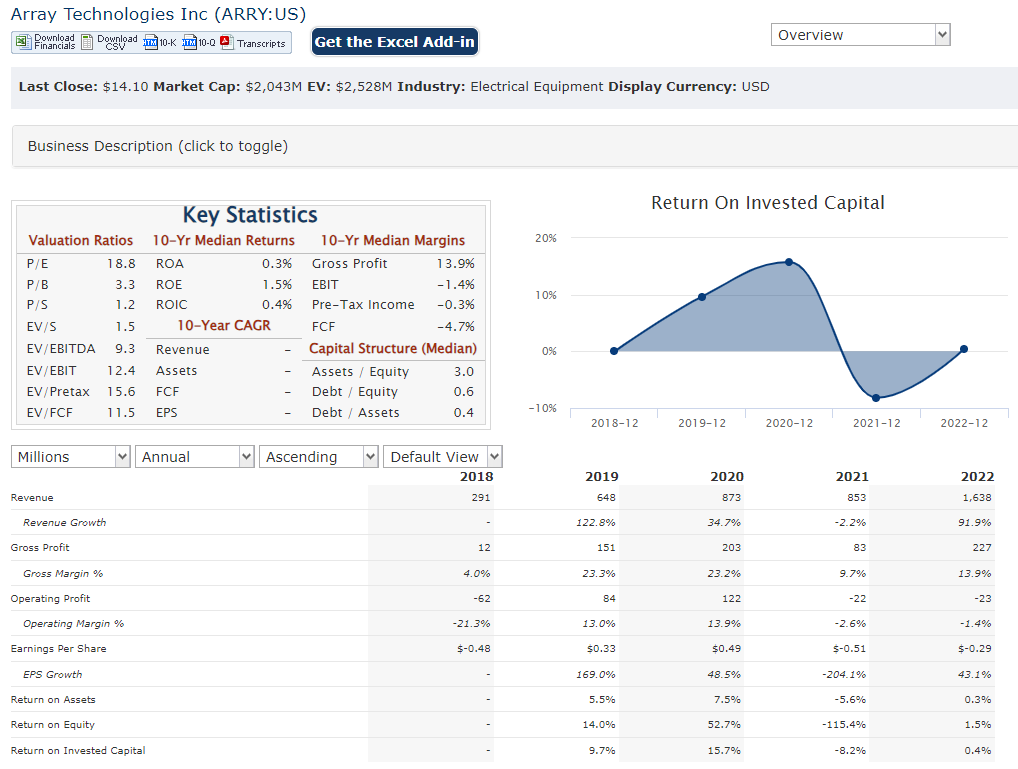

Array Technologies reported full year 2023 earnings on February 22nd, 2024. They achieved a net income of $85.5 million, which is a significant improvement from a net loss of $43.6 million in 2022. This translates to earnings per share (EPS) of $0.57, up from a loss of $0.29 in the previous year. Revenue decreased slightly by 3.7% year-over-year to $1.58 billion.

Stock Overview:

| Ticker | $ARRY | Price | $14.10 | Market Cap | $2.13B |

| 52 Week High | $26.64 | 52 Week Low | $12.52 | Shares outstanding | 151.22M |

Company background:

The company has a rich history of innovation in the solar energy industry spanning over 30 years. The single-axis trackers follow the sun’s path throughout the day, maximizing energy production from solar panels compared to fixed-tilt systems. Their flagship product, the DuraTrack, is known for its reliability and durability in harsh environments. They also offer the newer OmniTrack, which is designed for un-level terrain and requires minimal site grading.

In the competitive solar tracker market, Array Technologies faces competition from companies like NEXTracker $NXT, Trina Solar, and ArcVera. Despite this competition, Array Technologies remains a major player in the industry, known for its high-quality products and customercentric approach.

Recent Earnings:

Array recently reported its earnings for the quarter ended in December. The company posted quarterly adjusted earnings of $0.21 per share, which was higher than the same quarter last year when it reported earnings per share (EPS) of $0.10. This result surpassed the mean expectation of twenty-three analysts, who had forecasted earnings of $0.11 per share. Revenue for the quarter fell 15% to $341.62 million from a year ago, but still exceeded analysts’ expectations of $314.86 million.

Despite the earnings beat, analysts have made substantial cuts to their estimates for Array Technologies’ future performance. The consensus revenue forecast for 2024 has been reduced to $1.6 billion, down from previous estimates of $1.9 billion. EPS estimates for 2024 have also been slashed from $0.87 to $0.65. This bearish outlook has led to a decrease in the consensus price target for the company’s stock, which fell 13% to $21.28.

Analysts are concerned about Array Technologies’ balance sheet and the potential for a business downturn, as indicated by the high debt burden and the downgrade in forecasts.

The Market, Industry, and Competitors:

Array Technologies operates in the utility-scale solar tracker market, a segment of the broader solar energy industry:

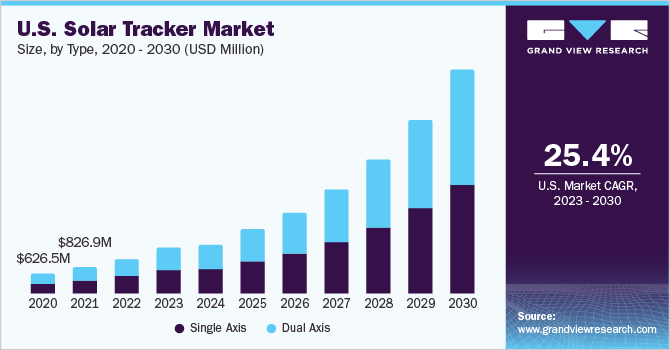

Considering these factors, the global utility-scale solar tracker market is projected to reach a size of approximately $25 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of around 12.5% from 2023 to 2030.

Unique differentiation:

Array Technologies faces competition from several established players in the utility-scale solar tracker market.

- NEXTracker: A leading competitor with a global presence, offering single-axis solar trackers known for their durability and innovation. They compete directly with Array Technologies’ DuraTrack and OmniTrack products.

- Trina Solar: A major solar panel manufacturer that also offers solar tracker solutions under the brand name Vanguard. They pose a competitive threat by leveraging their existing presence in the solar energy sector to potentially bundle trackers with their panels.

- ArcVera Renewables: A company specializing in tracker controls, software, and balance-of-system (BOS) solutions for solar projects. While not directly manufacturing trackers themselves, ArcVera can indirectly compete with Array Technologies by offering integrated tracker and control systems to developers.

These are just a few of the major players in the market, and the competitive landscape is constantly evolving. Other companies like Parsec Energy, GameChange Solar, and Valmont Solar also hold positions in the market, contributing to a dynamic and competitive environment for Array Technologies.

Array Technologies, Inc. differentiates itself in the solar energy market through several key strategies and innovations that set it apart from competitors. Here’s a comprehensive overview of its unique differentiators:

Global Expansion and Integration

Array Technologies has been focusing on global expansion and the integration of its operations, particularly following the acquisition of STI Norland. This move not only expanded its global footprint but also enriched its product line and market presence. The company aims to be a leader not just in the solar tracker industry but in the renewable energy sector at large, leveraging its diverse product offerings and strong global presence.

Product Innovation and Diversification

Array Technologies has introduced new products and innovations, such as the OmniTrack and STI-H250, to new markets. These products, along with its focus on technological advancements, help differentiate its offerings in the market. The company’s emphasis on innovation is a key strategy to maintain a competitive edge.

Strategic Partnerships and Supply Chain Management

Array Technologies has built strong relationships with its customers and suppliers, which is crucial in the solar energy industry. The company’s strategic partnerships and an asset-light operating model have enabled it to maintain short and reliable lead times, a critical advantage in the market. Moreover, its recent deals with Steel Dynamics and the Extruded Aluminum Corporation demonstrate its commitment to securing a robust supply chain, ensuring the availability of materials for its solar trackers

Management & Employees:

Array Technologies’ Management Team:

1. Kevin Hostetler, Chief Executive Officer: Bringing over 18 years of experience in industrial business leadership, Mr. Hostetler has transformed multiple engineered products and services companies throughout his career. He assumed the CEO role at Array Technologies in April 2022.

2. Kurt Wood, Chief Financial Officer: Mr. Wood oversees all financial aspects of the company, including financial reporting, accounting, tax, and treasury functions. He brings extensive experience in finance and leadership to his role.

3. Neil Manning, Chief Operations Officer: Mr. Manning leads the company’s global operations, encompassing manufacturing, supply chain, and project management. His experience lies in driving operational excellence and efficiency.

Financials:

Array Technologies: Financial Performance Overview (2019-2023)

Revenue: Over the past five years, Array Technologies experienced fluctuations in revenue growth. From 2019 to 2020, revenue grew by a healthy 22.5%, but dipped by 14.3% in 2021. However, the company showed signs of recovery in 2022 with a 10.6% increase in revenue.

Earnings: Compared to revenue, fluctuations in earnings were more pronounced. The company reported losses in both 2019 and 2020, followed by a significant improvement in 2021 with a net income of $12.9 million. However, they faced another setback in 2022 with a net loss of $43.6 million.

Balance Sheet: Array has over $700M in debt and about $831M in cash and equivalents.

Technical Analysis:

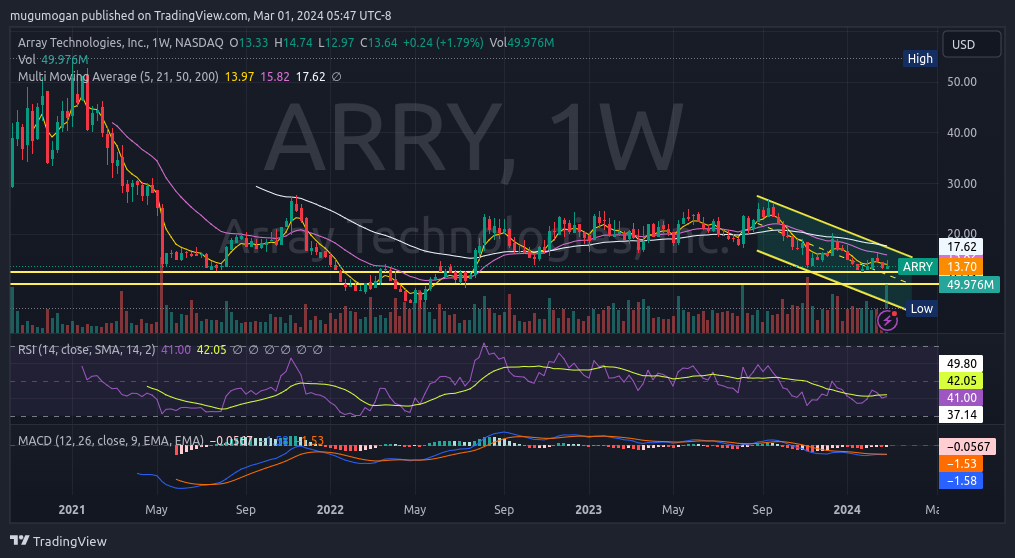

Array shares are on a declining trend line on the monthly chart, with support at $12.5 and $10. On the weekly chart there is a possibility of bounce at the $13 range, with multiple touches in that zone. On the daily chart, the stock is still retesting its 52 week low of $12.52 but has attempted a strong rally off the $13 range. We would wait for a confirmation over $14. The moving averages are all pointing lower.

Bull Case:

Strong industry tailwinds: The global solar energy market is projected to experience significant growth in the coming years, driven by factors like increasing focus on renewable energy, decreasing solar technology costs, and rising demand for land-use efficiency.

2. Unique product offerings and differentiation: Array Technologies’ focus on specialized solar tracker solutions with a reputation for durability and innovation sets them apart from competitors. Their integrated software and controls, along with a strong global service network.

3. Shift towards profitability: After experiencing losses in previous years, Array Technologies achieved a significant turnaround in 2023, transitioning to profitability. This shift indicates improved financial health and potentially signals the start of a sustainable profit trajectory.

Bear Case:

1. Supply chain challenges: The current global supply chain disruptions can affect the availability and cost of raw materials and components necessary for solar tracker manufacturing. This can lead to production delays, higher costs, and ultimately impact the company’s profit margins.

2. Dependence on a single market segment: Array Technologies focuses solely on the utility-scale solar tracker market, making them vulnerable to specific risks within that segment.

3. Macroeconomic headwinds: Global economic slowdowns or recessions can negatively impact investment in renewable energy projects, leading to a decline in demand for solar trackers and potentially affecting revenue growth.